News

European Blockchain Sandbox announces the selected projects for the first cohort

The DLT use case was conducted in July 2021 and presented two months later in Trieste during the conference “Italy Smart Export”. The “Pilot 1.0” was a shipment from Italy to Turkey with a complete digitisation of the logistics documentation and interoperability between public and private subjects involved. It was the first fully digital shipment exploiting blockchain technology in Italy and Europe and it involved the following players: Benetton Group (exporting company), Port of Trieste (customs and place of departure for the Ro-Ro shipment), ADM (the Italian Customs Agency which gave a quality check about the correctness of the process), a global freight forwarder and a Turkish Import Company. The shipment has been done using the ACCUDIRE platform and creating an e-CMR (Electronic Consignment Note for road transportation). The identities of the subjects involved have been verified through two-factor authentication and their signatures have been geolocated and saved on blockchain, interoperating with AIDA (ADM’s software) and sending the pre-arrival notification of goods to the PCS (Port Community Systems). Specifically, the e-CMR document needs 3 signatures (sender, carrier and receiver) and ACCUDIRE saves on blockchain these signatures (including geolocation, identity and all other relevant information) in order to guarantee immutability, traceability and security of the shipping related information. Blockchain used is a permissioned Hyper Ledger Fabric supplied by TrustedChain with nodes all in Italy at AgID (Agency for Digital Italy) qualified entities (Trust Service Providers, according to the eIDAS-regulation).

The pilot has been inserted also as a use case of the DTLF and mentioned in the Subgroup 1 (Paperless Transport) of the e-FTI (Electronic Freight Transport Information) discussions, which is regularising and formalising digital processes related to the transport of goods across Europe. Additionally, ACCUDIRE is part of the European Horizon 2020 TRICK project, which aims at supporting SMEs operating in fashion and food industries in the adoption, tracing and demonstration of sustainable approaches by means of Blockchain.

The impact of the use case has been relevant for Italy and Europe. The pilot represents the first shipment with fully digitised documents and processes with blockchain, simplifying all the procedures and especially the interoperability between public and private players involved. ACCUDIRE is now an innovative platform that allows Large and SMEs involved in global supply chains in the complete digitisation of processes and documentation through a paperless and eco-friendly approach, preserving “Made in” and protecting products against counterfeiting. Thanks to ACCUDIRE, companies can reduce costs, maximise margins, decrease waste and work in synergy with the many other actors involved along the chain. In addition, ACCUDIRE allows a better connection between trade and trade finance, simplifying the flow of financial information and thus the payment of the goods and the dialogue between banks and firms.

Giotto OnChain Notarization SaaS

The service enables the authenticity and immutability of digital assets to be certified through the attribution of a timestamp and a certain owner of the transaction performed and guarantees the asset integrity and origin. It’s a highly innovative evolution of blockchain notarisation use cases because it exceeds the constraints of cryptocurrencies and balance sheets or technological integration skills, potentially interfacing any Blockchain. The service is a SaaS (Software As A Service) based on blockchain, other decentralised technologies and cloud services. It allows notarisation on public blockchains (Ethereum and Bitcoin) via APIs, but thanks to AlmavivA hybrid model it has no technological lock-in in the development of blockchain solutions, so it is compatible with the European Blockchain Services Infrastructure (EBSI) too. It produces interoperable receipts compliant with the Chainpoint opensource standard that enables the verification of notarisations without the need to interact with the SaaS service that generated them. The receipts are also made available on the decentralised file system IPFS (InterPlanetary File System).

Highlights:

- authentication of any type of file to prove its originality and existence at a certain date and time;

- verification of the incorruptibility of assets;

- confirmation of a creative work registration;

- certification of administrative procedures and workflows, response to a tender, maintenance certificates etc.;

- transparency to verify autonomously without notarisations’ costs and without lock-in on the service provider;

- flexibility and modularity thanks to API model to maximise interoperability and integration with existing and future systems.

Advantages:

- Operational: simplified integration of blockchain services with IT systems in a scalable way through global, national or EU infrastructures (EBSI).

- Commercial: cutting-edge features in a simple and effective way through qualified tools and Cloud with guaranteed certification, regulatory compliance and security that increases the protection of valuable data.

- Social and public: make public docs and processes transparent and verifiable increases actors’ trust and social impact on citizens and PA.

- Economic: no crypto risk in customers’ balance sheets, notarisation on public blockchains, requiring crypto, is done via a third party that can guarantee true disintermediated verification without vendor lockin and that it has performed exactly the required transaction.

- Technical: optimise multiple operations by performing a notarisation round, from which receipts are generated, this also increases Privacy and prevents the appearance in the receipts of other customers data hashes.

Giotto OnChain Notarization SaaS, thanks to the use of opensource format as Blockchain Proof & Anchoring Standard for receipts, contributes to the interoperability pillar of the European Strategy for Data, comprised within the wider policy “a Europe fit for the digital age”. This also avoids vendor-lock in and allows for trustless verification, which is mandatory when the use case is adopted in the context of cooperation between Public Bodies or Private entities. Moreover, the Service is currently being proposed as a Building Block in R&D projects involving carbon footprint certification, which allows Enterprises to implement a reliable tool to reach their ESG objectives in the context of the European Green Deal. Finally, the certification function is a primary driver in fighting fake news and misinformation, contributing to media pluralism, and preserving European Democracy.

Anotherblock

introducing anotherblock, a revolutionary platform powering emotional and financial bonds between creators and consumers.

at the heart of the traditional music rights landscape, anotherblock provides a platform for creators to sell their rights to their community, bypassing financial intermediaries, all enabled by cutting-edge technology.

our music ownership tokens have been implemented using the ERC-721 standard on Ethereum. each token possesses a unique custom ID that stores the ownership percentage for a particular song on the blockchain. these tokens encompass unique artwork together with a real-world legal contract which includes the terms of streaming royalties and guarantees the collector’s legitimate ownership rights.

with anotherblock, creators gain the opportunity to sell their music rights directly to consumers, ensuring a fair and transparent transaction. by removing the presence of middlemen, creators can secure a fair price for their music rights, while maintaining control over their artistic endeavors.

For consumers, anotherblock offer a unique investment opportunity to form an emotional and financial connection with the tracks they love. through anotherblock, the community can invest in individual tracks, unlocking a new level of engagement with the music they are passionate about. this innovative approach bridges the gap between creators and their community, fostering a mutually beneficial relationship within the music ecosystem.

by leveraging our platform’s capabilities, anotherblock paves the way for a seamless and inclusive music investment experience, providing a win-win solution for both creators and the community alike.

