Ethereum

Optimism Finally Gets Its Critical “Flaw Proofs”

Optimism, a leader layer 2 blockchain, aims to help Ethereum users transact quickly and inexpensively. Its technology serves as the foundation for some of the biggest names in blockchain, including the popular blockchain exchange Coinbase and Worldcoin’s World Chain, from OpenAI founder Sam Altman.

But for years, Optimism had a problem. All blockchains that used Optimism’s technology were built on one fundamental principle: they “borrowed” Ethereum’s security apparatus. But in reality, that wasn’t the case.

Until now, Optimism was missing a critical feature at the heart of its security design: “failure proofs.” On Monday, this long-promised technology finally arrives on the Optimism mainnet.

Defaults are intended to keep optimism-based layer 2 chains honest. They help prevent operators on a Layer 2 chain from transmitting inaccurate transaction data to Ethereum’s Layer 1 transaction ledger, and they power the Layer 2 chain’s “decentralized” withdrawal mechanism.

Similar “proof” technology is used by all Layer 2 accumulation networks, including Optimism’s competitors like Arbitrum. It aims to ensure that users of a rollup – whether NFT traders, retail investors or renowned financial institutions – can trust Ethereum’s vast network of operators, rather than ‘to the rollup’s own internal systems, to record their transactions and withdrawals accurately.

While Layer 2 chains like Arbitrum test their systems, Optimism is lagging behind. For years, this made Optimism the target of criticism from peers who claimed their own technology was safer and more advanced.

Now that evidence of the outage is finally arriving on Optimism’s mainnet, the network’s developers – and the growing ecosystem of other teams using its technology – are hoping to put their past behind them.

Over the past couple of years, Layer 2 cumulative networks like Optimism have become the go-to method for operating on the notoriously expensive Ethereum blockchain.

When a user submits a transaction to a rollup network, it is grouped with other users’ transactions before being transmitted to Ethereum. These batches are recorded simultaneously in Ethereum’s transaction ledger, a setup that allows users to transact faster and for only a fraction of the fees.

In theory, cumulative transactions are secured by “proofs,” which are cryptographic methods that allow observers on Ethereum to verify whether transaction details were accurately recorded. This is particularly relevant in the context of withdrawals, as it allows users to trust Ethereum – rather than the rollup network – to withdraw their funds from the Layer 2 chain.

Without evidence of wrongdoing, users who deposited their funds into Optimism had to trust the rollup. “Security Council” to return their funds – a system that exposed the rollup human error or potential bias. With evidence of outages, these users should only have to trust Ethereum.

Optimism takes its name from its “optimistic” proof systemand it launched a version of the technology when it first released in 2021 before quickly removing it after finding issues.

“We literally took out the entire system, reorganized it and rewrote the whole thing,” said Karl Floersch, CEO of OP Labs, in an interview with CoinDesk. “It was brutal, but it was absolutely the right decision.”

The Optimism team previously announced in March that it was testing its fault proof system. on their Sepolia testnet. Since then, they have had a Audit conducted by blockchain security company Sherlock, and found a few bugs that they were able to fix.

“So we fixed everything we found, and we had a lot of confidence in the actual implementation being ready for prime time,” Floersch said.

From this week, the network will once again rely on a seamless energy collection system, but it will still retain “training wheels” intended to ensure proper functioning. The Security Council will remain intact and will be able to intervene in the event of a breakdown of the infallible system. This combination of the two entities is what Optimism calls “first stage decentralization”.

“Stage 2 is a multiple-failure-proof system, sufficient that it is possible to operate the system in a certain way, like on autopilot. The Security Council does not have the possibility to intervene at the last moment,” Floersch said.

Floersch added that the team was working hard to achieve its Stage 2 goals, but he did not give a timeline for when that ultimate vision would be achieved.

With the outage evidence finally shipped to Optimism’s mainnet, other chains that use Optimism’s OP stack will also have access to the technology. (According to DefiLlama, two blockchains that use Optimism’s OP stack, Blast and Base, currently outperform Optimism’s mainnet in terms of total value locked.)

“We’re going to start with the OP mainnet for this upgrade, it’s a pretty big upgrade,” Floersch told CoinDesk. “However, it should not be too long” for Coinbase’s base chain to also implement the proof-of-failure system, Floersch added.

Ethereum

QCP sees Ethereum as a safe bet amid Bitcoin stagnation

QCP, a leading trading firm, has shared key observations on the cryptocurrency market. Bitcoin’s struggle to surpass the $70,000 mark has led QCP to predict Selling pressure is still strong, with BTC likely to remain in a tight trading range. In the meantime, Ethereum (ETH) is seen as a more promising investment, with potential gains as ETH could catch up to BTC, thanks to decreasing ETHE outflows.

