News

DMG Blockchain Solutions Reports Second Quarter 2024 Results Ending March 31, 2024

DMG Blockchain Solutions Inc.

VANCOUVER, British Columbia, May 22, 2024 (GLOBE NEWSWIRE) — DMG Blockchain Solutions Inc. (TSX-V: DMGI) (OTCQB US: DMGGF) (FRANKFURT: 6AX) (“DMG”), a vertically integrated blockchain and data center technology company, today announces its fiscal second quarter 2024 financial results. All financial references are in Canadian Dollars unless specified otherwise.

Q2 2024 Financial Results Highlights

-

Q2 2024 revenue increased 31% over the prior year to $10M, driven by self mining revenues increasing 39%

-

Net Income was slightly positive, maintaining profitability for the second consecutive quarter

-

153 bitcoin mined, down 22% from the prior quarter, with a hashrate of 0.96 EH/s and fleet efficiency of 28.4 J/TH

-

$4.5 million cash flow from operations, up 19% from the prior quarter

-

Deploying Bitmain T21 miners with goal to reach 1.7 EH/s by the end of June, targeting 2 EH/s and beyond longer term

-

Strong balance sheet with $43.6M in cash and digital currency, $118M in total assets

Sheldon Bennett, DMG Blockchain Solutions’ Chief Executive Officer, commented, “We are pleased with our robust performance this quarter, achieving a 3% sequential revenue increase to $10.0M and maintaining profitability for the second consecutive quarter. Our strategic investments in both our Core and Core+ strategies are delivering promising results. Systemic Trust is paving the way for financial institutions to transact bitcoin in a carbon-neutral manner, while the deployment of our Bitmain T21 miners positions us to achieve 1.7 EH/s by the end of June with further expansion planned. Additionally, our strong cash flow from operations of $4.5M and a solid balance sheet with $43.6M in cash and digital currency underscore our execution.”

Second Quarter 2024 Financial Results Review

Revenue for the second fiscal quarter ending March 31, 2024 was $10.0 million versus $7.6 million in the prior year period, an increase of 31%, primarily due to the increase in digital currency mining revenues as a result of bitcoin price increasing 133% over the year-ago period to an average of $71,851 in the March quarter. This increase was partially offset by a 93% increase in Bitcoin network difficulty that lowered DMG’s bitcoin generation per EH/s by 47% from the same period last year. In addition, revenue was also partially offset by a loss in net pool revenue of $1.3 million.

Income before other items for the three months ended March 31, 2024 was -$1.8 million versus -$4.6 million in the prior year period.

Operating and maintenance costs for the three months ended March 31, 2024 were $5.3 million as compared to $4.6 million in the same quarter in the prior year. The increase is attributed to utility expenses, driven by the expansion of digital currency mining operations and the addition of new miners.

Story continues

Net income for the three months ending March 31, 2024 was $2 thousand versus a loss of $3.8 million in the prior year period. The improvement in net income was driven primarily by an increase in revenue of $10.0 million versus $7.6 million in the prior year period, unrealized revaluation gain on digital currency, which was a gain of $1.0 million versus zero in the prior year period as well as realized gain on sale of digital currency of $1.1 million versus $0.5 million in the year-ago period. It was also driven by lower depreciation, which was $3.8 million versus $5.9 million in the prior year period. These were partially offset by operating and maintenance costs, which increased by $0.7 million and general and administrative expenses which increased by $1.1 million over the prior year.

Earnings per share for the second fiscal quarter ending March 31, 2024 was $0.00 versus -$0.02 in the prior year period.

As of March 31, 2024, the Company had cash of $1.6 million, digital currency of $42.0 million and total assets of $118.4 million. For more details, please refer to the Company’s filings.

Readers are encouraged to review the Company’s March 31, 2024 quarterly unaudited financial statements and management’s discussion and analysis thereof for a fulsome assessment of the Company’s performance and applicable risk factors, available at www.sedarplus.ca.

DMG Blockchain Solutions Inc. Second Quarter 2024 Financial Results Conference Call

The Company will host a conference call to review second quarter 2024 financial results and provide a corporate update on May 23, 2024 at 4:30 pm ET. Participants are asked to pre-register for the call through this link. Registered participants will receive a conference call weblink and dial-in information in their confirmation email.

As there will be no live Q&A session, management will address pre-submitted questions during the call. Those wishing to submit a question may do so via investors@dmgblockchain.com using the subject line ‘Conference Call Question Submission’ through 2:00 pm ET on May 23, 2024.

About DMG Blockchain Solutions Inc.

DMG is an environmentally friendly vertically integrated blockchain and data center company that manages, operates and develops end-to-end digital solutions to monetize the blockchain ecosystem. DMG’s sustainable businesses are segmented into two business lines under the Core and Core+ strategies and unified through DMG’s vertical integration.

For more information on DMG Blockchain Solutions visit: www.dmgblockchain.com

Follow @dmgblockchain on X and subscribe to DMG’s YouTube channel.

For further information, please contact:

On behalf of the Board of Directors,

Sheldon Bennett, CEO & Director

Tel: 516-222-2560

Email: investors@dmgblockchain.com

Web: www.dmgblockchain.com

Investor Relations Contact:

Core IR 516-222-2560

For Media Inquiries:

Jules Abraham

Core IR

917-885-7378

julesa@coreir.com

Neither the TSX Venture Exchange nor its Regulation Service Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this news release.

