Regulation

What to expect in a mainstream crypto economy

In 2009, an anonymous person released the genetic building block of Blockchain and launched Bitcoin, a pioneering decentralized currency. From its near-zero value in 2009, Bitcoin’s value has risen to a staggering $73,500, while the total valuation of the cryptocurrency economy stands at $1.3 trillion.

Initially considered a niche digital currency reserved for computer geeks, today cryptocurrencies and decentralized finance (DeFi) have emerged as a strong alternative to traditional financial systems around the world.

Today, governments are actively investing in cryptocurrencies and blockchain technology. Multi-billion dollar trading companies have emerged and there are millions of investors and cryptocurrency enthusiasts fixated on the phenomenon which seems to become more and more popular every day.

Cryptocurrencies’ journey from an obscure peer-to-peer transfer system to mainstream acceptance has been fueled by the evolution of blockchain technology and changing security measures to ensure safe transactions.

In this article, we will discuss whether cryptocurrencies will become mainstream and penetrate families of all age groups and what are the reasons behind its exponential growth and adoption.

How did cryptocurrencies gain mainstream acceptance?

Every day, cryptocurrencies are gaining more widespread acceptance. Its relevance is no longer limited to cryptocurrency-related platforms, as we have recently seen tech and finance giants such as Microsoft and PayPal use cryptocurrencies in their services. This penetration by the cryptocurrency industry has given them access to a much larger customer base to trade and invest in cryptocurrencies.

The online gambling industry is also one of the pioneers in cryptocurrency adoption, with the first casinos accepting Bitcoin in 2012. Cryptocurrency adoption has since enabled the growth of the crypto gambling industry billion-dollar business, including sports betting and Bitcoin casino with instant withdrawal.

Several countries including the United States, the United Kingdom, and European Union countries have regulated the use of cryptocurrencies. Countries like El Salvador have made Bitcoin legal tender, while the Bahamas, India and Japan have launched their own central bank digital currencies (CBDCs). Additionally, 130 countries are exploring the development and launch of their own CBDCs to compete with cryptocurrencies.

Furthermore, the use of blockchain technology is expanding beyond decentralized finance (DeFi) services, providing solutions in medical, agricultural, logistics, management and other sectors. Despite concerns about market volatility and regulatory concerns, cryptocurrencies are becoming increasingly mainstream as countries are now actively enacting new laws to regulate the industry.

What factors contributed to cryptocurrencies becoming mainstream?

Large-scale investments

In the venture capital sector, cryptocurrency has proven to be one of the fastest growing markets. During March and April 2024, the Crypto venture capital funding they reached $1.09 billion and $1.02 billion respectively.

Just in 2024, the cryptocurrency market has witnessed several breakthrough investments, including $1.7 billion to blockchain infrastructure companies, followed closely by decentralized financial protocols of $626 million, another $225 million in funding to “Monad” and a $47 million investment in “Securitize.”

Institutional interest

Several large financial institutions such as banks and publicly traded companies are investing in and offering crypto products, lending credibility to the asset class. Institutional enthusiasm has attracted more investors and legitimized cryptocurrencies.

Growing use cases

Cryptocurrencies are used for various purposes beyond simple peer-to-peer transactions. Their use cases have expanded to areas such as online shopping, online gambling, cross-border payments, decentralized finance and as a safeguard against inflation. This diversification has contributed to their increased adoption.

Technological advances

Technological progress, such as advances in scalability and user-friendly interfaces, has improved the accessibility and efficiency of cryptocurrencies. This played a role in increasing their public acceptance.

For example, platforms like Skrill have contributed significantly to the advancement of cryptocurrencies. Skrill offers cryptocurrency trading and wallet services with popular e-commerce platforms, and the widespread use of cryptocurrencies in crypto casinos has helped bridge the gap between traditional finance and cryptocurrencies.