Read on to find out how you can benefit from it.

Bitcoin’s Struggle: The $70,000 Barrier

For the sixth time in a row, BTC has failed to break above the $70,000 mark. Bitcoin is at $66,048 after a sharp decline. Many investors sold Bitcoin to capitalize on the rising values, which caused a dramatic drop. The market is becoming increasingly skeptical about Bitcoin’s rise, with some investors lowering their expectations.

Despite the continued sell-off from Mt. Gox and the US government, the ETF market remains bullish. There is a notable trend in favor of Ethereum (ETH) ETFs as major bulls have started investing in ETFs, indicating a bullish sentiment for ETH.

QCP Telegram Update UnderlinesIncreased market volatility. The NASDAQ has fallen 10% from its peak, led by a pullback in major technology stocks. Currency carry trades are being unwound and the VIX, a measure of market volatility, has jumped to 19.50.

The main factors driving this uncertainty are Value at Risk (VaR) shocks, high stock market valuations and global risk aversion sentiment. Commodities such as oil and copper have also declined on fears of an economic slowdown.

Additionally, QCP anticipates increased market volatility ahead of the upcoming FOMC meeting, highlighting the importance of the Federal Reserve’s statement and Jerome Powell’s subsequent press conference.

A glimmer of hope

QCP notes a positive development in the crypto space with an inflow of $33.7 million into ETH spot ETFs, which is giving a much-needed boost to ETH prices. However, they anticipate continued outflows of ETHE in the coming weeks. The recent Silk Road BTC moves by the US government have added to the market uncertainty.

QCP suggests a strategic trade involving BTC, which will likely remain in its current range, while ETH offers a more promising opportunity. They propose a trade targeting a $4,000-$4,500 range for ETH, which could generate a 5.5x return by August 30, 2024.

Ethereum

Ethereum Whale Resurfaces After 9 Years, Moves 1,111 ETH Worth $3.7 Million

An Ethereum ICO participant has emerged from nearly a decade of inactivity.

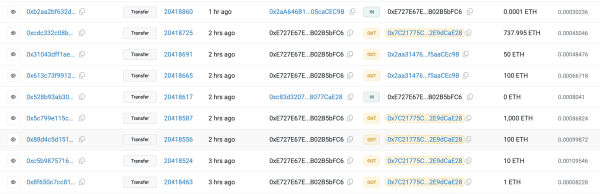

Lookonchain, a smart on-chain money tracking tool, revealed On X, this long-inactive participant recently transferred 1,111 ETH, worth approximately $3.7 million, to a new wallet. This significant move marks a notable on-chain movement, given the participant’s prolonged dormancy.

The Ethereum account in question, identified as 0xE727E67E…B02B5bFC6, received 2,000 ETH on the Genesis block over 9 years ago.

This initial allocation took place during the Ethereum ICOwhere the participant invested in ETH at around $0.31 per coin. The initial investment, worth around $620 at the time, has now grown to millions of dollars.

Recent Transactions and Movements

The inactive account became active again with several notable output transactions. Specifically, the account transferred 1,000 ETH, 100 ETH, 10 ETH, 1 ETH, and 1 more ETH to address 0x7C21775C…2E9dCaE28 within a few minutes. Additionally, it moved 1 ETH to 0x2aa31476…f5aaCE9B.

Additionally, in the latest round of transactions, the address transferred 737,995 ETH, 50 ETH, and 100 ETH, for a total of 887,995 ETH. These recent activities highlight a significant movement of funds, sparking interest and speculation in the crypto community.

Why are whales reactivating?

It is also evident that apart from 0xE727E67E…B02B5bFC6, other previously dormant Ethereum whales are waking up with significant transfers.

In May, another dormant Ethereum whale made headlines when it staked 4,032 ETHvalued at $7.4 million, after more than two years of inactivity. This whale initially acquired 60,000 ETH during the Genesis block of Ethereum’s mainnet in 2015.

At the time, this activity could have been related to Ethereum’s upgrade known as “Shanghai,” which improved the network’s scalability and performance. This whale likely intended to capitalize on the price surge that occurred after the upgrade.

Disclaimer: This content is informational and should not be considered financial advice. The opinions expressed in this article may include the personal opinions of the author and do not reflect the opinion of The Crypto Basic. Readers are encouraged to conduct thorough research before making any investment decisions. The Crypto Basic is not responsible for any financial losses.

