Bitcoin

Inside the ‘Nightmare’ Health Crisis of a Texas Bitcoin Town

On an evening in December 2023, 43-year-old small business owner Sarah Rosenkranz collapsed in her home in Granbury, Texas and was rushed to the emergency room. Her heart pounded 200 beats per minute; her blood pressure spiked into hypertensive crisis; her skull throbbed. “It felt like my head was in a pressure vise being crushed,” she says. “That pain was worse than childbirth.”

Rosenkranz’s migraine lasted for five days. Doctors gave her several rounds of IV medication and painkiller shots, but nothing seemed to knock down the pain, she says. This was odd, especially because local doctors were similarly vexed when Indigo, Rosenkranz’s 5-year-old daughter, was taken to urgent care earlier that year, screaming that she felt a “red beam behind her eardrums.”

It didn’t occur to Sarah that these symptoms could be linked. But in January 2024, she walked into a town hall in Granbury and found a room full of people worn thin from strange, debilitating illnesses. A mother said her 8-year-old daughter was losing her hearing and fluids were leaking from her ears. Several women said they experienced fainting spells, including while driving on the highway. Others said they were wracked by debilitating vertigo and nausea, waking up in the middle of the night mid-vomit.

None of them knew what, exactly, was causing these symptoms. But they all shared a singular grievance: a dull aural hum had crept into their lives, which growled or roared depending on the time of day, rattling their windows and rendering them unable to sleep. The hum, local law enforcement had learned, was emanating from a Bitcoin mining facility that had recently moved into the area—and was exceeding legal noise ordinances on a daily basis.

Over the course of several months in 2024, TIME spoke to more than 40 people in the Granbury area who reported a medical ailment that they believe is connected to the arrival of the Bitcoin mine: hypertension, heart palpitations, chest pain, vertigo, tinnitus, migraines, panic attacks. At least 10 people went to urgent care or the emergency room with these symptoms. The development of large-scale Bitcoin mines and data centers is quite new, and most of them are housed in extremely remote places. There have been no major medical studies on the impacts of living near one. But there is an increasing body of scientific studies linking prolonged exposure to noise pollution with cardiovascular damage. And one local doctor—ears, nose, and throat specialist Salim Bhaloo—says he sees patients with symptoms potentially stemming from the Bitcoin mine’s noise on an almost weekly basis.

Cheryl Shadden’s homemade signs on her property across the street from the mine.

“I’m sure it increases their cortisol and sugar levels, so you’re getting headaches, vertigo, and it snowballs from there,” Bhaloo says. “This thing is definitely causing a tremendous amount of stress. Everyone is just miserable about it.”

Not all data centers make noise. And industry insiders say they have a technical fix for the ones that do, which involves replacing their facilities’ loud air fans with much quieter liquid-based cooling solutions. But some of their touted methods, including “immersion cooling” in oil, are expensive and untested on a large scale.

A representative for Marathon Digital Holdings, the company that owns the mine, did not answer questions about health impacts, but told TIME that it is working to remove the noisy fans from the site. “By the end of 2024, we intend to have replaced the majority of air-cooled containers with immersion cooling, with no expansion required. Initial sound readings on immersion containers indicate favorable results in sound reduction and compliance with all relevant state noise ordinances,” they wrote in an email.

The number of commercial-scale Bitcoin mining operations in the U.S. has increased sharply over the last few years; there are now at least 137. Similar medical complaints have been registered near facilities in Arkansas and North Dakota. And the Bitcoin mining industry is urgently trying to push bills through state legislatures, including in Indiana and Missouri, which would exempt Bitcoin mines from local zoning or noise ordinances. In May, Oklahoma governor Kevin Stitt signed a “Bitcoin Rights” bill to protect miners and prevent any future attempts to ban the industry.

While some Granbury residents are fiercely protesting the mine, many others feel powerless to alter the will of a company with legal, political, and financial might. And the data center industry at large is only growing more dominant, thanks to the twin forces of Bitcoin mining and AI, the latter which spends a vast amount of energy training generative models to find patterns in data sets. According to a recent report, data centers will use 8% of total U.S. power by 2030, up from 3% in 2022. And if operators continue to locate the centers near existing communities and prioritize profits above all else, then the story of Granbury could become the story of countless small towns across America.

Granbury sits about an hour southwest of Fort Worth in Hood County, which houses a mostly rural and Republican population of about 65,000 people. About a 15-minute drive south of Granbury’s charming historic town center—which includes a 19th-century opera house—lies a gas plant called Wolf Hollow II. Driving toward the plant on a windy, predawn morning in May, it rises out of the sky like an oil rig in a pitch-black ocean, lights ablaze.

But the glowing gas plant never caused substantial issues for the local residents. Rather, the problems started when Constellation Energy, which operated the plant, signed a deal in 2021 to power a new Bitcoin mining facility that would sit directly on its lot. The new facility consisted of 163 squat metal boxes resembling shipping containers, which housed a total of over 30,000 computers. These computers started running in the summer of 2022, and seemed to be switched on all day and night. As of December 2023, the Granbury mine is owned and operated by Marathon, one of the largest Bitcoin holders in the world.

