Ethereum

Ethereum records $17.9 billion in spot volume despite 3% drop

Ethereum (ETH) continues to generate strong trading volume despite a recent 3% drop over the past 24 hours and ongoing bearish pressure.

The current market situation has not been particularly favorable for Ethereum, the second-largest cryptocurrency. As one of the leading crypto assets, ETH has been at the forefront of the ongoing sell-off. As a result, the token has fallen by 10.33% this month, struggling to hold the $3,000 threshold.

This month’s price collapse follows an 8.62% close in June, which saw Ethereum abandon the psychological territories of $3,700 and $3,500. The Decline of Ethereum is a result of its price correlation with Bitcoin (BTC), which fell 8.61% in July. Data from IntoTheBlock shows that Ethereum has a 93% correlation with Bitcoin over the past month.

Ethereum Sees Surge in Volume

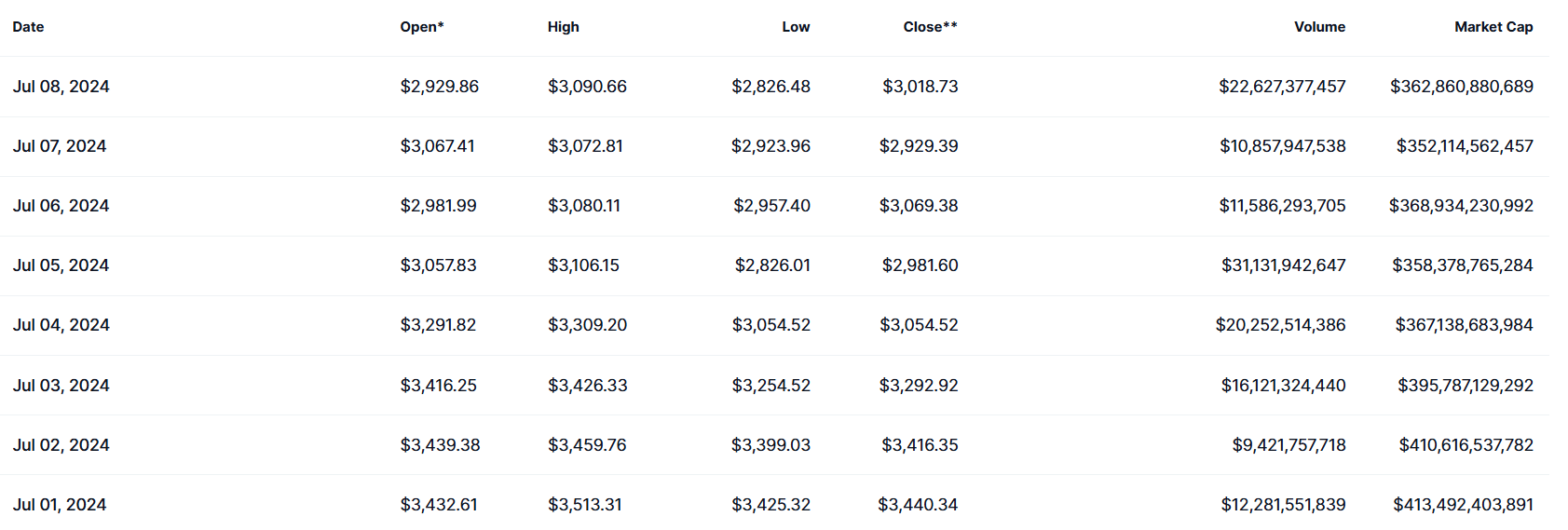

Interestingly, despite the continued decline, market interest in Ethereum has not diminished. Market data from CoinMarketCap indicates that Ethereum 24-Hour Trading Volume The ETH price has not fallen below $10 billion this month. The lowest figure recorded by ETH is $10.85 billion, recorded on July 7 during a price drop of 4.43%.

The latest data shows that Ethereum recorded $17.927 billion in volume over the past 24 hours, despite a 3.09% decline. This makes it the third-largest asset in terms of 24-hour volume, behind Bitcoin and USDT. Two of Binance’s Ethereum trading pairs account for 14.54% of global volume, with a combined total of $2.605 billion.

Additionally, IntoTheBlock confirms that large Ethereum transactions have been high, with a 7-day peak of $8.62 billion on July 5. The increase in trading volume reflects continued interest in Ethereum.

However, volume data alone cannot provide information on investor behavior in terms of bullish or bearish sentiments.

A trend towards excessive demand for whales

Typically, an increase in trading volume during a sharp market crash is a sign of increasing selling pressure. However, Ethereum price has been showing some stability lately, protecting against further declines. This confirms that increased trading volume is not necessarily a direct result of increased selling.

Data watch Bulls bought over 6.065 million ETH ($18.62 million) in July. On the other hand, bears sold 5.815 million ETH worth $17.9 million during the same period. This indicates that the Ethereum market saw an excess demand of 250,000 ETH from large whales this month.

Ethereum ETH could take advantage of this increased demand for a recovery move when the broader market recovers. However, to reach higher highs, it must first conquer the resistance at $3,079, aligned with the 23.6% Fibonacci. A break of this level would help ETH reclaim the $3,200 level, with the next hurdle at $3,251.

Disclaimer: This content is informational and should not be considered financial advice. The opinions expressed in this article may include the personal opinions of the author and do not reflect the opinion of The Crypto Basic. Readers are encouraged to conduct thorough research before making any investment decisions. The Crypto Basic is not responsible for any financial losses.

-Advertisement-