Cautionary Note Regarding Forward-Looking Information

This news release contains forward-looking information or statements based on current expectations. Forward-looking statements contained in this news release include statements regarding DMG’s strategies and plans, the expected increase in realized hashrate, deploying Bitmain T21 miners to reach 1.7 EH/s by June 2024, targeting 2 EH/s and beyond, hosting the conference call, the deployment of new capacity, the expected arrival of new miners, the expected timelines, the opportunity and plans to monetize bitcoin transactions, the continued investment in Bitcoin network software infrastructure and applications, developing and executing on the Company’s products and services, increasing self-mining, efforts to improve the operation of its mining fleet, the launch of products and services, events, courses of action, and the potential of the Company’s technology and operations, among others, are all forward-looking information.

Future changes in the Bitcoin network-wide mining difficulty rate or Bitcoin hash rate may materially affect the future performance of DMG’s production of bitcoin, and future operating results could also be materially affected by the price of bitcoin and an increase in hash rate mining difficulty.

Forward-looking statements consist of statements that are not purely historical, including any statements regarding beliefs, plans, expectations, or intentions regarding the future. Such information can generally be identified by the use of forwarding-looking wording such as “may”, “expect”, “estimate”, “anticipate”, “intend”, “believe” and “continue” or the negative thereof or similar variations. The reader is cautioned that assumptions used in the preparation of any forward-looking information may prove to be incorrect. Events or circumstances may cause actual results to differ materially from those predicted, as a result of numerous known and unknown risks, uncertainties, and other factors, many of which are beyond the control of the Company, including but not limited to, market and other conditions, volatility in the trading price of the common shares of the Company, business, economic and capital market conditions; the ability to manage operating expenses, which may adversely affect the Company’s financial condition; the ability to remain competitive as other better financed competitors develop and release competitive products; regulatory uncertainties; access to equipment; market conditions and the demand and pricing for products; the demand and pricing of bitcoins; security threats, including a loss/theft of DMG’s bitcoins; DMG’s relationships with its customers, distributors and business partners; the inability to add more power to DMG’s facilities; DMG’s ability to successfully define, design and release new products in a timely manner that meet customers’ needs; the ability to attract, retain and motivate qualified personnel; competition in the industry; the impact of technology changes on the products and industry; failure to develop new and innovative products; the ability to successfully maintain and enforce our intellectual property rights and defend third-party claims of infringement of their intellectual property rights; the impact of intellectual property litigation that could materially and adversely affect the business; the ability to manage working capital; and the dependence on key personnel. DMG may not actually achieve its plans, projections, or expectations. Such statements and information are based on numerous assumptions regarding present and future business strategies and the environment in which the Company will operate in the future, including the demand for its products, the ability to successfully develop software, that there will be no regulation or law that will prevent the Company from operating its business, anticipated costs, the ability to secure sufficient capital to complete its business plans, the ability to achieve goals and the price of bitcoin. Given these risks, uncertainties, and assumptions, you should not place undue reliance on these forward-looking statements. The securities of DMG are considered highly speculative due to the nature of DMG’s business. For further information concerning these and other risks and uncertainties, refer to the Company’s filings on www.sedarplus.ca. In addition, DMG’s past financial performance may not be a reliable indicator of future performance.

Factors that could cause actual results to differ materially from those in forward-looking statements include, failure to obtain regulatory approval, the continued availability of capital and financing, equipment failures, lack of supply of equipment, power and infrastructure, failure to obtain any permits required to operate the business, the impact of technology changes on the industry, the impact of viruses and diseases on the Company’s ability to operate, secure equipment, and hire personnel, competition, security threats including stolen bitcoins from DMG or its customers, consumer sentiment towards DMG’s products, services and blockchain technology generally, failure to develop new and innovative products, litigation, adverse weather or climate events, increase in operating costs, increase in equipment and labor costs, equipment failures, decrease in the price of Bitcoin, failure of counterparties to perform their contractual obligations, government regulations, loss of key employees and consultants, and general economic, market or business conditions. Forward-looking statements contained in this news release are expressly qualified by this cautionary statement. The reader is cautioned not to place undue reliance on any forward-looking information. The forward-looking statements contained in this news release are made as of the date of this news release. Except as required by law, the Company disclaims any intention and assumes no obligation to update or revise any forward-looking statements, whether as a result of new information, future events, or otherwise. Additionally, the Company undertakes no obligation to comment on the expectations of or statements made by third parties in respect of the matters discussed above.

DMG Blockchain Solutions Inc.

Consolidated Statements of Loss and Comprehensive Loss

(Expressed in Canadian Dollars)

(Unaudited)

