News

La blockchain pubblica porta benefici alle industrie regolamentate

I settori regolamentati, tra cui sanità e servizi finanziari, devono rispettare numerosi requisiti, come know your customer (KYC), antiriciclaggio (AML) e normative sulla privacy dei dati. Per molti versi, la blockchain è la risposta alle liste dei desideri di questi settori. La blockchain consente robuste KYC e AML verificando le identità in tempo reale e fornendo un registro immutabile di dati e transazioni per il rilevamento di reati finanziari. Facilita inoltre la sicurezza Condivisione dei dati tra parti autorizzate tramite crittografia e controlli di accesso. Infine, gli smart contract su blockchain possono far rispettare le regole automaticamente, favorendo la conformità e riducendo l’errore umano.

Una domanda che si pone alle imprese regolamentate, tuttavia, è se sia preferibile una blockchain pubblica o privata per queste istituzioni. In effetti, l’opinione passata ha talvolta consigliato una blockchain privata e autorizzata per tali casi d’uso per garantire la massima privacy e protezione dei dati, tuttavia le catene private presentano una serie di sfide che possono vanificare i loro vantaggi. Ci sono sostenitori da entrambe le parti, ma le recenti innovazioni sulla blockchain pubblica, che offrono tutte le funzionalità di sicurezza delle catene private più i numerosi vantaggi delle catene pubbliche, potrebbero presto rendere questa domanda obsoleta.

I settori regolamentati offrono un terreno fertile per la blockchain

La tecnologia blockchain offre numerosi potenziali vantaggi per soddisfare le esigenze specifiche dei settori regolamentati, tra cui finanza, assistenza sanitaria, verifica dell’identità e gestione della supply chain, per citarne alcuni.

$19,7 miliardi Valore stimato del mercato della tecnologia blockchain in 2024

$943 miliardi Valore stimato del mercato della tecnologia blockchain in 2032

30%

La tecnologia Blockchain offre soluzioni eleganti alle sfide che devono affrontare i settori regolamentati.

Settori regolamentati presentano sfide speciali che la blockchain è idealmente attrezzata per gestire. In generale, esistono normative per offrire protezione ai partecipanti del settore, in genere in merito ai dati o al movimento di denaro. La trasparenza e la tracciabilità della blockchain hanno la capacità di aumentare la fiducia e la sicurezza, aumentando al contempo la velocità e l’efficienza delle operazioni.

Ad esempio, nell’assistenza sanitaria, la tecnologia di registro distribuito della blockchain può essere sfruttata per semplificare la centralizzazione delle cartelle cliniche dei pazienti, garantendo al contempo che solo le parti autorizzate abbiano accesso ai loro dati riservati. La blockchain offre inoltre ai servizi finanziari maggiore velocità e sicurezza delle transazioni, nonché l’eliminazione di costosi intermediari, come nel caso di pagamenti transfrontalieriLa tecnologia facilita transazioni più rapide ed efficienti rispetto ai metodi bancari tradizionali e la sua programmabilità tramite contratti intelligenti consente transazioni automatizzate e conformità normativa.

La blockchain sta diventando un elemento costante nella finanza.

Con l’espansione dell’economia digitale, la necessità di una forma di denaro digitale stabile, efficiente e sicura sta diventando sempre più evidente. Entrambi monete stabili E depositare token — rappresentazioni digitali di depositi bancari tradizionali emessi da istituzioni finanziarie regolamentate — stanno guadagnando consensi per questo scopo. A differenza delle criptovalute come Bitcoin o Ethereum, che sono spesso soggette a volatilità, sia le stablecoin che i token di deposito sono supportati da valuta fiat, il che li rende stabili come il denaro tradizionale o i depositi bancari. Alcune delle più grandi banche ritengono che gli asset tokenizzati siano cruciali per il futuro del panorama globale della moneta digitale.

Casi d’uso della blockchain per i settori regolamentati

Protezione dei dati sanitari:

La tecnologia blockchain può facilitare la condivisione sicura dei dati sanitari tra pazienti e fornitori, preservando al contempo la privacy e l’integrità dei dati.

Verifica dell’identità:

La tecnologia blockchain può offrire una verifica dell’identità decentralizzata, consentendo agli individui di condividere in modo sicuro le proprie informazioni personali senza dover ricorrere a provider di identità.

Contratti intelligenti:

I contratti autoeseguibili, o contratti intelligenti, possono far rispettare automaticamente i termini contrattuali, evitando la necessità di un’autorità centrale e determinando una riduzione dei costi e una maggiore efficienza.

Gestione della catena di approvvigionamento:

La blockchain può essere utilizzata per tracciare e verificare i beni mentre si spostano attraverso le diverse fasi di una supply chain. Ciò porta a una maggiore trasparenza, a una minore incidenza di frodi e a un approvvigionamento più etico.

