Ethereum

Is ADA Price at Risk

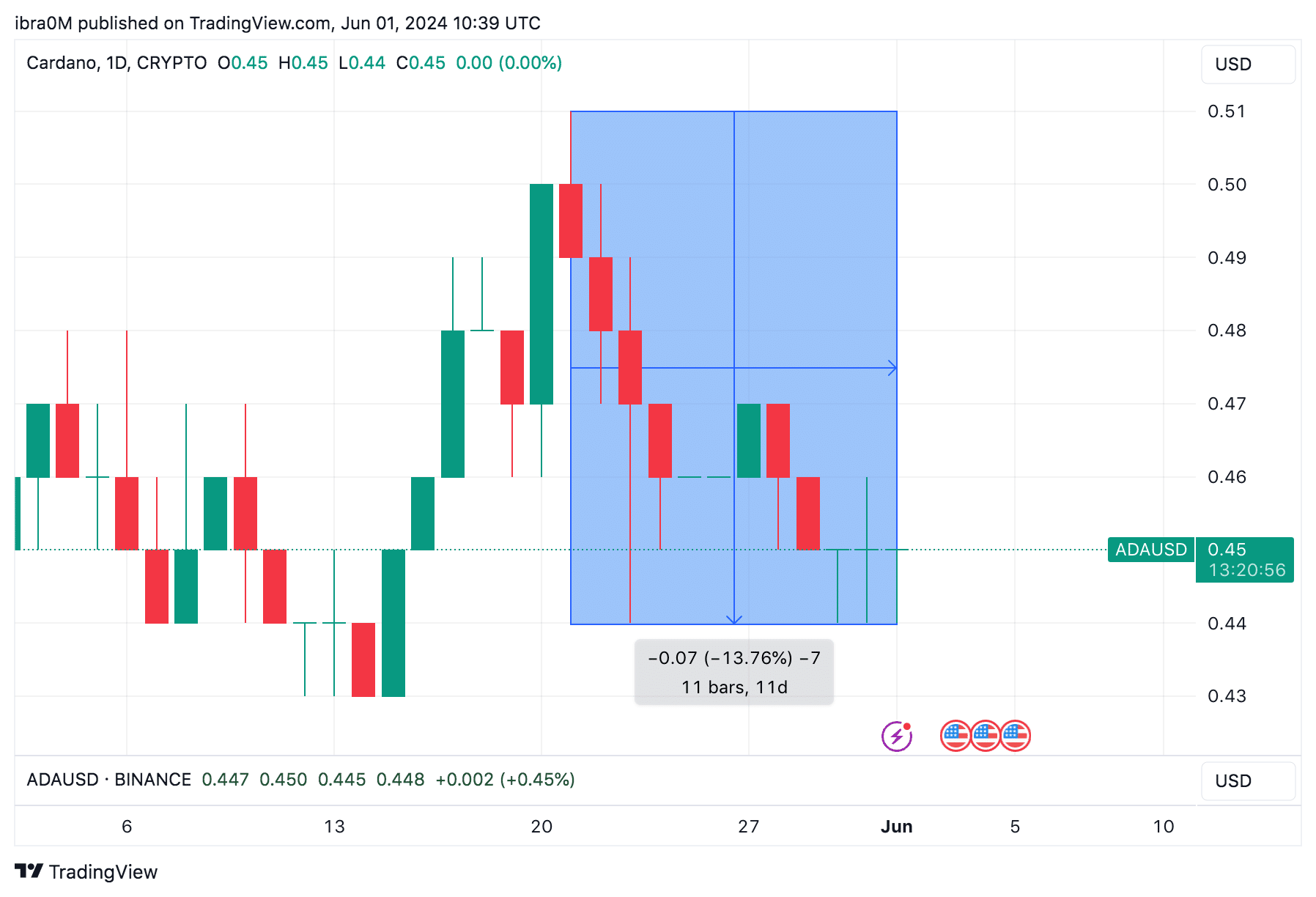

Cardano price closed May 2024 at $0.44, down 12% over the last 10 days, on-chain analysis examines the key bearish catalysts behind the current ADA downtrend.

Cardano price slips below critical $0.45 support level

Since the approval of the Ethereum ETF, rival layer 1 networks including Solana (SOL), Bitcoin (BTC), and Cardano have struggled to gain traction. In recent market events, retail investors have turned to Ethereum markets in a bid to increase their profits as the broader crypto markets enter a consolidation phase.

This rare market dynamic has been evident in ADA’s recent price action.

Cardano price closed May 2024 at the $0.44 level, marking a 14% decline from the monthly high of $0.51 recorded on May 21. ADA’s negative price action over the past 10 days has coincided with the bullish momentum surrounding ETH Markets.

Cardano Network Revenue Falls to 3-Year Low

However, this change in investor preferences has not been limited to speculative markets alone. On-chain data trends show that Cardano attracted significantly less traction on its native DeFi protocols this week, leading to a reduction in network revenue.

The IntoTheBlock chart below tracks daily fees charged on transactions made on the Cardano blockchain network. This provides insight into network activity as well as revenue generated by network validators staking their assets.

As shown above, the Cardano network generated 11,970 ADA in total transaction fees on May 26, 63% lower than its 2024 peak of 32,480 ADA recorded in March. Notably, historical data shows that these are the lowest daily transaction fees recorded since 2021.

– Advertisement –

When a blockchain network sees such a dramatic drop in transaction fees, it signals that the network is losing market share to its competitors, leading to a decline in demand for its native products and services.

Additionally, as a Proof-of-Stake network, this drop in Cardano fees means less revenue for network validators who stake their assets to validate operators and secure the network.

The decline in revenue could lead Cardano players to start cashing out their assets and focusing on more profitable PoS protocols in the coming days. If this scenario plays out, it could further exacerbate the downward price trend for ADA.

ADA Price Prediction: $0.40 Reverse on the move?

Cardano price fell below the $0.45 support cluster twice in the last 48 hours. As transaction fees hit a 3-year low, the bears are expected to force a decline in Cardano’s price towards the $0.40 level in the coming days.

However, GIOM data from IntoTheBlock suggests that the bears may face a hurdle at the $0.43 area in the near term.

Looking at the chart above, 407,260 addresses acquired 3.83 billion ADA at the maximum price of $0.43. If they maintain their positions, ADA price could instantly bounce above $0.45.

However, with demand weakening, as indicated by falling transaction fees, the bears appear to be in control, putting Cardano price at risk of an inevitable reversal towards $0.40.

Alternatively, if markets move higher, the $0.46 level could be the next important resistance level to watch.

Disclaimer: This content is informational and should not be considered financial advice. The opinions expressed in this article may include the personal opinions of the author and do not reflect the opinions of The Crypto Basic. Readers are encouraged to conduct thorough research before making any investment decisions. Crypto Basic is not responsible for any financial losses.

-Advertisement-