|

|

|

For the Three Months |

For the Six Months Ended |

|||

|

|

Notes |

March 31, |

March 31, |

March 31, |

March 31, |

|

|

|

|

|

|

|

|

|

|

Revenue |

15 |

10,015,659 |

7,623,323 |

19,706,423 |

14,797,915 |

|

|

|

|

|

|

|

|

|

|

Expenses |

|

|

|

|

|

|

|

Operating and maintenance costs |

16(a) |

5,270,851 |

4,594,898 |

10,418,502 |

9,003,690 |

|

|

General and administrative |

16(b) |

1,846,398 |

776,942 |

2,732,459 |

1,724,878 |

|

|

Stock-based compensation |

|

398,010 |

423,079 |

766,502 |

938,209 |

|

|

Research and development |

|

486,216 |

499,165 |

924,395 |

931,104 |

|

|

Provision for doubtful accounts |

|

42 |

50,773 |

3,806 |

114,377 |

|

|

Depreciation |

10 |

3,805,988 |

5,854,704 |

8,147,770 |

11,945,549 |

|

|

Total expenses |

|

11,807,503 |

12,199,561 |

22,993,434 |

24,657,807 |

|

|

|

|

|

|

|

|

|

|

Loss before other items |

|

(1,791,844) |

(4,576,238) |

(3,287,011) |

(9,859,892) |

|

|

|

|

|

|

|

|

|

|

Other income (expense) |

|

|

|

|

|

|

|

Interest and other income |

7 |

170,044 |

122,091 |

335,825 |

235,232 |

|

|

Provision of sales tax receivable |

|

(381,690) |

– |

(635,590) |

– |

|

|

Gain on disposition of assets |

|

4,809 |

– |

4,809 |

70,429 |

|

|

Foreign exchange loss |

|

(28,341) |

(26,014) |

(122,926) |

(106,991) |

|

|

Unrealized gain on revaluation of digital currency |

5 |

1,019,456 |

– |

9,182,316 |

– |

|

|

Realized gain on sale of digital currency |

|

1,143,489 |

506,054 |

1,995,359 |

328,892 |

|

|

Gain (loss) on change in fair value of marketable securities |

|

(133,708) |

134,698 |

111,043 |

(94,823) |

|

|

Loss on fair value of investments |

10 |

|

– |

(609,120 |

– |

|

|

Net income (loss) |

|

2,215 |

(3,839,409) |

6,974,705 |

(9,427,153) |

|

|

|

|

|

|

|

|

|

|

Other comprehensive income |

|

|

|

|

|

|

|

Items that may be reclassified subsequently to income or loss: |

|

|

|

|

|

|

|

Unrealized revaluation gain on digital currency |

5 |

15,472,215 |

6,245,331 |

15,472,215 |

4,820,027 |

|

|

Cumulative translation adjustment |

|

(11,278) |

48,347 |

(1,196) |

48,091 |

|

|

Comprehensive income (loss) |

|

15,463,152 |

2,454,269 |

22,445,724 |

(4,559,035) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic and diluted income (loss) per share |

13(d) |

0.00 |

(0.02) |

0.04 |

(0.06) |

|

|

Weighted average number of shares outstanding |

13(d) |

|

|

|

|

|

|

– basic |

|

169,029,065 |

167,681,377 |

168,585,910 |

167,599,591 |

|

|

– diluted |

|

172,516,428 |

167,681,377 |

173,248,160 |

167,599,591 |

|

|

|

|

|

|

|

|

|

DMG Blockchain Solutions Inc.

Consolidated Statements of Financial Position

(Expressed in Canadian Dollars)

(Unaudited)

|

|

Notes |

As at |

As at |

|

|

ASSETS |

|

$ |

$ |

|

|

Current |

|

|

|

|

|

Cash and cash equivalents |

|

1,609,479 |

1,789,913 |

|

|

Amounts receivable |

6 |

2,102,769 |

2,476,679 |

|

|

Digital currency |

5 |

41,966,494 |

17,142,683 |

|

|

Prepaid expense and other current assets |

|

332,900 |

193,512 |

|

|

Marketable securities |

8 |

498,027 |

386,984 |

|

|

Assets held for sale |

11 |

3,702,466 |

3,451,024 |

|

|

Total current assets |

|

50,212,135 |

25,440,795 |

|

|

|

|

|

|

|

|

Long-term deposits |

9 |

18,687,623 |

3,256,324 |

|

|

Property and equipment |

12 |

42,632,378 |

47,398,585 |

|

|

Long-term investments |

13 |

45,000 |

45,000 |

|

|

Amount recoverable |

7 |

6,782,076 |

6,446,251 |

|

|

Total assets |

|

118,359,212 |

82,586,955 |

|

|

|

|

|

|

|

|

LIABILITIES AND SHAREHOLDERS’ EQUITY |

|

|

|

|

|

Current |

|

|

|

|

|

Trade and other payables |

14 |

5,408,373 |

4,178,104 |

|

|

Deferred revenue |

19 |

63,712 |

64,361 |

|

|

Current portion of lease liability |

15 |

57,014 |

50,555 |

|

|

Current portion of loans payable |

16 |

12,127,654 |

1,272,397 |

|

|

Total current liabilities |

|

17,656,753 |

5,565,417 |

|

|

|

|

|

|

|

|

Long-term lease liability |

15 |

71,873 |

41,202 |

|

|

Total liabilities |

|

17,728,626 |

5,606,619 |

|

|

|

|

|

|

|

|

Shareholders’ Equity |

|

|

|

|

|

Share capital |

17(a) |

111,820,687 |

110,820,540 |

|

|

Reserves |

17(b)(c) |

45,711,651 |

45,507,272 |

|

|

Accumulated other comprehensive income |

|

15,620,063 |

149,044 |

|

|

Accumulated deficit |

|

(72,521,815) |

(79,496,520) |

|

|

Total shareholders’ equity |

|

100,630,586 |

76,980,336 |

|

|

Total liabilities and shareholders’ equity |

|

118,359,212 |

82,586,955 |

|

|

|

|

|

|

|

|

Contingencies |

23 |

|

|

|

|

Subsequent events |

25 |

|

|

|

|

|

|

|

|

|

DMG Blockchain Solutions Inc.

