Bitcoin

Cryptoqueen Ruja Ignatova’s links with Bulgarian underworld are missing

Image source, Shutterstock

Image caption Ruja Ignatova has not been seen since taking a flight from Sofia to Athens in October 2017Article information

- Author, BBC Eye Investigations, Panorama team and The Missing Cryptoqueen podcast

- Function, BBC World Service and BBC News

-

2 hours ago

In September 2019, a BBC podcast began reporting the extraordinary story of Ruja Ignatova, a Bulgarian woman wanted by the FBI after scamming investors out of $4.5 billion (£3.54 billion) through her cryptocurrency fake, before disappearing into thin air.

Now we follow his trail to try to discover his fate. BBC Eye Investigations and Panorama looked into her close ties to an alleged Bulgarian organized crime boss and allegations she was brutally murdered. Did Ignatova enjoy the billions stolen or was she killed by the very people paid to protect her?

Oxford University graduate Ruja Ignatova was born in Bulgaria and raised in Germany, pursuing a successful career in finance before launching the OneCoin cryptocurrency in 2014.

Ignatova convinced millions of people around the world to invest in OneCoin, promising to eclipse the kind of huge returns seen by early Bitcoin investors.

But in reality, Ignatova – known to many as Dr. Ruja – created a cleverly disguised investment fraud without the digital ledger underlying legitimate cryptocurrencies like Bitcoin.

When investigators from Germany and the US approached Ignatova in October 2017, she took an early morning Ryanair flight from Sofia to Athens, and was never seen again.

Over the past year, BBC World Service’s Eye Investigations and Panorama has been trying to find out more about what happened to her and whether she is alive.

The key to this was establishing who his inner circle was.

Richard Reinhardt, who initiated the OneCoin investigation for the US Internal Revenue Service along with the FBI, told the BBC about a key character that investigators have never mentioned publicly before.

The missing Cryptoqueen: dead or alive?

The CEO of fake cryptocurrency OneCoin, Ruja Ignatova, is the FBI’s most wanted woman. She stole billions and then disappeared. New evidence reveals what may have happened. Is she missing or was she murdered?

The BBC understands it is the man who was assigned the role of keeping Ms Ignatova safe – Hristoforos Nikos Amanatidis, commonly known as Taki.

“We were told that supposedly a major drug lord was in charge of his physical security,” Reinhardt told us in his first interview since retiring at the end of 2023.

“Taki appeared more than once, it wasn’t something unique. That was a recurring theme.”

This was in line with information we already had – US government lawyers had said in 2019 that Ms Ignatova’s head of security was a major organized crime figure in Bulgaria, but had not named him.

“We have evidence that a very significant, if not the most prolific, drug trafficker of all time in Bulgaria was closely linked to OneCoin – served as [Ruja Ignatova’s] personal security guard,” said an assistant lawyer.

This was the same “chief of security” who another U.S. government lawyer said was “involved in the disappearance” of Ms. Ignatova in court a day earlier.

Image caption Richard Reinhardt, the former IRS investigator who opened the OneCoin case

According to Reinhardt, Ignatova was a much more sophisticated criminal than most people realize.

“This is like a white-collar criminal combined with a drug dealer or a mobster on steroids.”

This theory appears to be supported by leaked Europol documents, seen by the BBC, which show that – before Ignatova’s disappearance in 2017 – Bulgarian police had established links between her and Taki.

In the documents, police suspect that Taki is using OneCoin’s financial network to launder proceeds from drug trafficking.

In his native Bulgaria, Taki has an almost mythical status – an El Chapo or Pablo Escobar. He is widely suspected of being the head of a Bulgarian organized crime organization and a prolific drug smuggler. He and his associates were investigated there for armed robbery, drug smuggling and murder, but he was never successfully prosecuted for anything.

Image caption: At the same time, Taki was the subject of an Interpol “Red Notice”

“When we talk about Taki, he is the boss of the mafia in Bulgaria. He is extremely powerful,” says a former Bulgarian deputy minister, Ivan Hristanov, who in 2022 investigated allegations that Taki ran a criminal network with the help of corrupt officials – and believes this was the case.

“Taki is the ghost. You will never see it. You only hear about him. He is speaking to you through other people. If you don’t listen, you will simply disappear from the earth.”

“The only person who can protect her [Ignatova] of all these investigations, including by foreign agencies – it was Taki.”