Blockchain pubblica vs. privata per le industrie regolamentate

In passato, i preconcetti favorivano la blockchain privata rispetto a quella pubblica per i settori regolamentati, a causa dei severi requisiti sulla privacy dei dati, ma la blockchain privata presenta degli svantaggi che possono renderla insostenibile, oltre che meno sicura delle catene pubbliche.

Fonte: The Value Exchange. Risultati principali dell’indagine DLT nel mondo reale. 2024. https://www.broadridge.com/article/capital-markets/dlt-in-the-real-world-2024Ultimo accesso luglio 2024.

I vantaggi della blockchain privata per i settori normativi sono oggetto di dibattito.

La domanda inevitabile che si pone più frequentemente alle imprese regolamentate che stanno valutando l’ingresso nella blockchain è se le catene pubbliche o private siano più adatte ai loro scopi.

Blockchain private sono reti autorizzate in cui l’accesso è limitato ai partecipanti a cui è stato concesso il permesso di unirsi, con il processo di consenso generalmente controllato da una singola organizzazione o consorzio. Poiché il pubblico in generale non ha accesso al codice che abilita la rete, i sostenitori sostengono che blockchain privata è il candidato migliore per facilitare le transazioni aziendali regolamentate. In effetti, la pressione normativa ha portato a quasi due terzi delle ecosistema blockchain aziendale costituito da blockchain private. Tuttavia, ciò che questi argomenti non considerano è che la blockchain pubblica è in realtà molto sicura, e ci sono svantaggi all’utilizzo di catene private che possono renderle insostenibili o addirittura inutilizzabili.

La blockchain privata presenta degli svantaggi fondamentali rispetto alla blockchain pubblica.

Alcuni dei svantaggi della blockchain privata per le imprese includono quanto segue:

Costo alto: Stabilire e mantenere una rete blockchain privata può essere estremamente costoso, richiedendo un elevato numero di risorse relative a infrastruttura, sviluppo e costi operativi continui. In effetti, alcune fonti sostengono che le blockchain private sono, in sostanza, “database ingombranti,” con i costi dei server, del personale e dell’infrastruttura di rete che ricadono tutti sulla responsabilità dell’entità controllante. Questi costi spesso rendono le reti blockchain private impraticabili o insostenibili nel tempo, non solo per le aziende di medie e piccole dimensioni, ma anche per le principali aziende globali come IBM.

Difficoltà di scalabilità e interoperabilità: Le blockchain private possono incontrare problemi di scalabilità man mano che aumentano in dimensioni e complessità, soprattutto se la tecnologia sottostante non riesce a gestire adeguatamente un grande volume di informazioni. Una fonte nota che la blockchain privata è sostanzialmente Più lentamente e meno scalabile della blockchain pubblica. Inoltre, poiché le catene private sono generalmente costruite su tecnologie proprietariel’interoperabilità tra numerose istituzioni è spesso impossibile da realizzare, con costi che la rendono impraticabile per la maggior parte dei proprietari privati.

Problemi di sicurezza: La sicurezza di una blockchain privata dipende in larga misura dal meccanismo di consenso scelto e dall’affidabilità dei partecipanti. Un partecipante malintenzionato o compromesso potrebbe corrompere l’intera rete. Ironicamente, alcuni sostengono persino che la natura esclusiva delle blockchain private può renderle più vulnerabile ai cattivi attori rispetto alle reti pubbliche. Analogamente, la mancanza di trasparenza delle blockchain private attraverso la restrizione ai partecipanti autorizzati può, nel peggiore dei casi, aumentare il potenziale di manipolazione dei dati.

Blockchain pubblica: nuove funzionalità per i settori regolamentati

La blockchain pubblica è veloce, poco costosa e, in ultima analisi, molto sicura. Inoltre, le estensioni token innovative stanno portando tutti i vantaggi delle reti private e autorizzate alla blockchain pubblica.

I vantaggi della blockchain pubblica includono gli stessi vantaggi della blockchain privata e molto altro ancora.

Le blockchain pubbliche sono costituite da reti decentralizzate che consentono a chiunque di partecipare, visualizzare la cronologia delle transazioni e verificare l’integrità dei dati tramite un meccanismo di consenso, come la “prova di lavoro” su Bitcoin o la “prova di partecipazione” su reti come Ethereum o Solana. I proponenti della blockchain pubblica aggiunge anche che, contrariamente al suo nome, è molto privata. Infatti, nella sua forma originale ideazione e progettazionela sicurezza intrinseca della blockchain deriva dall’anonimato delle parti coinvolte in una determinata transazione. Il record immutabile e permanente delle transazioni della blockchain garantisce questa sicurezza e, poiché questo record viene rapidamente convalidato da più data center indipendenti in tutto il mondo, il consenso è rapido, escludendo quasi completamente la manomissione dei dati. Inoltre, la crittografia integrata e altre forme di offuscamento migliorano ulteriormente il principio di sicurezza innato della blockchain pubblica.

Su Solana, le estensioni dei token stanno aprendo nuovi casi d’uso sulla blockchain pubblica.

