Ethereum

What DOJ’s First MEV Lawsuit Means for Ethereum (ETH)

The US Department of Justice has charged two brothers with orchestrating an attack on Ethereum trading bots, load them with conspiracy to commit wire fraud, wire fraud and conspiracy to commit money laundering. Essentially, the brothers found a way to target bots that were directing transactions in a process called maximum extractable value, or MEV, which refers to the amount of money that can be removed from the block production process by ordering transactions .

Note: The opinions expressed in this column are those of the author and do not necessarily reflect those of CoinDesk, Inc. or its owners and affiliates. This is an excerpt from The Node newsletter, a daily digest of the most important crypto news from CoinDesk and beyond. You can subscribe to receive the full newsletter here.

MEV, which is itself controversial, can be a very lucrative game dominated by automated bots that often comes at the expense of blockchain users, which is part of why so many in the crypto community have rushed to speak out against it. the DOJ complaint. However, this is not a Robinhood situation, where two brothers, Anton and James Peraire-Bueno, from Bedford, Massachusetts, stole from the rich to give to the poor.

As the DOJ filing indicates, the brothers netted approximately $25 million in at least eight separate transactions in what the DOJ alleges was a highly orchestrated and premeditated conspiracy. They created shell companies and looked for ways to launder funds safely to avoid detection. The highly technical complaint describes the process by which the exploit occurred, which the DOJ calls “the first of its kind.”

“They used a flaw in MEV Boost to push invalid signatures to preview bundles. This gives an unfair advantage via an exploit,” former Ethereum Foundation and Flashbots employee Hudson Jameson told CoinDesk in an interview. Jameson added that the Peraire-Bueno brothers also operated their own validator when mining MEV, which somewhat violates a Gentleman’s Agreement in MEV circles.

“No one else in the MEV ecosystem was doing both of these things that we knew of,” he added. “They did more than just follow the codified rules and small promises of MEV extraction.”

“It’s not some sort of Robin Hood story, because they didn’t return the money to the people from whom the MEVs extracted it,” said a pseudonymous researcher. Banteg said.

On a more technical level, the brothers were able to leverage open source software created by the company MEV Flashbots, called mev-boost, which gave them an uneven view of how the MEV bots ordered trades. (Mev-boost is an open source protocol that allows different players to compete to “build” the most valuable blocks by ordering transactions.)

“Having access to the block body allowed the malicious proponent to extract transactions from the stolen block and use them in their own block where they could mine those transactions. In particular, the malicious nominator built his own block that broke the sandwich bots’ sandwiches and effectively stole their money,” according to a report from Flashbots. autopsy in 2023.

In particular, and what is at the heart of the DOJ’s case, is that the brothers found a way to sign fake transactions in order to run the scheme. “This false signature was designed to, and indeed did, trick Relay into prematurely disclosing the contents of the proposed block to Defendants, including private transaction information,” the document states.

“I think the invalid header part will be the needle that this whole thing hinges on,” said one cryptography researcher, who asked to remain anonymous.

“I think the indictment indicates that and so maybe it’s a good thing that SDNY is very technologically savvy in this area and has made it clear where they screwed up and hinted at the inevitability of MEV in blockchains,” Jameson said.

Others have also noted the technical sophistication of the DOJ’s argument, which appears to be less an indictment of MEV or Ethereum itself than an attempt to profit by unfairly obtaining information.

“If you hope that Ethereum will always be a ‘dark forest’ where on-chain predators compete for arbitrage opportunities, then you probably don’t like this lawsuit,” said Consensys General Counsel Bill Hughes, to CoinDesk in an interview. “Luckily, I think there are only a few that are actually like that. If you would prefer that predatory behavior like this be reduced, which is the vast majority, then you will probably feel the opposite.

“The defendants’ preparation for the attack and their completely clumsy attempts to cover their tracks afterward, including numerous compromising Google searches, only help the government prove that they intended to steal . All of this evidence will look very bad to the jury. I suspect they will plead guilty at some point,” he added.

Still, others remain convinced that exploiting MEV bots designed to rearrange transactions is a good thing. “It’s a little hard to sympathize with MEV bots and block builders getting screwed by block proposers, in exactly the same way they screw end users,” the anonymous researcher said.

Jameson, for his part, said that MEV is something the Ethereum community should work to minimize on Ethereum, but that it is a difficult problem to solve. For now, the process is “inevitable.”

