News

Wormhole implements a flow cancel regulator to improve transaction efficiency

Wormhole, a leading interoperability platform, introduced Governor V2, a Governor flow canceling mechanism designed to address congestion issues and improve transaction efficiency across its supported blockchains. This new feature focuses on net flows to minimize delays and improve transaction throughput while maintaining security, according to Hole in the wall.

The need for a flow cancellation regulation mechanism

Wormhole’s current rate limiting mechanism, known as Governor, places an upper limit on a chain’s total USD-denominated outflow within a 24-hour window. However, as usage increases, several chains frequently reach Governor limits, causing delays and frustration for users. This congestion is often due to non-fraudulent activities such as arbitrage and settlement, which consume the Governor’s limits, reducing its effectiveness in mitigating risks.

Flow canceling design

The Governor’s flow cancellation mechanism aims to alleviate these problems by taking into account both inflows and outflows. Here’s how it works:

- Net flow measurement: The Governor will now consider inflows along with outflows. As assets flow into a chain, the Governor reduces the cap usage, effectively canceling out the outflows that initially increased the cap. Only net flows (the difference between inflows and outflows) will be capped.

- Net flow management: For transactions where the net flow is zero, such as when users move a fixed amount of assets on and off the chain, the new behavior will prevent these flows from consuming Governor limits.

- Reliable Resources: The flow cancel functionality is initially enabled for a subset of stablecoins, allowing for better net flow management while maintaining security benefits.

Advantages of the flow canceling governor

This new mechanism offers several advantages:

- Users will no longer face delays when net flow is below the Governor’s limit for a given chain.

- Wormhole can support increased transaction flow in both directions without increasing Governor limits.

- THE protocol maintains lower limits, reducing risks and better protecting against vulnerabilities.

- Participants such as Guardians, Collaborators, and Builders can focus more on developing interoperability solutions rather than managing Governor limitations.

Backtesting analysis

Wormhole conducted a simulated implementation of the flow cancellation strategy against historical VAA flows, revealing that net flows were significantly lower than those observed in a simple outbound strategy. This indicates that the flow cancellation approach will reduce potential user delays.

Further analysis highlighted that stablecoins such as USDC and USDT account for a significant portion of Governor’s limit usage. By applying the flow cancellation mechanism specifically to these tokens, Wormhole can handle a higher transaction volume without exposing the protocol to the volatility of other tokens.

Conclusion

The Governor flow cancellation mechanism is a promising solution to congestion during periods of high usage. By focusing on net flows, Wormhole can support more transactions while maintaining its goals of security and viability. This improvement significantly improves the cross-chain experience, reducing delays and improving efficiency.

About Wormhole

Wormhole is a leading interoperability platform that connects over 30 blockchain networks, enabling a wide range of use cases including DeFi, NFTs, and governance. Trusted by major teams like Circle and Uniswap, Wormhole has facilitated over $40 billion in transfers across more than 1 billion cross-chain messages.

Image Source: Shutterstock

News

State Street is considering blockchain-based projects

Highway is reportedly evaluating various options for regulating payments via blockchain.

The financial services and banking company is considering creating its own stablecoin, creating its own deposit token, joining the efforts of the digital money consortium, and developing settlement options by initiating blockchain payments. Purposewhere he has an investment, Bloomberg reported Wednesday (July 17), citing an anonymous source.

State Street did not immediately respond to PYMNTS’s request for comment.

With these efforts, State Street would join other firms exploring or implementing cryptocurrency transactions, the report says.

These companies include Payment via PayPalwhich introduced its own stablecoin; Visa AND MasterCardthat enable stablecoin-based settlement; and JPMorgan Chasewhich is exploring deposit tokens, the report says.

According to the report, State Street earlier this year integrated members of its digital assets team into its overall business, seeking to strengthen the ties between digital assets and traditional finance.

When State Street reorganized its digital goods division in January, it was reported that most of the division’s employees had moved to other units of the company and that the company continues to provide clients with services and market infrastructure for digital assets.