Inoltre, le innovazioni nella blockchain pubblica stanno rendendo irrilevante lo stesso dibattito pubblico contro privato. Estensioni tokenun nuovo programma di emissione di token, ad esempio, è un’innovazione chiavi in mano sulla blockchain pubblica di Solana che può applicare controlli di sicurezza alla rete simili a quelli delle blockchain private autorizzate. Alcune delle funzionalità abilitate da queste “estensioni” includono trasferimenti riservati, reversibilità e la possibilità di inserire account in whitelist o blacklist a livello globale. Poiché queste funzionalità sono integrate nel token stesso, non c’è bisogno di smart contract di terze parti per abilitare questo tipo di funzionalità. Questa innovazione sta attualmente rendendo possibili nuovi casi d’uso sulla blockchain pubblica per le imprese regolamentate, come l’emissione di stablecoin per i pagamenti e la tokenizzazione di beni del mondo realecomprese azioni, obbligazioni, immobiliarematerie prime e persino opere d’arte. La tokenizzazione di questi asset consente una maggiore liquidità e una proprietà frazionata, rendendo questi investimenti più accessibili a coloro che altrimenti non potrebbero prendere parte a queste opportunità.

Si sta verificando un “cambiamento di slancio” tra le aziende verso l’adozione della blockchain pubblica.

Un rapporto di HFS Horizons ha notato un recente “cambiamento di slancio come attenzione all’impresa virato verso blockchain pubbliche”, con l’innovazione in corso che guida un’ulteriore crescita nella loro adozione da parte delle imprese regolamentate. I ricercatori hanno notato che mentre le imprese altamente regolamentate hanno spesso segnalato di scegliere blockchain private a causa della pressione normativa, le aziende stanno diventando sempre più a loro agio con blockchain pubbliche poiché l’innovazione sblocca nuovi livelli di privacy. Il rapporto conclude che le imprese si rivolgeranno sempre di più a blockchain pubbliche per raggiungere la scalabilità negli anni a venire.

Soluzioni blockchain pubbliche sicure e stabili per i settori regolamentati

Innovazioni come le estensioni token della rete Solana sono indicative di un cambiamento di paradigma nel modo in cui gli asset vengono sviluppati, gestiti e scambiati. Rafforzando le misure di sicurezza, garantendo la conformità normativa e incoraggiando la tokenizzazione degli asset del mondo reale, questa innovazione potrebbe consentire alla blockchain di rivoluzionare una serie di settori regolamentati.

Poiché l’integrazione della blockchain continua a colmare il divario tra gli ecosistemi finanziari tradizionali e quelli decentralizzati, questa tecnologia può contribuire ad aprire la strada a un’economia globale più efficiente, basata su trasparenza, sicurezza e inclusione finanziaria.

Diversi fattori hanno contribuito a Solana che viene scelto per la [PayPal USD (PYUSD)] espansione, tra cui la comprovata convenienza economica e l’elevata produttività. Tuttavia, la ragione più sfumata per la scelta di Solana è legata alle caratteristiche uniche che abilita per PYUSD. PYUSD è abilitato dalle estensioni token Solana, che portano le familiari caratteristiche FinTech ai pagamenti stablecoin. Queste caratteristiche non sono semplicemente optional. Riteniamo che siano caratteristiche importanti da fornire ai commercianti se PYUSD deve crescere nella sua utilità per segmenti commerciali più ampi.”

Fonte: PayPal USD. PYUSD viene lanciato su Solana: la prossima fase di adozione. 29 maggio 2024. https://pyusd.mirror.xyz/TpEwPNybrwzPSSQenLtO4kggy98KH4oQRc06ggVnA0kUltimo accesso luglio 2024.

News

An enhanced consensus algorithm for blockchain

The introduction of the link and reputation evaluation concepts aims to improve the stability and security of the consensus mechanism, decrease the likelihood of malicious nodes joining the consensus, and increase the reliability of the selected consensus nodes.

The link model structure based on joint action

Through the LINK between nodes, all the LINK nodes engage in consistent activities during the operation of the consensus mechanism. The reputation evaluation mechanism evaluates the trustworthiness of nodes based on their historical activity status throughout the entire blockchain. The essence of LINK is to drive inactive nodes to participate in system activities through active nodes. During the stage of selecting leader nodes, nodes are selected through self-recommendation, and the reputation evaluation of candidate nodes and their LINK nodes must be qualified. The top 5 nodes of the total nodes are elected as leader nodes through voting, and the nodes in their LINK status are candidate nodes. In the event that the leader node goes down, the responsibility of the leader node is transferred to the nodes in its LINK through the view-change. The LINK connection algorithm used in this study is shown in Table 2, where LINKm is the linked group and LINKP is the percentage of linked nodes.

Table 2 LINK connection algorithm.