Help for the Underbanked

Cryptocurrencies have the potential to provide financial services to individuals around the world who do not have access to traditional banks. For example, crypto wallets and mobile payment solutions in areas with limited access to banking infrastructure have contributed to their adoption, as they provide greater financial inclusion.

Market adoption and integration

The growing acceptance of cryptocurrencies by both businesses and consumers, along with their integration into financial systems, can stimulate demand and reduce market volatility, ultimately driving broader adoption.

According to a report by Security.org, consumer adoption of cryptocurrencies has increased since From 30% in 2023 to 40% in 2024. This wave of adoption and integration improves liquidity levels, further driving mainstream acceptance of cryptocurrencies.

What are the challenges preventing the mainstream adoption of cryptocurrencies?

Several key factors currently prevent the full mainstream adoption of cryptocurrencies:

Regulatory uncertainty

The regulatory environment and legal framework of cryptocurrencies can vary significantly from country to country. While some jurisdictions have clear rules in place, others are more cautious, even restrictive. This lack of uniform global regulation serves as a barrier to the mainstream adoption of cryptocurrencies across the world.

Price volatility

The price volatility of cryptocurrencies may prevent their use as a medium of exchange or store value. Cryptocurrency prices fluctuate significantly over short periods, making them a high-risk, speculative investment.

Scalability issues

Popular cryptocurrencies like Ethereum and Bitcoin face scalability issues, leading to slower transaction speeds and higher fees during high usage periods. The transaction speeds of Litecoin and Dogecoin are much faster. While scalability issues may prevent mainstream adoption of the most popular cryptocurrencies, there are scalability solutions such as layer 2 solutions and proof-of-stake consensus mechanisms that could change the scalability issues.

Limited understanding and education

For widespread adoption to be successful, cryptocurrencies must become easier to use and more accessible to people who are not tech-savvy. Lack of education about the risks and benefits of cryptocurrencies among the general public prevents active involvement and adoption.

Resistance of traditional finance: Traditional financial institutions see cryptocurrencies as a disruptive threat to their established, traditional business models. For example, in 2018, US banks JPMorgan, CitiGroup and Chase limited or banned cryptocurrency purchases using their banking services or credit cards. This was seen as an attempt to limit the exposure of traditional financial institutions to the risks associated with cryptocurrencies.

What is the future of the mainstream cryptocurrency market?

If cryptocurrencies were fully widespread on a global scale, the future of finance, the economy and society would be significantly different. There are several radical changes that can be expected if cryptocurrencies become mainstream.

Transformation of financial systems

Traditional fiat currencies could be replaced with central bank-issued cryptocurrencies (CBDCs) or private cryptocurrencies such as Bitcoin and Ethereum. The importance and role of traditional banking systems and financial institutions could potentially decline as decentralized finance (DeFi) platforms built on blockchain technology enable peer-to-peer transactions, loans and other financial services without intermediaries.

Furthermore, cross-border transactions and remittances could be instantaneous, compared to traditional systems, more convenient and exceptionally convenient, leading to better financial inclusion for unbanked populations around the world.

Technological advances

Current blockchain networks are facing scalability challenges that can be resolved by implementing technological advances such as sharding, new consensus mechanisms, or incorporating layer 2 solutions.

Additionally, quantum computing could impact the security and sustainability of existing cryptocurrencies. Quantum computing uses complex calculations much faster than traditional computing models that could break encryption. The reality of this threat requires cryptocurrencies to constantly adapt and evolve.

Social changes

Increasing financial privacy and anonymity can empower individuals; however, it also raises concerns about illicit activities and the need for trust and regulatory oversight. The concept of trust could shift from centralized authorities to decentralized and transparent blockchain networks, potentially impacting governance models and social structures.

The widespread adoption of cryptocurrencies could pose a threat to the authority and control of traditional financial institutions and governments over financial systems.

Economic impact

As cryptocurrencies become more widely accepted and have greater liquidity, price fluctuations and volatility may decrease, making them stores of value and more stable means of exchange.