The BBC has written to the Bulgarian government about allegations regarding corrupt officials. Did not answer. The Public Prosecutor’s Office in the capital, Sofia, states that it “does not cover up crimes and people who possibly committed crimes”.

Taki is now believed to live in Dubai, where Ignatova purchased a luxury penthouse and where her bank accounts received tens of millions of dollars from the OneCoin fraud.

While it is not known how Taki and Ignatova met, or whether he was involved with OneCoin from the beginning, several sources say they had a close personal relationship and that he was her daughter’s godfather.

A Bulgarian source close to Ignatova told the BBC she may have paid Taki up to 100,000 euros a month for protection.

There appear to be other financial ties between Ignatova and Taki.

Europol documents mention a complex agreement for the sale of land on the Bulgarian Black Sea coast that links one of Ignatova’s companies to Taki’s wife.

The secret police documents were passed on to the BBC by Frank Schneider, a former spy and advisor to Ignatova, who has since disappeared.

He told us that his old boss worked with “con artists” and “gangsters.”

Image caption: A few months after speaking to us, Frank Schneider also disappeared

When we interviewed Mr. Schneider at his home in France, he was under house arrest, awaiting extradition to the US in connection with the OneCoin scam. He was not, however, prepared to reveal names.

“I’m not going to say who it is, because I have a family… This is a very serious organized crime.”

But in the end, Ignatova’s protector may have become an aggressor.

In 2022, Bulgarian investigative journalist Dimitar Stoyanov and his colleagues at the investigative media outlet bird.bg received a police report that was found in the home of a murdered Bulgarian police officer.

In the document, a police informant details hearing Taki’s drunken brother-in-law say that Ms. Ignatova had been murdered on Taki’s orders in late 2018, and her body was dismembered and dumped on a yacht in the Ionian Sea. Stoyanov says this account is “very, very possible.”

The authenticity of the police document has been confirmed by Bulgarian authorities, and several of Taki’s criminal associates believe the theory that he murdered her is true, says Stoyanov.

However, the BBC was unable to independently verify the claim.

The associates’ justification is that the sought-after Ms. Ignatova became a liability to Taki, who wanted to eliminate her links to the OneCoin fraud.

These associates include Krasimir Kamenov, known as Kuro, wanted by Interpol on murder charges.

Stoyanov says that Kuro told him that he heard Taki discuss his criminal dealings in front of Ignatova, and when Kuro challenged Taki about whether he should do that, Taki replied, “Don’t worry, she’s as good as dead. ”

Kuro also claimed to have spoken to the CIA about Taki, including about the allegation that Taki had ordered the murder of Ms. Ignatova. Sources close to Kuro confirmed to the BBC that this meeting took place in late 2022.

In May 2023, Kuro was murdered in his Cape Town home, along with his wife and two other people who worked for him. South African police are still searching for the killers, but former Bulgarian deputy minister Hristanov believes Kuro’s murder is linked to Taki.

“Certain people had to be removed because they knew too much about Taki.

“It was a kind of public execution that looked more like a declaration. Be careful who you deal with,” he told us.

Since the publication of allegations of Ignatova’s murder, journalist Dimitar Stoyanov says he and his colleagues have faced death threats, forcing him to temporarily leave Bulgaria for the fourth time in his career.

Stoyanov does not claim to know the motive for any alleged murder, but property records show, and eyewitnesses have told him, that since his disappearance, several of his Bulgarian properties are now being used by people linked to Taki.

Image caption, Evidence suggests Ruja Ignatova’s mansions are now being used by people linked to Taki

Taki was never arrested for claiming he ordered Ms. Ignatova’s murder. Her body was never found and investigators say they do not have enough evidence to prosecute.

But former IRS investigator Richard Reinhardt thinks Ignatova is probably dead. While he hasn’t seen any evidence linking her death to Taki, he says it fits with how drug cartels operate.

“There is no honor among thieves… knowing how violent the cartels are, if [Taki] thought she was a threat to him… he would probably kill her rather than get caught.

The BBC has written to Taki’s lawyers about the allegations in this investigation – they have not responded.

In 2022, Ignatova was placed on the FBI’s Ten Most Wanted list – where she remains to this day.

The BBC team behind The Missing Cryptoqueen podcast has received several sightings and tips about Ms Ignatova’s whereabouts following her alleged murder – including details of a botched police operation in Greece to capture her in 2022.

It could be that the rumors about his death are just another brilliant ploy to throw everyone off the scent.

If that’s the case, as the years go by, it’s likely to become increasingly difficult for her to continue running away.