Constable John Shirley, a former Oath Keeper, has been focused on keeping the mine accountable.

Constable John Shirley, a former Oath Keeper, has been focused on keeping the mine accountable. Shirley takes sound readings near the Wolf Hollow data site on May 20, 2024.

Shirley takes sound readings near the Wolf Hollow data site on May 20, 2024.

The computers power a process called proof-of-work mining. Rather than relying on a central bank or governmental agency, Bitcoin is created, maintained, and guarded by watchdogs around the world known as miners, who prevent tampering through a complex cryptographic process and are rewarded with bitcoin for doing so. Bitcoin’s first supporters hoped that this new system would support a global digital currency that would bring freedom, financial fairness, and wealth to its adopters.

But the system also requires an immense and ever-increasing amount of electricity. While Bitcoin’s first miners were solo operators often working out of their bedrooms, the industry is now dominated by a handful of billion-dollar corporations who operate industrial-size server farms across the globe. In the month of March 2024 alone, the Bitcoin mining industry generated a record $2 billion in revenue.

Much of the American Bitcoin mining industry can now be found in Texas, home to giant power plants, lax regulation, and crypto-friendly politicians. In October 2021, Governor Greg Abbott hosted the lobbying group Texas Blockchain Council at the governor’s mansion. The group insisted that their industry would help the state’s overtaxed energy grid; that during energy crises, miners would be one of the few energy customers able to shut off upon request, provided that they were paid in exchange. After meeting with the lobbyists, Abbott tweeted that Texas would soon be the “#1 [state] for blockchain & cryptocurrency.” The following month, the Commissioners Court of Hood County approved the development of a cryptocurrency operation at Wolf Hollow. The owners promised local jobs and said that they would mostly use “stranded energy” that would otherwise go unused.

For months during 2022, Granbury residents Nick and Virginia Browning sat in their front yard watching the new metal boxes of the massive facility be installed in the dirt across the road. “It layered our houses with dust. We haven’t gotten it all out yet,” Nick Browning, 82, says.

The dust, it turns out, was just a prelude to the noise. In order to cool the machines, the site’s operators attached thousands of fans to the containers, which churned constantly, emitting a vicious buzz. As more machines were switched on, the noise sounded like a ceiling fan, then a leaf blower, then a jet engine. It consumed afternoon dog walks and revved through cloudless nights, vibrating the trailer homes of many of the low-income residents who live blocks from the facility. The noise floated miles down the winding Brazos river, through the lush golf courses in the gated community Pecan Plantation and past county lines.

At first, residents responded to the intrusion by vacating their porches, retreating inside, and turning up their fans and air conditioners to the max. But many still felt tremors in their beds—including Larry Potts, a 77-year-old retired pastor who lives up the road from the plant. Potts says he stopped sleeping and started losing hearing in both ears. In February, his heart gave out after another sleepless night; he was rushed to the hospital and kept alive by an external pacemaker. There, he was diagnosed with third degree atrioventricular block, hypertension, and depression.

Larry Potts at his home in Granbury, Texas. He suffered from heart failure in February.

Larry Potts at his home in Granbury, Texas. He suffered from heart failure in February.

“I’m sick of this world and all this mess around here,” he says he told his wife that day, referring to the Bitcoin mine’s noise. “We moved out here for the peace and quiet. But this has made me want to go.”

Some nearby residents say they haven’t been affected. But the number of strange medical emergencies in the area have piled up. In addition to Potts’ discharge papers, TIME reviewed medical records provided by several Granbury residents. Hospital notes from 72-year-old Geraldine Lathers’ three-day stay document new prescriptions for high blood pressure and vertigo. Jenna Hornbuckle, 38, lost hearing in her right ear and was diagnosed with heart failure; ear exams document her hearing loss along with that of her 8-year-old daughter Victoria, who contracted ear infections that forced doctors to place a tube in her ear. And Avari Burns, a 19-year-old cancer patient, says she suffered from crippling migraines at home—but whenever she went to a Fort Worth hospital for chemotherapy, the migraines subsided.

Virginia Browning, 81, who can see the Bitcoin mine from her front yard, says she was taken to urgent care with violent vertigo after waking up one night mid-vomit. Browning says she gets so dizzy she can barely walk in a straight line, and that she rarely sleeps through the night. “When they crank this thing,” she says shakily, “I’m wide awake.”

“We’re living in a nightmare,” Sarah Rosenkranz says, sitting at a barbecue restaurant in downtown Granbury on an evening in May. As rock music blares from the speakers and other patrons chatter away, Rosenkranz pulls out her phone and clocks 72 decibels on a sound meter app—the same level that she records in Indigo’s bedroom in the dead of night. In early 2023, her daughter began waking up, yelling and holding her ears. Indigo’s room directly faces the mine, which sits about a mile and a half away. She soon refused to sleep in her own room. She then developed so many ear infections that Rosenkranz pulled her from school in March and learned how to homeschool her for the rest of the semester.