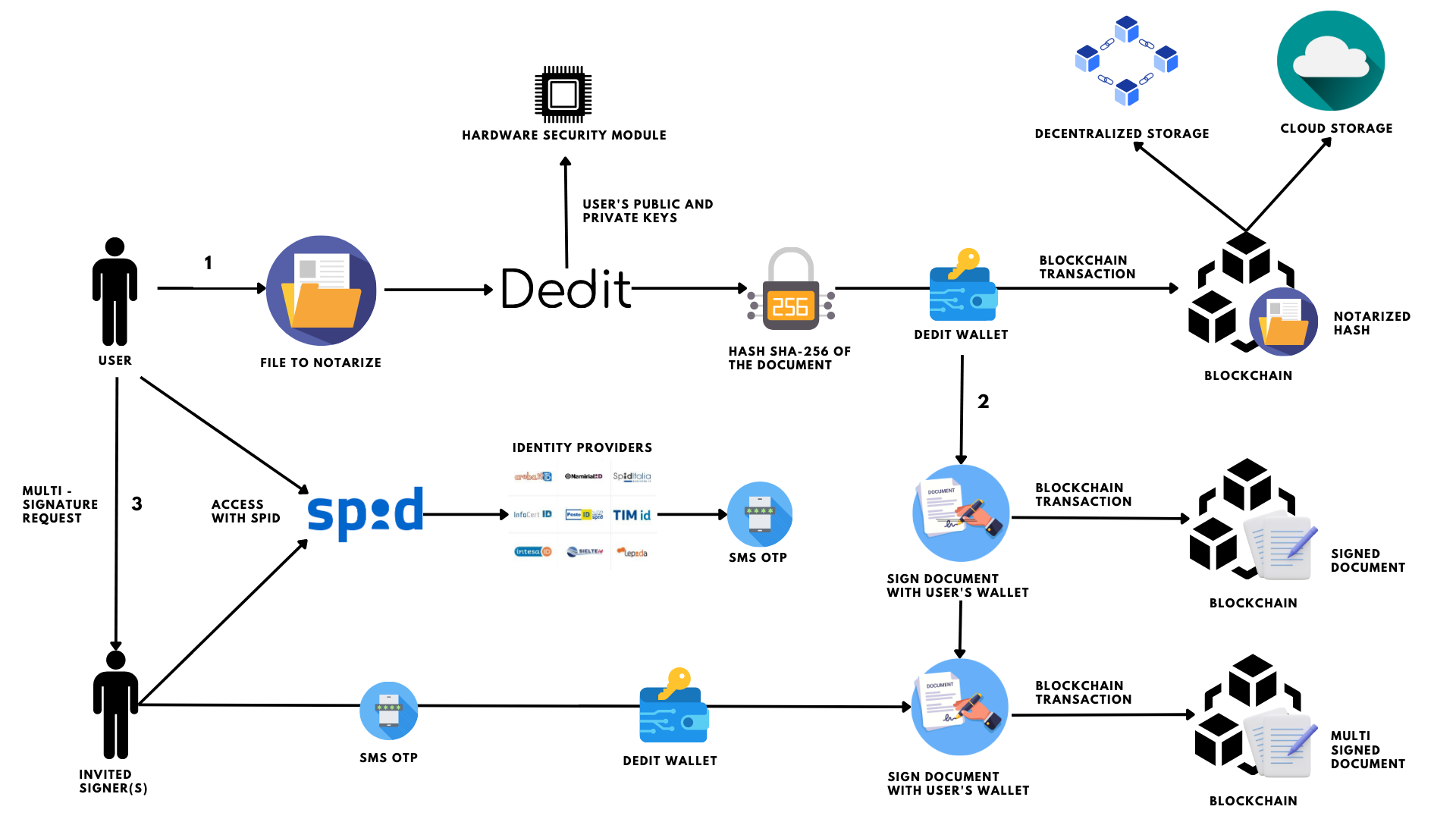

Blockchain Italia

Dedit is a blockchain-based platform designed for secure and efficient document notarization, signing, storage, and sharing. Using Ethereum and Algorand and supporting various EVM blockchains, it produces an immutable, timestamped, and author-verified record of every document by generating a unique digital fingerprint via a hash function and registering it on a specific blockchain block. The wide range of protocols and development languages that are supported, allow it to present itself to the market as a flexible model. The platform offers file management features such as dossier classification, custom viewing, and encrypted storage on both cloud and IPFS technology. It also supports multiple signatures on a document and integrates with SPID to ensure its legal validity in Italy, crucial for certain financial sector use cases.

Dedit has demonstrated various benefits in redesigning data certification and validation processes both with third-party clients and within internal workflows: operationally, it optimizes workflows and accelerates digitalization; economically, it boosts scalability and resource efficiency; socially, it reduces environmental impact through paperless operations and helps prevent document fraud; and commercially, it enhances customer attraction through transparent and comprehensive services. Additionally, Dedit brings transparency and data immutability.

In terms of regulatory compliance, Dedit aims to become a one-stop solution for managing all contractual documents and important assets. It seeks to align with the eIDAS regulation, leveraging national electronic identification schemes like Italy’s SPID and CIE during wallet creation. Dedit has also obtained the status of Advanced Electronic Signature according to legal opinions and compliance verification by our partner. Dedit is now seeking the status of Qualified Electronic Signature to ensure document authenticity, integrity, and non-repudiation, without continuous involvement of a trust service provider beyond the initial identity verification.

Dedit has integrated Hardware Security Module, to enhance user key security and streamline the password recovery and digital signing process. HSM, a specialized device providing an ultra-secure infrastructure for storing and managing cryptographic keys, will protect and store our users’ public and private keys, ensuring their anonymity and security. The HSM integration will benefit our users by allowing secure password recovery if lost and simplifying the digital signing process, reducing user interaction complexity with our application, and enhancing the overall user experience.

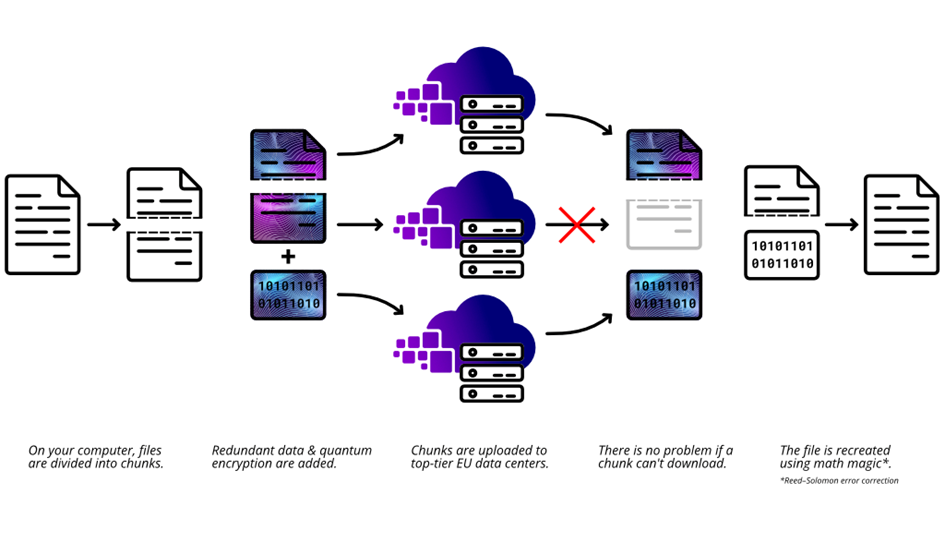

Chunk Works

Quantum-secure decentralized data solution

Our goal is to contribute to a more secure and equitable digital future because data breaches and hacks are no longer a question of “if” but “when”. Therefore, Chunk Works software offers easy-to-use, quantum-secure hybrid encryption and autonomous data recovery built on in-house-developed distributed ledger technology.

Chunk Works combines the convenience of multi-system operability with quantum-secure hybrid encryption. It prioritizes privacy and security without sacrificing performance and can be deployed on any infrastructure (cloud, on-premise, devices, etc.). Under the hood, data storage and retrieval are made more reliable by automatically distributing data across locations. With its autonomous data recovery system, users can be confident that their data is available to them when they need it.

How is data handled?

Chunk Works’ software safely stores your data using distributed ledger technology (DLT) and Erasure Coding (EC). EC protects data by breaking it up into pieces called chunks, encoding them with redundant data, and storing them in a number of different locations via DLT. In case any of the chunks later get lost, damaged, or can’t otherwise be downloaded, the added redundant data can recreate the file. Chunk Works cutting-edge software encrypts these chunks with post-quantum cryptography and stores them across locations.

COINFIRM

Our company gathers data from numerous on-chain, off-chain and shared intelligence data sources. The collected data is processed through advanced algorithms to create forensic-level knowledge of asset flows related to crime and money laundering. The system is supplemented with advanced risk-based analytics as required by regulators worldwide. Our AML Platform evaluates AML/CFT risks of blockchain addresses, allowing for the in-depth source of funds analyses and real-time monitoring of address clusters and transactions.

We support crypto market participants in meeting regulatory requirements. Our platform is used by VASP’ s like Banks, Financial Intermediaries, Custodians, Exchanges, Payment Providers, FIUs and DeFi protocols trusted in our solutions. We work closely and assist Regulators, educate Governments, provide risk management, crypto AML and blockchain analytics for numerous of European Banks, Crypto Exchanges, Trading Platforms, Wallet providers and custody service providers, Payment Providers, FIUs and DeFi protocols.