The integration of blockchain technology, smart contracts and decentralized apps could lead to the development of new economic models and business prospects, ultimately promoting growth and innovation.

This would require governments to adapt fiscal policies and regulations to take into account the decentralized nature of cryptocurrencies and their potential impact or influence on monetary policies.

Final thoughts

While achieving mainstream adoption of cryptocurrencies is possible and would bring significant benefits, it will also present challenges. As cryptocurrencies continue to evolve, their role in the global financial system is likely to become increasingly important.

This would also require regulators to provide clear and comprehensive guidelines on how cryptocurrencies should be classified and regulated. This would include clarifying whether cryptocurrencies are securities, commodities, currencies or assets for tax purposes.

Once the global regulatory and legal framework is established, the mainstream adoption of cryptocurrencies could be a positive development globally.

Regulation

Cryptocurrency Regulation in Dominican Republic 2024

The Dominican Republic, located on the island of Hispaniola in the Caribbean, is a nation famous for its culture, landscape, and economy. In terms of population and area, it is the second largest in the Caribbean region. It has over 11.4 million people. Interestingly, out of these 11.4 million, a whopping 3.6 million people live in its capital, Santo Domingo. Notably, the country also has the largest economy in the region. It has witnessed impressive growth in the past few decades. The growth has been driven by various key sectors such as construction, manufacturing, tourism, and mining. But that doesn’t mean it is better than other Latin American countries. It is also a poor performer when it comes to unemployment and income inequality, like similar Latin American economies. The biggest economic and political crisis it is facing right now is migration. However, the backbone of the Dominican Republic’s economy is its large diaspora in the United States, which contributes significantly to the economy in the form of remittances from abroad. All these factors make the country a perfect destination for the introduction of a crypto revolution. At the moment, the Dominican Republic’s crypto sector presents a mixed picture. The country has an active crypto community. But, from a regulatory standpoint, the Central Bank of the Dominican Republic has expressed caution. Recently, it has made statements aimed at discouraging individuals and financial institutions from dealing with cryptocurrencies. According to the central bank’s position, cryptocurrencies are not supported by the government. Unfortunately, it has even threatened financial institutions with potential sanctions. Despite these reservations, there is something that keeps people’s hopes alive. That is the support from the local community that the cryptocurrency sector enjoys at the moment. According to a recent report, the local crypto market in the Dominican Republic continues to thrive, with an estimated turnover of over $12 million.

Want to learn about the Dominican Republic’s cryptocurrency regulatory landscape? By the end of this session, you may have grasped everything you need to know about the country’s cryptocurrency regulatory landscape. Let’s dive in!

1. Cryptocurrency Regulation in the Dominican Republic: A General Overview

Currently, cryptocurrency is a trending topic in the Dominican Republic. The Latin American country has recently seen a sharp increase in cryptocurrency usage. According to a report released in 2022, it recorded a 52% increase in usage that year, compared to the previous year. Evidently, the growing acceptance of the cryptocurrency industry among the country’s residents has not yet had any influence on the government. The Dominican Republic has not yet created any regulatory framework to support the industry. Some of its recent actions have also been discouraging in nature. In 2021, the Central Bank of the Dominican Republic released a statement against the use of cryptocurrencies. The statement aimed to warn users that cryptocurrencies are not legal tender. The lack of regulation of cryptocurrencies in the country creates legal gray areas. This increases the possibility of scams and illegal activities, including money laundering. Creating an adequate regulatory framework for cryptocurrencies and informing the population about the risks and benefits of the sector are the best things that the government of the Dominican Republic can do at this time for the progress of its economy.

2. Cryptocurrency Regulation in the Dominican Republic: What’s New

Here are some of the interesting developments that have occurred in the recent past in the Dominican Republic’s Web 3 industry.