Over grilled salmon and hush puppies, Rosenkranz shares that her family has been sleeping peacefully at an inn downtown for the last three days in order to get away from the noise. But the next morning, after returning home, she contracts yet another migraine that lands her in urgent care.

Dr. Bhaloo, the ENT doctor in Granbury, says he’s seen an uptick since the new year in patients whose ailments—including ringing in their ears, vertigo, and headaches—could be related to the mine. “These people here, they’re good country folks, and Bitcoin, to them, is almost a foreign alien thing,” he says. “They don’t understand it. And [the noise] is detrimental to their health and anxiety.” Dr. Stephen Krzeminski, another Granbury ENT, agrees. “Sonic damage is real, there’s no disputing that,” he says. Krzeminski says he believes the mine is causing “mental and physical” health issues. “Imagine if I had vuvuzela in your ear all the time,” he says.

Trailer homes residing right next to the mine. Jake Dockins for TIME

Trailer homes residing right next to the mine. Jake Dockins for TIME

The level of noise is appalling to Dr. Thomas Münzel, a German cardiologist who is a leader in the growing field of scientific researchers measuring the impact of urban and industrial noise on humans. For the last 15 years, Münzel has studied how transportation and urban noise, especially at night, can be debilitating stressors on the heart, brain, and cardiovascular systems. In one study, he exposed young, healthy students to noise events up to 63 decibels, and found that their vascular function diminished after just a single night. In other studies, he’s found that nighttime noise pollution directly leads to heart failure and molecular changes in the brain, which may lead to impaired cognitive development of children and make some people more prone to developing dementia.

“The European Environmental Agency tells us that everything above 55 decibels is making us sick,” he says. The fact that the Granbury Bitcoin mine is emitting 70 or even 90 decibels on a nightly basis is “like torture,” he says. “The most spectacular cardiovascular diseases will develop. They have to stop the machines.”

Health effects have the potential to extend past the human residents of Granbury. Studies have shown that man-made noise pollution harms animals and wildlife, causing oxidative stress and memory loss in rodents, acute anxiety in dogs, and a decrease in forest growth. Shenice Copenhaver’s dog, Persephone, started going bald and developed debilitating anxiety shortly after the Bitcoin mine began operating four blocks away. Directly next door, Tom Weeks’ dog Jack Rabbit Slim started shaking and hyperventilating uncontrollably for hours on end; a vet placed him on the seizure medication Gabapentin. Rosenkranz’s chickens stopped laying eggs for months. And Jerry and Patricia Campbell’s centuries-old oak tree, which had served as the family’s hub and protector for generations of backyard family reunions and even a wedding, died suddenly three months ago.

It’s nearly impossible to prove the Bitcoin mine directly caused the afflictions of these specific animals and plants. But as the strange anecdotes collect, they’ve added to the stress of a town that feels under siege from all directions.

“I’ve lived in Texas all my life and I’ve never seen an oak tree be beautiful one year and die the next,” Jerry Campbell says on his lawn, beneath the tree’s gnarled, blackened limbs. “It’s so strange.”

Hood County Constable John Shirley has spent months trying to find his own solutions to a problem that at times seems supernatural. As a former member of the Oath Keepers, a far-right militia whose leaders were convicted of seditious conspiracy against the U.S. government, Shirley is a somewhat divisive figure in the town. But lately Shirley has been laser-focused on the mine—an issue he considers apolitical. “When you’ve got Greenpeace supporting the same cause as a former Oath Keeper, what weird episode of the Twilight Zone are we in?” he says, chuckling darkly. (Shirley resigned from the Oath Keepers before Jan. 6, 2021, due to “serious concerns” with the direction of the organization, he says.)

Shenice Copenhaver’s dog, Persephone, started going bald and developed anxiety shortly after the mine began operating four blocks away. Jake Dockins for TIME

Shenice Copenhaver’s dog, Persephone, started going bald and developed anxiety shortly after the mine began operating four blocks away. Jake Dockins for TIME

On a listless May morning before the sun has risen, Shirley is sitting in his truck across the road from the mine. He is used to getting up at this hour, as he’s been taking decibel readings of the plant around the clock in order to write tickets against the mine’s operators for disorderly conduct. Shirley sticks his recorder out the window and the numbers on it flicker up and down as the roar washes over it. Eventually, the recorder caps out at 91 decibels, which the CDC estimates as roughly in between the output of a lawnmower and a chainsaw.

This level of noise, the CDC writes, can cause hearing damage after two hours of exposure. The Occupational Safety and Health Administration advises that employees can only work in 90-decibel settings for eight hours a day and are required to wear ear protection. And Texas state penal code deems any noise above 85 decibels unreasonable. Over the course of 2024, Shirley has recorded a noise above 85 decibels coming from the plant more than 35 times.