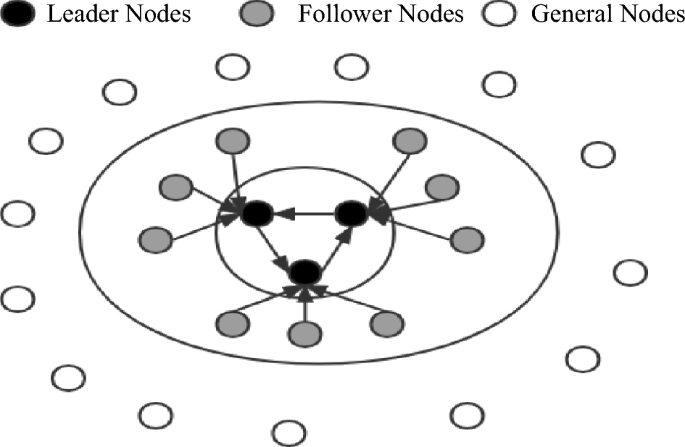

Node type

This paper presents a classification of nodes in a blockchain system based on their functionalities. The nodes are divided into three categories: leader nodes (LNs), follower nodes (FNs), and general nodes (Ns). The leader nodes (LNs) are responsible for producing blocks and are elected through voting by general nodes. The follower nodes (FNs) are nodes that are linked to leader nodes (LNs) through the LINK mechanism and are responsible for validating blocks. General nodes (N) have the ability to broadcast and disseminate information, participate in elections, and vote. The primary purpose of the LINK mechanism is to act in combination. When nodes are in the LINK, there is a distinction between the master and slave nodes, and there is a limit to the number of nodes in the LINK group (NP = {n1, nf1, nf2 ……,nfn}). As the largest proportion of nodes in the system, general nodes (N) have the right to vote and be elected. In contrast, leader nodes (LNs) and follower nodes (FNs) do not possess this right. This rule reduces the likelihood of a single node dominating the block. When the system needs to change its fundamental settings due to an increase in the number of nodes or transaction volume, a specific number of current leader nodes and candidate nodes need to vote for a reset. Subsequently, general nodes need to vote to confirm this. When both confirmations are successful, the new basic settings are used in the next cycle of the system process. This dual confirmation setting ensures the fairness of the blockchain to a considerable extent. It also ensures that the majority holds the ultimate decision-making power, thereby avoiding the phenomenon of a small number of nodes completely controlling the system.

After the completion of a governance cycle, the blockchain network will conduct a fresh election for the leader and follower nodes. As only general nodes possess the privilege to participate in the election process, the previous consortium of leader and follower nodes will lose their authorization. In the current cycle, they will solely retain broadcasting and receiving permissions for block information, while their corresponding incentives will also decrease. A diagram illustrating the node status can be found in Fig. 1.

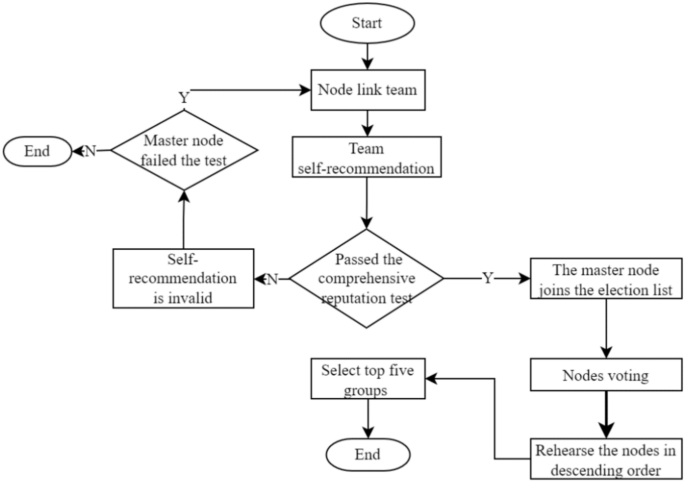

Election method

The election method adopts the node self-nomination mode. If a node wants to participate in an election, it must form a node group with one master and three slaves. One master node group and three slave node groups are inferred based on experience in this paper; these groups can balance efficiency and security and are suitable for other project collaborations. The successfully elected node joins the leader node set, and its slave nodes enter the follower node set. Considering the network situation, the maximum threshold for producing a block is set to 1 s. If the block fails to be successfully generated within the specified time, it is regarded as a disconnected state, and its reputation score is deducted. The node is skipped, and in severe cases, a view transformation is performed, switching from the master node to the slave node and inheriting its leader’s rights in the next round of block generation. Although the nodes that become leaders are high-reputation nodes, they still have the possibility of misconduct. If a node engages in misconduct, its activity will be immediately stopped, its comprehensive reputation score will be lowered, it will be disqualified from participating in the next election, and its equity will be reduced by 30%. The election process is shown in Fig. 2.