October 11, 2023: The Central American Bank for Economic Integration and the Dominican Innovation Cabinet have developed an AI strategy. This is in line with the National Innovation Policy 2030, promoting research, public-private partnerships and talent development.

May 9, 2024: Popular Bank trained 1,200 entrepreneurs and SEs on AI opportunities in the Dominican Republic. The 10th edition of the forum had 2,800 registrations, which shows a growing interest in Web 3 for businesses.

July 8, 2024: The Dominican Republic has ranked high in the Global Index on Responsible AI, recognized for ethical development of artificial intelligence by the Global Center on AI Governance in South Africa.

3. Explanation of the regulatory framework for cryptocurrency taxation in the Dominican Republic

The fundamental principle of the Dominican Republic’s fiscal framework is to balance revenue needs with investment promotion. The country follows a territorial tax regime, which means that any income earned within the country is subject to taxation.

Society: are required to pay a 27% tax rate on local income.

Residents: face progressive tax rates of up to 25% on local income.

Donations are taxed at 27% and inheritances at 3%. There is no wealth tax in the country.

For cryptocurrency users, the same principles apply, in the absence of a separate tax framework for cryptocurrencies. This means that if you earn income from cryptocurrency activities within the Dominican Republic, such as trading or mining, it is considered local source income and is subject to the same tax rates.

4. Timeline of the evolution of cryptocurrency regulation in the Dominican Republic

Here is the evolution of the national regulatory framework regarding cryptocurrencies.

1996: It ratified the Inter-American Convention against Corruption.

2002: It approved the United Nations Convention against Transnational Organized Crime and enacted a law to combat money laundering.

2017: He implemented the Anti-Money Laundering and Anti-Terrorist Financing Act, which modernized financial crime laws.

2021: The Central Bank has warned that cryptocurrencies are neither government-backed assets nor legal tender.

Final note

In conclusion, creating a comprehensive cryptocurrency regulatory framework in the Dominican Republic is a challenging task. An ideal regulatory framework for the country will be one that strikes a balance between encouraging innovation and protecting users. To create such a strong cryptocurrency regulatory framework, what is essentially needed is a strong collaboration between the government, financial institutions, and the cryptocurrency community. At a time when the world is rapidly racing towards its digital future, it is better to achieve such collaboration as soon as possible. Otherwise, the country may miss the ticket to its digital economic future.

Read also: Cryptocurrency Regulation in Bolivia 2024

Regulation

Cryptocurrencies and Politics: Trump, Dimon, and Silicon Valley’s Shifting Alliances

Explore the intersection of cryptocurrencies and US politics as Trump nominates one-time “never bitcoin fan” Jamie Dimon for Treasury chief, Ethereum’s Vitalik Buterin issues cautionary warnings, and official cryptocurrency policies from both parties enter a state of flux.

In the latest developments intertwining cryptocurrency and US presidential politics, well-known figures and their shifting positions have come under the spotlight. Former US President and current Republican presidential candidate Donald Trump has indicated a surprising shift in his views and potential cabinet picks.

In a recent interviewTrump has suggested that JP Morgan CEO Jamie Dimon, once a vocal critic of Bitcoin and cryptocurrencies, could be considered for Treasury secretary. This marks a significant shift given Dimon’s historical skepticism, having labeled Bitcoin a “fraud” as recently as 2017. While he has some reservations, Dimon has shown a softening stance, acknowledging the right to buy and hold Bitcoin and supporting blockchain technology.

Trump’s evolving outlook on cryptocurrencies coincides with broader political endorsements in the tech sector. The venture capital firm Andreessen Horowitz, led by Marc Andreessen and Ben Horowitz, has publicly shifted its support to Trump, citing his favorable policies on technology, including cryptocurrency and artificial intelligence. The endorsement underscores a growing trend in traditionally Democratic Silicon Valley, where tech leaders are prioritizing supportive policies over traditional political affiliations.