Technically there is federal mandate to regulate noise, which stems from the 1972 Noise Control Act—but it was essentially de-funded during the Reagan administration. This leaves noise regulation up to states, cities, and counties. New York City, for instance, has a noise code which officially caps restaurant music and air conditioning at 42 decibels (as measured within a nearby residence). Texas’s 85 decibels, in contrast, is by far the loudest state limit in the nation, says Les Blomberg, the executive director of the nonprofit Noise Pollution Clearinghouse. “It is a level that protects noise polluters, not the noise polluted,” he says.

Ultimately, Constable John Shirley can’t stop the machines, because there is no state law forcing the operator of a noisy machine to turn it off. When Shirley writes a ticket for disorderly conduct, it merely triggers a $500 fine, as opposed to jail time or another punitive measure. Hood County can’t even pass a relevant noise ordinance law: only Texas cities, not counties, have the ability to do so.

Shirley’s tickets now add up to a theoretical fine of $17,500 and counting. But that number is chump change for Marathon, which earned $165 million in revenue in the first quarter of 2024 and bragged to shareholders about “record earnings.” And the company is fighting back: They have requested a jury trial to overturn this low-level misdemeanor, which starts July 8. At a pre-trial hearing in May, the company arrived with a full team of lawyers. “To bring two or three full-suited attorneys to a justice of the peace court citation issue: I’ve never seen that,” says Patrick Ryan, a local lawyer who has consulted with Granbury community members about the possibility of a civil nuisance lawsuit. “They’re coming with both barrels.”

A representative for Marathon declined several interview requests with TIME, saying that the company would refrain from commenting publicly until Constable Shirley’s “unwarranted” citations against the plant had been resolved. As Shirley sits outside the facility recording the pulsating drone, his nostrils flare, and his voice rises with impatience. “When I was a murder investigator and someone killed somebody, I had the law on my side,” he says. “With this, it’s like I’m swatting at a rhinoceros.” As he reads the decibel levels on his sound meter, a security guard from the facility steps out of his car and snaps pictures of Shirley’s truck in the dark.

Shadden, who suffered from hearing loss, on her property in Granbury, Texas.Jake Dockins for TIME

Shadden, who suffered from hearing loss, on her property in Granbury, Texas.Jake Dockins for TIME

The residents of Granbury feel they’ve been lied to. In 2023, the site’s previous operators, US Bitcoin Corp, constructed a wall around the mine almost 2,000 feet long and claimed that they had “solved the concern.” But Shirley says that the complaints from the community about the sound actually increased when the wall was nearing completion last fall. Since Marathon bought the facility outright in December, its hash rate, or computational power expended, has doubled.

As complaints mounted at the top of 2024, the company contended it did not know about the extent of the sound issues. “We are now the owners, but we are not the operator. USBTC is still the operator. Prior to the purchase, we were not aware of the noise issues,” a Marathon representative wrote to TIME in an email in January. “Now that we own the site and have been made aware of the issue, we are working to gather information and address the situation.”

But documents show that Marathon provided a $67 million loan in May 2021 to the site’s first formal owners, Compute North, to build out the site’s infrastructure, and Marathon’s purchase agreement of the site, dated December 15, 2023, clearly mentions the existence of the $1.9 million “sound wall” built several months prior.

As community complaints reached a fever pitch earlier this year, Marathon held a meet-and-greet on March 29—Good Friday, which rubbed many people in Granbury’s deeply religious community the wrong way. For the handful of people that did show up, Marathon laid out a noise mitigation plan which included turning off idle fans, moving some containers into liquid cooling by April 2024, and installing vegetation and trees around the perimeter.

In an emailed statement to TIME in late June, Marathon said that 58 air-cooled containers have been removed from the site, and pointed to a roadmap which vows to convert 50% of the site’s containers to immersion cooling by the end of the year. A representative for Constellation Energy, which owns the power plant that Marathon connects to, said in a statement that the company is “staying updated on [Marathon’s] efforts to respond to the concerns raised by neighbors… We will continue working closely with Marathon as they take actions to reduce their impacts.”

Marathon says that immersion cooling, in which computers are placed in tubs of oil, will largely fix the noise problem. But the technique has potential drawbacks, including the difficulty of regularly performing maintenance on a computer submerged in oil, says Kent Draper, the chief commercial officer of the Bitcoin and AI data center operator IREN. “Although it’s been around for a long time in the industry, it’s just not that widely adopted,” he says.

Even Marathon expressed skepticism about its ability to convert its many machines to immersion technology in a 2023 year-end SEC Report. “There is a risk we may not succeed in developing or deploying immersion-cooling at such a large scale to achieve sufficient cooling performance,” the company wrote.

In an email to TIME, Marathon wrote: “While we are confident in our ability to scale this new technology, it is our obligation, as a publicly traded company, to identify any potential risks from a financial perspective.”

A representative for Marathon Digital Holdings says the company is transitioning to a quieter form of cooling. Jake Dockins for TIME

A representative for Marathon Digital Holdings says the company is transitioning to a quieter form of cooling. Jake Dockins for TIME

Granbury community members are exploring political and legal avenues. A petition against the mine in Granbury and its “excessive and unhealthy noise” garnered 800 in-person signatures, and was brought by representatives to the Texas Republican state convention in San Antonio in May, with the hopes of gaining statewide support for some sort of ban. But two local elected officials, Nannette Samuelson and Shannon Wolf, say they tried to take the floor to stump for the issue, but weren’t given time to speak. Samuelson’s goal is now to pass resolutions in commissioners court prompting state senators to draft legislation.

