Bitcoin

Fort Worth started mining cryptocurrencies over two years ago. What have been the results?

Fort Worth is becoming a destination for cryptocurrencies.

An influx of cryptocurrency companies now calls Cowtown home — and Fort Worth is embracing them. Experts and Fort Worth officials attribute this growth to the city’s decision to bring in a bitcoin mining operation for the City Hall in April 2022.

“For Fort Worth, municipal bitcoin mining, I think, has created this tech hub energy that the city needs to continue to develop,” said Brandon Chicotsky, assistant professor of marketing at Texas Christian University.

Carlo Capua, the city’s chief strategy and innovation officer, said Texas’s efforts and favorable business practices have encouraged companies to set up shop here.

“Fort Worth is innovative, it’s visionary, it’s not afraid to try dynamic things to position itself as a great home for entrepreneurs,” Capua said. “Sometimes you can talk theoretically about why your city is great, and (the program’s success) is a perfect opportunity to give a real, specific example of how we’re putting our money where our mouth is.”

Tangible effect

Advanced Crypto Services is one of the companies that has moved to Fort Worth in the last two years.

Founded in founder and CEO James Scaggs’ garage in Frisco, the bitcoin mining maintenance and repair company is a nonprofit startup/member of the Texas Blockchain Council, an organization dedicated to advancing blockchain technology.

Fort Worth’s relationship with the cryptocurrency industry played a factor in Advanced Crypto Services’ move and it was a positive outcome, Scaggs said. The business gained access to local opportunities, grants and programs.

The company also got closer to its customers.

Companies are moving to Tarrant County to be closer to where mines are being built, Texas Blockchain Council President Lee Bratcher said.

“Just like Fort Worth was the closest city to the oil field — you ended up having a lot of oil and gas people coming to Fort Worth — I think there’s a possibility that Fort Worth could become a bitcoin mining city,” Bratcher said.

There is no federal registry for cryptocurrency mining locations. However, websites have gathered information based on news articles and press releases. Data compiled by Fractracker Alliance As of November 2022, 23 mines in the state were found to be operating or under construction, including 10 near Midland and Odessa in West Texas.

What is a cryptocurrency mine?

Cryptocurrency miners are computers that solve complex mathematical problems. Machines around the world compete to be the first to solve the problem. The first miner to solve the problem is rewarded with a sum of cryptocurrency, which has monetary value. Most mining facilities have around 10,000 to 20,000 mines, but the largest have around 100,000.

Several of the mining facilities are considered large, many with capacities exceeding 200 megawatts, according to a analysis by the US Energy Information Administration.

Texas leads the nation in large mines, with 10 that use enough energy to power more than 30,000 homes, according to The New York Times. Thirty-four mines nationwide use more energy than 30,000 homes. New York is second, with four.

Upon moving to Fort Worth in September 2022, Scaggs said Advanced Crypto Services is prepared to serve mines across Texas.

“It’s well-located for miners heading to Abilene, also Midland-Odessa. It’s not too far towards Austin, which is where we have another good batch of customers,” Scaggs said.

Long before the city entered the market, the world’s largest bitcoin ATM operator, Coinsource, was founded in Fort Worth in 2015.

Blockchain software company Consensys has announced its move to the city around the same time as the 2023 North American Blockchain Summit in Fort Worth.

Blockchain is a digital database that stores information. In cryptocurrency systems, the blockchain stores a record of transactions. Blockchain differs from other digital databases in that it is decentralized, meaning that no single computer has control over the system. Any information uploaded to the blockchain is irreversible.

What is blockchain?

The state’s “pro-crypto policies” and the vibrant entrepreneurial ecosystem in Fort Worth prompted Consensys’ move from New York, said Simon Morris, chief strategy officer at Consensys.

“It’s encouraging to be surrounded by a community that values innovation and economic independence,” Morris said in an email.

Double-edged sword

Fort Worth’s bitcoin mining program began in 2022 with three machines donated by the Texas Blockchain Council. Two months inthe city replaced the miners with a newer donated machine.

When the pilot program is completed in November 2022, Capua called it success and recommended that the machines keep mining. The program’s launch generated more than 752 million web impressions in those first six months, according to city officials.