“At some point it looks like Elvis Presley might still be alive… It’s not very likely,” says Hristanov.

According to Reinhardt, the FBI “not only keeps people in [the] Top ten list for fun.” But they would only remove someone if there was “definitive proof” that they were dead. And given the circumstances, with Ruja Ignatova there may never be.

And that means that, at least for now, the missing Cryptoqueen remains a hunted woman.

If you have information about Dr Ruja Ignatova you can email BBC journalists at cryptoqueen@bbc.co.uk

Bitcoin

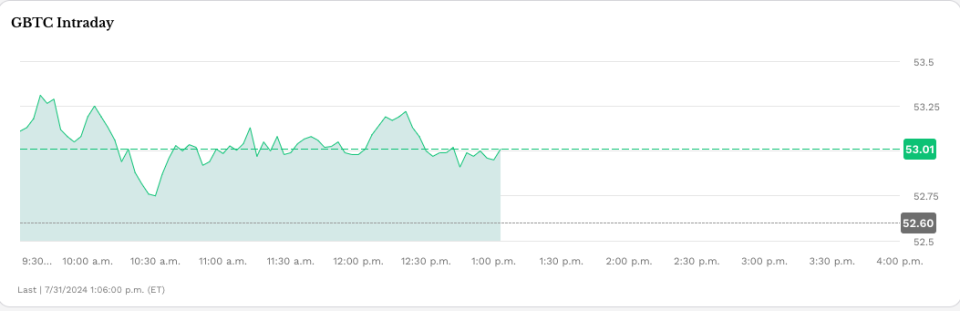

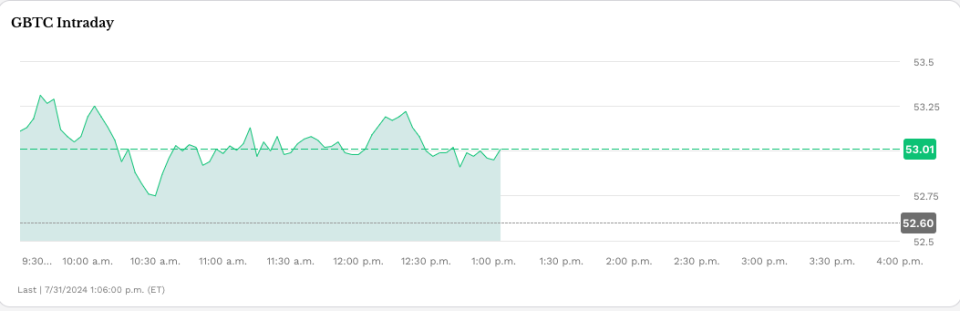

Grayscale Unveils Bitcoin Mini Trust ETF

Bitcoin Currency

Grayscale Investments The Bitcoin Mini Trust began trading on Wednesday with a 0.15% expense ratio, offering a lower-cost option for bitcoin exposure in the market.

The Mini Trust, which has the symbol BTC and trades on NYSE Arca, is structured as a spin-off of the Grayscale Bitcoin Trust (GBTC). New shares will be distributed to existing GBTC shareholders with the fund contributing a portion of its bitcoin holdings to the new product. According to a company press releaseBTC’s S-1 registration statement became effective last week.

“The Grayscale team has believed in the transformative potential of Bitcoin since the initial launch of GBTC in 2013, and we are excited to launch the Grayscale Bitcoin Mini Trust to help further lower the barrier to entry for Bitcoin in an SEC-regulated investment vehicle,” said David LaValle, Senior Managing Director and Head of ETFs at Grayscale.

The Bitcoin Mini Trust’s debut comes amid growing interest in ETFs based on the current price of the two largest cryptocurrencies by market cap, bitcoin and ether. Spot bitcoin ETFs have generated nearly $18 billion in inflows since the first ones began trading on Jan. 11, though GBTC has lost nearly $19 billion in assets.

This fund differs from other funds because it is a conversion of an existing fund and has a 1.5% fee, the highest among spot bitcoin products that have received SEC approval this year.

Mini Bitcoin Trust Low Fee

On a Post X On Wednesday, Bloomberg senior ETF analyst Eric Balchunas noted the Bitcoin Mini Trust’s “lowest fee in the category…”

“[Important] to recognize how incredibly cheap 15bps is — about 10x cheaper than spot ETFs in other countries and other vehicles,” Balchunas wrote, adding that this pricing strategy reflects the competitive nature of the U.S. ETF market, which he referred to as the “ETF Terrordome.”