Any statewide legislation is sure to hit significant headwinds, because the very idea of regulation runs contrary to many Texans’ political beliefs. “As constitutional conservatives, they have taken our core values and used that against us,” says Demetra Conrad, a city council member in the nearby town of Glen Rose.

Some community members are also exploring a potential civil nuisance suit against Marathon, in which they would seek an injunction against the company and/or damages. One affected woman, Cheryl Shadden—who has medically-documented hearing loss—has retained the nonprofit Earthjustice to examine potential litigative routes. Deputy managing attorney Mandy DeRoche says Earthjustice is exploring the possibility of taking its own sound readings near the site. The nonprofit has been involved in several lawsuits against crypto mining companies across the country.

“Historically, Bitcoin miners go to the cheapest source of electricity with the least amount of regulation, and they do the cheapest thing possible,” DeRoche says. “It’s one of the reasons why noise pollution from crypto mining tends to be so much worse than traditionally-operated data center operators.”

As Bitcoin continues to gain value, miners are building progressively bigger operations, causing gas plants and other fossil fuel emitters to spring back into action. It is unclear whether states even have the energy capacity to support this new demand: In June, Texas lieutenant governor Dan Patrick tweeted that Texans “will ultimately pay the price” for the growth of crypto and AI data centers, writing that they “produce very few jobs compared to the incredible demands they place on our grid.” Regardless, Bitcoin lobbying groups are attempting to pass pro-Bitcoin-mining bills in state legislatures across the country, which would exempt similar operations from noise ordinances and local zoning laws. People have reported similar symptoms near Bitcoin mines in Arkansas and Williston, North Dakota. Ultimately, Granbury is just one canary of several in the proverbial mine.

In the week before this article’s publication, two more Granbury residents suffered from acute health crises. The first was Tom Weeks, the owner of the hyperventilating dog. On July 2, Weeks, 64, rose after another sleepless night of listening to the mine and realized he couldn’t breathe. He was rushed to a Fort Worth hospital, where he was diagnosed with a pulmonary embolism—a blood clot blocking his lungs—and hooked up to an oxygen tank. Weeks was supposed to testify against Marathon in the jury trial, but is now physically unable to do so. “This whole thing is an eye opener for me into profit over people,” Weeks says in a phone call from the ICU.

The second person affected was the five-year-old Indigo Rosenkranz. On July 6, she suffered from a seizure and was taken to the emergency room, before being routed to a childrens’ hospital in Fort Worth for further testing. Her mother, Sarah, was terrified and now feels she has no choice but to get a second mortgage to move away from the mine. “A second one would really be a lot,” she says. “God will provide, though. He always sees us through.”

Bitcoin

Grayscale Unveils Bitcoin Mini Trust ETF

Bitcoin Currency

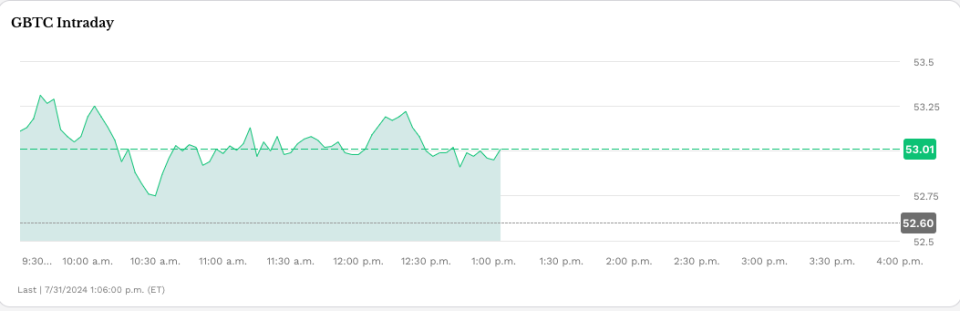

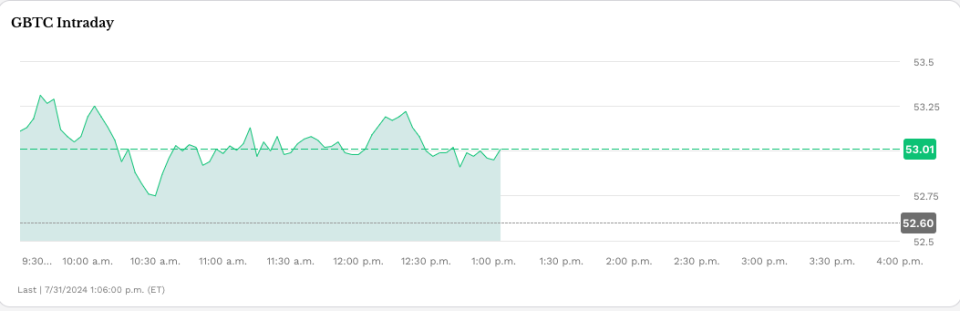

Grayscale Investments The Bitcoin Mini Trust began trading on Wednesday with a 0.15% expense ratio, offering a lower-cost option for bitcoin exposure in the market.