On the contrary, Vitalik Buterin, the creator of Ethereum, has called for caution within the crypto community. In a recent blog postButerin cautioned against supporting political candidates based solely on their pro-crypto stance. He stressed the importance of evaluating politicians on a broader spectrum of values, including their stance on internationalism and immigration. Buterin argued that aligning with politicians who don’t have a comprehensive and principled approach could undermine the core values of the cryptocurrency space.

These developments highlight the growing influence of cryptocurrency and technology policies on U.S. presidential politics, reflecting a complex and evolving landscape in which political affiliations and positions play critical roles.

Republicans or Democrats? Crypto Policy Comparison

Biden Administration Cryptocurrency Policies

The Biden administration has taken a cautious but structured approach to cryptocurrency regulation. Key elements include:

- Executive Order on Digital Activities: Issued in March 2022, this order outlines a coordinated effort among federal agencies to develop policies and regulations for digital assets. The focus is on balancing innovation with risk mitigation, emphasizing consumer protection, financial stability, and combating illicit activity.

- Regulatory framework and enforcement:The administration has developed a structure to ensure the safe development of digital assets while addressing the associated risks. This includes enhanced enforcement actions against fraudulent activities and strengthened guidance to protect consumers and the financial system.

- Budget and taxation proposals: Biden’s budget proposals have included provisions aimed at increasing tax revenue from cryptocurrencies. This includes expanding mark-to-market accounting rules to cover digital assets and imposing a tax on crypto mining operations. The administration expects these measures to generate significant revenue over the next decade.

- Consumer protection and financial stability: The administration’s roadmap highlights the need for strong measures to prevent cryptocurrencies from undermining financial stability. It includes efforts to raise public awareness of the risks of cryptocurrencies and protect investors from fraudulent schemes.

Republican Party Cryptocurrency Policy

The Republican Party generally takes a more pro-crypto stance, supporting policies that promote innovation and minimize regulatory burdens. Key aspects include:

- In his 2024 GOP platform In the “Make America Great Again” policy document, released at the ongoing Republican National Convention in Milwaukee, Wisconsin, the Republican Party issued the following statement on cryptocurrencies: “Republicans will end Democrats’ illegal and un-American crackdown on cryptocurrencies and oppose the creation of a central bank digital currency. We will defend the right to mine Bitcoin and ensure that every American has the right to self-custody of their digital assets and transact free from government surveillance and control.”

- Supporting innovation and reducing regulation: Republicans often emphasize the need to promote technological innovation, including cryptocurrencies, by reducing regulatory hurdles. They argue that excessive regulation stifles growth and innovation in the cryptocurrency industry.

- Pro-Crypto Politicians: Prominent Republicans, such as former President Donald Trump, have expressed support for more lenient cryptocurrency policies. Trump has suggested that he is considering figures such as JP Morgan CEO Jamie Dimon, who has shown a softer stance on cryptocurrencies, for significant roles in his administration, reflecting a more crypto-friendly approach.

- Venture Capital Approvals: Influential figures in the tech and venture capital sectors, such as Marc Andreessen and Ben Horowitz, have publicly supported Republican candidates for their policies supporting tech and cryptocurrency. This reflects a broader alignment within the tech sector that favors the Republican approach to cryptocurrency regulation.

- Beware of over-regulation:Republicans often warn of the potential negative impacts of excessive regulation on the cryptocurrency industry, advocating for policies that support market growth and technological progress.

Summary

The Biden administration is focused on a balanced approach to cryptocurrency regulation, emphasizing consumer protection, financial stability, and strong enforcement against illicit activity. In contrast, the Republican Party tends to favor more pro-crypto policies, advocating for reduced regulation to foster innovation and growth within the industry. As the cryptocurrency landscape evolves, these differing approaches highlight the ongoing debate over how to best integrate digital assets into the broader financial system.