Carlo Capua has served as the city of Fort Worth’s chief strategy and innovation officer since August 2022. (Cristian ArguetaSoto | Fort Worth Report)

Despite the program’s positive effects, Bratcher said Fort Worth is still the only city to participate. The Texas Blockchain Council donated a machine to the central Texas city of Temple, but the city never installed it, he said.

Bratcher doesn’t think cities will mine for profit. However, he does think municipal power districts could get more involved in the industry.

“There is municipally owned energy generation that is underutilized and they could monetize that for the citizens of their community more effectively,” Bratcher said.

One example is currently taking place in Denton. Bitcoin mining company Core Scientific began mining an underutilized section of Denton’s municipal power grid in 2022. RecentlyDenton has agreed to a second mining center that will also use grid power.

The city of Fort Worth did the best it could “to educate the public” about the pilot program, Capua said.

However, the city did not disclose the total energy cost to operate the machine. The Report filed an open records request for the machine’s electricity costs but did not receive a response by the time of publication.

“Our tariff with our energy supplier is confidential, so I’m afraid I can’t share the total cost of electricity as it would be easy for someone to reverse engineer our tariff,” Capua said before the report.

The Future of Fort Worth Cryptocurrency Investing

Fort Worth has no plans to buy more miners, Capua said. The city’s current bitcoin machine has a lifespan of about four years and has been in operation for more than two years.

The machine’s primary cost is electricity, which was offset by bitcoin mined, Capua said. As of August 2023, Capua said the machine generated nearly $2,000 after electricity costs, and he recently confirmed that the amount of profit the machine made was “in the thousands.”

“We can still be profitable with that machine. So we’ll probably keep that machine running until it becomes completely obsolete,” Capua said.

If the machine stops working or can no longer compete with other miners, Capua said the city will evaluate next steps.

He also said the machine will remain at the current City Hall, at 200 Texas St., despite current plans for the rest of the city’s operations to move to the new City Hall, at 100 Fort Worth Trail, in the coming months.

Fort Worth has called its current City Hall home since 1978. The building is pictured in March 2021. (Rodger Mallison | Fort Worth Report)

Fort Worth has called its current City Hall home since 1978. The building is pictured in March 2021. (Rodger Mallison | Fort Worth Report)

Chicotsky, the TCU professor, said Fort Worth can now claim to be more tech-savvy in “a way that is responsible and likely to generate revenue for the city and its residents.”

Capua wants to continue to strengthen the city’s reputation as a city that pushes the boundaries of innovation.

Last year, the city adopted a policy defining appropriate and responsible uses of artificial intelligence for city government. The goal was for the city to outline ways AI could be used across various city departments, Capua said.

Other emerging technologies could help the city and its residents, Capua said.

“We’re really looking at how we can look beyond that to provide better services to our residents here in the city and our visitors,” Capua said.

Ismael M. Belkoura is a reporting fellow at the Fort Worth Report. Contact him at ismael.belkoura@fortworthreport.org. At Fort Worth Report, news decisions are made independently of our board members and financial supporters. Read more about our policy of editorial independence here.

Related

Republish this story

Republishing is free for non-commercial entities. Commercial entities are prohibited without a licensing agreement. Contact us for more details.