Commissariat à l’énergie atomique

The Green Blockchain combines GreenTech and Tech4Green to notarise the treatment of climatic data from low-cost sensors deployed in urban areas. We focus on the issue of digital frugality, in the context of the environmental objectives of the Paris Agreement and the European infrastructure for the observation of the carbon cycle, called ICOS.

Our use case consists of a blockchain-based tool for collecting, processing and displaying CO2 concentrations from sensors deployed in urban areas. A network of sensors collects raw climatic data and sends it to a laboratory (typically one for each urban area) that treats this data in order to arrive at a temporal series of CO2 concentrations for each sensor. The treated data is then made public through a web dashboard, and the treatment process is notarised via calls to smart contracts on the blockchain. Our tool relies on non-energy consuming technologies such as proof-of-stake and Byzantine fault tolerance, which can reduce the consumption of traditional blockchains (i.e., those based on proof-of-work) by three orders of magnitude.

Notarisation is done by anchoring (i.e., storing the hashes of data on the blockchain to ensure data’s integrity). The anchoring allows the laboratories (or other third parties) to audit each other by reproducing the treatment process and checking data’s integrity against the hashes stored on the blockchain. The ultimate goal is to provide trust on the climatic data and its treatment to the public.

Essentially, the Green Blockchain adds new trusted services that enable European environmental players (whether institutional or industrial) to interact with each other without any central control body.

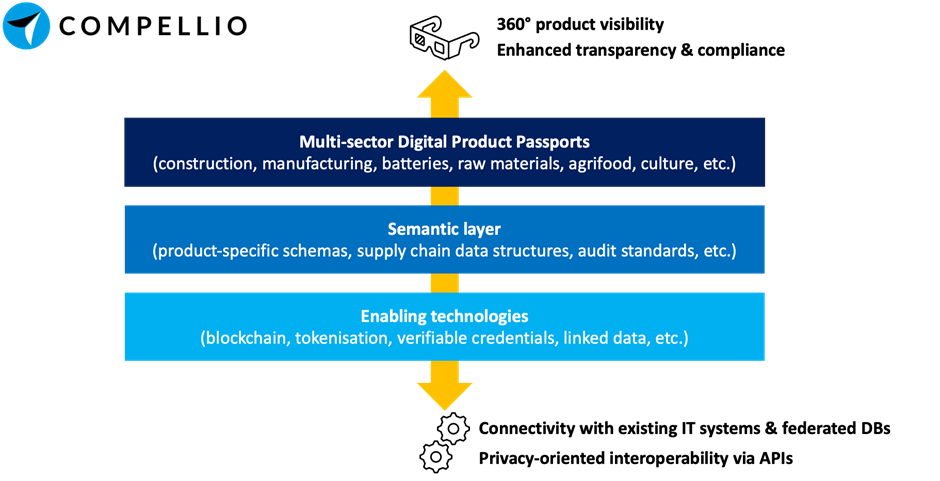

Compellio (Uni Systems)

Why Digital Product Passports?

Digital Product Passports (DPP) are an important element of the EU digital strategy to track the origin of components and raw materials used in various kinds of products. DPPs facilitate access to information from businesses and end consumers for the whole product lifecycle, including environmental impact, with the goal to support the EU’s green transition.

Compellio has developed a new multi-sector DPP solution that combines blockchain, verifiable credentials, and decentralized identity technologies to deliver enhanced levels of accountability and transparency within complex supply chains.

Initially focusing on circular supply chains within the construction sector, and as a member of the Product Circularity Data Sheets Initiative, Compellio has leveraged its patented technology to implement a novel solution that effectively addresses critical privacy, scalability, and interoperability requirements.

Cross-industry benefits

With the support of the EU Blockchain Sandbox, Compellio and Unisystems aim to deliver the following advantages to businesses, auditors, and public authorities:

- Increased trust and verifiability for product claims/disclosures

- Better access management and traceability of workflows

- Stronger risk controls related to 3rd party disclosures

- Streamlined compliance with upcoming standards and EU regulations

1st focus area – The construction sector

The environmental and socio-economic impact of the construction sector is significant. The construction ecosystem represents appx 10% of EU value added & employs appx 25mil people in over 5mil firms. The construction products industry counts 430,000 companies (mainly SMEs) in the EU, with a turnover of €800bil. They are a key economic and social asset for local communities in European regions and cities. Buildings are responsible for i) appx 50% of resource extraction and consumption, ii) more than 30% of the EU’s total waste generated per year, iii) 40% of EU’s energy consumption, and iv) 36% of energy-related greenhouse gas emissions.

Upcoming focus areas

- Manufacturing: Electronics, batteries, textiles, raw materials

- Agri-food: Geographical indications and quality schemes, organic products, e-labels for alcoholic beverages

- Energy: Certification of origin, smart metering, energy communities, flexibility service provision, electric vehicle grid integration

- Culture: Imports of cultural goods, tackling of illicit trade, IP management

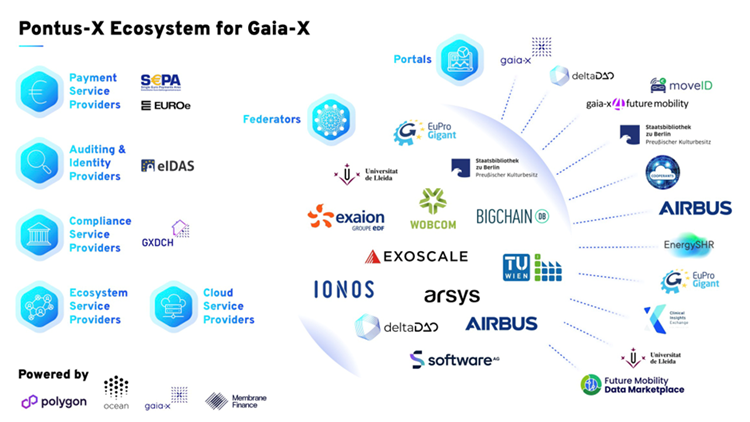

deltaDAO

deltaDAO AG Launches Blockchain-Based Gaia-X Data Infrastructure for EU Market

deltaDAO AG introduces Pontus-X, the Web3 Ecosystem for Gaia-X. This digital ecosystem operates across Europe and uses Distributed Ledger Technology (DLT) to exchange and orchestrate software, data, and infrastructure services. The solution leverages blockchain technology and cutting-edge privacy- and IP-preserving measures, such as Compute-to-Data, to ensure data sovereignty, IP-protection, and privacy. This adheres to European values while facilitating data sharing, distributed computation, and data monetization. The Pontus-X ecosystem includes a transaction layer and data exchange logging services based on DLT, NFT-based metadata catalogues, sovereign data exchange services based on smart contracts, access controllers, Gaia-X portals, and an identity and trust layer founded the European Trust Anchors, the Gaia-X Trust Framework, Self-Sovereign Identity (SSI) and W3C Verifiable Credentials (VC). It also integrates the EU-regulated stablecoin EUROe for frictionless, real-time inter-company and cross-border settlement.

Incorporating the advanced Compute-to-Data feature, Pontus-X enables secure and efficient data processing without moving raw data from its original location, thereby preserving data privacy, and reducing transmission costs. This use case, already validated through real-world deployments and collaborations with industry leaders, aims at creating a European and global decentralized, secure, and transparent digital services infrastructure across domains. It aids in facilitating cooperation among participants, enabling tamper-proof audit trails required by compliance laws, and fostering an economically sustainable, transparent, and competitive ecosystem for all stakeholders.

deltaDAO AG provides domain-agnostic solutions already applied in sectors including aerospace, transportation, automotive, healthcare, open science, digital services, IT, cloud services, AI and data-driven businesses, industry 4.0, and manufacturing. This is unified through dedicated AI, data and infrastructure marketplaces within Pontus-X. This open ecosystem allows participants to exchange AI models and digital services safely, unlocking new avenues for data monetization and collaborative AI development while adhering to stringent European data protection norms.

