Bitcoin

Why Bitcoin and Cryptocurrency Stocks Soared or Fell in the First Half of 2024

Find out which crypto stocks are thriving in the 2024 post-halving market and why. The answers could set you up for market-beating returns in the long run.

O Bitcoin (BTC 2.46%) cryptocurrency posted a solid gain in the first half of 2024, starting with the introduction of spot bitcoin exchange traded funds (ETFs) in January. Bitcoin mining rewards were halved on April 19, hardly moving the cryptocurrency’s price immediately but setting the stage for another four-year boom-bust cycle. By the end of June, it had sailed to a solid 44.2% gain according to data from S&P Global Market Intelligence.

So there is Microstrategy (MSTR 2.81%). The enterprise software company decided to ride the Bitcoin wave in the most amplified way four years ago. MicroStrategy’s balance sheet contained $7.5 billion in Bitcoin but only $81 million in cash as of the end of March. Mirroring Bitcoin’s rise with an extra shot of adrenaline, MicroStrategy has surged an incredible 118.1% in six months.

Meanwhile, most cryptocurrency miners did not share the same optimistic fate. The reward is half had an immediate effect on their financial results, and the major mining companies went in different directions. Digital Marathon Participations (MARA 9.20%) had a price drop of 15.5%, while Riot platforms (REBELLION 5.32%) lost 40.9% of its market value. Highlighting the complex nature of today’s cryptocurrency market, Clean spark (CLSK 5.95%) managed to keep up with Bitcoin’s gains, pocketing a 44.6% return.

Bitcoin Price data by Y-Graphs

Same fundamental news, different market reactions

Why have these crypto-related investments gone in different directions? Their operations are quite different, and market makers are paying attention to these unique qualities.

Clean spark

CleanSpark acquired a total of 13 new mining facilities from other companies in the first half of the year, spanning the U.S. map from Georgia to Wyoming.

Additionally, the all-American Bitcoin mining company also crushed Wall Street consensus estimates in its February Q1 report and May Q2 update. The company posted a profit in both of these earnings reports, both in terms of free cash flows and adjusted earnings per share.

With proven profitability, a debt-free balance sheet, $323 million in cash reserves, and a similar amount of Bitcoin holdings, CleanSpark appears poised to outperform the lower yields of this rewards halving cycle.

It’s no surprise to see this success story inspire rising stock prices.

Marathon

Marathon has experienced the same halving rewards as CleanSpark and has gone on its own production facility buying spree. The company currently has 31.5 exahashes per second (EH/s) of mining equipment installed, targeting the Bitcoin mining business. A much smaller fleet of machines with a capacity of 0.6 EH/s is mining the smaller Kaspa cryptocurrency instead, diversifying Marathon’s crypto operations a bit.

The cryptocurrency miner is also exploring international production beyond its Texas facility, running a small test project in Finland and a power grid partnership in Kenya. Marathon consumes more cash than it generates, and its Bitcoin holdings outweigh its cash balance by a ratio of 4 to 1.

Investors see this as a riskier structure, making Marathon shares more vulnerable to economic challenges.

Riot platforms

Riot Platforms operates a smaller Bitcoin mining operation than either Marathon or CleanSpark. Its average production capacity stops at 11.4 EH/s, targeting 31 EH/s by the end of 2024. Both Marathon and CleanSpark are targeting 50 EH/s capacity by the same calendar milestone.

The company supplements its Bitcoin revenue with energy credits earned by slowing down or shutting down its mining operations when the Texas power grid needs a boost. The company is involved in an attempted stock-for-stock buyout of a smaller rival Bit Farms (BITF 3.26%), building a 14% equity stake while Bitfarms adopted a poison pill policy.

The acquisition is up in the air and investors generally hate uncertainty, so Riot Platforms’ stock performance isn’t impressing anyone in 2024.

Microstrategy

MicroStrategy is a different story. The company doesn’t operate any Bitcoin miners, so it doesn’t care much about the lower mining rewards.

Founder and CEO Michael Saylor’s company cares deeply about the price of Bitcoin, now and in the long term, as nearly all of its cash reserves have been converted into Bitcoin holdings. Furthermore, the company continues to buy more Bitcoin at every opportunity.

The purchases were funded by profits from MicroStrategy’s software business, additional stock sales, new debt and, in a short-lived test, even a loan secured by some of the company’s Bitcoin holdings. This coin-buying strategy amplifies Bitcoin’s gains when times are good, but it also exposes investors to more risk when Bitcoin prices are low.

Cryptocurrency is on the rise this year, so MicroStrategy’s stock price is benefiting from the cryptocurrency trend.