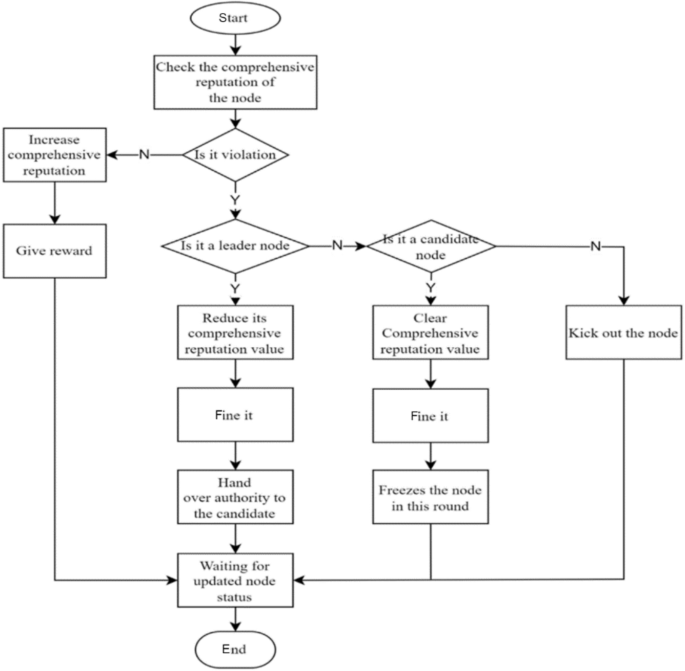

Incentives and penalties

To balance the rewards between leader nodes and ordinary nodes and prevent a large income gap, two incentive/penalty methods will be employed. First, as the number of network nodes and transaction volume increase, more active nodes with significant stakes emerge. After a prolonged period of running the blockchain, there will inevitably be significant class distinctions, and ordinary nodes will not be able to win in the election without special circumstances. To address this issue, this paper proposes that rewards be reduced for nodes with stakes exceeding a certain threshold, with the reduction rate increasing linearly until it reaches zero. Second, in the event that a leader or follower node violates the consensus process, such as by producing a block out of order or being unresponsive for an extended period, penalties will be imposed. The violation handling process is illustrated in Fig. 3.

Violation handling process.

Comprehensive reputation evaluation and election mechanism based on historical transactions

This paper reveals that the core of the DPoS consensus mechanism is the election process. If a blockchain is to run stably for a long time, it is essential to consider a reasonable election method. This paper proposes a comprehensive reputation evaluation election mechanism based on historical records. The mechanism considers the performance indicators of nodes in three dimensions: production rate, tokens, and validity. Additionally, their historical records are considered, particularly whether or not the nodes have engaged in malicious behavior. For example, nodes that have ever been malicious will receive low scores during the election process unless their overall quality is exceptionally high and they have considerable support from other nodes. Only in this case can such a node be eligible for election or become a leader node. The comprehensive reputation score is the node’s self-evaluation score, and the committee size does not affect the computational complexity.

Moreover, the comprehensive reputation evaluation proposed in this paper not only is a threshold required for node election but also converts the evaluation into corresponding votes based on the number of voters. Therefore, the election is related not only to the benefits obtained by the node but also to its comprehensive evaluation and the number of voters. If two nodes receive the same vote, the node with a higher comprehensive reputation is given priority in the ranking. For example, in an election where node A and node B each receive 1000 votes, node A’s number of stake votes is 800, its comprehensive reputation score is 50, and only four nodes vote for it. Node B’s number of stake votes is 600, its comprehensive reputation score is 80, and it receives votes from five nodes. In this situation, if only one leader node position remains, B will be selected as the leader node. Displayed in descending order of priority as comprehensive credit rating, number of voters, and stake votes, this approach aims to solve the problem of node misconduct at its root by democratizing the process and subjecting leader nodes to constraints, thereby safeguarding the fundamental interests of the vast majority of nodes.

Comprehensive reputation evaluation

This paper argues that the election process of the DPoS consensus mechanism is too simplistic, as it considers only the number of election votes that a node receives. This approach fails to comprehensively reflect the node’s actual capabilities and does not consider the voters’ election preferences. As a result, nodes with a significant stake often win and become leader nodes. To address this issue, the comprehensive reputation evaluation score is normalized considering various attributes of the nodes. The scoring results are shown in Table 3.

Table 3 Comprehensive reputation evaluation.

Since some of the evaluation indicators in Table 3 are continuous while others are discrete, different normalization methods need to be employed to obtain corresponding scores for different indicators. The continuous indicators include the number of transactions/people, wealth balance, network latency, network jitter, and network bandwidth, while the discrete indicators include the number of violations, the number of successful elections, and the number of votes. The value range of the indicator “number of transactions/people” is (0,1), and the value range of the other indicators is (0, + ∞). The equation for calculating the “number of transactions/people” is set as shown in Eq. (1).

$$A_{1} = \left\{ {\begin{array}{*{20}l} {0,} \hfill & {{\text{G}} = 0} \hfill \\ {\frac{{\text{N}}}{{\text{G}}}*10,} \hfill & {{\text{G}} > 0} \hfill \\ \end{array} } \right.$$

(1)

where N represents the number of transactional nodes and G represents the number of transactions. It reflects the degree of connection between the node and other nodes. Generally, nodes that transact with many others are safer than those with a large number of transactions with only a few nodes. The limit value of each item, denoted by x, is determined based on the situation and falls within the specified range, as shown in Eq. (2). The wealth balance and network bandwidth indicators use the same function to set their respective values.

$${A}_{i}=20*\left(\frac{1}{1+{e}^{-{a}_{i}x}}-0.5\right)$$

(2)

where x indicates the value of this item and expresses the limit value.