“Until it can be eliminated, let’s study it.” Let’s turn it on. Let’s minimize it. And since that exists, let’s make it as open as possible for everyone to participate with the same rules,” he said.

If there is a silver lining, the Flashbots team was able to correct the error that enabled the attack relatively quickly, said Ari Juels, a professor at Cornell Tech.

“There are no lasting implications,” he added. “There is of course an irony in what happened: a thief is stealing money from sandwich bots, who themselves are exploiting users in the eyes of many in the community.”

Ethereum

Ethereum Price Hits $3,300, Eyes on $4,000 This Week?

The cryptocurrency market has seen a strong price rally over the past weekend. This has helped Ethereum price reclaim the $3,300 mark. Moreover, with the increased bullish sentiment, ETH price is likely to see some positive action this week.

Moreover, with the recent market rally, the Ethereum token market cap has crossed the $400 billion mark and is currently valued at $404.72 billion. In this context, investors are worried about whether Ethereum will reach $5,000 and whether ETH will rise again.

Scroll down because in this article, we have covered the market sentiment, price analysis, and possible short-term price targets of ETH price. To know if the Ethereum token will hit $10,000 in this bull rally, read CoinPedia’s detailed analysis on the Ethereum Price Prediction.

ETH coin price evolution:

Ethereum price started the week on a positive note by adding 5.67% to its portfolio over the past two days. Additionally, the altcoin recorded 5 out of 7 positive days over the past week, highlighting increased buying pressure.

TradingView: ETH/USDT

Additionally, with the continued bullish price action in the crypto space, the ETH Price is about to test its descending channel pattern resistance trendline, the outcome of which is unpredictable.

With a jump of around 5% over the past day, the Ethereum token has regained the $3,300 mark. Moreover, the altcoin leader has surged by 11.76% over the past seven days, indicating an increase in bullish sentiment within the cryptocurrency market.

Ethereum Market Sentiments:

The Relative Strength Index (RSI) has crossed above its midpoint and is heading towards its overbought zone. This indicates a strong bullish reversal in the crypto space. Moreover, the average trendline is showing a positive curve, suggesting that the ETH price will continue to gain value this week.

The MACD indicator is showing a steady rise in the green histogram, highlighting an increase in buying pressure. Moreover, the averages have registered a bullish convergence, indicating a positive outlook for the altcoin leader in the crypto space.

Will ETH Price Hit $4,000 in July?

If Ethereum price breaks out from its channel pattern resistance trendline, the bulls will gear up to test its upper resistance level of $3,700. Sustaining the price at this level will pave the way for the ETH cryptocurrency to head towards its higher high of $4,000 in the coming time.

Conversely, a bearish trend reversal could push Ethereum price towards its July low of $3,000.

Ethereum

Digital assets see record $17.8 billion inflows year-to-date as Bitcoin and Ethereum lead the charge

Digital asset investment products saw back-to-back inflows this month, with $1.44 billion recorded last week, according to CoinShares“Last weekly fund flow report.

The recent inflow brought the year-to-date total to a record $17.8 billion, surpassing the $10.6 billion in inflows in 2021.

However, trading volumes remained low, at around $8.9 billion, compared with a seven-day average of $21 billion.

Bitcoin sees fifth largest inflow.

A flow analysis showed that Bitcoin Last week, Bitcoin recorded its fifth-largest weekly inflows ever, totaling $1.5 billion. Conversely, short-Bitcoin saw its largest weekly outflow since April 2024, amounting to $8.6 million.

This move suggests a shift in market sentiment for the cryptocurrency industry. Bitcoin’s large inflows indicate growing investor confidence in the asset’s potential for substantial growth, with many investors taking advantage of the recent price drop to enter the market.

James Butterfill, Director of Research at CoinShares, said:

“We believe that price weakness due to German government bitcoin sales and a sentiment reversal due to lower-than-expected US CPI prompted investors to add to their positions.”

Crypto Asset Inflows (Source: CoinShares)

In the meantime, EthereumCryptocurrency-linked crypto products attracted $72 million in inflows ahead of the launch of its cash exchange-traded funds (ETFs). This was its largest inflow since March, bringing its year-to-date flows to $57 million.