How Bitcoin Halving Boosts Cryptocurrency Mining Profits

Bitcoin’s mining reward halving makes it harder to run a profitable mining business — at least for a while. This four-year cycle is codified was designed to limit the supply of new coins while the cryptocurrency creates its real-world demand.

The basic laws of supply and demand dictate rising prices in this scenario, and the Bitcoin price chart has shown this pattern in each of the first three halvings. History doesn’t repeat itself, but it often echoes familiar patterns, and the fourth reward halving cycle looks set to send Bitcoin prices much higher in the next year or so.

This predictable trend is the basis of Michael Saylor’s Bitcoin strategy. It also weeds out weaker hands from the costly Bitcoin mining industry when rewards are low and the price of Bitcoin has yet to begin its bull run. Riot’s attempted purchase of Bitfarms is an ambitious but risky effort to capitalize on the target company’s financial weakness before the cryptocurrency’s price rises again.

There is one clear takeaway for investors about Bitcoin trends in early 2024: understand the cyclical nature of Bitcoin and strategic moves by key industry players around it can provide significant upside. Keep an eye on the players that thrive under pressure, as they are the ones likely to shine when the market recovers. The presence of spot Bitcoin ETFs should boost and support the current cycle, thanks to a large inflow of money from institutional investors.

Bitcoin

Grayscale Unveils Bitcoin Mini Trust ETF

Bitcoin Currency

Grayscale Investments The Bitcoin Mini Trust began trading on Wednesday with a 0.15% expense ratio, offering a lower-cost option for bitcoin exposure in the market.

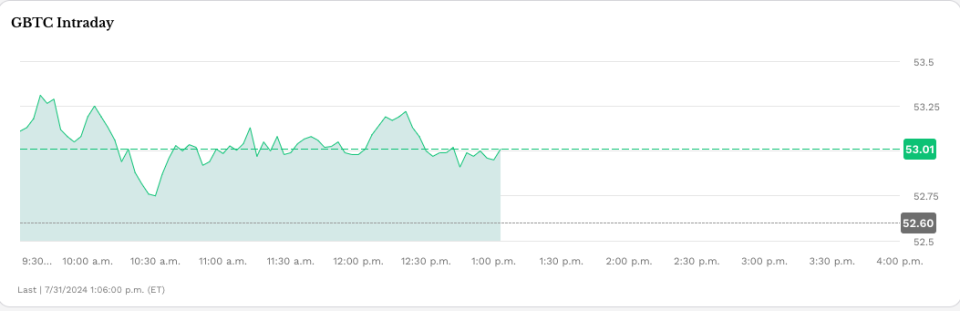

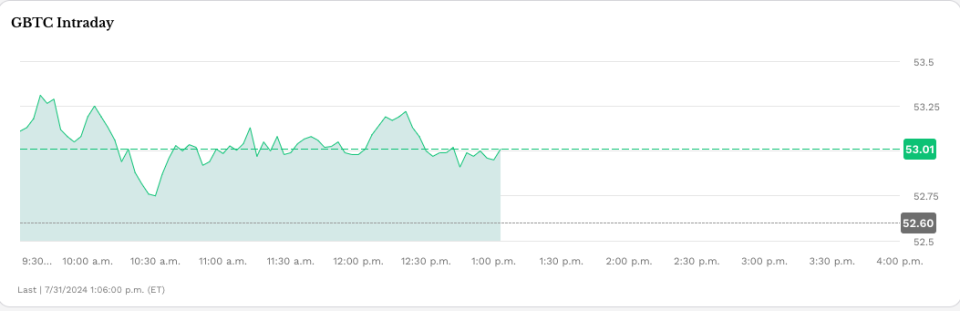

The Mini Trust, which has the symbol BTC and trades on NYSE Arca, is structured as a spin-off of the Grayscale Bitcoin Trust (GBTC). New shares will be distributed to existing GBTC shareholders with the fund contributing a portion of its bitcoin holdings to the new product. According to a company press releaseBTC’s S-1 registration statement became effective last week.

“The Grayscale team has believed in the transformative potential of Bitcoin since the initial launch of GBTC in 2013, and we are excited to launch the Grayscale Bitcoin Mini Trust to help further lower the barrier to entry for Bitcoin in an SEC-regulated investment vehicle,” said David LaValle, Senior Managing Director and Head of ETFs at Grayscale.

The Bitcoin Mini Trust’s debut comes amid growing interest in ETFs based on the current price of the two largest cryptocurrencies by market cap, bitcoin and ether. Spot bitcoin ETFs have generated nearly $18 billion in inflows since the first ones began trading on Jan. 11, though GBTC has lost nearly $19 billion in assets.