Regulation

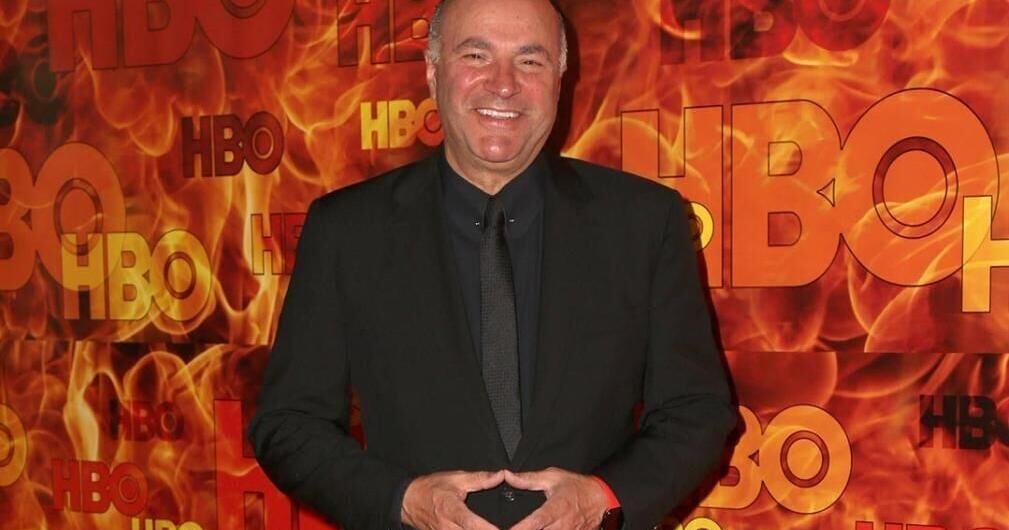

Wall Street’s Bitcoin Adoption Is Being Hampered by Regulatory Scrutiny, Says Shark Tank Expert

In recent news, Kevin O’Leary, a prominent figure on “Shark Tank,” has expressed doubts about the likelihood of major Wall Street institutions investing in Bitcoin. Benzinga note that this skepticism emerges despite recent moves by asset managers such as BlackRock and Fidelity to establish Bitcoin Spot ETFs.

During a Interview with CoinBaseO’Leary expressed his concerns about the current federal oversight of the cryptocurrency industry, led by SEC Chairman Gary Gensler. He believes this oversight is a major deterrent to these institutions.

“They own nothing and they won’t own anything until Gensler sues everyone,” O’Leary said.

The SEC has recently launched several lawsuits against major players in the industry, including cryptocurrency exchanges Coinbase and Binance. The argument is that many tokens traded are unregulated securities. O’Leary suggests that this lawsuit limits options for companies like BlackRock, calling into question the feasibility of launching an ETF on a regulated exchange.

O’Leary also touched on the decline of Binance and the intense pressure on its co-founder Changpeng Zhao. He questioned the likelihood of institutional involvement under such circumstances.

Additionally, O’Leary commented on the ongoing trial of Sam Bankman-Fried, whose mismanagement led to the collapse of the FTX exchange last year. He suggested that the era of “crypto cowboys” is coming to an end, and without regulatory approval in the United States, the industry may not expand as expected. It is understandable that he is cautious about the current state of cryptocurrencyas he reportedly personally lost just under $15 million in that crash.

Despite the skepticism, O’Leary hinted at the possibility of more transparent cryptocurrency exchanges emerging in other parts of the world. These could potentially attract institutional interest. However, the current regulatory environment in the United States appears to be a significant barrier for major Wall Street institutions to invest in bitcoin.

This story It was produced by Benzinga and reviewed and distributed by Stacker Media.

Regulation

Regulation, Digital Wallet Adoption, and Ponzi Alerts

- Brazil postpones vote on artificial intelligence regulation, citing potential impacts on tech sector, and delays vote until after municipal elections.

- Nine out of ten Argentines under the age of 40 now use digital wallets, thanks in large part to growing access to smartphones and the Internet.