Bitcoin

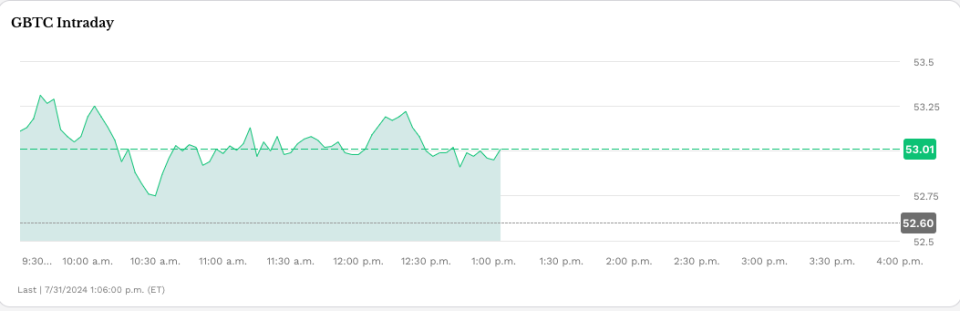

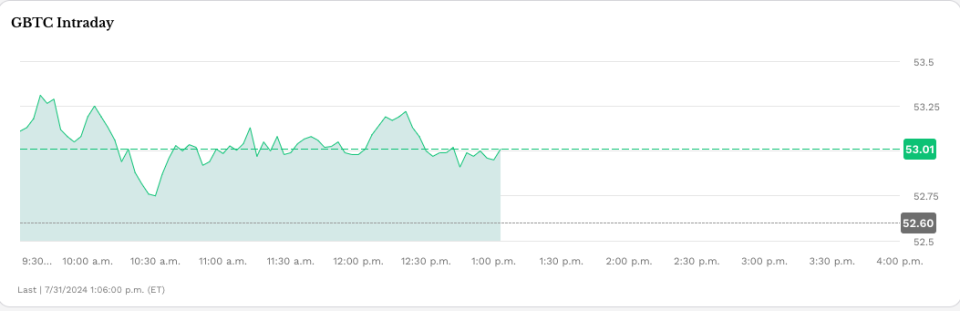

Grayscale Unveils Bitcoin Mini Trust ETF

Bitcoin Currency

Grayscale Investments The Bitcoin Mini Trust began trading on Wednesday with a 0.15% expense ratio, offering a lower-cost option for bitcoin exposure in the market.

The Mini Trust, which has the symbol BTC and trades on NYSE Arca, is structured as a spin-off of the Grayscale Bitcoin Trust (GBTC). New shares will be distributed to existing GBTC shareholders with the fund contributing a portion of its bitcoin holdings to the new product. According to a company press releaseBTC’s S-1 registration statement became effective last week.

“The Grayscale team has believed in the transformative potential of Bitcoin since the initial launch of GBTC in 2013, and we are excited to launch the Grayscale Bitcoin Mini Trust to help further lower the barrier to entry for Bitcoin in an SEC-regulated investment vehicle,” said David LaValle, Senior Managing Director and Head of ETFs at Grayscale.

The Bitcoin Mini Trust’s debut comes amid growing interest in ETFs based on the current price of the two largest cryptocurrencies by market cap, bitcoin and ether. Spot bitcoin ETFs have generated nearly $18 billion in inflows since the first ones began trading on Jan. 11, though GBTC has lost nearly $19 billion in assets.

This fund differs from other funds because it is a conversion of an existing fund and has a 1.5% fee, the highest among spot bitcoin products that have received SEC approval this year.

Mini Bitcoin Trust Low Fee

On a Post X On Wednesday, Bloomberg senior ETF analyst Eric Balchunas noted the Bitcoin Mini Trust’s “lowest fee in the category…”

“[Important] to recognize how incredibly cheap 15bps is — about 10x cheaper than spot ETFs in other countries and other vehicles,” Balchunas wrote, adding that this pricing strategy reflects the competitive nature of the U.S. ETF market, which he referred to as the “ETF Terrordome.”

“This is what Terrordome does to fund [cost]. It reaches 1.5% [and] end in 0.15%, how to go from [a] country club to the jungle. But that’s why all the flows are here, investor paradise,” he noted.

Read more: Spot Bitcoin ETF Inflows Hit Daily High of Over $1 Billion

Bitcoin was recently trading at around $66,350, virtually flat since U.S. markets opened on Wednesday.

Grayscale also offers two spot Ethereum ETFs, the Grayscale Ethereum Trust (ETHE) and the Grayscale Ethereum (ETH) Mini Trustwhose performance is based on ETHE. ETHE outflows exceeded $1.8 billion in its first six days of trading, while ETH added more than $181 million in the same period, according to Farside. The remaining seven ETFs generated about $1.2 billion in inflows.