This fund differs from other funds because it is a conversion of an existing fund and has a 1.5% fee, the highest among spot bitcoin products that have received SEC approval this year.

Mini Bitcoin Trust Low Fee

On a Post X On Wednesday, Bloomberg senior ETF analyst Eric Balchunas noted the Bitcoin Mini Trust’s “lowest fee in the category…”

“[Important] to recognize how incredibly cheap 15bps is — about 10x cheaper than spot ETFs in other countries and other vehicles,” Balchunas wrote, adding that this pricing strategy reflects the competitive nature of the U.S. ETF market, which he referred to as the “ETF Terrordome.”

“This is what Terrordome does to fund [cost]. It reaches 1.5% [and] end in 0.15%, how to go from [a] country club to the jungle. But that’s why all the flows are here, investor paradise,” he noted.

Read more: Spot Bitcoin ETF Inflows Hit Daily High of Over $1 Billion

Bitcoin was recently trading at around $66,350, virtually flat since U.S. markets opened on Wednesday.

Grayscale also offers two spot Ethereum ETFs, the Grayscale Ethereum Trust (ETHE) and the Grayscale Ethereum (ETH) Mini Trustwhose performance is based on ETHE. ETHE outflows exceeded $1.8 billion in its first six days of trading, while ETH added more than $181 million in the same period, according to Farside. The remaining seven ETFs generated about $1.2 billion in inflows.

The story continues

Read more: Spot Ethereum ETFs Approved to Start Trading

Permanent link | © Copyright 2024 etf.com. All rights reserved

Bitcoin

Bitcoin (BTC) Price Drops Below $65K After FOMC as Middle East Tensions Rise

Cryptocurrencies fell sharply on Wednesday as rising geopolitical risks captivated investors’ attention following the conclusion of the Federal Reserve’s July meeting.

Bitcoin (BTC) fell to $64,500 from around $66,500, where it traded following Federal Reserve Chairman Jerome Powell’s press conference and is down more than 2% in the past 24 hours. Major altcoins including ether (ETH)sunbathing (SUN)Avalanche AVAX (AVAX) and Cardano (ADA) also fell, while Ripple’s XRP saved some of its early gains today. The broad cryptocurrency market benchmark CoinDesk 20 Index was 0.8% lower than 24 hours ago.

The liquidation happened when the New York Times reported that Iran’s leaders have ordered retaliation against Israel over the killing of Hamas leader Ismail Haniyeh in Tehran, raising the risk of a wider conflict in the region.

Earlier today, the Fed left benchmark interest rates unchanged and gave little indication that a widely expected rate cut in September is a given. The Fed’s Powell said that while no decision has been made on a September cut, the “broad sense is that we are getting closer” to cutting rates.

While digital assets suffered losses, most traditional asset classes rose higher during the day. U.S. 10-year bond yields fell 10 basis points, while gold rose 1.5% to $2,450, slightly below its record highs, and WTI crude oil prices rose 5%. Stocks also rallied during the day, with the tech-heavy Nasdaq 100 index rebounding 3% and the S&P 500 closing the session 2.2% higher, led by 12% gains in chipmaker giant Nvidia (NVDA).

The different performances across asset classes could be due to traders’ positioning ahead of the Fed meeting, Zach Pandl, head of research at Grayscale, said in an emailed note.

“Equities may have been slightly underutilized after the recent dip, while bitcoin is coming off a strong period with solid inflows, while gold has recovered after a period of weakness,” he said.

“Overall, the combination of Fed rate cuts, bipartisan focus on cryptocurrency policy issues, and the prospect of a second Trump administration that could advocate for a weaker U.S. dollar should be viewed as very positive for bitcoin,” he concluded.

UPDATE (July 31, 2024, 21:30 UTC): Adds grayscale comments.

Bitcoin

Donald Trump’s Cryptocurrency Enthusiasm Is Just Another Scam

Former US President Donald Trump spoke at the Libertarian National Convention in May and lent his a strong support to crypto: “I will also stop Joe Biden’s crusade to crush crypto. … I will ensure that the future of crypto and the future of bitcoin is made in the US, not taken overseas. I will support the right to self-custody. To the 50 million crypto holders in the country, I say this: With your vote, I will keep Elizabeth Warren and her henchmen out of your bitcoin.”

Former US President Donald Trump spoke at the Libertarian National Convention in May and lent his a strong support to crypto: “I will also stop Joe Biden’s crusade to crush crypto. … I will ensure that the future of crypto and the future of bitcoin is made in the US, not taken overseas. I will support the right to self-custody. To the 50 million crypto holders in the country, I say this: With your vote, I will keep Elizabeth Warren and her henchmen out of your bitcoin.”