The cryptocurrency landscape in Latin America continues to evolve with major regulatory developments and changes in market dynamics. This update covers legislative actions in Brazil and the growing popularity of Argentine soccer fan tokens.

Brazil postpones vote on AI regulation

The Brazilian Senate has postponed voting on a bill to regulate artificial intelligence technologies until after the next municipal elections. we noticed Previously on Crypto News Flash, the proposed bill aims to protect against misuse in elections and establish privacy guidelines, but has sparked debate over its potential to inhibit technological progress.

“The bill seeks to regulate AI to prevent its misuse in elections and establish privacy standards. However, it imposes excessive restrictions on a nascent industry,” he said.

Increased use of digital wallet in Argentina

In ArgentinaDigital wallet use has increased, with nine out of ten Argentines under 40 now using these platforms for transactions. This increase is supported by widespread access to smartphones and the Internet, enhancing the modernization of financial services.

“The outlook is one of growth: the increased adoption of digital wallets among young people allows us to think that their use will become increasingly widespread,” said Joaquín Molina of the consultancy firm Taquion.

Crypto Ponzi Scheme Alerts in Venezuela

Venezuela has seen a continuation of cryptocurrency Ponzi schemes, with recent warnings of a new fraudulent scheme using the name of state-owned oil company PDVSA to lure investors with false promises of high returns.

“As some large Ponzi schemes collapsed, new ones continue to emerge every week. Some last longer than others. The latest, supposedly launched on July 2, is called PDVSA_Mall,” RoamingVzla tweeted.

Argentine Football Fans Tokens Increase

With Argentina heading to the Copa América final, the national football federation’s fan token has seen a surge in value. This movement illustrates how sports results can directly impact the values of associated cryptocurrencies, introducing both potential rewards and risks for investors.

These segments highlight the growing integration of cryptocurrency into everyday transactions and regulatory frameworks in Latin America. Ongoing legislative changes and the growing adoption of blockchain technologies suggest that the region will maintain a pivotal role in the global cryptocurrency landscape.

No spam, no lies, just insights. You can unsubscribe at any time.

-

News1 year ago

News1 year ago“Captain Tsubasa – RIVALS” launches on Oasys Blockchain

-

Ethereum1 year ago

Ethereum1 year agoComment deux frères auraient dérobé 25 millions de dollars lors d’un braquage d’Ethereum de 12 secondes • The Register

-

News1 year ago

News1 year agoSolana ranks the fastest blockchain in the world, surpassing Ethereum, Polygon ⋆ ZyCrypto

-

Videos1 year ago

Videos1 year agoHistoric steps for US cryptocurrencies! With a shocking majority vote!🚨

-

Videos1 year ago

Videos1 year agoIs Emorya the next gem💎 of this Bitcoin bull run?

-

News1 year ago

News1 year agoSolana Surpasses Ethereum and Polygon as the Fastest Blockchain ⋆ ZyCrypto

-

Videos1 year ago

Videos1 year agoNexus Chain – Ethereum L2 with the GREATEST Potential?

-

Ethereum1 year ago

Ethereum1 year agoScaling Ethereum with L2s damaged its Tokenomics. Is it possible to repair it?

-

News1 year ago

News1 year agoFnality, HQLAᵡ aims to launch blockchain intraday repositories this year – Ledger Insights

-

Regulation1 year ago

Regulation1 year agoFinancial Intelligence Unit imposes ₹18.82 crore fine on cryptocurrency exchange Binance for violating anti-money laundering norms

-

Bitcoin1 year ago

Bitcoin1 year agoBitcoin Drops to $60K, Threatening to Derail Prices of Ether, Solana, XRP, Dogecoin, and Shiba Inu ⋆ ZyCrypto

-

Videos1 year ago

Videos1 year agoRaoul Pal’s Crypto Predictions AFTER Bitcoin Halving in 2024 (The NEXT Solana)