The Mini Trust, which has the symbol BTC and trades on NYSE Arca, is structured as a spin-off of the Grayscale Bitcoin Trust (GBTC). New shares will be distributed to existing GBTC shareholders with the fund contributing a portion of its bitcoin holdings to the new product. According to a company press releaseBTC’s S-1 registration statement became effective last week.

“The Grayscale team has believed in the transformative potential of Bitcoin since the initial launch of GBTC in 2013, and we are excited to launch the Grayscale Bitcoin Mini Trust to help further lower the barrier to entry for Bitcoin in an SEC-regulated investment vehicle,” said David LaValle, Senior Managing Director and Head of ETFs at Grayscale.

The Bitcoin Mini Trust’s debut comes amid growing interest in ETFs based on the current price of the two largest cryptocurrencies by market cap, bitcoin and ether. Spot bitcoin ETFs have generated nearly $18 billion in inflows since the first ones began trading on Jan. 11, though GBTC has lost nearly $19 billion in assets.

This fund differs from other funds because it is a conversion of an existing fund and has a 1.5% fee, the highest among spot bitcoin products that have received SEC approval this year.

Mini Bitcoin Trust Low Fee

On a Post X On Wednesday, Bloomberg senior ETF analyst Eric Balchunas noted the Bitcoin Mini Trust’s “lowest fee in the category…”

“[Important] to recognize how incredibly cheap 15bps is — about 10x cheaper than spot ETFs in other countries and other vehicles,” Balchunas wrote, adding that this pricing strategy reflects the competitive nature of the U.S. ETF market, which he referred to as the “ETF Terrordome.”

“This is what Terrordome does to fund [cost]. It reaches 1.5% [and] end in 0.15%, how to go from [a] country club to the jungle. But that’s why all the flows are here, investor paradise,” he noted.

Read more: Spot Bitcoin ETF Inflows Hit Daily High of Over $1 Billion

Bitcoin was recently trading at around $66,350, virtually flat since U.S. markets opened on Wednesday.

Grayscale also offers two spot Ethereum ETFs, the Grayscale Ethereum Trust (ETHE) and the Grayscale Ethereum (ETH) Mini Trustwhose performance is based on ETHE. ETHE outflows exceeded $1.8 billion in its first six days of trading, while ETH added more than $181 million in the same period, according to Farside. The remaining seven ETFs generated about $1.2 billion in inflows.

The story continues

Read more: Spot Ethereum ETFs Approved to Start Trading

Permanent link | © Copyright 2024 etf.com. All rights reserved

Bitcoin

Bitcoin (BTC) Price Drops Below $65K After FOMC as Middle East Tensions Rise

Cryptocurrencies fell sharply on Wednesday as rising geopolitical risks captivated investors’ attention following the conclusion of the Federal Reserve’s July meeting.

Bitcoin (BTC) fell to $64,500 from around $66,500, where it traded following Federal Reserve Chairman Jerome Powell’s press conference and is down more than 2% in the past 24 hours. Major altcoins including ether (ETH)sunbathing (SUN)Avalanche AVAX (AVAX) and Cardano (ADA) also fell, while Ripple’s XRP saved some of its early gains today. The broad cryptocurrency market benchmark CoinDesk 20 Index was 0.8% lower than 24 hours ago.

The liquidation happened when the New York Times reported that Iran’s leaders have ordered retaliation against Israel over the killing of Hamas leader Ismail Haniyeh in Tehran, raising the risk of a wider conflict in the region.

Earlier today, the Fed left benchmark interest rates unchanged and gave little indication that a widely expected rate cut in September is a given. The Fed’s Powell said that while no decision has been made on a September cut, the “broad sense is that we are getting closer” to cutting rates.

While digital assets suffered losses, most traditional asset classes rose higher during the day. U.S. 10-year bond yields fell 10 basis points, while gold rose 1.5% to $2,450, slightly below its record highs, and WTI crude oil prices rose 5%. Stocks also rallied during the day, with the tech-heavy Nasdaq 100 index rebounding 3% and the S&P 500 closing the session 2.2% higher, led by 12% gains in chipmaker giant Nvidia (NVDA).

The different performances across asset classes could be due to traders’ positioning ahead of the Fed meeting, Zach Pandl, head of research at Grayscale, said in an emailed note.

“Equities may have been slightly underutilized after the recent dip, while bitcoin is coming off a strong period with solid inflows, while gold has recovered after a period of weakness,” he said.

“Overall, the combination of Fed rate cuts, bipartisan focus on cryptocurrency policy issues, and the prospect of a second Trump administration that could advocate for a weaker U.S. dollar should be viewed as very positive for bitcoin,” he concluded.

UPDATE (July 31, 2024, 21:30 UTC): Adds grayscale comments.