Trump continued to court the cryptocurrency industry in the months that followed; he he appeared at the Bitcoin 2024 Conference in Nashville this week, along with independent presidential candidate Robert F. Kennedy Jr.’s parting words to Trump — “Have fun with your bitcoin, your cryptocurrency and whatever else you’re playing with” — were less than enthusiastic, but the industry itself remains packed with ardent Trump supporters.

This turnaround came as a surprise, given Trump’s previous strong opposition to cryptocurrency. When Facebook was floating its Libra cryptocurrency in 2019, Trump tweeted: “I am not a fan of Bitcoin and other cryptocurrencies, which are not money, and whose value is highly volatile and based on thin air.” Former national security adviser John Bolton’s White House memoir, The Room Where It Happened, quotes Trump as telling Treasury Secretary Steven Mnuchin: “Don’t be a trade negotiator. Go after Bitcoin.” [for fraud].” In 2021, Trump counted Fox Business that bitcoin “just looks like a scam. … I want the dollar to be the world’s currency.”

Why the change? There doesn’t seem to be any crypto votes. Trump’s “50 million” number comes from a poorly sampled push survey by cryptocurrency exchange Coinbase which claimed 52 million cryptocurrency users in the United States starting in February 2023. But one survey A survey conducted last October by the US Federal Reserve showed that only 7% of adults (about 18.3 million people) admitted to owning or using cryptocurrencies — down from 10% in 2022 and 12% in 2021. Many of these people are likely wallet owners who were left holding the bag after crypto plunged in 2022 — and are not necessarily new fans.

What Trump wants from the cryptocurrency industry is money. The cryptocurrency industry has already raised more than US$ 180 million to run in the 2024 US elections through his super PACs Fairshake, Defend American Jobs and Protect Progress.

Fairshake spent $10 million on taking Rep. Katie Porter in the primary battle for Dianne Feinstein’s California Senate seat by funding Porter’s pro-crypto rival Adam Schiff. This put $2 million to knock out Rep. Jamaal Bowman in the Democratic primary for New York’s 16th District in favor of pro-crypto George Latimer. In the Utah Senate Republican primary, Rep. John Curtis defeated Trent Staggs with the help of $4.7 million from Defend American Jobs. In Alabama’s House District 2, the majority of campaign expenses came from the cryptocurrency industry.

Fairshake is substantially financed by Coinbase, cryptocurrency issuer Ripple Labs, and Silicon Valley venture capital firm Andreessen Horowitz, or a16z. Silicon Valley was awash in cryptocurrencies during the 2021 bubble, and a16z in particular continues to promote blockchain startups to this day — and still holds a huge amount of bubble crypto tokens that he wishes he could cash in on.

Many in Silicon Valley would like an authoritarian who they think will let them run wild with money — while bailing them out in tough times. Indeed, Trump promised Bitcoin 2024 participants that he hold all bitcoins that the United States acquires. (Never mind that it is usually acquired as the proceeds of crime.) Silicon Valley explicitly sees regulation of any kind as its greatest enemy. Three a16z manifestos — “Politics and the Future” It is “The Techno-Optimist Manifesto” and 2024 “The Small Tech Agenda—describe co-founders Marc Andreessen and Ben Horowitz’s demands for a technology-powered capitalism unhindered by regulation or social considerations. They name “experts,” “bureaucracy,” and “social responsibility” as their “enemies.” Their 2024 statement alleges that banks are unfairly cutting off startups from the banking system; these would be crypto companies funded by a16z.

Trump’s vice presidential pick, Senator J.D. Vance, is a former Silicon Valley venture capitalist. He was once employed by Peter Thiel, who bankrolled Vance’s successful 2022 Senate run; Vance has been described as a “Thiel creation”. He has increased support for the Trump ticket among his venture capital associates. Vance is a bitcoin holder and a frequent advocate of encryption. He recently released a draft bill to review how the Securities and Exchange Commission (SEC) and the Commodity Futures Trading Commission (CFTC) control crypto assets. In 2023, he circulated a bill to prevent banks from cutting out cryptocurrency exchanges.

Minimal regulation has been tried before. It led to the wild exuberance of the 1920s, which ended with the Black Tuesday crash of 1929 and the Great Depression of the 1930s. Regulators like the SEC were put in place during this era to protect investors and transform the securities market from a jungle into a well-tended garden, leading to many prosperous and stable decades that followed.

