Bitcoin

Portfolio Recovery Firms Shake Up as Locked-In Crypto Investors Panic Over Bitcoin Boom

By Ankika Biswas and Johann M Cherian

(Reuters) – The recent surge in bitcoin prices has left crypto wallet recovery companies’ phones off the hook as retail investors locked out of their digital vaults make frantic calls to regain access to their accounts.

Cryptocurrencies exist on a decentralized digital ledger known as a blockchain, and investors can choose to access their assets through a locally stored software wallet or a hardware wallet to avoid risks associated with holding cryptocurrencies on an exchange, such as in the case of the old FTX.

Losing access to a crypto wallet is a well-known problem. Investors forgetting their complex passwords are the main reason, but loss of access to two-factor authentication devices, unexpected cryptocurrency exchange closures, and cyberattacks are also common.

Wallet passwords are usually alphanumeric and the wallet provider also offers a set of random words, known as “seed phrases”, for additional security – both of which are known only to the user. If investors lose passwords and phrases, access to their wallets will be cut off.

With bitcoin prices regaining strength since last October and reaching a record high of $73,803.25 in March, investors appear to be suffering from a classic case of FOMO, or fear of missing out.

Reuters spoke to nearly a dozen retail investors who lost access to their crypto wallets. Six of them contacted a recovery services company and were able to regain access to their assets.

“What would be driving this trend is the fact that bitcoin prices are at $60,000 and not $30,000…it’s just pure economics,” said Steve Sosnick, chief strategist at Interactive Brokers.

“People who are losing their cryptocurrencies for one reason or another, or those who do not have access to their cryptocurrencies, are highly encouraged to get them back.”

The world’s largest cryptocurrency has risen 161% over the past two quarters on hopes of an interest rate cut from the US Federal Reserve and optimism surrounding the launch of spot bitcoin exchange-traded funds (ETFs).

BOOM IN RECOVERY ORDERS

A Switzerland-based company that uses Nvidia graphics processing unit cards to run artificial intelligence models to access idle wallets saw requests increase tenfold in the first quarter compared to the same period a year ago.

“We have seen an increase (in requests to unlock wallets) whenever the price changes drastically,” said a senior company executive who declined to be named.

ReWallet, a Germany-based provider of wallet recovery services, saw a 334% jump in requests in the previous quarter and saw a record number of requests in early March when bitcoin prices reached an all-time high.

The story continues

The company estimates that about 20% of the total 19 million bitcoins in circulation as of March 13 are likely inactive and are now worth about $237 billion.

US-based wallet recovery services saw a 30% increase in requests this year in mid-April.

Recovery services provided by companies are not cheap. ReWallet and WRS charge a 20% fee on the contents of the wallets, with the caveat that they will only be paid at the time of recovery.

ATTEMPTS TO RECOVER INVESTOR PORTFOLIO

“I was simply worried that I would no longer have access (to my wallet) and thus lose my bitcoins forever,” said an investor living in Germany, who declined to be named. “Of course, the high price of bitcoin was an incentive to finally resolve this.”

Another Swiss-based investor, who also requested anonymity, said: “I had protected the wallet with passwords and couldn’t remember it. I tried several times and created several lists with possible alternatives, but unfortunately without success.”

Recounting ReWallet’s recovery of his bitcoin holdings, now worth more than $300,000, he said: “It was an indescribably great feeling. I’m retiring in a year and a half and now feel financially well-positioned.”

Speaking about investors’ difficulties, Ralf Wintergerst, chief executive of German security technology company Giesecke+Devrient, said: “Looking ahead, there is a growing trend towards solutions that mitigate the main management problem inherent in self-custody.” “This could entail the use of multi-signature wallets or other decentralized recovery mechanisms to distribute liability and increase security.”

(Reporting by Ankika Biswas and Johann M Cherian in Bengaluru; Editing by Pooja Desai)

Bitcoin

Bitcoin Will Surge to $100K After Q4, Here’s Why

Dan Weiskopf, portfolio manager at Tidal Financial Group, spoke with David Lin and discussed the future prospects of Bitcoin. The focus was on the future of Bitcoin, especially its potential to reach $100,000. The talk also touched on recent market trends, noting strong interest in Bitcoin ETFs as a possible boost to its price. Looking ahead, there is hope that more platforms will approve Bitcoin ETFs, possibly pushing its price to $100,000.

Forecasts and Volatility: The Path to New Highs

While some predict Bitcoin could go as high as $150,000 or even $1 million, Dan agrees that it needs to hit $100,000 first. Dan also acknowledged Bitcoin’s volatility, saying that large price drops of as much as 50% to 70% could happen, drawing on his experience since 2017.

“We’re going to new highs because I think partly because ETF inflows have been really strong lately. Yeah, and then I think you’ll have more platforms approving spot Bitcoin ETFs in Q4, and we’re going to go up to 100K,” he said.