The initiative aligns with the European data strategy, EU digital strategy, and EU policy priorities, promoting a secure and transparent digital single market, data sovereignty, and trust in the European Union. The use of blockchain technology, smart contracts, tokens, and NFTs, in compliance with EU regulations, is critical to fostering data-driven innovation and collaboration across domains. deltaDAO’s commitment is to ensure that data is managed according to European data protection values and interests, supporting Europe’s digital transformation, and enhancing its global competitiveness, welfare and standing as a digital and industrial innovation hub.

deltaDAO is proud to be a Gaia-X member the Gaia-X AISBL endorsed representative for the European Blockchain Regulatory Sandbox and committed to comply with the Gaia-X and regulatory framework and rules to promote Europe’s sovereignty and competitiveness.

DNV

Vidameco for edge data integrity and standardization

Lack of standardization limits the utility of data generated on board vessels. Proprietary data formats, naming standards and ad-hoc data collection and transmission add complexity and cost to this value chain. Moreover, the possibility of undetected tampering with the data can undermine trust in the data and the services relying on it. Our blockchain use case, developed in research project Vidameco, demonstrates an integrated hardware and software solution for standardized data collection and tamperproofing using microservices and blockchain.

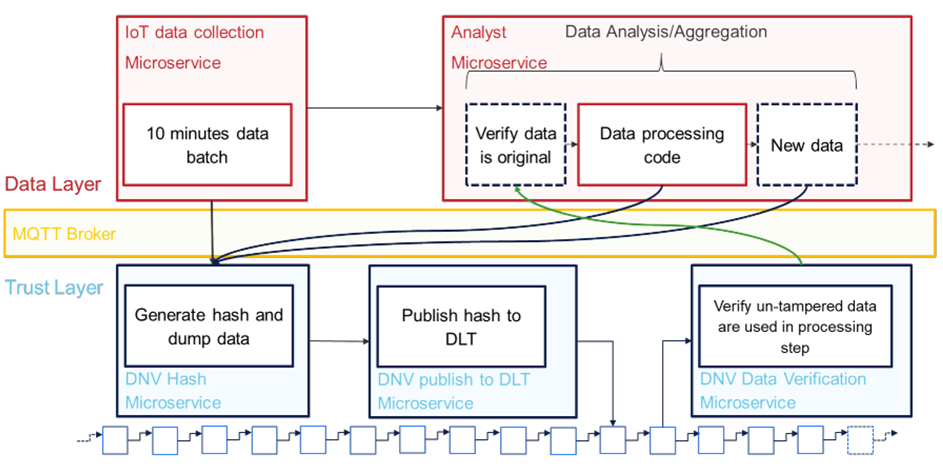

Figure 1 shows the architecture of the Vidameco solution. Microservices are developed to collect edge data batches. These batches are hashed, and the hash is published to the blockchain. Later the data consumer can use our DApp to access a microservice for verification of data integrity based on the published hash. These microservices are deployed as Docker containers making a modular solution with plug and play components. MQTT broker is used for inter-process communication.

Figure 1: Vidameco Architecture

Vidameco can be used to enable standardization and data integrity for a variety of use cases. In more traditional sectors such as shipping this can drive digitalization. Focusing on EU’s Monitoring, Reporting and Verification (MRV) regulations, implementing the Vidameco approach, can reduce redundancy in data collection and quick verification of both, the data used as input to the value chain and the certification produced at the end, ensuring traceability from the former to the latter. Tying the stakeholder activities and data to their identity will also reduce complexity and avenues for mistakes and fraud. Finally, integration of smart contracts will introduce automation for repetitive processes, reducing paperwork.

EBSI Verifiable Credentials use case

EBSI-VECTOR – EBSI enabled Verifiable Credentials & Trusted Organisations Registries

The Digital Europe project «EBSI-VECTOR» that started on June 1st, 2023, with a term of two years, has launched its official Kick-Off Meeting on July 5th 2023. This project is the result of the unique historical moment that we are living, where digital transformation represents a step forward from the merely adoption of any enabling technologies towards a process guided by a strategy of revisiting and redesigning existing ways of living, working, doing business and managing public good.

Hence, digital transformation is pushing governmental entities towards an open, transparent, citizen-centred, decentralised, multi provider and co-operative model that can be supported by cutting-edge blockchain and distributed ledger technologies (so-called DLTs). Blockchain is a type of distributed ledger, that organizes data into blocks, and they are chained together in an append – only mode, meaning data can only be added in time-ordered sequential order. Furthermore, distributed ledgers use independent computers (so-called nodes) to record, share and synchronize transactions in their respective (decentralized) electronic ledgers.

The blockchain technology currently sits within the innovators and the early adopter user groups (e.g., citizens, students, etc.). EBSI stands for European Blockchain Services Infrastructure, is the first EU-wide blockchain infrastructure, and several national initiatives are moving towards the overcoming of “Proof of Concept” stage, to accelerate the creation of cross-border services and put blockchain at the service of public administrations for the purpose of verifying information, increase efficiency and making the services trustworthy.

Blockchain becoming fully operational.

In this frame EBSI-VECTOR aims to support in an organized and coordinated way a series of activities aimed at reducing the gap between a “pre-production” implementation and a real-life production adoption in specific application sectors. In particular, the project overarching vision is to “Improve the capabilities of social security, educational credentials and ESSIF use cases, extending the paradigm of self-sovereignty, and decentralized verifiable credentials and decentralized trusted registries for each use case related with real end user services for European citizens via the support of the European Blockchain Service Infrastructure (EBSI) and implement this in different countries and cross-border interactions”. EBSI-VECTOR will also inspire and support the EUDI development with the elaboration of current and new EBSI-capabilities and engaging more stakeholders and actors in the decentralized identity ecosystem.

Demonstration in three relevant use cases

The potential behind EBSI VECTOR will be demonstrated through the following use cases that will be developed and deployed in a cross-border context.

- Education: use case learning outcomes achievements, use case transcript of records and use case student ID.

- Social Security: use case European Health Insurance Card (EHIC) and use case Portable Document PDA1.

- Business registries: use case identity of legal persons deployed with selected partners.

Consortium:

More than 50 partners from 20 countries ….

The EBSI VECTOR consortium, therefore, consists of a well-balanced but extraordinary large group of partners that make the implementation of verifiable credentials in the education and social security domain possible and extend the current capabilities for further uptake. The collaboration between the public sector organisations from the European Blockchain Partnership (which explored the verifiable credentials and decentralised registries in the past three years) with the business domain experts and policy advisors of education and social security (actively engaged in different use case groups and related projects) supplemented with academic and technical experts (most of them already provide EBSI compliant solutions and with lots of development and design experience) is the best guarantee to achieve the objectives of this project. This consortium widely represents Europe including partners from Austria, Belgium, Cyprus, Denmark, France, Germany, Greece, Hungary, Italy, Lithuania, Luxembourg, Norway, Poland, Portugal, Romania, Slovakia, Slovenia, Spain, Sweden and The Netherlands.

Equilibrium

Equilibrium Group: Tokenizing real-world assets – starting with the digital EURO

Equilibrium Group is a leading Web3 development powerhouse in the EU. We build decentralized solutions for our clients, who are world-renowned players in the Web3 space. We aim to tokenize various real-world assets and enable them to operate on DLT/blockchain systems.

EUROe

Through our subsidiary, Membrane Finance, we have already successfully tokenized the euro fiat currency by creating a fully regulated e-money version called EUROe. The token is already available and usable on Ethereum, Polygon, Avalanche, Arbitrum and Solana networks, with more coming soon. EUROe is real money on the blockchain and can be used for any payment on blockchain networks.

EUROe is the only EU-based stablecoin and payment network regulated as an electronic money institution in the European Union. Based in Finland, a leading European hub for technology & regulatory stability, EUROe is being built for tomorrow’s businesses today. www.euroe.com

Tokenized stocks

Equilibrium Group is exploring the regulatory environment for tokenizing shares of unlisted companies, which would allow companies to use DLT-based technologies to maintain their share registries. DLT-based technologies already constitute the cheapest and fastest way to issue, maintain and use digital assets, driving efficiency gains. Furthermore, DLT-based technologies are inherently standardized, allowing issued assets to smoothly interoperate with other services deployed on the platform, with minimal integration related overhead.