Consolidated Statements of Cash Flows

(Expressed in Canadian Dollars)

(Unaudited)

|

|

|

For the Six Months Ended |

|

|

|

March 31, 2024 |

March 31, 2023 |

|

|

|

$ |

$ |

|

|

OPERATING ACTIVITIES |

|

|

|

|

Net income (loss) for the period |

6,974,705 |

(9,427,153) |

|

|

Non-cash items: |

|

|

|

|

Accretion |

23,272 |

25,466 |

|

|

Depreciation |

8,147,770 |

11,945,549 |

|

|

Share-based payments |

766,502 |

938,209 |

|

|

Unrealized foreign exchange loss |

40,351 |

43,613 |

|

|

Gain on disposition of assets |

(4,809) |

(70,429) |

|

|

Gain (loss) on change in fair value of marketable securities |

(111,043) |

94,824 |

|

|

Loss on fair value of investment |

609,120 |

– |

|

|

Provision for sales tax receivable |

635,590 |

– |

|

|

Bad debt expense |

3,806 |

114,377 |

|

|

Digital currency related revenue |

(18,355,313) |

(13,773,874) |

|

|

Unrealized gain on digital currency |

(9,182,315) |

– |

|

|

Digital currency sold |

20,173,781 |

11,161,893 |

|

|

Realized gain on sale of digital currency |

(1,995,359) |

(328,892) |

|

|

Non-cash interest income |

(329,914) |

(229,349) |

|

|

Accrued interest |

– |

(129) |

|

|

|

|

|

|

|

Changes in non-cash operating working capital: |

|

|

|

|

Prepaid expenses and other current assets |

(144,388) |

52,650 |

|

|

Amounts receivable |

(212,015) |

3,000,466 |

|

|

Amounts recoverable |

– |

(237,039) |

|

|

Deferred revenue |

11,277 |

(91,752) |

|

|

Trade and other payables |

1,144,920 |

1,895,676 |

|

|

Net cash provided by operating activities |

8,195,938 |

5,114,106 |

|

|

|

|

|

|

|

INVESTING ACTIVITIES |

|

|

|

|

Purchase of property and equipment |

(830,859) |

(572,044) |

|

|

Deposits on mining equipment |

(18,102,867) |

(1,991,167) |

|

|

Proceeds on sale of equipment |

– |

4,829 |

|

|

Purchase of short-term investment |

(609,120) |

– |

|

|

Proceeds from sublease |

– |

37,012 |

|

|

Net cash used by investing activities |

(19,542,846) |

(2,521,370) |

|

|

|

|

|

|

|

FINANCING ACTIVITIES |

|

|

|

|

Proceeds from option exercises |

438,024 |

63,750 |

|

|

Principal lease payments |

(61,187) |

(102,973) |

|

|

Proceeds from secured loan |

10,791,288 |

950,665 |

|

|

Repayment of loans payable |

(1,668) |

– |

|

|

Net cash provided by financing activities |

11,166,457 |

911,442 |

|

|

|

|

|

|

|

Impact of currency translation on cash |

17 |

(481) |

|

|

Change in cash |

(180,434) |

3,503,697 |

|

|

Cash, beginning |

1,789,913 |

1,247,513 |

|

|

Cash, end |

1,609,479 |

4,751,210 |

|

News

An enhanced consensus algorithm for blockchain

The introduction of the link and reputation evaluation concepts aims to improve the stability and security of the consensus mechanism, decrease the likelihood of malicious nodes joining the consensus, and increase the reliability of the selected consensus nodes.

The link model structure based on joint action

Through the LINK between nodes, all the LINK nodes engage in consistent activities during the operation of the consensus mechanism. The reputation evaluation mechanism evaluates the trustworthiness of nodes based on their historical activity status throughout the entire blockchain. The essence of LINK is to drive inactive nodes to participate in system activities through active nodes. During the stage of selecting leader nodes, nodes are selected through self-recommendation, and the reputation evaluation of candidate nodes and their LINK nodes must be qualified. The top 5 nodes of the total nodes are elected as leader nodes through voting, and the nodes in their LINK status are candidate nodes. In the event that the leader node goes down, the responsibility of the leader node is transferred to the nodes in its LINK through the view-change. The LINK connection algorithm used in this study is shown in Table 2, where LINKm is the linked group and LINKP is the percentage of linked nodes.

Table 2 LINK connection algorithm.

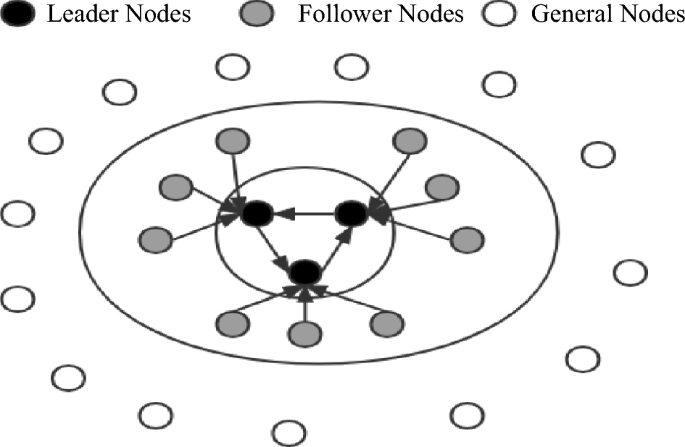

Node type

This paper presents a classification of nodes in a blockchain system based on their functionalities. The nodes are divided into three categories: leader nodes (LNs), follower nodes (FNs), and general nodes (Ns). The leader nodes (LNs) are responsible for producing blocks and are elected through voting by general nodes. The follower nodes (FNs) are nodes that are linked to leader nodes (LNs) through the LINK mechanism and are responsible for validating blocks. General nodes (N) have the ability to broadcast and disseminate information, participate in elections, and vote. The primary purpose of the LINK mechanism is to act in combination. When nodes are in the LINK, there is a distinction between the master and slave nodes, and there is a limit to the number of nodes in the LINK group (NP = {n1, nf1, nf2 ……,nfn}). As the largest proportion of nodes in the system, general nodes (N) have the right to vote and be elected. In contrast, leader nodes (LNs) and follower nodes (FNs) do not possess this right. This rule reduces the likelihood of a single node dominating the block. When the system needs to change its fundamental settings due to an increase in the number of nodes or transaction volume, a specific number of current leader nodes and candidate nodes need to vote for a reset. Subsequently, general nodes need to vote to confirm this. When both confirmations are successful, the new basic settings are used in the next cycle of the system process. This dual confirmation setting ensures the fairness of the blockchain to a considerable extent. It also ensures that the majority holds the ultimate decision-making power, thereby avoiding the phenomenon of a small number of nodes completely controlling the system.