The story continues

Read more: Spot Ethereum ETFs Approved to Start Trading

Permanent link | © Copyright 2024 etf.com. All rights reserved

Bitcoin

Bitcoin (BTC) Price Drops Below $65K After FOMC as Middle East Tensions Rise

Cryptocurrencies fell sharply on Wednesday as rising geopolitical risks captivated investors’ attention following the conclusion of the Federal Reserve’s July meeting.

Bitcoin (BTC) fell to $64,500 from around $66,500, where it traded following Federal Reserve Chairman Jerome Powell’s press conference and is down more than 2% in the past 24 hours. Major altcoins including ether (ETH)sunbathing (SUN)Avalanche AVAX (AVAX) and Cardano (ADA) also fell, while Ripple’s XRP saved some of its early gains today. The broad cryptocurrency market benchmark CoinDesk 20 Index was 0.8% lower than 24 hours ago.

The liquidation happened when the New York Times reported that Iran’s leaders have ordered retaliation against Israel over the killing of Hamas leader Ismail Haniyeh in Tehran, raising the risk of a wider conflict in the region.

Earlier today, the Fed left benchmark interest rates unchanged and gave little indication that a widely expected rate cut in September is a given. The Fed’s Powell said that while no decision has been made on a September cut, the “broad sense is that we are getting closer” to cutting rates.

While digital assets suffered losses, most traditional asset classes rose higher during the day. U.S. 10-year bond yields fell 10 basis points, while gold rose 1.5% to $2,450, slightly below its record highs, and WTI crude oil prices rose 5%. Stocks also rallied during the day, with the tech-heavy Nasdaq 100 index rebounding 3% and the S&P 500 closing the session 2.2% higher, led by 12% gains in chipmaker giant Nvidia (NVDA).

The different performances across asset classes could be due to traders’ positioning ahead of the Fed meeting, Zach Pandl, head of research at Grayscale, said in an emailed note.

“Equities may have been slightly underutilized after the recent dip, while bitcoin is coming off a strong period with solid inflows, while gold has recovered after a period of weakness,” he said.

“Overall, the combination of Fed rate cuts, bipartisan focus on cryptocurrency policy issues, and the prospect of a second Trump administration that could advocate for a weaker U.S. dollar should be viewed as very positive for bitcoin,” he concluded.

UPDATE (July 31, 2024, 21:30 UTC): Adds grayscale comments.

Bitcoin

Donald Trump’s Cryptocurrency Enthusiasm Is Just Another Scam

Former US President Donald Trump spoke at the Libertarian National Convention in May and lent his a strong support to crypto: “I will also stop Joe Biden’s crusade to crush crypto. … I will ensure that the future of crypto and the future of bitcoin is made in the US, not taken overseas. I will support the right to self-custody. To the 50 million crypto holders in the country, I say this: With your vote, I will keep Elizabeth Warren and her henchmen out of your bitcoin.”

Former US President Donald Trump spoke at the Libertarian National Convention in May and lent his a strong support to crypto: “I will also stop Joe Biden’s crusade to crush crypto. … I will ensure that the future of crypto and the future of bitcoin is made in the US, not taken overseas. I will support the right to self-custody. To the 50 million crypto holders in the country, I say this: With your vote, I will keep Elizabeth Warren and her henchmen out of your bitcoin.”

Trump continued to court the cryptocurrency industry in the months that followed; he he appeared at the Bitcoin 2024 Conference in Nashville this week, along with independent presidential candidate Robert F. Kennedy Jr.’s parting words to Trump — “Have fun with your bitcoin, your cryptocurrency and whatever else you’re playing with” — were less than enthusiastic, but the industry itself remains packed with ardent Trump supporters.

This turnaround came as a surprise, given Trump’s previous strong opposition to cryptocurrency. When Facebook was floating its Libra cryptocurrency in 2019, Trump tweeted: “I am not a fan of Bitcoin and other cryptocurrencies, which are not money, and whose value is highly volatile and based on thin air.” Former national security adviser John Bolton’s White House memoir, The Room Where It Happened, quotes Trump as telling Treasury Secretary Steven Mnuchin: “Don’t be a trade negotiator. Go after Bitcoin.” [for fraud].” In 2021, Trump counted Fox Business that bitcoin “just looks like a scam. … I want the dollar to be the world’s currency.”