Big Investors and the Transformative Power of Bitcoin

He also discussed what is persuading large investors to get in on this cycle. He mentioned two key factors. Many argue that if you haven’t invested in Bitcoin, you’re missing out, citing its strong performance over the past decade. This pressure could influence returns and client expectations.

However, he emphasized a deeper reason: if you are not embracing the transformation driven by Bitcoin and digital assets, you may face challenges. This technology has the potential to reshape industries, just as the internet revolutionized business.

“A lot of people look at Bitcoin and crypto and don’t appreciate that with higher prices comes more supply. We talk about 100K, I would expect more supply to come into the market as we go up, and that’s not really new news, but it’s higher demand that’s offsetting that supply,” he added.

Read too: It’s time tor ETH Point ETF: Here’s What to Expect From the Ethereum Price Rally

Bitcoin

Bitcoin Jumps as Markets See Increased Chances of Trump Victory

CFOTO | Future Publishing | Getty Images

Bitcoin hit a two-week high on Monday as betting markets suggested a higher chance of crypto-friendly candidate Donald Trump winning the US presidential election.

The value of the world’s largest cryptocurrency, bitcoin, was up about 5% as of 1:40 p.m. London time to $62,781.48, according to CoinGecko.

The rally follow the dramatic and failed assassination attempt about the former president Trump on Saturday.

“There is a ‘parallel’ to the assassination of President Reagan in 1981,” even though it was not an election year, Ben Emons, chief investment officer at FedWatch Advisors, said in an emailed note.

“After the incident, Reagan’s popularity skyrocketed amid a double-dip recession. The S&P 500, however, fell 9% in the aftermath due to the economic malaise. But in the current strong economy, former President Trump’s favorability is likely to skyrocket and impact markets positively.”

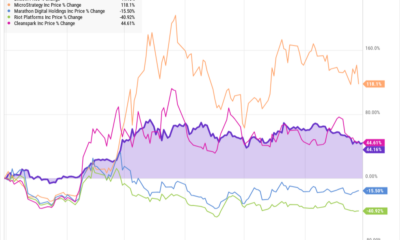

Investors said on the weekend they were hoping that so-called “Trump victory trades” would get a boost. These trades broadened to include several cryptocurrency stocks, such as Coinbase Global and miner Riot platformswhich rose 4.5% and 5.25%, respectively, in pre-market trading.

“Bitcoin’s price rose about 9% over the weekend, which could indicate that investors are hoping that a Trump presidency will create a more favorable regulatory climate for the crypto industry,” Zach Pandl, head of research at Grayscale Investments, told CNBC in an email.

Trump has yet to lay out any detailed proposals on cryptocurrency regulation, but the Republican candidate is now seen as broadly supportive of the sector — despite his past skepticism. He is set to speak at a major annual bitcoin conference later this month.

Trump’s campaign started accepting donations of the cryptocurrency industry in May and its the message became increasingly positive about the future of these digital assets. He also sought to position oneself against Democrats who are in favor of controlling the industry, such as Senator Elizabeth Warren.

“In addition, macro policy changes under a second Trump presidency — including continued deficit spending, reduced U.S. leadership in international affairs, weaker Federal Reserve independence, and a desire for currency weakness to help reduce the trade deficit, among other things — could introduce downside risks to the U.S. dollar in the medium term. Any downside risks to the U.S. dollar could provide support for Bitcoin’s price,” Pandl added.

Last month, analysts at Standard Chartered said that the US presidential election is the next key catalyst for bitcoin’s price and a Trump victory could push it to $150,000 by the end of the year.

“Cryptocurrencies have not had an easy time in recent months. We are currently in a crisis of previously growing capital inflows into this market that can be measured by the capitalization of stablecoins, which has frozen in the last two months,” Grzegorz Drozdz, market analyst at Conotoxia, told CNBC in an email.

With a higher likelihood of a Trump presidency and the consequent reduced chances of unrest and destabilization in the US, Drozdz now sees a potential “influx of confidence into the markets,” which could positively impact cryptocurrencies and bitcoin in the coming weeks.

Bitcoin

Germany Sells Final Bitcoin Reserves of Initial $3 Billion in Holdings

Germany Sells Final Bitcoin Reserves of Initial $3 Billion in Holdings

The German government completed the sale of its remaining Bitcoin holdings on July 12. The final transaction involved 3,846 Bitcoin, valued at around $62,604 per Bitcoin, which were sent to “Flow Traders and 139Po,” entities likely for institutional/OTC deposit services, according to for Arkham Intelligence.

The majority of the 50,000 Bitcoins sold by the German government over the past three weeks originated from asset seizures. This sale marked the culmination of weeks of increased sales activity by the German government, which unloaded tens of thousands of Bitcoins in multiple tranches. This significant liquidation was a key factor in keeping the Bitcoin selloff at a low of $54,000 on July 5.

Despite Germany’s exit from its Bitcoin holdings, market pressures remain due to Mt. Gox’s impending $9 billion repayment plan. The Mt. Gox exchange, which collapsed in 2014 when Bitcoin was still in the hundreds of dollars, has long been a source of market anxiety. The repayment plan aims to compensate creditors, potentially adding significant selling pressure to the market in the coming weeks. However, it is difficult to estimate the impact of Mt. Gox’s repayment on the markets due to several factors.