After the completion of a governance cycle, the blockchain network will conduct a fresh election for the leader and follower nodes. As only general nodes possess the privilege to participate in the election process, the previous consortium of leader and follower nodes will lose their authorization. In the current cycle, they will solely retain broadcasting and receiving permissions for block information, while their corresponding incentives will also decrease. A diagram illustrating the node status can be found in Fig. 1.

Election method

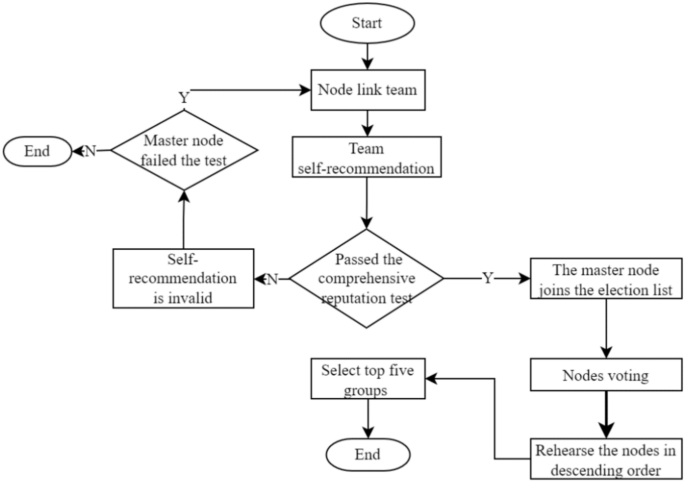

The election method adopts the node self-nomination mode. If a node wants to participate in an election, it must form a node group with one master and three slaves. One master node group and three slave node groups are inferred based on experience in this paper; these groups can balance efficiency and security and are suitable for other project collaborations. The successfully elected node joins the leader node set, and its slave nodes enter the follower node set. Considering the network situation, the maximum threshold for producing a block is set to 1 s. If the block fails to be successfully generated within the specified time, it is regarded as a disconnected state, and its reputation score is deducted. The node is skipped, and in severe cases, a view transformation is performed, switching from the master node to the slave node and inheriting its leader’s rights in the next round of block generation. Although the nodes that become leaders are high-reputation nodes, they still have the possibility of misconduct. If a node engages in misconduct, its activity will be immediately stopped, its comprehensive reputation score will be lowered, it will be disqualified from participating in the next election, and its equity will be reduced by 30%. The election process is shown in Fig. 2.

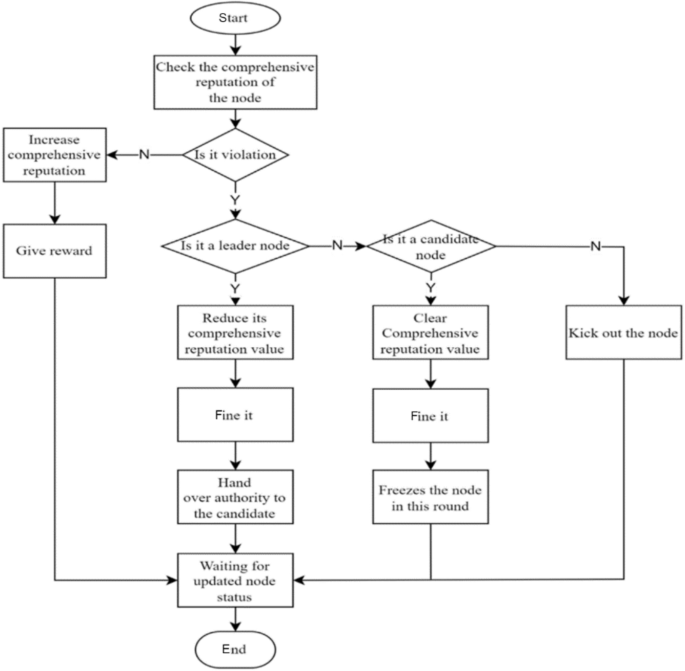

Incentives and penalties

To balance the rewards between leader nodes and ordinary nodes and prevent a large income gap, two incentive/penalty methods will be employed. First, as the number of network nodes and transaction volume increase, more active nodes with significant stakes emerge. After a prolonged period of running the blockchain, there will inevitably be significant class distinctions, and ordinary nodes will not be able to win in the election without special circumstances. To address this issue, this paper proposes that rewards be reduced for nodes with stakes exceeding a certain threshold, with the reduction rate increasing linearly until it reaches zero. Second, in the event that a leader or follower node violates the consensus process, such as by producing a block out of order or being unresponsive for an extended period, penalties will be imposed. The violation handling process is illustrated in Fig. 3.

Violation handling process.

Comprehensive reputation evaluation and election mechanism based on historical transactions

This paper reveals that the core of the DPoS consensus mechanism is the election process. If a blockchain is to run stably for a long time, it is essential to consider a reasonable election method. This paper proposes a comprehensive reputation evaluation election mechanism based on historical records. The mechanism considers the performance indicators of nodes in three dimensions: production rate, tokens, and validity. Additionally, their historical records are considered, particularly whether or not the nodes have engaged in malicious behavior. For example, nodes that have ever been malicious will receive low scores during the election process unless their overall quality is exceptionally high and they have considerable support from other nodes. Only in this case can such a node be eligible for election or become a leader node. The comprehensive reputation score is the node’s self-evaluation score, and the committee size does not affect the computational complexity.