-Advertisement-

Ethereum

Only Bitcoin and Ethereum are viable for ETFs in the near future

BlackRock: Only Bitcoin and Ethereum Are Viable for ETFs in the Near Future

Bitcoin and Ethereum will be the only cryptocurrencies traded via ETFs in the near future, according to Samara Cohen, chief investment officer of ETFs and indices at BlackRock, the world’s largest asset manager.

In an interview with Bloomberg TV, Cohen explained that while Bitcoin and Ethereum have met BlackRock’s rigorous criteria for exchange-traded funds (ETFs), no other digital asset currently comes close. “We’re really looking at the investability to see what meets the criteria, what meets the criteria that we want to achieve in an ETF,” Cohen said. “Both in terms of the investability and from what we’re hearing from our clients, Bitcoin and Ethereum definitely meet those criteria, but it’s going to be a while before we see anything else.”

Cohen noted that beyond the technical challenges of launching new ETFs, the demand for other crypto ETFs, particularly Solana, is not there yet. While Solana is being touted as the next potential ETF candidate, Cohen noted that the market appetite remains lacking.

BlackRock’s interest in Bitcoin and Ethereum ETFs comes after the successful launch of Ethereum ETFs last week, which saw weekly trading volume for the crypto fund soar to $14.8 billion, the highest level since May. The success has fueled speculation about the next possible ETF, with Solana frequently mentioned as a contender.

Solana, known as a faster and cheaper alternative to Ethereum, has been the subject of two separate ETF filings in the US by VanEck and 21Shares. However, the lack of CME Solana futures, unlike Bitcoin and Ethereum, is a significant hurdle for SEC approval of a Solana ETF.

Despite these challenges, some fund managers remain optimistic about Solana’s potential. Franklin Templeton recently described Solana as an “exciting and major development that we believe will drive the crypto space forward.” Solana currently accounts for about 3% of the overall cryptocurrency market value, with a market cap of $82 billion, according to data from CoinGecko.

Meanwhile, Bitcoin investors continue to show strong support, as evidenced by substantial inflows into BlackRock’s iShares Bitcoin Trust (NASDAQ: IBIT). On July 22, IBIT reported inflows of $526.7 million, the highest single-day total since March. This impressive haul stands in stark contrast to the collective inflow of just $6.9 million seen across the remaining 10 Bitcoin ETFs, according to data from Farside Investors. The surge in IBIT inflows coincides with Bitcoin’s significant $68,000 level, just 8% off its all-time high of $73,000.

Ethereum

Ethereum Posts First Consecutive Monthly Losses Since August 2023 on New ETFs

Available exclusively via

Bitcoin ETF vs Ethereum: A Detailed Comparison of IBIT and ETHA

Andjela Radmilac · 3 days ago

CryptoSlate’s latest market report takes an in-depth look at the technical and practical differences between IBIT and BlackRock’s ETHA to explain how these products work.

-

Ethereum12 months ago

Ethereum12 months agoEthereum Posts First Consecutive Monthly Losses Since August 2023 on New ETFs

-

Regulation12 months ago

Regulation12 months agoCryptocurrency Regulation in Slovenia 2024

-

News12 months ago

News12 months agoNew bill pushes Department of Veterans Affairs to examine how blockchain can improve its work

-

Regulation12 months ago

Regulation12 months agoThink You Own Your Crypto? New UK Law Would Ensure It – DL News

-

Regulation12 months ago

Regulation12 months agoUpbit, Coinone, Bithumb Face New Fees Under South Korea’s Cryptocurrency Law

-

Regulation12 months ago

Regulation12 months agoA Blank Slate for Cryptocurrencies: Kamala Harris’ Regulatory Opportunity

-

Regulation12 months ago

Regulation12 months agoBahamas Passes Cryptocurrency Bill Designed to Prevent FTX, Terra Disasters

-

Regulation12 months ago

Regulation12 months agoIndia to Follow G20 Policy for Cryptocurrency Regulation: MoS Finance

-

News1 year ago

News1 year ago“Captain Tsubasa – RIVALS” launches on Oasys Blockchain

-

Ethereum1 year ago

Ethereum1 year agoComment deux frères auraient dérobé 25 millions de dollars lors d’un braquage d’Ethereum de 12 secondes • The Register

-

News12 months ago

News12 months agoEU supports 15 startups to fight online disinformation with blockchain

-

News1 year ago

News1 year agoSolana ranks the fastest blockchain in the world, surpassing Ethereum, Polygon ⋆ ZyCrypto