Bitcoin

Donald Trump’s Cryptocurrency Enthusiasm Is Just Another Scam

Former US President Donald Trump spoke at the Libertarian National Convention in May and lent his a strong support to crypto: “I will also stop Joe Biden’s crusade to crush crypto. … I will ensure that the future of crypto and the future of bitcoin is made in the US, not taken overseas. I will support the right to self-custody. To the 50 million crypto holders in the country, I say this: With your vote, I will keep Elizabeth Warren and her henchmen out of your bitcoin.”

Former US President Donald Trump spoke at the Libertarian National Convention in May and lent his a strong support to crypto: “I will also stop Joe Biden’s crusade to crush crypto. … I will ensure that the future of crypto and the future of bitcoin is made in the US, not taken overseas. I will support the right to self-custody. To the 50 million crypto holders in the country, I say this: With your vote, I will keep Elizabeth Warren and her henchmen out of your bitcoin.”

Trump continued to court the cryptocurrency industry in the months that followed; he he appeared at the Bitcoin 2024 Conference in Nashville this week, along with independent presidential candidate Robert F. Kennedy Jr.’s parting words to Trump — “Have fun with your bitcoin, your cryptocurrency and whatever else you’re playing with” — were less than enthusiastic, but the industry itself remains packed with ardent Trump supporters.

This turnaround came as a surprise, given Trump’s previous strong opposition to cryptocurrency. When Facebook was floating its Libra cryptocurrency in 2019, Trump tweeted: “I am not a fan of Bitcoin and other cryptocurrencies, which are not money, and whose value is highly volatile and based on thin air.” Former national security adviser John Bolton’s White House memoir, The Room Where It Happened, quotes Trump as telling Treasury Secretary Steven Mnuchin: “Don’t be a trade negotiator. Go after Bitcoin.” [for fraud].” In 2021, Trump counted Fox Business that bitcoin “just looks like a scam. … I want the dollar to be the world’s currency.”

Why the change? There doesn’t seem to be any crypto votes. Trump’s “50 million” number comes from a poorly sampled push survey by cryptocurrency exchange Coinbase which claimed 52 million cryptocurrency users in the United States starting in February 2023. But one survey A survey conducted last October by the US Federal Reserve showed that only 7% of adults (about 18.3 million people) admitted to owning or using cryptocurrencies — down from 10% in 2022 and 12% in 2021. Many of these people are likely wallet owners who were left holding the bag after crypto plunged in 2022 — and are not necessarily new fans.

What Trump wants from the cryptocurrency industry is money. The cryptocurrency industry has already raised more than US$ 180 million to run in the 2024 US elections through his super PACs Fairshake, Defend American Jobs and Protect Progress.

Fairshake spent $10 million on taking Rep. Katie Porter in the primary battle for Dianne Feinstein’s California Senate seat by funding Porter’s pro-crypto rival Adam Schiff. This put $2 million to knock out Rep. Jamaal Bowman in the Democratic primary for New York’s 16th District in favor of pro-crypto George Latimer. In the Utah Senate Republican primary, Rep. John Curtis defeated Trent Staggs with the help of $4.7 million from Defend American Jobs. In Alabama’s House District 2, the majority of campaign expenses came from the cryptocurrency industry.

Fairshake is substantially financed by Coinbase, cryptocurrency issuer Ripple Labs, and Silicon Valley venture capital firm Andreessen Horowitz, or a16z. Silicon Valley was awash in cryptocurrencies during the 2021 bubble, and a16z in particular continues to promote blockchain startups to this day — and still holds a huge amount of bubble crypto tokens that he wishes he could cash in on.

Many in Silicon Valley would like an authoritarian who they think will let them run wild with money — while bailing them out in tough times. Indeed, Trump promised Bitcoin 2024 participants that he hold all bitcoins that the United States acquires. (Never mind that it is usually acquired as the proceeds of crime.) Silicon Valley explicitly sees regulation of any kind as its greatest enemy. Three a16z manifestos — “Politics and the Future” It is “The Techno-Optimist Manifesto” and 2024 “The Small Tech Agenda—describe co-founders Marc Andreessen and Ben Horowitz’s demands for a technology-powered capitalism unhindered by regulation or social considerations. They name “experts,” “bureaucracy,” and “social responsibility” as their “enemies.” Their 2024 statement alleges that banks are unfairly cutting off startups from the banking system; these would be crypto companies funded by a16z.

Trump’s vice presidential pick, Senator J.D. Vance, is a former Silicon Valley venture capitalist. He was once employed by Peter Thiel, who bankrolled Vance’s successful 2022 Senate run; Vance has been described as a “Thiel creation”. He has increased support for the Trump ticket among his venture capital associates. Vance is a bitcoin holder and a frequent advocate of encryption. He recently released a draft bill to review how the Securities and Exchange Commission (SEC) and the Commodity Futures Trading Commission (CFTC) control crypto assets. In 2023, he circulated a bill to prevent banks from cutting out cryptocurrency exchanges.