“This is what Terrordome does to fund [cost]. It reaches 1.5% [and] end in 0.15%, how to go from [a] country club to the jungle. But that’s why all the flows are here, investor paradise,” he noted.

Read more: Spot Bitcoin ETF Inflows Hit Daily High of Over $1 Billion

Bitcoin was recently trading at around $66,350, virtually flat since U.S. markets opened on Wednesday.

Grayscale also offers two spot Ethereum ETFs, the Grayscale Ethereum Trust (ETHE) and the Grayscale Ethereum (ETH) Mini Trustwhose performance is based on ETHE. ETHE outflows exceeded $1.8 billion in its first six days of trading, while ETH added more than $181 million in the same period, according to Farside. The remaining seven ETFs generated about $1.2 billion in inflows.

The story continues

Read more: Spot Ethereum ETFs Approved to Start Trading

Permanent link | © Copyright 2024 etf.com. All rights reserved

Bitcoin

Bitcoin (BTC) Price Drops Below $65K After FOMC as Middle East Tensions Rise

Cryptocurrencies fell sharply on Wednesday as rising geopolitical risks captivated investors’ attention following the conclusion of the Federal Reserve’s July meeting.

Bitcoin (BTC) fell to $64,500 from around $66,500, where it traded following Federal Reserve Chairman Jerome Powell’s press conference and is down more than 2% in the past 24 hours. Major altcoins including ether (ETH)sunbathing (SUN)Avalanche AVAX (AVAX) and Cardano (ADA) also fell, while Ripple’s XRP saved some of its early gains today. The broad cryptocurrency market benchmark CoinDesk 20 Index was 0.8% lower than 24 hours ago.

The liquidation happened when the New York Times reported that Iran’s leaders have ordered retaliation against Israel over the killing of Hamas leader Ismail Haniyeh in Tehran, raising the risk of a wider conflict in the region.

Earlier today, the Fed left benchmark interest rates unchanged and gave little indication that a widely expected rate cut in September is a given. The Fed’s Powell said that while no decision has been made on a September cut, the “broad sense is that we are getting closer” to cutting rates.

While digital assets suffered losses, most traditional asset classes rose higher during the day. U.S. 10-year bond yields fell 10 basis points, while gold rose 1.5% to $2,450, slightly below its record highs, and WTI crude oil prices rose 5%. Stocks also rallied during the day, with the tech-heavy Nasdaq 100 index rebounding 3% and the S&P 500 closing the session 2.2% higher, led by 12% gains in chipmaker giant Nvidia (NVDA).

The different performances across asset classes could be due to traders’ positioning ahead of the Fed meeting, Zach Pandl, head of research at Grayscale, said in an emailed note.

“Equities may have been slightly underutilized after the recent dip, while bitcoin is coming off a strong period with solid inflows, while gold has recovered after a period of weakness,” he said.

“Overall, the combination of Fed rate cuts, bipartisan focus on cryptocurrency policy issues, and the prospect of a second Trump administration that could advocate for a weaker U.S. dollar should be viewed as very positive for bitcoin,” he concluded.

UPDATE (July 31, 2024, 21:30 UTC): Adds grayscale comments.

Bitcoin

Donald Trump’s Cryptocurrency Enthusiasm Is Just Another Scam

Former US President Donald Trump spoke at the Libertarian National Convention in May and lent his a strong support to crypto: “I will also stop Joe Biden’s crusade to crush crypto. … I will ensure that the future of crypto and the future of bitcoin is made in the US, not taken overseas. I will support the right to self-custody. To the 50 million crypto holders in the country, I say this: With your vote, I will keep Elizabeth Warren and her henchmen out of your bitcoin.”

Former US President Donald Trump spoke at the Libertarian National Convention in May and lent his a strong support to crypto: “I will also stop Joe Biden’s crusade to crush crypto. … I will ensure that the future of crypto and the future of bitcoin is made in the US, not taken overseas. I will support the right to self-custody. To the 50 million crypto holders in the country, I say this: With your vote, I will keep Elizabeth Warren and her henchmen out of your bitcoin.”

Trump continued to court the cryptocurrency industry in the months that followed; he he appeared at the Bitcoin 2024 Conference in Nashville this week, along with independent presidential candidate Robert F. Kennedy Jr.’s parting words to Trump — “Have fun with your bitcoin, your cryptocurrency and whatever else you’re playing with” — were less than enthusiastic, but the industry itself remains packed with ardent Trump supporters.