Why the change? There doesn’t seem to be any crypto votes. Trump’s “50 million” number comes from a poorly sampled push survey by cryptocurrency exchange Coinbase which claimed 52 million cryptocurrency users in the United States starting in February 2023. But one survey A survey conducted last October by the US Federal Reserve showed that only 7% of adults (about 18.3 million people) admitted to owning or using cryptocurrencies — down from 10% in 2022 and 12% in 2021. Many of these people are likely wallet owners who were left holding the bag after crypto plunged in 2022 — and are not necessarily new fans.

What Trump wants from the cryptocurrency industry is money. The cryptocurrency industry has already raised more than US$ 180 million to run in the 2024 US elections through his super PACs Fairshake, Defend American Jobs and Protect Progress.

Fairshake spent $10 million on taking Rep. Katie Porter in the primary battle for Dianne Feinstein’s California Senate seat by funding Porter’s pro-crypto rival Adam Schiff. This put $2 million to knock out Rep. Jamaal Bowman in the Democratic primary for New York’s 16th District in favor of pro-crypto George Latimer. In the Utah Senate Republican primary, Rep. John Curtis defeated Trent Staggs with the help of $4.7 million from Defend American Jobs. In Alabama’s House District 2, the majority of campaign expenses came from the cryptocurrency industry.

Fairshake is substantially financed by Coinbase, cryptocurrency issuer Ripple Labs, and Silicon Valley venture capital firm Andreessen Horowitz, or a16z. Silicon Valley was awash in cryptocurrencies during the 2021 bubble, and a16z in particular continues to promote blockchain startups to this day — and still holds a huge amount of bubble crypto tokens that he wishes he could cash in on.

Many in Silicon Valley would like an authoritarian who they think will let them run wild with money — while bailing them out in tough times. Indeed, Trump promised Bitcoin 2024 participants that he hold all bitcoins that the United States acquires. (Never mind that it is usually acquired as the proceeds of crime.) Silicon Valley explicitly sees regulation of any kind as its greatest enemy. Three a16z manifestos — “Politics and the Future” It is “The Techno-Optimist Manifesto” and 2024 “The Small Tech Agenda—describe co-founders Marc Andreessen and Ben Horowitz’s demands for a technology-powered capitalism unhindered by regulation or social considerations. They name “experts,” “bureaucracy,” and “social responsibility” as their “enemies.” Their 2024 statement alleges that banks are unfairly cutting off startups from the banking system; these would be crypto companies funded by a16z.

Trump’s vice presidential pick, Senator J.D. Vance, is a former Silicon Valley venture capitalist. He was once employed by Peter Thiel, who bankrolled Vance’s successful 2022 Senate run; Vance has been described as a “Thiel creation”. He has increased support for the Trump ticket among his venture capital associates. Vance is a bitcoin holder and a frequent advocate of encryption. He recently released a draft bill to review how the Securities and Exchange Commission (SEC) and the Commodity Futures Trading Commission (CFTC) control crypto assets. In 2023, he circulated a bill to prevent banks from cutting out cryptocurrency exchanges.

Minimal regulation has been tried before. It led to the wild exuberance of the 1920s, which ended with the Black Tuesday crash of 1929 and the Great Depression of the 1930s. Regulators like the SEC were put in place during this era to protect investors and transform the securities market from a jungle into a well-tended garden, leading to many prosperous and stable decades that followed.

Crypto provides the opposite of a stable and functional system; it is a practical example of how a lack of regulation allows opportunists and scammers to cause large-scale disasters. The 2022 Crypto Crash repeated the 2008 financial crisis in miniature. FTX’s Sam Bankman-Fried was feted as a financial prodigy who would perform economic miracles if you just gave him carte blanche; he ended up stealing billions of dollars of customers’ money, destroying the lives of ordinary people, and is now in a prison cell.

U.S. regulators have long been concerned about the prospect of cryptocurrency contagion to the broader economy. Criminal money laundering is rampant in cryptocurrency; even the Trump administration has made rules in December 2020 to reduce the risk of money laundering from crypto. Meanwhile, the crypto industry has persistently tried to infiltrate systemically risky corners of the economy, such as pension funds.