Other real-world assets

Additionally, we will explore the tokenization of other real-world assets and the creation of a DLT-based regulated marketplace, which entails personal data processing and would require novel digital identity solutions (e.g., zero-knowledge proof-based KYC). This work may lead to a new RWA token standard.

However, the regulatory framework/landscape regarding the tokenization of real world assets in the EU is still unclear and without many precedents. Also, once a tokenized asset has been created, there are regulatory uncertainties as to where this asset can be transacted with and what are the rights and/or obligations for all relevant parties. Through participating in the sandbox, Equilibrium Group wants to explore these regulatory questions and find solutions for creating these types of assets and market systems facilitating their trading.

Eviden

The Eviden battery passport is a smart platform initiative for the (European) automotive industry. It offers digital passports for all car batteries in use for electric vehicles, which allows the car and battery manufacturers to distribute battery production information (where required) and collect battery performance and usage information.

Key principles for the platform are that:

- Batteries are uniquely represented on the platform in order to assure reliability of the battery information

- The platform is open to all participants in the automotive industry and can join without vetting or approval from third parties

- Data is distributed democratically, to support repair and recycling shops to be able to do their work optimally

- Data security and privacy is upheld in order to protect commercially sensitive information for both car and battery manufacturers

The platform is fully cloud based, though participating entities can manage their relevant data as they see fit. The main underlying technologies are artificial intelligence and blockchain, which allow for the appropriate processing of battery information.

Fraunhofer (Open Logistics Foundation, ALS Holding)

Open Customs Blockchain

What is the project about?

Open Customs Blockchain introduces Europeanmade, open source blockchain software into logistics and customs processing to simplify data exchange and increase transparency in crossborder supply chains. It aims to speed up border processes, decrease transit times, reduce the need for physical inspections at the border and finally make international trade more sustainable by replacing current paper-based documentation with a more efficient, trustworthy technology: Blockchain.

Customs information – based on the original invoice data (Goods Passport ID Project) and the export accompanying document (EAD) as exemplified by the project BORDER – is stored in a tamper-proof way and distributed along the supply chain. Together, the two sub-projects form the framework of the Open Customs Blockchain. As the customs-related information is required repeatedly in various steps of an export or import process by several parties, blockchain increases transparency and trust by making data origins consistently traceable.

What is the project goal?

|

An end-to-end integration of customs and logistics processes in external trade. Tamper-proof. Trustworthy. Cross-border. Open Source. |

What data is exchanged?

The focus is on a set of data that is used recurrently in most customs processes. It contains basic information on the seller, the buyer, the invoice, origin and classification of the goods traded. Another focus is on an EAD-based dataset as it is used in the European customs union.

What are the benefits?

Expected benefits include more transparency in supply chains, more efficient data sharing, faster trade processes and improved means of checking, due to blockchain as a trustworthy source of verifiable information. Simultaneously, this is expected to reduce risks of fraud, evasion of duty and undervaluation. It could help ease the post-Brexit border delays between the EU and UK.

Who is behind this?

The project is initiated and supported by the Open Logistics Foundation and its Working Group Open Customs Blockchain. It consists of major logistics companies Rhenus, DHL and DACHSER, as well as customs and IT service providers ALS, AEB, IP Customs Solutions and leading logistics research institution Fraunhofer Institute for Material Flow and Logistics.

A practical test of the first software components in a blockchain test network is currently being prepared. To ensure the best possible practical relevance, customs authorities are invited to participate and oversee further development.

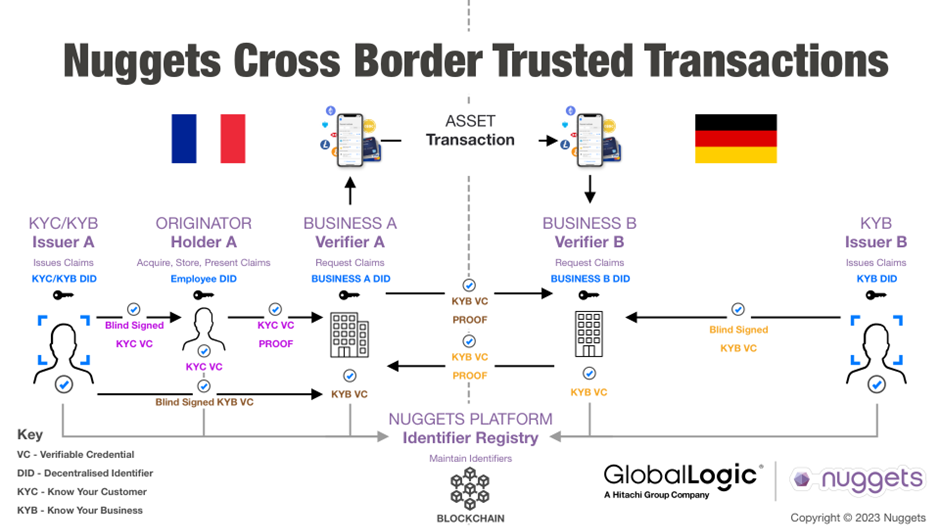

Globallogic (Nuggets)

A use case for European cross-border payments using Verified Self-Sovereign Decentralized Identity (SSDID) and blockchain technology involves facilitating secure, efficient, and transparent remittances between individuals, businesses, or governments in different European countries.

INO MTÜ

INO MTÜ, an Estonia-based non-profit, is paving the way for reshaping Decentralized Autonomous Organizations (DAOs) with an aim to increase transparency, trust, and community involvement. The organization is committed to facilitating the adoption of Internet Native Organizations by introducing an equitable, code-driven governance model that champions distributed control, further rebranding DAOs for broader acceptance.

INO (Internet Native Organization), anchored in its distinctive legal architecture, continually evolves its digital core through regular compliance-focused updates. This structure aligns seamlessly with the e-governance and legal ecosystems of progressive European nations, facilitating the creation of a regulatory framework where INOs can flourish, tapping into the robust digital societies of countries like Estonia.

INO MTÜ’s landmark achievements encompass becoming Estonia’s first incorporated DAO in August 2022, facilitating the biggest DAO-centric conference, DAO Day Estonia, in March 2023, and launching ‘Internet-Native Show’, a unique interview series spotlighting key figures in the DAO and internet-native landscape.

“INO is spearheading the effort to deliver DAO solutions and elevate legal awareness to the mainstream, mitigating risks of DAO concept misuse. We acknowledge the critical challenges in the DAO arena, encompassing members liability, KYC challenges, taxation, and legal recognition.” — Astra Tikas, Founding Board Member of INO MTÜ

You can find more information about the organization and its activities here.

![]()

![]()