This turnaround came as a surprise, given Trump’s previous strong opposition to cryptocurrency. When Facebook was floating its Libra cryptocurrency in 2019, Trump tweeted: “I am not a fan of Bitcoin and other cryptocurrencies, which are not money, and whose value is highly volatile and based on thin air.” Former national security adviser John Bolton’s White House memoir, The Room Where It Happened, quotes Trump as telling Treasury Secretary Steven Mnuchin: “Don’t be a trade negotiator. Go after Bitcoin.” [for fraud].” In 2021, Trump counted Fox Business that bitcoin “just looks like a scam. … I want the dollar to be the world’s currency.”

Why the change? There doesn’t seem to be any crypto votes. Trump’s “50 million” number comes from a poorly sampled push survey by cryptocurrency exchange Coinbase which claimed 52 million cryptocurrency users in the United States starting in February 2023. But one survey A survey conducted last October by the US Federal Reserve showed that only 7% of adults (about 18.3 million people) admitted to owning or using cryptocurrencies — down from 10% in 2022 and 12% in 2021. Many of these people are likely wallet owners who were left holding the bag after crypto plunged in 2022 — and are not necessarily new fans.

What Trump wants from the cryptocurrency industry is money. The cryptocurrency industry has already raised more than US$ 180 million to run in the 2024 US elections through his super PACs Fairshake, Defend American Jobs and Protect Progress.

Fairshake spent $10 million on taking Rep. Katie Porter in the primary battle for Dianne Feinstein’s California Senate seat by funding Porter’s pro-crypto rival Adam Schiff. This put $2 million to knock out Rep. Jamaal Bowman in the Democratic primary for New York’s 16th District in favor of pro-crypto George Latimer. In the Utah Senate Republican primary, Rep. John Curtis defeated Trent Staggs with the help of $4.7 million from Defend American Jobs. In Alabama’s House District 2, the majority of campaign expenses came from the cryptocurrency industry.

Fairshake is substantially financed by Coinbase, cryptocurrency issuer Ripple Labs, and Silicon Valley venture capital firm Andreessen Horowitz, or a16z. Silicon Valley was awash in cryptocurrencies during the 2021 bubble, and a16z in particular continues to promote blockchain startups to this day — and still holds a huge amount of bubble crypto tokens that he wishes he could cash in on.

Many in Silicon Valley would like an authoritarian who they think will let them run wild with money — while bailing them out in tough times. Indeed, Trump promised Bitcoin 2024 participants that he hold all bitcoins that the United States acquires. (Never mind that it is usually acquired as the proceeds of crime.) Silicon Valley explicitly sees regulation of any kind as its greatest enemy. Three a16z manifestos — “Politics and the Future” It is “The Techno-Optimist Manifesto” and 2024 “The Small Tech Agenda—describe co-founders Marc Andreessen and Ben Horowitz’s demands for a technology-powered capitalism unhindered by regulation or social considerations. They name “experts,” “bureaucracy,” and “social responsibility” as their “enemies.” Their 2024 statement alleges that banks are unfairly cutting off startups from the banking system; these would be crypto companies funded by a16z.

Trump’s vice presidential pick, Senator J.D. Vance, is a former Silicon Valley venture capitalist. He was once employed by Peter Thiel, who bankrolled Vance’s successful 2022 Senate run; Vance has been described as a “Thiel creation”. He has increased support for the Trump ticket among his venture capital associates. Vance is a bitcoin holder and a frequent advocate of encryption. He recently released a draft bill to review how the Securities and Exchange Commission (SEC) and the Commodity Futures Trading Commission (CFTC) control crypto assets. In 2023, he circulated a bill to prevent banks from cutting out cryptocurrency exchanges.

Minimal regulation has been tried before. It led to the wild exuberance of the 1920s, which ended with the Black Tuesday crash of 1929 and the Great Depression of the 1930s. Regulators like the SEC were put in place during this era to protect investors and transform the securities market from a jungle into a well-tended garden, leading to many prosperous and stable decades that followed.

Crypto provides the opposite of a stable and functional system; it is a practical example of how a lack of regulation allows opportunists and scammers to cause large-scale disasters. The 2022 Crypto Crash repeated the 2008 financial crisis in miniature. FTX’s Sam Bankman-Fried was feted as a financial prodigy who would perform economic miracles if you just gave him carte blanche; he ended up stealing billions of dollars of customers’ money, destroying the lives of ordinary people, and is now in a prison cell.