Amid heightened selling pressure, institutional investors seized the opportunity to buy the dip. Data from CoinShares showed that U.S. exchange-traded funds (ETFs) saw $295 million in inflows during the week of July 8, reversing a trend of suppressed inflows into these investment funds. This activity suggests that institutional investors remain confident in Bitcoin’s long-term prospects.

Bitcoin

Bitcoin surges as traders bet on Donald Trump election victory after shooting

Unlock the US Election Countdown newsletter for free

The stories that matter about money and politics in the race for the White House

Bitcoin surged on Monday following an assassination attempt on Donald Trump, as investors increased their bets on the former president winning the US presidential election in November.

Bitcoin’s price rose as much as 9.1 percent to $62,830, its highest level in two weeks, after a shooter hit Trump in the ear at a campaign rally over the weekend. The Republican is seen as the most pro-crypto candidate, having hosted industry executives at Mar-a-Lago and expressed enthusiasm for bitcoin mining in the U.S.

Trump’s campaign also accepted cryptocurrency payments, a first for a major U.S. political party, raising hopes of an end to the U.S. regulatory crackdown on the sector seen in recent years.

“The probability of a Donald Trump victory has increased significantly,” said Grzegorz Dróżdż, market analyst at exchange firm Conotoxia, adding that a Trump presidency would have a “positive impact” on cryptocurrencies.

Shares of Trump’s Truth social media company jumped 60 percent in premarket trading. Trump Media & Technology Group went public in March in a merger with a blank-check company and rallied ahead of the debate between Trump and President Joe Biden last month.

The slimmer chances of a second Trump presidency were also felt in broader financial markets. U.S. Treasury yields and the dollar rose in a more muted version of the reaction that followed Biden’s disastrous debate performance.

Many investors believe Trump’s tax-cutting policies would increase deficits and inflation, hurting U.S. Treasuries and boosting the dollar, in a pattern similar to what occurred after his 2016 election victory.

The U.S. dollar index, which tracks the greenback against a basket of six other major currencies, rose 0.2% in morning trade, having weakened so far in July as investors increased their bets on a September interest rate cut by the Federal Reserve.

Yields on benchmark 10-year Treasuries rose 0.03 percentage point to 4.21 percent, reflecting a small decline in price. Contracts tracking Wall Street’s blue-chip S&P 500 and the tech-heavy Nasdaq 100 rose 0.3 percent and 0.5 percent ahead of the New York open.

Monday’s movements “touch[s] with a Trumpian theme given the popular narrative that he is good for business and… his pro-crypto stance,” Rabobank analysts said in a note to clients.

“For markets, the complexities of the US political landscape have boiled down to the assumption that the weekend’s events will lead to a greater chance of Trump winning the November presidential election,” they added.

Bitcoin peaked above $70,000 in mid-March but has struggled to make headway since the so-called halving event in April, when the number of daily bitcoins available for miners to share to secure the bitcoin network fell from 900 to 450. Some analysts had expected bitcoin to rebound after the halving.

-

News1 year ago

News1 year ago“Captain Tsubasa – RIVALS” launches on Oasys Blockchain

-

Ethereum1 year ago

Ethereum1 year agoComment deux frères auraient dérobé 25 millions de dollars lors d’un braquage d’Ethereum de 12 secondes • The Register

-

News1 year ago

News1 year agoSolana ranks the fastest blockchain in the world, surpassing Ethereum, Polygon ⋆ ZyCrypto

-

Videos1 year ago

Videos1 year agoHistoric steps for US cryptocurrencies! With a shocking majority vote!🚨

-

Videos1 year ago

Videos1 year agoIs Emorya the next gem💎 of this Bitcoin bull run?

-

News1 year ago

News1 year agoSolana Surpasses Ethereum and Polygon as the Fastest Blockchain ⋆ ZyCrypto

-

Videos1 year ago

Videos1 year agoNexus Chain – Ethereum L2 with the GREATEST Potential?

-

Ethereum1 year ago

Ethereum1 year agoScaling Ethereum with L2s damaged its Tokenomics. Is it possible to repair it?

-

News1 year ago

News1 year agoFnality, HQLAᵡ aims to launch blockchain intraday repositories this year – Ledger Insights

-

Regulation1 year ago

Regulation1 year agoFinancial Intelligence Unit imposes ₹18.82 crore fine on cryptocurrency exchange Binance for violating anti-money laundering norms

-

Bitcoin1 year ago

Bitcoin1 year agoBitcoin Drops to $60K, Threatening to Derail Prices of Ether, Solana, XRP, Dogecoin, and Shiba Inu ⋆ ZyCrypto

-

Videos1 year ago

Videos1 year agoRaoul Pal’s Crypto Predictions AFTER Bitcoin Halving in 2024 (The NEXT Solana)