Moreover, the comprehensive reputation evaluation proposed in this paper not only is a threshold required for node election but also converts the evaluation into corresponding votes based on the number of voters. Therefore, the election is related not only to the benefits obtained by the node but also to its comprehensive evaluation and the number of voters. If two nodes receive the same vote, the node with a higher comprehensive reputation is given priority in the ranking. For example, in an election where node A and node B each receive 1000 votes, node A’s number of stake votes is 800, its comprehensive reputation score is 50, and only four nodes vote for it. Node B’s number of stake votes is 600, its comprehensive reputation score is 80, and it receives votes from five nodes. In this situation, if only one leader node position remains, B will be selected as the leader node. Displayed in descending order of priority as comprehensive credit rating, number of voters, and stake votes, this approach aims to solve the problem of node misconduct at its root by democratizing the process and subjecting leader nodes to constraints, thereby safeguarding the fundamental interests of the vast majority of nodes.

Comprehensive reputation evaluation

This paper argues that the election process of the DPoS consensus mechanism is too simplistic, as it considers only the number of election votes that a node receives. This approach fails to comprehensively reflect the node’s actual capabilities and does not consider the voters’ election preferences. As a result, nodes with a significant stake often win and become leader nodes. To address this issue, the comprehensive reputation evaluation score is normalized considering various attributes of the nodes. The scoring results are shown in Table 3.

Table 3 Comprehensive reputation evaluation.

Since some of the evaluation indicators in Table 3 are continuous while others are discrete, different normalization methods need to be employed to obtain corresponding scores for different indicators. The continuous indicators include the number of transactions/people, wealth balance, network latency, network jitter, and network bandwidth, while the discrete indicators include the number of violations, the number of successful elections, and the number of votes. The value range of the indicator “number of transactions/people” is (0,1), and the value range of the other indicators is (0, + ∞). The equation for calculating the “number of transactions/people” is set as shown in Eq. (1).

$$A_{1} = \left\{ {\begin{array}{*{20}l} {0,} \hfill & {{\text{G}} = 0} \hfill \\ {\frac{{\text{N}}}{{\text{G}}}*10,} \hfill & {{\text{G}} > 0} \hfill \\ \end{array} } \right.$$

(1)

where N represents the number of transactional nodes and G represents the number of transactions. It reflects the degree of connection between the node and other nodes. Generally, nodes that transact with many others are safer than those with a large number of transactions with only a few nodes. The limit value of each item, denoted by x, is determined based on the situation and falls within the specified range, as shown in Eq. (2). The wealth balance and network bandwidth indicators use the same function to set their respective values.

$${A}_{i}=20*\left(\frac{1}{1+{e}^{-{a}_{i}x}}-0.5\right)$$

(2)

where x indicates the value of this item and expresses the limit value.

In Eq. (3), x represents the limited value of this indicator. The lower the network latency and network jitter are, the higher the score will be.

The last indicators, which are the number of violations, the number of elections, and the number of votes, are discrete values and are assigned different scores according to their respective ranges. The scores corresponding to each count are shown in Table 4.

$$A_{3} = \left\{ {\begin{array}{*{20}l} {10*\cos \frac{\pi }{200}x,} \hfill & {0 \le x \le 100} \hfill \\ {0,} \hfill & {x > 100} \hfill \\ \end{array} } \right.$$

(3)

Table 4 Score conversion.

The reputation evaluation mechanism proposed in this paper comprehensively considers three aspects of nodes, wealth level, node performance, and stability, to calculate their scores. Moreover, the scores obtain the present data based on historical records. Each node is set as an M × N dimensional matrix, where M represents M times the reputation evaluation score and N represents N dimensions of reputation evaluation (M < = N), as shown in Eq. (4).

$${\text{N}} = \left( {\begin{array}{*{20}c} {a_{11} } & \cdots & {a_{1n} } \\ \vdots & \ddots & \vdots \\ {a_{m1} } & \cdots & {a_{mn} } \\ \end{array} } \right)$$

(4)

The comprehensive reputation rating is a combined concept related to three dimensions. The rating is set after rating each aspect of the node. The weight w and the matrix l are not fixed. They are also transformed into matrix states as the position of the node in the system changes. The result of the rating is set as the output using Eq. (5).

$$\text{T}=\text{lN}{w}^{T}=\left({l}_{1}\dots {\text{l}}_{\text{m}}\right)\left(\begin{array}{ccc}{a}_{11}& \cdots & {a}_{1n}\\ \vdots & \ddots & \vdots \\ {a}_{m1}& \cdots & {a}_{mn}\end{array}\right){\left({w}_{1}\dots {w}_{n}\right)}^{T}$$

(5)

Here, T represents the comprehensive reputation score, and l and w represent the correlation coefficient. Because l is a matrix of order 1*M, M is the number of times in historical records, and M < = N is set, the number of dimensions of l is uncertain. Set the term l above to add up to 1, which is l1 + l2 + …… + ln = 1; w is also a one-dimensional matrix whose dimension is N*1, and its purpose is to act as a weight; within a certain period of time, w is a fixed matrix, and w will not change until the system changes the basic settings.

Assume that a node conducts its first comprehensive reputation rating, with no previous transaction volume, violations, elections or vote. The initial wealth of the node is 10, the latency is 50 ms, the jitter is 100 ms, and the network bandwidth is 100 M. According to the equation, the node’s comprehensive reputation rating is 41.55. This score is relatively good at the beginning and gradually increases as the patient participates in system activities continuously.