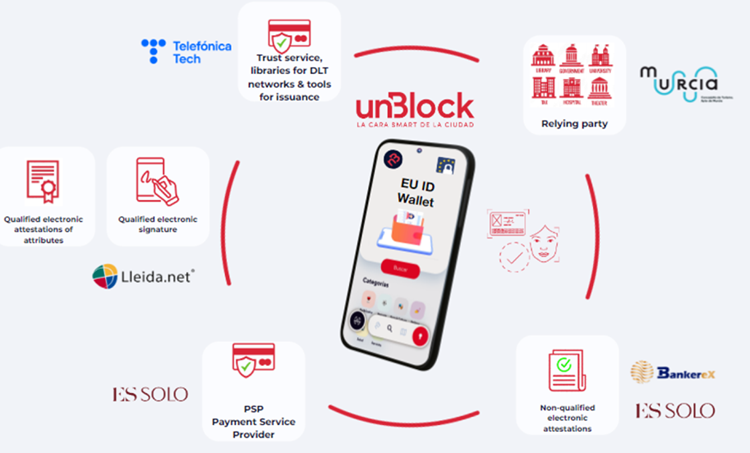

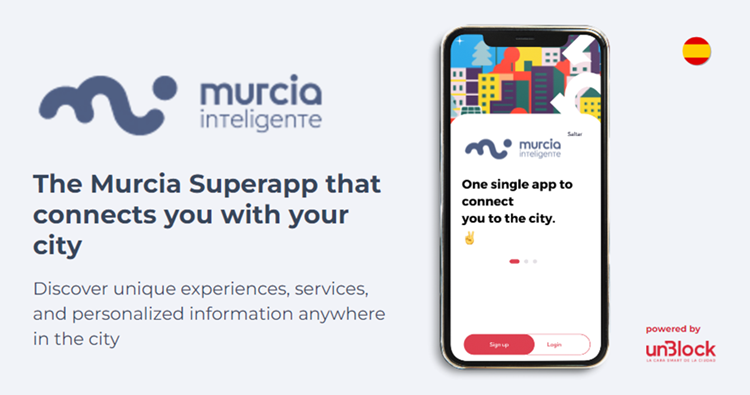

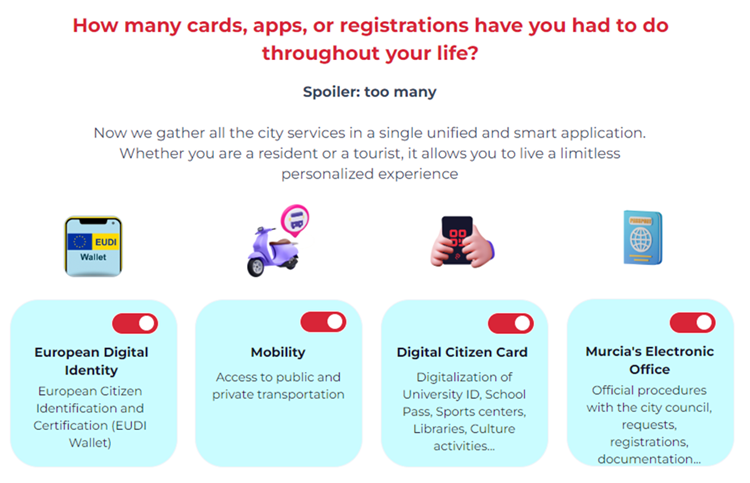

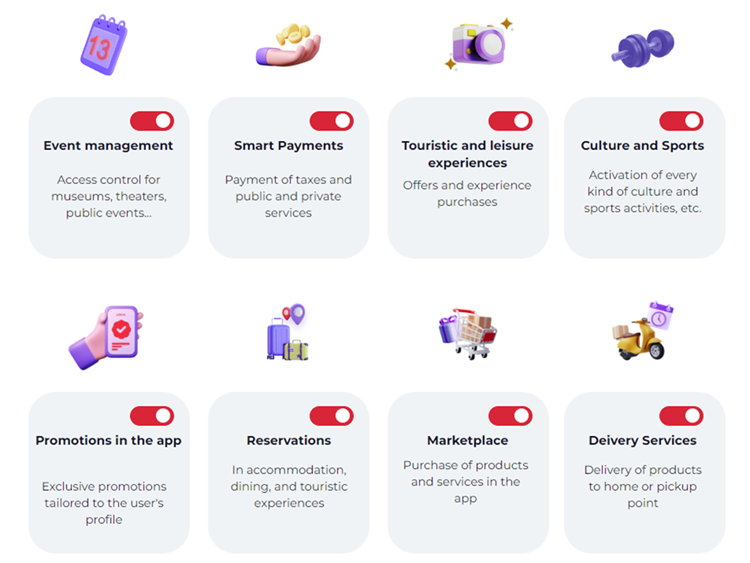

Lokovice / unBlock (Murcia City Counsel, LleidaNetworks Serveis Telematics, Bankerex Financial, ES SOLO Holdings)

What is unBlock?

Video: https://youtu.be/lId3aExpb9c

The web3 Smartcity SuperApp that connects cities, spaces, businesses and PEOPLE.

📍 A single app for the whole city. Multipurpose, simple, secure and attractive for the resident and the tourist.

📍 Personalized, unified and digital experience in any space, time and place in the city. Both in precincts or public spaces and in any type of private business.

📍 You will be able to buy, pay, book and access any product, event, tourist experience and service throughout the city.

📍 We are the perfect complement and solve the last mile of any Smartcity or Smart Tourism Destination project.

We’ll use new European digital Identity (EU ID WALLET) into all normal situation from citizen and tourist way of life living in the city.

Citizen will use unBlock Web3 SuperApp to activate any kind of service, products, procedure or whatever situation they need to identificate theirself.

They’ll use EU ID WALLET to access, pay, admin procedure, reservation or register in any space, service, event, experience or business public or private into the city.

You’ll find more info next:

https://www.unblockthecity.com/murcia-inteligente-en

https://www.unblockthecity.com/digital-identity-wallet

Stichting 2Tokens (Rabobank, ABN AMRO Bank, Catena Investment, Enercoin, Catena Power)

2Tokens, ABNAmro, Assetblocks, and Rabobank usecase – tokenized securities with payments through stablecoins

2Tokens collaborates with ABN AMRO, Assetblocks, and Rabobank in our joint application for the European Blockchain Sandbox (EBS). Our use case aims to explore the use of Euro or bank deposit stablecoins. Both non-hosted and hosted wallets provided by banks will support these stablecoin transactions, ensuring new ways of accessibility and convenience for investors. The base case for the relevant scenarios is as follows:

The Assetblocks use case provides the possibility to invest in the tracking stock of SPVs that represent renewable energy sources like wind, solar and battery parks for both professional as well as non-professional investors. The proof of ownership is tokenized and represented by a Non-Fungible Token (NFT). The issuance is a security under MiFIDII. Owners of the tracking stock, based on their (number of) NFT(s) are potentially entitled to pro rate dividend payments.

Owners of the NFT(s) are not necessarily in the country of origin of the issuer of tracking stock. Payments can thus be cross-border, but within the EU/SEPA region. Up until recently, payments were only made using fiat currency, but going forward, payments, both for purchase/sale of the NFT and distribution of dividends, should be performed using a stablecoin.

Payment scenario one will focus on buying, selling and buy-back of the NFTs using stablecoin. The NFT owners will use accounts and hosted wallets at banks to hold their NFTs as well as stablecoins for buying, selling an receiving dividend pay-out, with the possibility to on- and of ramp EUR stablecoins via the bank. The type of stablecoin will be existing regulated stablecoins, EUROC (Circle) and EURe (Monerium) and/or Euro stablecoin issued by Rabobank and ABN AMRO (deposit backed token).

The second scenario build on the first one but will be extended with various elements. For all actions described in the first scenario (buy, sell, dividend payment, on- and of ramping), the possibility to do so in cryptocurrency instead of stablecoin is added as well. Furthermore, besides using hosted wallets at the banks, the usage of unhosted wallets is in place as well. In this scenario, there are a few more elements enclosed. The possibility to set up peer-to-peer escrow smart contracts for real time settlement of payment through stablecoins in the transfer of ownership of the NFT without the use of a third party. Also owners of the NFTs, besides having economic rights, will be able to be part of the governance (voting rights) in the SPV. The type of stablecoins for this scenario is all types. Including dollar versions like USDT/USDC and non-fiat related stablecoins.

We are also interested to explore other options to tokenize assets as a security token as a third scenario and explore if the answers to the questions asked in the first two scenarios are still valid.

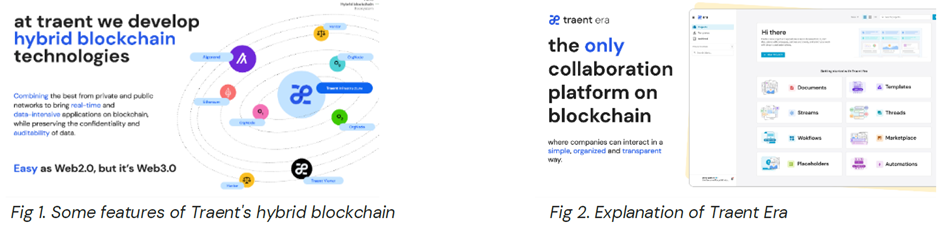

Traent

Traent develops hybrid blockchains, a novel technical solution that combines public and private networks to bring real-time and data-intensive applications on blockchain, while preserving the confidentiality and auditability of data.

Thanks to its visual and user-friendly ecosystem, Traent enables companies from various industries and continents to track, collect, and review their environmental, social, and governance (ESG) data with ease.