In a statement to PYMNTS at the time, State Street said, “In an effort to offer clients better digital expertise and solutions, we have brought together our traditional custody and digital finance into a seamless, interoperable client experience. This approach is reducing fragmentation for clients and making the digital transition as easy as possible for investors.”

In March, it was reported that State Street was one of more than three dozen participants in a recently completed pilot project that aimed to reframe assumptions about the use of blockchain based applications within traditional finance.

The project, called Canton Network, brought together 15 asset managers, 13 banks, four custodians, three exchanges and a stablecoin issuer to explore the potential of an open, privacy-friendly blockchain network that enables real-time settlement and instant reconciliation between counterparty systems.

It has demonstrated that blockchain can be leveraged to simplify and synchronize financial applications, while meeting regulatory requirements for asset control, security, and data privacy.

News

Will the Federal Government Allow Wyoming to Work on Blockchain-Based Mergers?

The New Wyoming Law on decentralized and unincorporated non-profit organizations (DUNA) enables the formation of US-based nonprofits suited to the multi-billion dollar blockchain mergers currently taking place in Asia, such as Kaya with an Abu Dhabi foundation or the Alliance for Artificial Superintelligence in Singapore.

The law, effective July 1, is also written to give blockchains that use its framework a regulatory advantage under U.S. law. In theory, DUNA would make Wyoming the best place for blockchains with (or wanting) a U.S. footprint to legally locate their governance.

However, the current state of federal regulation of decentralized finance and digital assets means that…

News

Cardano Creator Offers Elon Musk to Secure X with Blockchain

Gamza Khanzadaev

Elon Musk Gets Surprising Offer From Cardano’s Charles Hoskinson

Read U.TODAY on

Google News

Ben Goertzel, a prominent AI developer and founder of the Cardano-based SingularityNet project, recently suffered a hacking incident on X, the social media platform formerly known as Twitter. In response, Cardano’s creator Charles Hoskinson solicited Elon Musk to implement decentralized identifiers (DIDs) on X to improve security.

Hoskinson proposed that integrating DIDs would solve numerous security problems on X. He suggested to Musk that DIDs could help verify and protect digital identities, reducing the risk of hacks and unauthorized access. Cardano The founder even offered to implement the solution for free, emphasizing the importance of improved identity solutions for the social network.

The proposal caught the attention of Timothy Ruff, a general partner at Digital Trust Ventures with experience in decentralized identity solutions. Ruff took issue with Hoskinson’s proposal, arguing that true decentralization requires a different approach than that offered by DIDs.

He stressed the need for a truly decentralized identity solution, rather than embedding one platform within another.

How is it possible?

Hoskinson clarified that his reference to DIDs was in line with the W3C standard, highlighting a blockchain-agnostic hyperledger project designed to issue and manage DIDs and other parts of the identity stack.

He argued that X, which aims to become a financial services company, needs a better identity solution for better security, access control and compliance. He reiterated his offer to integrate the framework into X’s infrastructure, which would then be managed by the development team.

Despite Ruff’s concerns about DID and its perceived limitations, Hoskinson continued to be committed to helping X evolve as a platform. He proposed creating an industry working group to bring together leading experts to address identity issues for X and position it as essential public infrastructure.

About the author

Gamza Khanzadaev

Financial analyst, trader and cryptocurrency enthusiast.

Gamza graduated with a degree in finance and credit with a focus on securities and financial derivatives. He then completed a master’s degree in banking and asset management.

He wants to contribute to the discussion of economic and fintech topics, as well as inform more people about cryptocurrencies and blockchain.

News

New Tool Enables Implementation of “No Code” Blockchain — TradingView News

BVM Studio was introduced as a new tool to simplify blockchain implementation with a no-code solution that aims to make blockchain technology more accessible.

The tool will provide a visual programming editor interface that will allow users to deploy their own blockchains using drag-and-drop blocks, similar to Lego bricks.