Voting calculation method

To ensure the security and stability of the blockchain system, this paper combines the comprehensive reputation score with voting and randomly sorts the blocks, as shown in Eqs. (3–6).

$$Z=\sum_{i=1}^{n}{X}_{i}+nT$$

(6)

where Z represents the final election score, Xi represents the voting rights earned by the node, n is the number of nodes that vote for this node, and T is the comprehensive reputation score.

The voting process is divided into stake votes and reputation votes. The more reputation scores and voters there are, the more total votes that are obtained. In the early stages of blockchain operation, nodes have relatively few stakes, so the impact of reputation votes is greater than that of equity votes. This is aimed at selecting the most suitable node as the leader node in the early stage. As an operation progresses, the role of equity votes becomes increasingly important, and corresponding mechanisms need to be established to regulate it. The election vote algorithm used in this paper is shown in Table 5.

Table 5 Election vote counting algorithm.

This paper argues that the election process utilized by the original DPoS consensus mechanism is overly simplistic, as it relies solely on the vote count to select the node that will oversee the entire blockchain. This approach cannot ensure the security and stability of the voting process, and if a malicious node behaves improperly during an election, it can pose a significant threat to the stability and security of the system as well as the safety of other nodes’ assets. Therefore, this paper proposes a different approach to the election process of the DPoS consensus mechanism by increasing the complexity of the process. We set up a threshold and optimized the vote-counting process to enhance the security and stability of the election. The specific performance of the proposed method was verified through experiments.

The election cycle in this paper can be customized, but it requires the agreement of the blockchain committee and general nodes. The election cycle includes four steps: node self-recommendation, calculating the comprehensive reputation score, voting, and replacing the new leader. Election is conducted only among general nodes without affecting the production or verification processes of leader nodes or follower nodes. Nodes start voting for preferred nodes. If they have no preference, they can use the LINK mechanism to collaborate with other nodes and gain additional rewards.

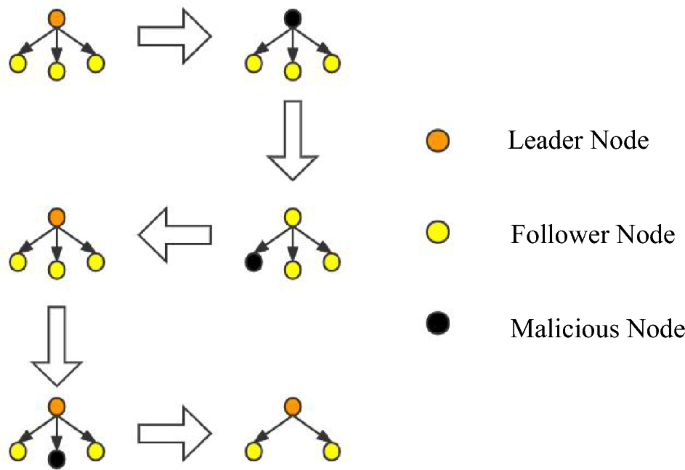

View changes

During the consensus process, conducting a large number of updates is not in line with the system’s interests, as the leader node (LN) and follower node (FN) on each node have already been established. Therefore, it is crucial to handle problematic nodes accurately when issues arise with either the LN or FN. For instance, when a node fails to perform its duties for an extended period or frequently fails to produce or verify blocks within the specified time range due to latency, the system will precisely handle them. For leader nodes, if they engage in malicious behavior such as producing blocks out of order, the behavior is recorded, and their identity as a leader node is downgraded to a follower node. The follower node inherits the leader node’s position, and the nature of their work is transformed as they swap their responsibilities of producing and verifying blocks with their original work. This type of behavior will not significantly affect the operation of the blockchain system. Instead of waiting until the end of the current committee round to punish malicious nodes, dynamic punishment is imposed on the nodes that affect the operation of the blockchain system to maintain system security. The view change operation is illustrated in Fig. 4.

In traditional PBFT, view changes are performed according to the view change protocol by changing the view number V to the next view number V + 1. During this process, nodes only receive view change messages and no other messages from other nodes. In this paper, the leader node group (LN) and follower node group (FN) are selected through an election of the LINK group. The node with LINKi[0] is added to the LN leader node group, while the other three LINK groups’ follower nodes join the FN follower node group since it is a configuration pattern of one master and three slaves. The view change in this paper requires only rearranging the node order within the LINK group to easily remove malicious nodes. Afterward, the change is broadcast to other committee nodes, and during the view transition, the LINK group does not receive block production or verification commands from the committee for stability reasons until the transition is completed.

News

The Hype Around Blockchain Mortgage Has Died Down, But This CEO Still Believes

LiquidFi Founder Ian Ferreira Sees Huge Potential in Blockchain Despite Hype around technology is dead.

“Blockchain technology has been a buzzword for a long time, and it shouldn’t be,” Ferriera said. “It should be a technology that lives in the background, but it makes everything much more efficient, much more transparent, and ultimately it saves costs for everyone. That’s the goal.”

Before founding his firm, Ferriera was a portfolio manager at a hedge fund, a job that ended up revealing “interesting intricacies” related to the mortgage industry.

Being a mortgage trader opened Ferriera’s eyes to a lot of the operational and infrastructure problems that needed to be solved in the mortgage-backed securities industry, he said. That later led to the birth of LiquidFi.

“The point of what we do is to get raw data attached to a resource [a loan] on a blockchain so that it’s provable. You reduce that trust problem because you have the data, you have the document associated with that data,” said the LiquidFi CEO.

Ferriera spoke with National Mortgage News about the value of blockchain technology, why blockchain hype has fizzled out, and why it shouldn’t.

News

New bill pushes Department of Veterans Affairs to examine how blockchain can improve its work

The Department of Veterans Affairs would have to evaluate how blockchain technology could be used to improve benefits and services offered to veterans, according to a legislative proposal introduced Tuesday.