Nate Geraci, President of ETF Store, predicted The SEC will reportedly approve ETH ETF products for trading this week as the financial regulator “sees no good reason to delay further at this point.”

Additionally, large-cap alternative digital currencies like Solana, Chainlink, Avalanche and XRP has recorded more than $8 million in cumulative admissions.

Regionally, the United States led the way with capital inflows of $1.3 billion last week, reflecting generally positive sentiment. Switzerland set a yearly record with $58 million in inflows, while Hong Kong and Canada recorded $55 million and $24 million, respectively.

Mentioned in this article

Ethereum

Bitcoin, Binance, Ethereum, Solana and Ripple: The biggest crypto news of the past week

2:00 p.m. ▪ 4 min read ▪ by Luc Jose A.

Between groundbreaking announcements, technological advances, and regulatory turbulence, the crypto ecosystem continues to prove that it is both a territory of limitless innovation and a field of regulatory and economic battles. Here is a summary of the most significant news from the past week around Bitcoin, Ethereum, Binance, Solana, and Ripple.

Assassination attempt against Trump: Bitcoin soars

Last Saturday, an assassination attempt against Donald Trump during a rally in Pennsylvania shook the political and financial scene. The shooter, Thomas Matthew Crooks, was neutralized after wounding Trump in the ear. This attack triggered an immediate reaction in crypto markets, with the price of Bitcoin rising 5.5% to $62,450. Donald Trump’s support for the cryptocurrency industry stands in stark contrast to that of his opponent Joe Biden, who has bolstered investor confidence in a potential pro-crypto administration. Bitcoin’s rise has been followed by other cryptocurrencies like Ethereum and Solana, driven by public support from influential figures like Elon Musk.

XRP Takes Another Step Towards Institutional Recognition

Ripple has taken a crucial step in integrating XRP into the institutional market with the announcement by the Chicago Mercantile Exchange (CME) to launch real-time price indices for the crypto. The move, backed by Ripple CEO Brad Garlinghouse, marks a significant step forward for XRP and provides institutional investors with reliable and accurate price references. The launch of these indices by CME, in partnership with CF Benchmarks, includes continuous updates based on the activities of major trading platforms such as Coinbase and Kraken. This could pave the way for future developments such as an XRP-based ETF, further strengthening its position in the traditional financial market.

Bitcoin joins French retirement savings plans

Bitcoin made a notable entry into Retirement Savings Plans (PER) via an innovative partnership between VanEck Europe and Inter Invest. This partnership introduces a Bitcoin ETN, allowing French savers to diversify their portfolios with the leading crypto. This ETN, backed by real bitcoins and held by a regulated custodian, ensures secure and controlled exposure to this emerging asset class. Jean-Baptiste de Pascal, Deputy CEO of Inter Invest, underlines that this initiative is part of a strategy to democratize innovative financial assets. Martijn Rozemuller, CEO of VanEck Europe, adds that while Bitcoin is currently volatile, it represents an innovative asset in the long term. This integration of Bitcoin into the PER opens up new opportunities for savers while modernizing the retirement savings sector in France and meeting the expectations of investors seeking diversification.

USDT surpasses Bitcoin, Ethereum and Solana in trading volume

Tether (USDT) recently reached daily transaction volume exceeding $55 billionoutperforming Bitcoin (BTC), Ethereum (ETH), USD Coin (USDC), and Solana (SOL) combined. This performance underscores the growing role of stablecoins in the crypto ecosystem, especially during periods of high volatility. The increased demand for more stable assets like USDT, coupled with its growing use in trading, is behind this trend. The increased liquidity provided by USDT boosts investor confidence and stabilizes trading. The outlook for USDT and stablecoins, in general, is promising but depends on regulatory developments and market adoption.

That’s the main takeaway from this week. But if you’d like a more detailed summary and in-depth analysis delivered straight to your inbox, feel free to Subscribe to our weekly newsletter.

Optimize your Cointribune experience with our “Read to Earn” program! Earn points for each article read and access exclusive rewards. Sign up now and start earning benefits.

Click here to join “Read to Earn” and turn your passion for crypto into rewards!

Luc José A.