The ESG data platform is built on top of two main elements: Era and the Viewer. Traent Era offers companies an intuitive interface and efficient templates, empowering them to automate the gathering, reviewing, and sharing of their ESG KPIs, ensuring transparency and reliability throughout the reporting process. On the other hand, the Traent Viewer is a browser-based application that allows companies to share visually captivating presentations of their sustainability-related data. By utilizing interactive graphs, charts, and maps, companies can effectively demonstrate their dedication to sustainability in a user-friendly way, encouraging stakeholder comprehension and engagement.

Tracking environmental, social, and governance metrics on a blockchain platform provides a transparent and secure way to manage sustainability data. By leveraging blockchain technology, data is securely recorded and tracked, providing a reliable and tamper-proof of ESG performance.

Data protection is a key aspect of Traent’s platform, as it allows for granular data sharing and the subsequent respect of the EU GDPR 2016/679. Thanks to the unique Traent Granular Data Disclosure feature, companies have the freedom to choose specific ESG data to publish from their blockchain data lake while safeguarding sensitive information. By selecting different data sets for each different audience, companies can provide personalized ESG Reports without hindering the verifiability of shared data.

Furthermore, the Traent ecosystem is utilized to create product passports and streamline supply chain processes. This holistic approach empowers companies to provide customers with detailed information, including the company’s ESG data, through product passports. These passports are conveniently accessible to customers, scanning a QR code at the time of purchase, enabling them to make informed decisions.

All the aforementioned applications of Traent’s ESG data platform are in alignment with numerous recent European Union initiatives. These initiatives include the European Green Deal, Agenda for Sustainable Finance, Circular Economy Action Plan, and Sustainable Product Initiative. Traent’s platform not only supports ESG reporting but also complements these initiatives, demonstrating its commitment to advancing sustainability across various domains.

Twinu

Circularity solution for Digital Product Passports

Twinu‘s blockchain-based circularity solution for Digital Product Passports helps companies to measure and improve the circularity of their physical products.

The Circular Pass adds to each product a digital twin on the blockchain. It is used to improve functionality, convenience, and safety of the product, to extend lifetime and usage, and to build a closer relationship with the customer until the product is collected and recycled at the end of its lifetime.

Twinu’s solution delivers an innovative implementation of the upcoming EU regulation of Digital Product Passport which is a tool to create transparency and unlock circularity proposed by the European Commission (EC). Awarded “Most Sustainable Solution” by Deutsche Telekom & T-Mobile.

News

Blockchain Technology Will Transform Water Access and Management Globally

Disclosure: The views and opinions expressed here are solely those of the author and do not represent the views and opinions of the crypto.news editorial team.

Access to clean water is a basic human need, yet billions of people around the world still struggle to get it. According to the World Health Organization, over 2 billion people live in countries suffering from severe water stress, and this number is expected to continue to grow due to climate change and population growth.

Traditional water management systems have struggled to address these challenges, often hampered by inefficiencies, lack of transparency, and misallocation of resources. Blockchain technology offers a promising solution to these challenges, providing equitable access and sustainable use of this crucial resource.

The current state of water management

Water management today faces several pressing issues. Inefficiencies in water supply, distribution, and use, coupled with a lack of real-time monitoring, often result in resource waste and misallocation. Many water sources fail to realize their full potential due to infrastructure and financing shortfalls. For example, the Environmental Protection Agency (EPA) report indicated that the United States would need to invest $625 billion over the next 20 years to repair, maintain and improve the country’s drinking water infrastructure due to aging pipes and other infrastructure problems. Additionally, in the United States alone, household leaks can to waste nearly 900 billion gallons of water per year nationwide. This is equivalent to the annual domestic water consumption of nearly 11 million homes.

Furthermore, corruption and mismanagement of water resources can cause unequal distribution, with disadvantaged communities often bearing the brunt of water scarcity. For example, South Africa is struggling with myriad challenges to its water security: drought, inadequate water conservation measures, outdated infrastructure, and unequal access to water resources. The country faces significant water scarcity, with demand expected to outstrip supply by 2030, creating a projected gap of 17%.

Furthermore, the global water industry is highly monopolized, with a few key players controlling a significant share of the market. These companies exert substantial influence over the water supply chain, often prioritizing profit over equitable distribution and environmental responsibility. This concentration of power can lead to inflated prices and limited access for vulnerable populations. The global bottled water market alone is projected to reach $509.18 billion by 2030, with these large companies capturing a significant share of revenue. This monopolization exacerbates existing inequalities in water access and highlights the need for more decentralized and community-driven water management solutions.

Source: Grand View Search

The potential of blockchain in water management

Blockchain technology can address these issues by providing a transparent, secure, and decentralized platform for water resource management. This approach offers several advantages:

- Transparency and accountability. Blockchain’s immutable ledger ensures that all transactions and data entries are transparent and cannot be changed once recorded. This transparency can reduce corruption and ensure that water resources are allocated fairly and efficiently. For example, blockchain can be used to track water usage from source to end user, providing a clear record of how water is distributed and used. This level of transparency can help hold authorities accountable and manage water resources sustainably.

- Efficient resource management. Blockchain can facilitate the creation of smart contracts, which are self-executing contracts with the terms of the agreement written directly into the code. These contracts can automate water distribution based on real-time data, directing water to where it is needed most. For example, smart contracts could be used to manage urban water supply systems, automatically adjusting water distribution based on real-time consumption patterns and demand. This can help optimize water use, reduce waste, and ensure that households and businesses receive the right amount of water at the right time.

In Dubai, the Dubai Electricity and Water Authority (DEWA) has implemented a blockchain-based smart water network initiative as part of its broader smart city strategy. This project integrates blockchain technology with IoT sensors to monitor water usage in real time, manage distribution, and detect leaks. The decentralized ledger ensures data integrity and transparency, enabling more efficient water management and reduced waste. DEWA’s initiative aims to improve sustainability and resource management in the rapidly growing city, highlighting the potential of blockchain to support urban water management and conservation efforts.

Community participation and ownership

Through blockchain, individuals can directly control and monetize their access to water resources, eliminating the need for third-party intermediaries. This direct control model allows local communities to make collective and transparent decisions about their water use. By managing their water directly from the source, communities can tailor water management practices to their specific needs, promoting equitable distribution and encouraging a sense of accountability and stewardship.

Additionally, future models could allow people to monetize their access to water through web3 technologies. For example, a community-to-business (C2B) model could allow people to sell water directly to companies. In this model, people do not have to own the water directly, but can profit by staking their tokens during event sales pools. This approach not only supports sustainable water management, but also creates economic opportunities for community members. Additionally, a “Burn to Secure” protocol can be used to provide water allocation rights. This protocol provides a true sense of water security and financial opportunity by allowing people to redeem their rights. This system not only secures future water allocations, but also increases token scarcity and value.

Additionally, a pure sense of investment is achieved through investments in water sources. This leads to potential financial returns and dividends by addressing the inefficiencies in water supply mentioned above. By investing to finance infrastructure projects, such as building factories and improving distribution systems, more water can be brought to communities, creating additional economic opportunities.

Monetizing water access through the C2B model, the “Burn to Secure” protocol, and investments in water sources all generate economic benefits for the community, promoting a more equitable and efficient water management system.

Overcoming challenges

While blockchain technology has the potential to improve water management, there are challenges to its adoption. The complexity of blockchain systems and the need for technological infrastructure can be barriers, especially in developing regions. Additionally, there are concerns about the significant energy consumption of blockchain networks. However, technological advances and the development of more energy-efficient blockchain solutions are helping to alleviate these concerns. Additionally, education and capacity building are key to ensuring stakeholders understand how to effectively use blockchain technology. Governments, NGOs, and private sector partners need to work together to provide training and support to communities and water management authorities.

Blockchain technology offers a practical and effective means to improve water management. In addition to addressing inefficiencies, blockchain empowers communities, promotes sustainable practices, and opens up new economic opportunities through models like community-to-business (C2B). As we face the growing challenges of climate change and population growth, blockchain is not only an innovative solution, but represents a fundamental shift in the way we manage and value water resources. Adopting blockchain in water management is essential to creating a sustainable and equitable future by changing the way we interact with and protect our most vital resource.