The bill, sponsored by Rep. Nancy Mace, R-S.C., would direct the VA to “conduct a comprehensive study of the feasibility, potential benefits, and risks associated with using distributed ledger technology in various programs and services.”

Distributed ledger technology, including blockchain, is used to protect and track information by storing data across multiple computers and keeping a record of its use.

According to the text of the legislation, which Mace’s office shared exclusively with Nextgov/FCW ahead of its publication, blockchain “could significantly improve benefits allocation, insurance program management, and recordkeeping within the Department of Veterans Affairs.”

“We need to bring the federal government into the 21st century,” Mace said in a statement. “This bill will open the door to research on improving outdated systems that fail our veterans because we owe it to them to use every tool at our disposal to improve their lives.”

Within one year of the law taking effect, the Department of Veterans Affairs will be required to submit a report to the House and Senate Veterans Affairs committees detailing its findings, as well as the benefits and risks identified in using the technology.

The mandatory review is expected to include information on how the department’s use of blockchain could improve the way benefits decisions are administered, improve the management and security of veterans’ personal data, streamline the insurance claims process, and “increase transparency and accountability in service delivery.”

The Department of Veterans Affairs has been studying the potential benefits of using distributed ledger technology, with the department emission a request for information in November 2021 seeking input from contractors on how blockchain could be leveraged, in part, to streamline its supply chains and “secure data sharing between institutions.”

The VA’s National Institute of Artificial Intelligence has also valued the use of blockchain, with three of the use cases tested during the 2021 AI tech sprint focused on examining its capabilities.

Mace previously introduced a May bill that would direct Customs and Border Protection to create a public blockchain platform to store and share data collected at U.S. borders.

Lawmakers also proposed additional measures that would push the Department of Veterans Affairs to consider adopting other modernized technologies to improve veteran services.

Rep. David Valadao, R-Calif., introduced legislation in June that would have directed the department to report to lawmakers on how it plans to expand the use of “certain automation tools” to process veterans’ claims. The House of Representatives Subcommittee on Disability Assistance and Memorial Affairs gave a favorable hearing on the congressman’s bill during a Markup of July 23.

News

California DMV Uses Blockchain to Fight Auto Title Fraud

TDR’s Three Takeaways: California DMV Uses Blockchain to Fight Fraud

- California DMV uses blockchain technology to manage 42 million auto titles.

- The initiative aims to improve safety and reduce car title fraud.

- The immutable nature of blockchain ensures accurate and tamper-proof records.

The California Department of Motor Vehicles (DMV) is implementing blockchain technology to manage and secure 42 million auto titles. This innovative move aims to address and reduce the persistent problem of auto title fraud, a problem that costs consumers and the industry millions of dollars each year. By moving to a blockchain-based system, the DMV is taking advantage of the technology’s key feature: immutability.

Blockchain, a decentralized ledger technology, ensures that once a car title is registered, it cannot be altered or tampered with. This creates a highly secure and transparent system, significantly reducing the risk of fraudulent activity. Every transaction and update made to a car title is permanently recorded on the blockchain, providing a complete and immutable history of the vehicle’s ownership and status.

As first reported by Reuters, the DMV’s adoption of blockchain isn’t just about preventing fraud. It’s also aimed at streamlining the auto title process, making it more efficient and intuitive. Traditional auto title processing involves a lot of paperwork and manual verification, which can be time-consuming and prone to human error. Blockchain technology automates and digitizes this process, reducing the need for physical documents and minimizing the chances of errors.

Additionally, blockchain enables faster verification and transfer of car titles. For example, when a car is sold, the transfer of ownership can be done almost instantly on the blockchain, compared to days or even weeks in the conventional system. This speed and efficiency can benefit both the DMV and the vehicle owners.

The California DMV’s move is part of a broader trend of government agencies exploring blockchain technology to improve their services. By adopting this technology, the DMV is setting a precedent for other states and industries to follow, showcasing blockchain’s potential to improve safety and efficiency in public services.

-

Ethereum12 months ago

Ethereum12 months agoEthereum Posts First Consecutive Monthly Losses Since August 2023 on New ETFs

-

Regulation12 months ago

Regulation12 months agoCryptocurrency Regulation in Slovenia 2024

-

News12 months ago

News12 months agoNew bill pushes Department of Veterans Affairs to examine how blockchain can improve its work

-

Regulation12 months ago

Regulation12 months agoThink You Own Your Crypto? New UK Law Would Ensure It – DL News

-

Regulation12 months ago

Regulation12 months agoUpbit, Coinone, Bithumb Face New Fees Under South Korea’s Cryptocurrency Law

-

Regulation12 months ago

Regulation12 months agoA Blank Slate for Cryptocurrencies: Kamala Harris’ Regulatory Opportunity

-

Regulation12 months ago

Regulation12 months agoBahamas Passes Cryptocurrency Bill Designed to Prevent FTX, Terra Disasters

-

Regulation12 months ago

Regulation12 months agoIndia to Follow G20 Policy for Cryptocurrency Regulation: MoS Finance

-

News1 year ago

News1 year ago“Captain Tsubasa – RIVALS” launches on Oasys Blockchain

-

Ethereum1 year ago

Ethereum1 year agoComment deux frères auraient dérobé 25 millions de dollars lors d’un braquage d’Ethereum de 12 secondes • The Register

-

News12 months ago

News12 months agoEU supports 15 startups to fight online disinformation with blockchain

-

News1 year ago

News1 year agoSolana ranks the fastest blockchain in the world, surpassing Ethereum, Polygon ⋆ ZyCrypto