Minimal regulation has been tried before. It led to the wild exuberance of the 1920s, which ended with the Black Tuesday crash of 1929 and the Great Depression of the 1930s. Regulators like the SEC were put in place during this era to protect investors and transform the securities market from a jungle into a well-tended garden, leading to many prosperous and stable decades that followed.

Crypto provides the opposite of a stable and functional system; it is a practical example of how a lack of regulation allows opportunists and scammers to cause large-scale disasters. The 2022 Crypto Crash repeated the 2008 financial crisis in miniature. FTX’s Sam Bankman-Fried was feted as a financial prodigy who would perform economic miracles if you just gave him carte blanche; he ended up stealing billions of dollars of customers’ money, destroying the lives of ordinary people, and is now in a prison cell.

U.S. regulators have long been concerned about the prospect of cryptocurrency contagion to the broader economy. Criminal money laundering is rampant in cryptocurrency; even the Trump administration has made rules in December 2020 to reduce the risk of money laundering from crypto. Meanwhile, the crypto industry has persistently tried to infiltrate systemically risky corners of the economy, such as pension funds.

Four U.S. banks collapsed during the 2023 banking crisis, the first since 2020. Two of them, Silvergate Bank and Signature Bank, were deeply embedded in the crypto world — Silvergate in particular appears to have collapsed directly from its heavy reliance on FTX and failed a few months after that. Silicon Valley Bank was not involved in crypto but collapsed due to a run on the bench due to panic among venture capital deposit holders, particularly Thiel’s Founders Fund.

Project 2025the Heritage Foundation mammoth conservative wish list The plan, which Trump and Vance have both endorsed and tried to distance themselves from at various times, emphasizes the importance of party loyalists, noting especially financial regulation. The plan recommends replacing as much of the federal bureaucracy as possible with loyalists and “trusted” career officials rather than nonpartisan “experts.” Vance defended in 2021 that Trump should “fire every mid-level bureaucrat, every civil servant in the administrative state” and “replace them with our people.” Loyalty will likely trump competence.

Crypto is barely mentioned directly in Project 2025 — suggesting it has little active support among the broader conservative coalition. But near the end of the manifesto is a plan to dismantle most U.S. financial regulations and investor protections put in place since the 1930s, suggesting the exemption the crypto industry seeks from current SEC and CFTC regulations.

Bitcoin, the first cryptocurrency, started as an ideological project to promote a strange variant of Murray Rothbard’s anarcho-capitalism and the Austrian gold-backed economy—the kind we abandoned to escape the Great Depression. Crypto quickly co-opted the “end of the Fed” and “establishment elites” conspiracy theories of the John Birch Society and Eustace Mullins. It’s a way for billionaire capitalists like Thiel, Andreessen and Elon Musk to claim they’re not part of the so-called elite.

If a second Trump administration were to limp along with financial regulators and allow cryptocurrencies to have free rein, it could help foster the collapse of the U.S. economy that bitcoin claimed to prevent. But Trump is more likely to be happy to take the crypto money and run.

Bitcoin

Trump’s Bitcoin (BTC) Reserve Plan Seen as Just a ‘Small Token Stash’

Donald Trump’s recent promise to create a “strategic national stockpile of Bitcoin” may not turn out to be as big a commitment as the hype surrounding the announcement makes it seem.

“Trump’s proposal is extremely modest,” said George Selgin, director emeritus of the Center for Monetary and Financial Alternatives at the Cato Institutea Washington-based public policy group. “It doesn’t have much economic implication.”

-

Ethereum11 months ago

Ethereum11 months agoEthereum Posts First Consecutive Monthly Losses Since August 2023 on New ETFs

-

Regulation11 months ago

Regulation11 months agoCryptocurrency Regulation in Slovenia 2024

-

News11 months ago

News11 months agoNew bill pushes Department of Veterans Affairs to examine how blockchain can improve its work

-

Regulation11 months ago

Regulation11 months agoThink You Own Your Crypto? New UK Law Would Ensure It – DL News

-

Regulation11 months ago

Regulation11 months agoUpbit, Coinone, Bithumb Face New Fees Under South Korea’s Cryptocurrency Law

-

Regulation11 months ago

Regulation11 months agoA Blank Slate for Cryptocurrencies: Kamala Harris’ Regulatory Opportunity

-

Regulation11 months ago

Regulation11 months agoBahamas Passes Cryptocurrency Bill Designed to Prevent FTX, Terra Disasters

-

Regulation11 months ago

Regulation11 months agoIndia to Follow G20 Policy for Cryptocurrency Regulation: MoS Finance

-

Ethereum1 year ago

Ethereum1 year agoComment deux frères auraient dérobé 25 millions de dollars lors d’un braquage d’Ethereum de 12 secondes • The Register

-

News1 year ago

News1 year ago“Captain Tsubasa – RIVALS” launches on Oasys Blockchain

-

News11 months ago

News11 months agoEU supports 15 startups to fight online disinformation with blockchain

-

Videos1 year ago

Videos1 year agoNexus Chain – Ethereum L2 with the GREATEST Potential?