Jean-Hugues Gavarini

Jean-Hugues Gavarini is the CEO and co-founder of LAKE (LAK3), a real-world asset company leveraging blockchain technology to decentralize access to the global water economy. LAKE aims to ensure access to clean water for all, protect water resources, and deliver water to those in need through innovative technologies. Jean-Hugues has a diverse career spanning the luxury, fashion, and footwear industries. His career path includes notable successes at Mellow Yellow, Cremieux, and Tod’s. Raised between Silicon Valley and the French Alps, Jean-Hugues has always been immersed in technology and freshwater resources. In 2018, Jean became the CEO of Lanikea Waters, a water solutions entity based in the French Alps. In 2019, the concept of LAKE was born, embodying his commitment to innovation and sustainability.

News

Blockchain and AI Expo 2024

With rapid advances in the world of AI and blockchain, there are opportunities to leverage the security and transparency features of blockchain to improve the reliability and trust of AI systems and data transactions.

Explore the synergy of these advanced technologies in virtual mode Blockchain and AI Expowhich takes place on October 31, 2024 TO 10:00 GMT.

The event features cutting-edge presentations led by leading experts in evolving fields. Presentations are set to explore opportunities and challenges in the fusion of blockchain and AI, real-world applications, ethics, innovations in environmental sustainability, and more!

Gain a comprehensive understanding of how these technologies can synergistically drive innovation, optimize operations, and promote strategic growth opportunities. Develop your knowledge to facilitate informed decision making and give your company a competitive edge in the growing technology landscape.

News

Nigeria Eyes National Blockchain Nigerium for Data Sovereignty

Nigeria is keeping an eye on a new native blockchain network to protect the country’s data sovereignty.

According to local media, a team from the University of Hertfordshire has proposed the new blockchain, Nigeriato the National Information Technology Development Agency (NITDA).

Chanu Kuppuswamy, who leads the team, argued that relying on blockchain networks whose developers are located in other regions poses national security risks to the Nigerian government. He further said that Nigerium would allow the West African nation to customize the network to meet specific needs, while also promoting data sovereignty.

In his presentation, Chanu cited the recent migration of Ethereum to test of participation (PoS) consensus as an instance in which no Nigerians were involved but whose impact is far-reaching.

“Developing an indigenous blockchain like Nigerium is a significant step towards achieving data sovereignty and promoting trust in digital transactions in Nigeria,” he said.

While receiving the proposals in Abuja, NITDA’s Kashifu Abdullahi acknowledged the benefits a local blockchain would bring to Nigeria, including increased security of citizens’ data.

However, a NITDA spokesperson later clarified that Nigerium is still at the proposal stage and that the government has not yet decided whether to proceed or not.

“The committee is still discussing the possibility with stakeholders. Even if a decision is finally made, there is no guarantee that the name will be Nigerium,” the spokesperson told the media.

Nigerium’s reception in the country has been mixed. Some, like financial analyst Olumide Adesina, To say the network is “dead on arrival”. He believes the Nigerian government’s poor record in following through on its big technology plans will claim another victim. He pointed to the eNaira as a missed opportunity whose chances of success were much higher than those of Nigerium.

Others welcomed the proposal. Chimezie Chuta, who chairs the renewed The Nigerian Blockchain Policy Committee is “extremely optimistic“that Nigerium will be more successful than eNaira.

Speaking to a local news agency, Chuta stressed that eNaira failed because the central bank initiated the project on its own, without involving any stakeholders.

“They just cooked it and expected everyone to like it. [With Nigerium]there will be a lot of collaboration,” he said.

Registration of property title, digital identity and Certificate Verification are among the use cases that Nigerium is expected to initially target. However, Nigeria has already made progress in some of these fields through public blockchains.

SPPG, a leading school in governance and politics, announced in May the country’s first blockchain certificate verification system. Built on the The BSV BlockchainIt was developed in collaboration with the blockchain data recording company VX Technologies and local lender Sterling Bank.

Watch: The Future Has Already Arrived in Nigeria

Italian: https://www.youtube.com/watch?v=M40GXUUauLU width=”560″ height=”315″ frameborder=”0″ allowfullscreen=”allowfullscreen”>

Italian: https://www.youtube.com/watch?v=M40GXUUauLU width=”560″ height=”315″ frameborder=”0″ allowfullscreen=”allowfullscreen”>

New to blockchain? Check out CoinGeek Blockchain for Beginners section, the definitive guide to learn more about blockchain technology.

News

Cambodian CBDC Developer to Build Palau Bond Market on Blockchain: Report

A Japanese fintech developer will build a blockchain-based bond market gateway for Palau, aiming to launch a trial in 2024 and a full launch the following year.

Japanese fintech developer Suramitsubest known for developing a central bank digital currency (CBDC) for Cambodia, is intended to build a Blockchain-gateway to the bond market based on the Pacific island nation of Palau, Nikkei He learned.

Soramitsu won the contract and plans to introduce the market on a trial basis in fiscal 2024, with a full launch scheduled for the following year, allowing the Palauan government to issue bonds to individual investors and efficiently manage principal and interest payments, according to the report.

The total cost of the project is estimated at several hundred million yen ($1.2 million to $5.6 million), less than half the cost of a non-blockchain alternative, people familiar with the matter said. The project has reportedly received support from Japan’s Ministry of Economy, Trade and Industry, with Japan’s foreign and finance ministries providing strategic and management advice on the project.

Soramitsu’s successful development of Cambodia’s CBDC in 2020 has boosted its reputation, with the digital currency’s popularity soaring, with over 10 million accounts opened by December 2023, representing 60% of Cambodia’s population. Following this, Cambodia’s central bank governor Chea Serey indicated intends to expand the reach of its CBDC internationally, particularly through collaboration with UnionPay International, the Chinese card payment service, and other global partners.

While Soramitsu’s work in Cambodia has been well received, the long-term popularity of CBDCs remains to be seen. As of late June, crypto.news reported a sharp drop in activity in India’s digital currency, the e-rupee, after local banks stopped artificially inflating its values.

According to people familiar with the matter, the Reserve Bank of India managed to hit the 1 million retail transaction milestone last December only after the metrics were artificially infiltrated by local banks, which offered incentives to retail users and paid a portion of the bank’s employees’ salaries using the digital currency.

-

News1 year ago

News1 year ago“Captain Tsubasa – RIVALS” launches on Oasys Blockchain

-

Ethereum1 year ago

Ethereum1 year agoComment deux frères auraient dérobé 25 millions de dollars lors d’un braquage d’Ethereum de 12 secondes • The Register

-

News1 year ago

News1 year agoSolana ranks the fastest blockchain in the world, surpassing Ethereum, Polygon ⋆ ZyCrypto

-

Videos1 year ago

Videos1 year agoHistoric steps for US cryptocurrencies! With a shocking majority vote!🚨

-

Videos1 year ago

Videos1 year agoIs Emorya the next gem💎 of this Bitcoin bull run?

-

News1 year ago

News1 year agoSolana Surpasses Ethereum and Polygon as the Fastest Blockchain ⋆ ZyCrypto

-

Videos1 year ago

Videos1 year agoNexus Chain – Ethereum L2 with the GREATEST Potential?

-

Ethereum1 year ago

Ethereum1 year agoScaling Ethereum with L2s damaged its Tokenomics. Is it possible to repair it?

-

News1 year ago

News1 year agoFnality, HQLAᵡ aims to launch blockchain intraday repositories this year – Ledger Insights

-

Regulation1 year ago

Regulation1 year agoFinancial Intelligence Unit imposes ₹18.82 crore fine on cryptocurrency exchange Binance for violating anti-money laundering norms

-

Bitcoin1 year ago

Bitcoin1 year agoBitcoin Drops to $60K, Threatening to Derail Prices of Ether, Solana, XRP, Dogecoin, and Shiba Inu ⋆ ZyCrypto

-

News1 year ago

News1 year agoSendBlocks Debuts with Major Support to Improve Blockchain Data Management