Ethereum

ETH eyes $4,500 as transactions surge 240%

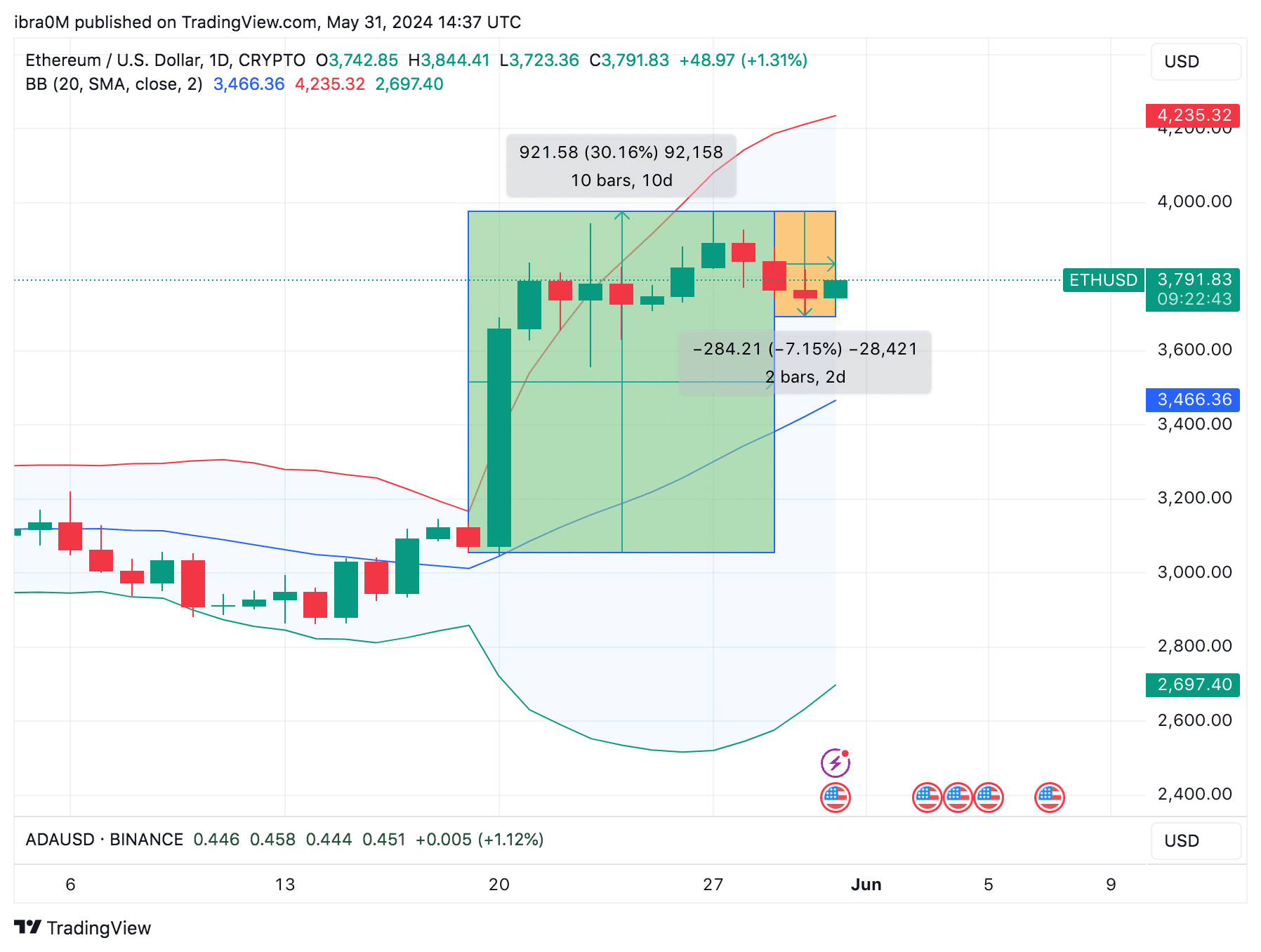

Ethereum price continues to defend $3,800 despite slowing investor momentum ahead of upcoming US non-farm payrolls data, and on-chain data analysis reveals rare bullish signal that could trigger the next rally.

Ethereum Price Rise Calms Ahead of US Inflation and Jobs Data

The U.S. Bureau of Labor Statistics is scheduled to release the next installment of its monthly nonfarm payrolls data on Friday, May 31. Non-agricultural jobs is a key macroeconomic indicator that impacts how regulators and investors view changes in inflation and overall economic activity.

In the current environment, a further decline in non-farm payrolls could push the Fed to cut interest rates, and vice versa.

As the report draws closer, strategic crypto investors have cooled their trading activity, sending Ethereum markets into a consolidation phase over the past 24 hours, hating the week-long uptrend following the approval of the ETH ETF.

As seen above, between May 21 and May 29, the price of Ethereum climbed 30%, reaching a new monthly high of $3,974. But between May 29 and May 31, the price of ETH fell by 7%, reaching a weekly low of $3,698.

This suggests that the ETH price rally after ETF appears to have entered a recessionary period as crypto investors take moderate positions ahead of upcoming US macroeconomic index data.

However, taking a closer look at the on-chain data, institutional investors in the Ethereum network are still conducting large volumes of transactions behind the scenes.

– Advertisement –

As shown below, IntoTheBlock’s average transaction size provides insight into the speed at which investors make large investments on a blockchain network.

Ethereum price compared to average ETH transaction size

As seen above, the average Ethereum transaction size stood at 1.03 ETH as of May 19. However, since the approval of the Ethereum ETF, this figure has continued to increase significantly.

At the time of writing on May 31, Ethereum’s average transaction size now reached 2.46 ETH, reflecting a 240% increase over the past two weeks.

Typically, a 240% increase in average trade size is a key bullish signal for several reasons. First, it signals improved sentiment and bullish conviction as investors are now willing to make higher value trades.

More so, these higher value transactions also indicate significant growth in market liquidity, which potential new entrants might find attractive.

Ethereum (ETH) Price Forecast: Is the $4,500 Target Viable?

Ethereum price is struggling to defend the $3,800 support at the time of writing on May 31. However, if the United States. Non-farm payrolls data generates positive market reaction, 240% increase in transactions could set the stage for ETH price to surpass $4,500 in June 2024.

However, looking at historical buying trends, Ethereum price could face major resistance at $4,200 during the next phase of the rally.

As seen above, 7.43 million active ETH holders acquired 3.06 million ETH at an average price of $4,213. ETH price may struggle to break out of this resistance group if they choose to take profits early.

But if Ethereum price can make a decisive breakout above $4,200, bulls can expect new highs above $4,500.

On the other hand, if ETH fails to defend the $3,700 support level, a decline towards $3,560 could be considered.

Disclaimer: This content is informational and should not be considered financial advice. The opinions expressed in this article may include the personal opinions of the author and do not reflect the opinions of The Crypto Basic. Readers are encouraged to conduct thorough research before making any investment decisions. Crypto Basic is not responsible for any financial losses.

-Advertisement-