In Eq. (3), x represents the limited value of this indicator. The lower the network latency and network jitter are, the higher the score will be.

The last indicators, which are the number of violations, the number of elections, and the number of votes, are discrete values and are assigned different scores according to their respective ranges. The scores corresponding to each count are shown in Table 4.

$$A_{3} = \left\{ {\begin{array}{*{20}l} {10*\cos \frac{\pi }{200}x,} \hfill & {0 \le x \le 100} \hfill \\ {0,} \hfill & {x > 100} \hfill \\ \end{array} } \right.$$

(3)

Table 4 Score conversion.

The reputation evaluation mechanism proposed in this paper comprehensively considers three aspects of nodes, wealth level, node performance, and stability, to calculate their scores. Moreover, the scores obtain the present data based on historical records. Each node is set as an M × N dimensional matrix, where M represents M times the reputation evaluation score and N represents N dimensions of reputation evaluation (M < = N), as shown in Eq. (4).

$${\text{N}} = \left( {\begin{array}{*{20}c} {a_{11} } & \cdots & {a_{1n} } \\ \vdots & \ddots & \vdots \\ {a_{m1} } & \cdots & {a_{mn} } \\ \end{array} } \right)$$

(4)

The comprehensive reputation rating is a combined concept related to three dimensions. The rating is set after rating each aspect of the node. The weight w and the matrix l are not fixed. They are also transformed into matrix states as the position of the node in the system changes. The result of the rating is set as the output using Eq. (5).

$$\text{T}=\text{lN}{w}^{T}=\left({l}_{1}\dots {\text{l}}_{\text{m}}\right)\left(\begin{array}{ccc}{a}_{11}& \cdots & {a}_{1n}\\ \vdots & \ddots & \vdots \\ {a}_{m1}& \cdots & {a}_{mn}\end{array}\right){\left({w}_{1}\dots {w}_{n}\right)}^{T}$$

(5)

Here, T represents the comprehensive reputation score, and l and w represent the correlation coefficient. Because l is a matrix of order 1*M, M is the number of times in historical records, and M < = N is set, the number of dimensions of l is uncertain. Set the term l above to add up to 1, which is l1 + l2 + …… + ln = 1; w is also a one-dimensional matrix whose dimension is N*1, and its purpose is to act as a weight; within a certain period of time, w is a fixed matrix, and w will not change until the system changes the basic settings.

Assume that a node conducts its first comprehensive reputation rating, with no previous transaction volume, violations, elections or vote. The initial wealth of the node is 10, the latency is 50 ms, the jitter is 100 ms, and the network bandwidth is 100 M. According to the equation, the node’s comprehensive reputation rating is 41.55. This score is relatively good at the beginning and gradually increases as the patient participates in system activities continuously.

Voting calculation method

To ensure the security and stability of the blockchain system, this paper combines the comprehensive reputation score with voting and randomly sorts the blocks, as shown in Eqs. (3–6).

$$Z=\sum_{i=1}^{n}{X}_{i}+nT$$

(6)

where Z represents the final election score, Xi represents the voting rights earned by the node, n is the number of nodes that vote for this node, and T is the comprehensive reputation score.

The voting process is divided into stake votes and reputation votes. The more reputation scores and voters there are, the more total votes that are obtained. In the early stages of blockchain operation, nodes have relatively few stakes, so the impact of reputation votes is greater than that of equity votes. This is aimed at selecting the most suitable node as the leader node in the early stage. As an operation progresses, the role of equity votes becomes increasingly important, and corresponding mechanisms need to be established to regulate it. The election vote algorithm used in this paper is shown in Table 5.

Table 5 Election vote counting algorithm.

This paper argues that the election process utilized by the original DPoS consensus mechanism is overly simplistic, as it relies solely on the vote count to select the node that will oversee the entire blockchain. This approach cannot ensure the security and stability of the voting process, and if a malicious node behaves improperly during an election, it can pose a significant threat to the stability and security of the system as well as the safety of other nodes’ assets. Therefore, this paper proposes a different approach to the election process of the DPoS consensus mechanism by increasing the complexity of the process. We set up a threshold and optimized the vote-counting process to enhance the security and stability of the election. The specific performance of the proposed method was verified through experiments.

