News

US passes crypto bill as crypto led 2023 blockchain M&A activity

SEC Chair Gary Gensler criticised the FIT21’s possible regulatory gaps. Credit: diamond.Studio/shutterstock

The US House of Representatives passed a landmark bill on Wednesday (22 May) to regulate cryptocurrency in the country, as centralised crypto topped blockchain M&A activity in 2023.

The Financial Innovation and Technology for the 21st Century Act (FIT21) was passed by a 279-136 vote and will now be passed to the US Senate to enact.

The bill is intended to support the US crypto industry by providing legal clarity and protection for cryptocurrency users.

According to Republican Rep. Patrick McHenry, the bill will end the “food fight for control” of crypto between the Securities and Exchange Commission (SEC) and the Commodity Futures Trading Commission.

SEC Chair Gary Gensler has criticised the bill for creating regulatory gaps.

“[FIT21] would create new regulatory gaps and undermine decades of precedent regarding the oversight of investment contracts, putting investors and capital markets at immeasurable risk,” stated Gensler.

Access the most comprehensive Company Profiles

on the market, powered by GlobalData. Save hours of research. Gain competitive edge.

Company Profile – free

sample

Thank you!

Your download email will arrive shortly

We are confident about the

unique

quality of our Company Profiles. However, we want you to make the most

beneficial

decision for your business, so we offer a free sample that you can download by

submitting the below form

By GlobalData

Country *

UK

USA

Afghanistan

Åland Islands

Albania

Algeria

American Samoa

Andorra

Angola

Anguilla

Antarctica

Antigua and Barbuda

Argentina

Armenia

Aruba

Australia

Austria

Azerbaijan

Bahamas

Bahrain

Bangladesh

Barbados

Belarus

Belgium

Belize

Benin

Bermuda

Bhutan

Bolivia

Bonaire, Sint

Eustatius

and

Saba

Bosnia and Herzegovina

Botswana

Bouvet Island

Brazil

British Indian Ocean

Territory

Brunei Darussalam

Bulgaria

Burkina Faso

Burundi

Cambodia

Cameroon

Canada

Cape Verde

Cayman Islands

Central African Republic

Chad

Chile

China

Christmas Island

Cocos Islands

Colombia

Comoros

Congo

Democratic Republic

of

the Congo

Cook Islands

Costa Rica

Côte d”Ivoire

Croatia

Cuba

Curaçao

Cyprus

Czech Republic

Denmark

Djibouti

Dominica

Dominican Republic

Ecuador

Egypt

El Salvador

Equatorial Guinea

Eritrea

Estonia

Ethiopia

Falkland Islands

Faroe Islands

Fiji

Finland

France

French Guiana

French Polynesia

French Southern

Territories

Gabon

Gambia

Georgia

Germany

Ghana

Gibraltar

Greece

Greenland

Grenada

Guadeloupe

Guam

Guatemala

Guernsey

Guinea

Guinea-Bissau

Guyana

Haiti

Heard Island and

McDonald

Islands

Holy See

Honduras

Hong Kong

Hungary

Iceland

India

Indonesia

Iran

Iraq

Ireland

Isle of Man

Israel

Italy

Jamaica

Japan

Jersey

Jordan

Kazakhstan

Kenya

Kiribati

North Korea

South Korea

Kuwait

Kyrgyzstan

Lao

Latvia

Lebanon

Lesotho

Liberia

Libyan Arab Jamahiriya

Liechtenstein

Lithuania

Luxembourg

Macao

Macedonia,

The

Former

Yugoslav Republic of

Madagascar

Malawi

Malaysia

Maldives

Mali

Malta

Marshall Islands

Martinique

Mauritania

Mauritius

Mayotte

Mexico

Micronesia

Moldova

Monaco

Mongolia

Montenegro

Montserrat

Morocco

Mozambique

Myanmar

Namibia

Nauru

Nepal

Netherlands

New Caledonia

New Zealand

Nicaragua

Niger

Nigeria

Niue

Norfolk Island

Northern Mariana Islands

Norway

Oman

Pakistan

Palau

Palestinian Territory

Panama

Papua New Guinea

Paraguay

Peru

Philippines

Pitcairn

Poland

Portugal

Puerto Rico

Qatar

Réunion

Romania

Russian Federation

Rwanda

Saint

Helena,

Ascension and Tristan da Cunha

Saint Kitts and Nevis

Saint Lucia

Saint Pierre and Miquelon

Saint Vincent and

The

Grenadines

Samoa

San Marino

Sao Tome and Principe

Saudi Arabia

Senegal

Serbia

Seychelles

Sierra Leone

Singapore

Slovakia

Slovenia

Solomon Islands

Somalia

South Africa

South

Georgia

and The South

Sandwich Islands

Spain

Sri Lanka

Sudan

Suriname

Svalbard and Jan Mayen

Swaziland

Sweden

Switzerland

Syrian Arab Republic

Taiwan

Tajikistan

Tanzania

Thailand

Timor-Leste

Togo

Tokelau

Tonga

Trinidad and Tobago

Tunisia

Turkey

Turkmenistan

Turks and Caicos Islands

Tuvalu

Uganda

Ukraine

United Arab Emirates

US Minor Outlying Islands

Uruguay

Uzbekistan

Vanuatu

Venezuela

Vietnam

British Virgin Islands

US Virgin Islands

Wallis and Futuna

Western Sahara

Yemen

Zambia

Zimbabwe

Kosovo

Industry *

Academia & Education

Aerospace, Defense &

Security

Agriculture

Asset Management

Automotive

Banking & Payments

Chemicals

Construction

Consumer

Foodservice

Government, trade bodies

and NGOs

Health & Fitness

Hospitals & Healthcare

HR, Staffing &

Recruitment

Insurance

Investment Banking

Legal Services

Management Consulting

Marketing & Advertising

Media & Publishing

Medical Devices

Mining

Oil & Gas

Packaging

Pharmaceuticals

Power & Utilities

Private Equity

Real Estate

Retail

Sport

Technology

Telecom

Transportation &

Logistics

Travel, Tourism &

Hospitality

Venture Capital

Tick here to opt out of curated industry news, reports, and event updates from Verdict.

Submit and

download

Visit our Privacy Policy for more information about our services, how we may use, process and share your personal data, including information of your rights in respect of your personal data and how you can unsubscribe from future marketing communications. Our services are intended for corporate subscribers and you warrant that the email address submitted is your corporate email address.

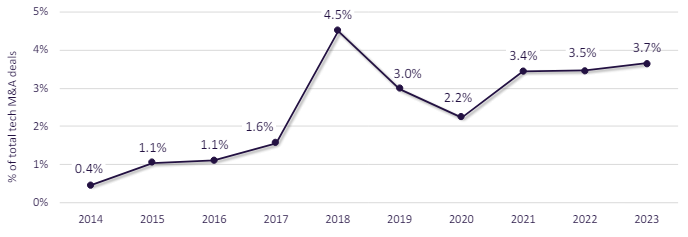

In its 2024 thematic intelligence report into blockchain technology, research and analysis company GlobalData recorded that blockchain was seeing an increase in the number of tech M&A deals related to the technology.

By 2023, around 3.7% of all technology M&A deals were related to blockchain technology, up from just 2.2% in 2020.

GlobalData reported that the primary targets of these deals were blockchain development platforms, mining and node infrastructure players, and crypto exchanges and trading platforms.

Large, centralised cryptocurrency exchange platforms such as Coinbase and Kraken led this M&A activity.

Between 2014 and 2023, the majority of these deals were based in the US. Around 35% of all blockchain M&A deals were conducted by US companies.