A graduate of Sciences Po Toulouse and holder of a blockchain consultant certification issued by Alyra, I joined the Cointribune adventure in 2019. Convinced of the potential of blockchain to transform many sectors of the economy, I am committed to raising awareness and informing the general public about this constantly evolving ecosystem. My goal is to enable everyone to better understand blockchain and seize the opportunities it offers. Every day, I strive to provide an objective analysis of current events, decipher market trends, relay the latest technological innovations and put into perspective the economic and societal challenges of this ongoing revolution.

DISCLAIMER

The views, thoughts and opinions expressed in this article are solely those of the author and should not be considered investment advice. Do your own research before making any investment decision.

Ethereum

Ethereum hits record high of $3,300 amid ETF hype

A busy week for Ethereum (ETH)The cryptocurrency has surpassed the $3,300 mark, driven by growing anticipation surrounding the Ethereum Spot Exchange Traded Funds Approval Imminent (ETF). According to Cointelegraph, analysts like Nate Geraci are betting big on this development, predicting that the SEC could greenlight eight ETH ETFs by the end of the week.

ETF Approval Imminent

Nate Geraci, known for his insightful analysis on The ETF Store, is optimistic about the chances of launching ETH spot ETFs this week. According to Cointelegraph, Geraci and insiders close to the process believe there are few hurdles left, suggesting that ETF approvals could go smoothly.

The Meteoric Rise of Ethereum

Ethereum’s price surging past $3,300 shows how confident the market is in ETFs. Experts like MV Global’s Tom Dunleavy predict an influx of money from big investors once these ETFs go live. Speaking to Cointelegraph, Dunleavy described Ethereum’s appeal as a tech stock in the crypto world that’s easier for ordinary investors to understand than Bitcoin.

Recent Ethereum Developments

While ETFs are in the spotlight, Ethereum’s core setup is seeing big improvements. According to Cryptoquant, Ethereum developers are talking about projects like Pectra and PeerDAS. These projects aim to make Ethereum faster and more secure, which is crucial to its long-term success.

What future for ETH?

ETH is now trading around $3,357 and climbing, all eyes are on Ethereum’s future. The focus is on two things: how regulators will decide on ETFs and the new technology updates that are underway. Analysts and investors are glued to these details, expecting them to shape Ethereum’s performance in the months to come. Moreover, if these ETH spot ETFs get the green light, it could send Ethereum’s price even higher.

-

News1 year ago

News1 year ago“Captain Tsubasa – RIVALS” launches on Oasys Blockchain

-

Ethereum1 year ago

Ethereum1 year agoComment deux frères auraient dérobé 25 millions de dollars lors d’un braquage d’Ethereum de 12 secondes • The Register

-

News1 year ago

News1 year agoSolana ranks the fastest blockchain in the world, surpassing Ethereum, Polygon ⋆ ZyCrypto

-

Videos1 year ago

Videos1 year agoHistoric steps for US cryptocurrencies! With a shocking majority vote!🚨

-

Videos1 year ago

Videos1 year agoIs Emorya the next gem💎 of this Bitcoin bull run?

-

News1 year ago

News1 year agoSolana Surpasses Ethereum and Polygon as the Fastest Blockchain ⋆ ZyCrypto

-

Videos1 year ago

Videos1 year agoNexus Chain – Ethereum L2 with the GREATEST Potential?

-

Ethereum1 year ago

Ethereum1 year agoScaling Ethereum with L2s damaged its Tokenomics. Is it possible to repair it?

-

News1 year ago

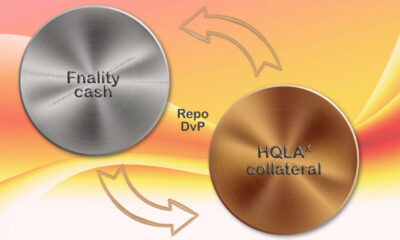

News1 year agoFnality, HQLAᵡ aims to launch blockchain intraday repositories this year – Ledger Insights

-

Regulation1 year ago

Regulation1 year agoFinancial Intelligence Unit imposes ₹18.82 crore fine on cryptocurrency exchange Binance for violating anti-money laundering norms

-

Bitcoin1 year ago

Bitcoin1 year agoBitcoin Drops to $60K, Threatening to Derail Prices of Ether, Solana, XRP, Dogecoin, and Shiba Inu ⋆ ZyCrypto

-

Videos1 year ago

Videos1 year agoRaoul Pal’s Crypto Predictions AFTER Bitcoin Halving in 2024 (The NEXT Solana)