The election cycle in this paper can be customized, but it requires the agreement of the blockchain committee and general nodes. The election cycle includes four steps: node self-recommendation, calculating the comprehensive reputation score, voting, and replacing the new leader. Election is conducted only among general nodes without affecting the production or verification processes of leader nodes or follower nodes. Nodes start voting for preferred nodes. If they have no preference, they can use the LINK mechanism to collaborate with other nodes and gain additional rewards.

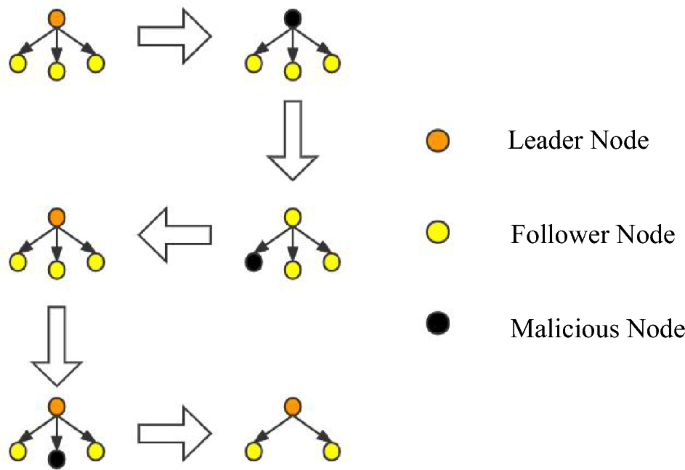

View changes

During the consensus process, conducting a large number of updates is not in line with the system’s interests, as the leader node (LN) and follower node (FN) on each node have already been established. Therefore, it is crucial to handle problematic nodes accurately when issues arise with either the LN or FN. For instance, when a node fails to perform its duties for an extended period or frequently fails to produce or verify blocks within the specified time range due to latency, the system will precisely handle them. For leader nodes, if they engage in malicious behavior such as producing blocks out of order, the behavior is recorded, and their identity as a leader node is downgraded to a follower node. The follower node inherits the leader node’s position, and the nature of their work is transformed as they swap their responsibilities of producing and verifying blocks with their original work. This type of behavior will not significantly affect the operation of the blockchain system. Instead of waiting until the end of the current committee round to punish malicious nodes, dynamic punishment is imposed on the nodes that affect the operation of the blockchain system to maintain system security. The view change operation is illustrated in Fig. 4.

In traditional PBFT, view changes are performed according to the view change protocol by changing the view number V to the next view number V + 1. During this process, nodes only receive view change messages and no other messages from other nodes. In this paper, the leader node group (LN) and follower node group (FN) are selected through an election of the LINK group. The node with LINKi[0] is added to the LN leader node group, while the other three LINK groups’ follower nodes join the FN follower node group since it is a configuration pattern of one master and three slaves. The view change in this paper requires only rearranging the node order within the LINK group to easily remove malicious nodes. Afterward, the change is broadcast to other committee nodes, and during the view transition, the LINK group does not receive block production or verification commands from the committee for stability reasons until the transition is completed.

News

The Hype Around Blockchain Mortgage Has Died Down, But This CEO Still Believes

LiquidFi Founder Ian Ferreira Sees Huge Potential in Blockchain Despite Hype around technology is dead.

“Blockchain technology has been a buzzword for a long time, and it shouldn’t be,” Ferriera said. “It should be a technology that lives in the background, but it makes everything much more efficient, much more transparent, and ultimately it saves costs for everyone. That’s the goal.”

Before founding his firm, Ferriera was a portfolio manager at a hedge fund, a job that ended up revealing “interesting intricacies” related to the mortgage industry.

Being a mortgage trader opened Ferriera’s eyes to a lot of the operational and infrastructure problems that needed to be solved in the mortgage-backed securities industry, he said. That later led to the birth of LiquidFi.

“The point of what we do is to get raw data attached to a resource [a loan] on a blockchain so that it’s provable. You reduce that trust problem because you have the data, you have the document associated with that data,” said the LiquidFi CEO.

Ferriera spoke with National Mortgage News about the value of blockchain technology, why blockchain hype has fizzled out, and why it shouldn’t.

News

New bill pushes Department of Veterans Affairs to examine how blockchain can improve its work

The Department of Veterans Affairs would have to evaluate how blockchain technology could be used to improve benefits and services offered to veterans, according to a legislative proposal introduced Tuesday.

The bill, sponsored by Rep. Nancy Mace, R-S.C., would direct the VA to “conduct a comprehensive study of the feasibility, potential benefits, and risks associated with using distributed ledger technology in various programs and services.”

Distributed ledger technology, including blockchain, is used to protect and track information by storing data across multiple computers and keeping a record of its use.

According to the text of the legislation, which Mace’s office shared exclusively with Nextgov/FCW ahead of its publication, blockchain “could significantly improve benefits allocation, insurance program management, and recordkeeping within the Department of Veterans Affairs.”

“We need to bring the federal government into the 21st century,” Mace said in a statement. “This bill will open the door to research on improving outdated systems that fail our veterans because we owe it to them to use every tool at our disposal to improve their lives.”