U.S. regulators have long been concerned about the prospect of cryptocurrency contagion to the broader economy. Criminal money laundering is rampant in cryptocurrency; even the Trump administration has made rules in December 2020 to reduce the risk of money laundering from crypto. Meanwhile, the crypto industry has persistently tried to infiltrate systemically risky corners of the economy, such as pension funds.

Four U.S. banks collapsed during the 2023 banking crisis, the first since 2020. Two of them, Silvergate Bank and Signature Bank, were deeply embedded in the crypto world — Silvergate in particular appears to have collapsed directly from its heavy reliance on FTX and failed a few months after that. Silicon Valley Bank was not involved in crypto but collapsed due to a run on the bench due to panic among venture capital deposit holders, particularly Thiel’s Founders Fund.

Project 2025the Heritage Foundation mammoth conservative wish list The plan, which Trump and Vance have both endorsed and tried to distance themselves from at various times, emphasizes the importance of party loyalists, noting especially financial regulation. The plan recommends replacing as much of the federal bureaucracy as possible with loyalists and “trusted” career officials rather than nonpartisan “experts.” Vance defended in 2021 that Trump should “fire every mid-level bureaucrat, every civil servant in the administrative state” and “replace them with our people.” Loyalty will likely trump competence.

Crypto is barely mentioned directly in Project 2025 — suggesting it has little active support among the broader conservative coalition. But near the end of the manifesto is a plan to dismantle most U.S. financial regulations and investor protections put in place since the 1930s, suggesting the exemption the crypto industry seeks from current SEC and CFTC regulations.

Bitcoin, the first cryptocurrency, started as an ideological project to promote a strange variant of Murray Rothbard’s anarcho-capitalism and the Austrian gold-backed economy—the kind we abandoned to escape the Great Depression. Crypto quickly co-opted the “end of the Fed” and “establishment elites” conspiracy theories of the John Birch Society and Eustace Mullins. It’s a way for billionaire capitalists like Thiel, Andreessen and Elon Musk to claim they’re not part of the so-called elite.

If a second Trump administration were to limp along with financial regulators and allow cryptocurrencies to have free rein, it could help foster the collapse of the U.S. economy that bitcoin claimed to prevent. But Trump is more likely to be happy to take the crypto money and run.

Bitcoin

Trump’s Bitcoin (BTC) Reserve Plan Seen as Just a ‘Small Token Stash’

Donald Trump’s recent promise to create a “strategic national stockpile of Bitcoin” may not turn out to be as big a commitment as the hype surrounding the announcement makes it seem.

“Trump’s proposal is extremely modest,” said George Selgin, director emeritus of the Center for Monetary and Financial Alternatives at the Cato Institutea Washington-based public policy group. “It doesn’t have much economic implication.”

-

Ethereum12 months ago

Ethereum12 months agoEthereum Posts First Consecutive Monthly Losses Since August 2023 on New ETFs

-

Regulation12 months ago

Regulation12 months agoCryptocurrency Regulation in Slovenia 2024

-

News12 months ago

News12 months agoNew bill pushes Department of Veterans Affairs to examine how blockchain can improve its work

-

Regulation12 months ago

Regulation12 months agoThink You Own Your Crypto? New UK Law Would Ensure It – DL News

-

Regulation12 months ago

Regulation12 months agoUpbit, Coinone, Bithumb Face New Fees Under South Korea’s Cryptocurrency Law

-

Regulation12 months ago

Regulation12 months agoA Blank Slate for Cryptocurrencies: Kamala Harris’ Regulatory Opportunity

-

Regulation12 months ago

Regulation12 months agoBahamas Passes Cryptocurrency Bill Designed to Prevent FTX, Terra Disasters

-

Regulation12 months ago

Regulation12 months agoIndia to Follow G20 Policy for Cryptocurrency Regulation: MoS Finance

-

News1 year ago

News1 year ago“Captain Tsubasa – RIVALS” launches on Oasys Blockchain

-

Ethereum1 year ago

Ethereum1 year agoComment deux frères auraient dérobé 25 millions de dollars lors d’un braquage d’Ethereum de 12 secondes • The Register

-

News12 months ago

News12 months agoEU supports 15 startups to fight online disinformation with blockchain

-

News1 year ago

News1 year agoSolana ranks the fastest blockchain in the world, surpassing Ethereum, Polygon ⋆ ZyCrypto