The approach promises to make it easy to build a zero-knowledge (ZK) rollup blockchain for any project, without any coding knowledge, computational setup, storage, or hardware nodes.

Speaking to Cointelegraph, the team at BVM, a blockchain-as-a-service infrastructure provider and creator of BVM Studio, explained that while the tool is “highly convenient,” it also has its drawbacks.

“[…] may not offer the same depth of customization as fully custom-coded solutions. However, we are constantly adding new modules and options to improve flexibility.”

Related: Web3 Game Center Makes It Easy to Release Minigames on Telegram

Self-service blockchain without code

Traditionally, implementing a blockchain requires technical knowledge, funding, and a solid basic understanding of coding and security measures.

Speaking to Cointelegraph, the BVM team clarified the functionality of the new self-service tool.

“[It] It requires no technical setup or coding skills, making it accessible to everyone. It offers a code-free drag-and-drop interface that allows anyone to deploy a blockchain in less than 2 minutes.”

The team explained that the tool allows for customization of “core layer, hardware, processing, data availability, block gas limit, withdrawal time, ZK prover” and pre-installed decentralized applications (DApps).

Safety and regulatory standards

As with all blockchain technologies, security is paramount, and it starts with the code behind the blockchain infrastructure.

The tool uses ZK-rollup technology to secure distributed blockchains “through three key components.”

“ZK-proofs stored on Bitcoin, ZK Provers to ensure correct execution, and ZK Light Nodes to verify the ZK-proofs. This is important because anyone can run a ZK Light Node on an old laptop.”

Speaking of regulatory considerations, the BVM team explained that “currently, building a blockchain does not conflict with any regulatory standards.”

“BVM Studio is just a tool that makes building a blockchain a lot easier.”

Users can deploy layer 2 and layer 3 blockchains using the tool on both Bitcoin and Ethereum.

-

News1 year ago

News1 year ago“Captain Tsubasa – RIVALS” launches on Oasys Blockchain

-

Ethereum1 year ago

Ethereum1 year agoComment deux frères auraient dérobé 25 millions de dollars lors d’un braquage d’Ethereum de 12 secondes • The Register

-

News1 year ago

News1 year agoSolana ranks the fastest blockchain in the world, surpassing Ethereum, Polygon ⋆ ZyCrypto

-

Videos1 year ago

Videos1 year agoHistoric steps for US cryptocurrencies! With a shocking majority vote!🚨

-

Videos1 year ago

Videos1 year agoIs Emorya the next gem💎 of this Bitcoin bull run?

-

News1 year ago

News1 year agoSolana Surpasses Ethereum and Polygon as the Fastest Blockchain ⋆ ZyCrypto

-

Videos1 year ago

Videos1 year agoNexus Chain – Ethereum L2 with the GREATEST Potential?

-

Ethereum1 year ago

Ethereum1 year agoScaling Ethereum with L2s damaged its Tokenomics. Is it possible to repair it?

-

News1 year ago

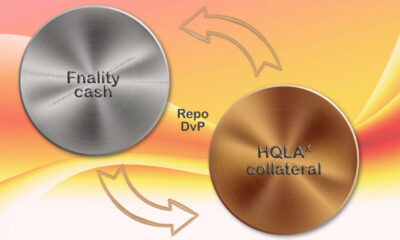

News1 year agoFnality, HQLAᵡ aims to launch blockchain intraday repositories this year – Ledger Insights

-

Regulation1 year ago

Regulation1 year agoFinancial Intelligence Unit imposes ₹18.82 crore fine on cryptocurrency exchange Binance for violating anti-money laundering norms

-

Bitcoin1 year ago

Bitcoin1 year agoBitcoin Drops to $60K, Threatening to Derail Prices of Ether, Solana, XRP, Dogecoin, and Shiba Inu ⋆ ZyCrypto

-

Videos1 year ago

Videos1 year agoRaoul Pal’s Crypto Predictions AFTER Bitcoin Halving in 2024 (The NEXT Solana)