Within one year of the law taking effect, the Department of Veterans Affairs will be required to submit a report to the House and Senate Veterans Affairs committees detailing its findings, as well as the benefits and risks identified in using the technology.

The mandatory review is expected to include information on how the department’s use of blockchain could improve the way benefits decisions are administered, improve the management and security of veterans’ personal data, streamline the insurance claims process, and “increase transparency and accountability in service delivery.”

The Department of Veterans Affairs has been studying the potential benefits of using distributed ledger technology, with the department emission a request for information in November 2021 seeking input from contractors on how blockchain could be leveraged, in part, to streamline its supply chains and “secure data sharing between institutions.”

The VA’s National Institute of Artificial Intelligence has also valued the use of blockchain, with three of the use cases tested during the 2021 AI tech sprint focused on examining its capabilities.

Mace previously introduced a May bill that would direct Customs and Border Protection to create a public blockchain platform to store and share data collected at U.S. borders.

Lawmakers also proposed additional measures that would push the Department of Veterans Affairs to consider adopting other modernized technologies to improve veteran services.

Rep. David Valadao, R-Calif., introduced legislation in June that would have directed the department to report to lawmakers on how it plans to expand the use of “certain automation tools” to process veterans’ claims. The House of Representatives Subcommittee on Disability Assistance and Memorial Affairs gave a favorable hearing on the congressman’s bill during a Markup of July 23.

News

California DMV Uses Blockchain to Fight Auto Title Fraud

TDR’s Three Takeaways: California DMV Uses Blockchain to Fight Fraud

- California DMV uses blockchain technology to manage 42 million auto titles.

- The initiative aims to improve safety and reduce car title fraud.

- The immutable nature of blockchain ensures accurate and tamper-proof records.

The California Department of Motor Vehicles (DMV) is implementing blockchain technology to manage and secure 42 million auto titles. This innovative move aims to address and reduce the persistent problem of auto title fraud, a problem that costs consumers and the industry millions of dollars each year. By moving to a blockchain-based system, the DMV is taking advantage of the technology’s key feature: immutability.

Blockchain, a decentralized ledger technology, ensures that once a car title is registered, it cannot be altered or tampered with. This creates a highly secure and transparent system, significantly reducing the risk of fraudulent activity. Every transaction and update made to a car title is permanently recorded on the blockchain, providing a complete and immutable history of the vehicle’s ownership and status.

As first reported by Reuters, the DMV’s adoption of blockchain isn’t just about preventing fraud. It’s also aimed at streamlining the auto title process, making it more efficient and intuitive. Traditional auto title processing involves a lot of paperwork and manual verification, which can be time-consuming and prone to human error. Blockchain technology automates and digitizes this process, reducing the need for physical documents and minimizing the chances of errors.

Additionally, blockchain enables faster verification and transfer of car titles. For example, when a car is sold, the transfer of ownership can be done almost instantly on the blockchain, compared to days or even weeks in the conventional system. This speed and efficiency can benefit both the DMV and the vehicle owners.

The California DMV’s move is part of a broader trend of government agencies exploring blockchain technology to improve their services. By adopting this technology, the DMV is setting a precedent for other states and industries to follow, showcasing blockchain’s potential to improve safety and efficiency in public services.

-

Ethereum12 months ago

Ethereum12 months agoEthereum Posts First Consecutive Monthly Losses Since August 2023 on New ETFs

-

Regulation12 months ago

Regulation12 months agoCryptocurrency Regulation in Slovenia 2024

-

News12 months ago

News12 months agoNew bill pushes Department of Veterans Affairs to examine how blockchain can improve its work

-

Regulation12 months ago

Regulation12 months agoThink You Own Your Crypto? New UK Law Would Ensure It – DL News

-

Regulation12 months ago

Regulation12 months agoUpbit, Coinone, Bithumb Face New Fees Under South Korea’s Cryptocurrency Law

-

Regulation12 months ago

Regulation12 months agoA Blank Slate for Cryptocurrencies: Kamala Harris’ Regulatory Opportunity

-

Regulation12 months ago

Regulation12 months agoBahamas Passes Cryptocurrency Bill Designed to Prevent FTX, Terra Disasters

-

Regulation12 months ago

Regulation12 months agoIndia to Follow G20 Policy for Cryptocurrency Regulation: MoS Finance

-

News1 year ago

News1 year ago“Captain Tsubasa – RIVALS” launches on Oasys Blockchain

-

Ethereum1 year ago

Ethereum1 year agoComment deux frères auraient dérobé 25 millions de dollars lors d’un braquage d’Ethereum de 12 secondes • The Register

-

News12 months ago

News12 months agoEU supports 15 startups to fight online disinformation with blockchain

-

News1 year ago

News1 year agoSolana ranks the fastest blockchain in the world, surpassing Ethereum, Polygon ⋆ ZyCrypto