Crypto provides the opposite of a stable and functional system; it is a practical example of how a lack of regulation allows opportunists and scammers to cause large-scale disasters. The 2022 Crypto Crash repeated the 2008 financial crisis in miniature. FTX’s Sam Bankman-Fried was feted as a financial prodigy who would perform economic miracles if you just gave him carte blanche; he ended up stealing billions of dollars of customers’ money, destroying the lives of ordinary people, and is now in a prison cell.

U.S. regulators have long been concerned about the prospect of cryptocurrency contagion to the broader economy. Criminal money laundering is rampant in cryptocurrency; even the Trump administration has made rules in December 2020 to reduce the risk of money laundering from crypto. Meanwhile, the crypto industry has persistently tried to infiltrate systemically risky corners of the economy, such as pension funds.

Four U.S. banks collapsed during the 2023 banking crisis, the first since 2020. Two of them, Silvergate Bank and Signature Bank, were deeply embedded in the crypto world — Silvergate in particular appears to have collapsed directly from its heavy reliance on FTX and failed a few months after that. Silicon Valley Bank was not involved in crypto but collapsed due to a run on the bench due to panic among venture capital deposit holders, particularly Thiel’s Founders Fund.

Project 2025the Heritage Foundation mammoth conservative wish list The plan, which Trump and Vance have both endorsed and tried to distance themselves from at various times, emphasizes the importance of party loyalists, noting especially financial regulation. The plan recommends replacing as much of the federal bureaucracy as possible with loyalists and “trusted” career officials rather than nonpartisan “experts.” Vance defended in 2021 that Trump should “fire every mid-level bureaucrat, every civil servant in the administrative state” and “replace them with our people.” Loyalty will likely trump competence.

Crypto is barely mentioned directly in Project 2025 — suggesting it has little active support among the broader conservative coalition. But near the end of the manifesto is a plan to dismantle most U.S. financial regulations and investor protections put in place since the 1930s, suggesting the exemption the crypto industry seeks from current SEC and CFTC regulations.

Bitcoin, the first cryptocurrency, started as an ideological project to promote a strange variant of Murray Rothbard’s anarcho-capitalism and the Austrian gold-backed economy—the kind we abandoned to escape the Great Depression. Crypto quickly co-opted the “end of the Fed” and “establishment elites” conspiracy theories of the John Birch Society and Eustace Mullins. It’s a way for billionaire capitalists like Thiel, Andreessen and Elon Musk to claim they’re not part of the so-called elite.

If a second Trump administration were to limp along with financial regulators and allow cryptocurrencies to have free rein, it could help foster the collapse of the U.S. economy that bitcoin claimed to prevent. But Trump is more likely to be happy to take the crypto money and run.

Bitcoin

Trump’s Bitcoin (BTC) Reserve Plan Seen as Just a ‘Small Token Stash’

Donald Trump’s recent promise to create a “strategic national stockpile of Bitcoin” may not turn out to be as big a commitment as the hype surrounding the announcement makes it seem.

“Trump’s proposal is extremely modest,” said George Selgin, director emeritus of the Center for Monetary and Financial Alternatives at the Cato Institutea Washington-based public policy group. “It doesn’t have much economic implication.”

-

Ethereum12 months ago

Ethereum12 months agoEthereum Posts First Consecutive Monthly Losses Since August 2023 on New ETFs

-

Regulation12 months ago

Regulation12 months agoCryptocurrency Regulation in Slovenia 2024

-

News12 months ago

News12 months agoNew bill pushes Department of Veterans Affairs to examine how blockchain can improve its work

-

Regulation12 months ago

Regulation12 months agoThink You Own Your Crypto? New UK Law Would Ensure It – DL News

-

Regulation12 months ago

Regulation12 months agoUpbit, Coinone, Bithumb Face New Fees Under South Korea’s Cryptocurrency Law

-

Regulation12 months ago

Regulation12 months agoA Blank Slate for Cryptocurrencies: Kamala Harris’ Regulatory Opportunity

-

Regulation12 months ago

Regulation12 months agoBahamas Passes Cryptocurrency Bill Designed to Prevent FTX, Terra Disasters

-

Regulation12 months ago

Regulation12 months agoIndia to Follow G20 Policy for Cryptocurrency Regulation: MoS Finance

-

Ethereum1 year ago

Ethereum1 year agoComment deux frères auraient dérobé 25 millions de dollars lors d’un braquage d’Ethereum de 12 secondes • The Register

-

News1 year ago

News1 year ago“Captain Tsubasa – RIVALS” launches on Oasys Blockchain

-

News12 months ago

News12 months agoEU supports 15 startups to fight online disinformation with blockchain

-

News1 year ago

News1 year agoSolana ranks the fastest blockchain in the world, surpassing Ethereum, Polygon ⋆ ZyCrypto