Four U.S. banks collapsed during the 2023 banking crisis, the first since 2020. Two of them, Silvergate Bank and Signature Bank, were deeply embedded in the crypto world — Silvergate in particular appears to have collapsed directly from its heavy reliance on FTX and failed a few months after that. Silicon Valley Bank was not involved in crypto but collapsed due to a run on the bench due to panic among venture capital deposit holders, particularly Thiel’s Founders Fund.

Project 2025the Heritage Foundation mammoth conservative wish list The plan, which Trump and Vance have both endorsed and tried to distance themselves from at various times, emphasizes the importance of party loyalists, noting especially financial regulation. The plan recommends replacing as much of the federal bureaucracy as possible with loyalists and “trusted” career officials rather than nonpartisan “experts.” Vance defended in 2021 that Trump should “fire every mid-level bureaucrat, every civil servant in the administrative state” and “replace them with our people.” Loyalty will likely trump competence.

Crypto is barely mentioned directly in Project 2025 — suggesting it has little active support among the broader conservative coalition. But near the end of the manifesto is a plan to dismantle most U.S. financial regulations and investor protections put in place since the 1930s, suggesting the exemption the crypto industry seeks from current SEC and CFTC regulations.

Bitcoin, the first cryptocurrency, started as an ideological project to promote a strange variant of Murray Rothbard’s anarcho-capitalism and the Austrian gold-backed economy—the kind we abandoned to escape the Great Depression. Crypto quickly co-opted the “end of the Fed” and “establishment elites” conspiracy theories of the John Birch Society and Eustace Mullins. It’s a way for billionaire capitalists like Thiel, Andreessen and Elon Musk to claim they’re not part of the so-called elite.

If a second Trump administration were to limp along with financial regulators and allow cryptocurrencies to have free rein, it could help foster the collapse of the U.S. economy that bitcoin claimed to prevent. But Trump is more likely to be happy to take the crypto money and run.

Bitcoin

Trump’s Bitcoin (BTC) Reserve Plan Seen as Just a ‘Small Token Stash’

Donald Trump’s recent promise to create a “strategic national stockpile of Bitcoin” may not turn out to be as big a commitment as the hype surrounding the announcement makes it seem.

“Trump’s proposal is extremely modest,” said George Selgin, director emeritus of the Center for Monetary and Financial Alternatives at the Cato Institutea Washington-based public policy group. “It doesn’t have much economic implication.”

-

Ethereum12 months ago

Ethereum12 months agoEthereum Posts First Consecutive Monthly Losses Since August 2023 on New ETFs

-

Regulation12 months ago

Regulation12 months agoCryptocurrency Regulation in Slovenia 2024

-

News12 months ago

News12 months agoNew bill pushes Department of Veterans Affairs to examine how blockchain can improve its work

-

Regulation12 months ago

Regulation12 months agoThink You Own Your Crypto? New UK Law Would Ensure It – DL News

-

Regulation12 months ago

Regulation12 months agoUpbit, Coinone, Bithumb Face New Fees Under South Korea’s Cryptocurrency Law

-

Regulation12 months ago

Regulation12 months agoA Blank Slate for Cryptocurrencies: Kamala Harris’ Regulatory Opportunity

-

Regulation12 months ago

Regulation12 months agoBahamas Passes Cryptocurrency Bill Designed to Prevent FTX, Terra Disasters

-

Regulation12 months ago

Regulation12 months agoIndia to Follow G20 Policy for Cryptocurrency Regulation: MoS Finance

-

News1 year ago

News1 year ago“Captain Tsubasa – RIVALS” launches on Oasys Blockchain

-

Ethereum1 year ago

Ethereum1 year agoComment deux frères auraient dérobé 25 millions de dollars lors d’un braquage d’Ethereum de 12 secondes • The Register

-

News12 months ago

News12 months agoEU supports 15 startups to fight online disinformation with blockchain

-

News1 year ago

News1 year agoSolana ranks the fastest blockchain in the world, surpassing Ethereum, Polygon ⋆ ZyCrypto