Ethereum

Is this a bullish sign?

Ethereum has reached a significant milestone, with over 28% of its total supply now staked, as observed by crypto researcher Leon Waidmann.

In an update on X, Waidmann Underlines ETH staking has reached an all-time high, with only 10% of Ethereum currently held on crypto exchanges. This record high confirms the growing confidence in Ethereum’s future and the community’s commitment to securing the network through staking.

Stock market assets fall

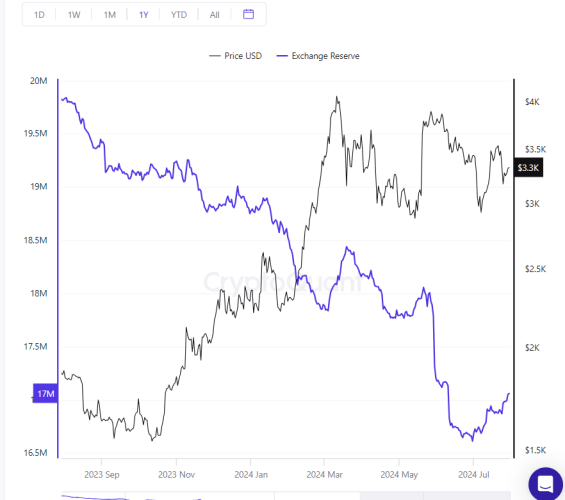

The drastic reduction of Ethereum Cryptocurrency exchanges, as shown in the chart below, have attracted attention. The percentage has fallen to around 10%, which is a significant drop from previous levels. This trend particularly highlights a move towards staking and long-term holding, reducing the supply available for trading.

Since last year, Ethereum reserves on exchanges have fallen from around 20 million to 17 million. This decline in reserves coincides with price fluctuations, including a notable increase starting in early 2024. The trend suggests that as ETH leaves exchanges, perhaps for private wallets or staking, the price tends to increase, reflecting increased investor confidence and long-term holding.

In addition, the market data CryptoQuant’s data shows a steady upward trend in the number of ETH tokens entering staking contracts over the past year. Currently, over 33.9 million tokens are locked, valued at more than $111 billion.

Clearly, the combination of reduced supply on exchanges and increased staking rates suggests a significant supply squeeze, which could impact Ethereum’s price dynamics.

Additionally, as supply on exchanges decreases and more ETH is locked in staking, buying pressure is likely to push prices higher, indicating a significant price increase ahead, as Waidmann suggests.

Technical indicators point to bullish outlook

Technical indicators like the RSI, which currently stands at 56.92, are highlighting bullish trends, further supporting the positive outlook for Ethereum.

Typically, an RSI reading above 50 indicates a bullish trend, and the current reading near 57 suggests that Ethereum is in slightly bullish territory. Notably, the RSI is not overbought (above 70) or oversold (below 30), indicating that there is no extreme buying or selling pressure at the moment.

Staking by reactivated whales

Additionally, other previously dormant Ethereum whales are also waking up with large transfers, some specifically for staking. In May, a dormant Ethereum whale made headlines when he staked 4,032 ETHvalued at $7.4 million, after more than two years of inactivity.

This whale initially acquired 60,000 ETH during the Genesis block in 2015. This activity may have been related to Ethereum’s “Shanghai” upgrade, which improved the network’s scalability and performance. These movements highlight significant on-chain activity, indicating increased confidence in Ethereum’s future.

Disclaimer: This content is informational and should not be considered financial advice. The opinions expressed in this article may include the personal opinions of the author and do not reflect the opinion of The Crypto Basic. Readers are encouraged to conduct thorough research before making any investment decisions. The Crypto Basic is not responsible for any financial losses.

-Advertisement-