Ethereum

Cardano (ADA) Price Surges 40% as $240M ETF and Ethereum Emerge as Bullish Catalysts

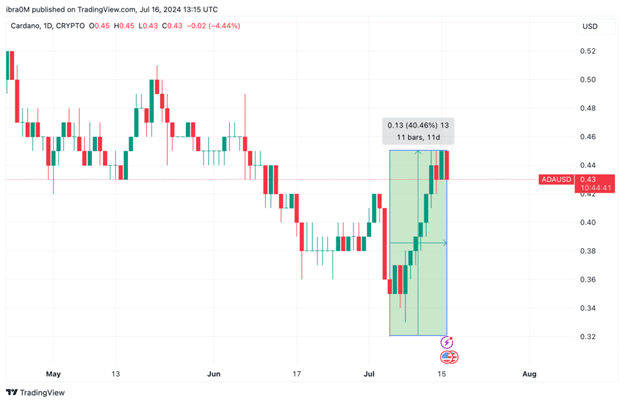

Cardano (ADA) has seen a significant price rally, trading at $0.44, up 40% in the last ten days, fueled by several internal and external factors that are generating renewed investor interest and optimism.

Cardano Price Surpasses $0.45 for First Time in 10 Days

After hitting all-time lows on Friday, July 5, a positive shift in the U.S. macroeconomic environment provided a favorable backdrop for ADA’s recent rally. Positive data on nonfarm payrolls (NFP) and the consumer price index (CPI) boosted investor confidence in the economic outlook, supporting the overall cryptocurrency market.

Additionally, anticipation of Ethereum ETFs set to launch soon has spilled over into the altcoin market, including Cardano, as investors look for promising opportunities beyond Bitcoin and Ethereum.

The chart above shows how the ADA price had slipped to a 2024 low of $0.32 on July 5. But following recent dovish macroeconomic reports, bulls have returned to ADA markets with intensity.

On Tuesday, July 16, ADA price briefly retested the $0.45 territory, marking a 40% rally over the past 10 trading days. While Cardano’s price uptrend mirrors the broader cryptocurrency market, on-chain data shows that some internal bullish catalysts are also in play.

Cardano TVL hits $240 million amid market rally

One of the main factors behind this price rally is the growth in total value locked (TVL) within Cardano’s decentralized finance (DeFi) ecosystem. According to DeFiLlama, TVL has increased dramatically, starting the year below 200 million ADA and now exceeding 682 million ADA.

Projects like collateralized debt protocol Indigo and decentralized exchange Minswap have both surpassed $50 million in TVL, reflecting strong adoption and engagement.

At current prices, the total value of assets deposited on the Cardano blockchain network has now surpassed $240 million for the first time in 3 weeks. Typically, an increase in TVL is often considered a major bullish signal for the native token for several reasons.

First, Cardano’s rising TVL is a strong indicator of increasing daily active addresses and transaction volumes, indicating strong network engagement. Second, it also indicates a slowdown in selling pressure as more tokens are locked up. This decrease in market supply could further accelerate ADA’s price rally, if the bulls remain in control.

Cardano Price Prediction: $0.50 Target in Sight

Cardano (ADA) has been on a notable uptrend, trading at $0.43 after a 40% increase over the past 11 days. This upward momentum is reflected in the strong performance of key technical indicators, suggesting that the cryptocurrency could soon test the $0.50 resistance level.

The daily chart shows a robust uptrend, with ADA managing to climb from a recent low of $0.31 to its current price, supported by a positive Accumulation/Distribution Line (ADL).

This indicator suggests a steady inflow of capital into ADA, highlighting growing investor confidence. The Parabolic SAR (Stop and Reverse) dots are well below the current price, indicating a sustained uptrend and providing a short-term support level around $0.35.

The Relative Strength Index (RSI) is also in a favorable position, currently at 56.36, which is just below the overbought territory. This suggests that there is still room for further price appreciation before ADA becomes overvalued. Recent price action has seen ADA consolidate its gains around $0.43, creating a solid base for a potential breakout.

If ADA manages to break above the immediate resistance at $0.45, the next target would be $0.50. Beyond this level, the Fibonacci extension tool points to a potential rally towards $0.55, which could be an important milestone for Cardano. Conversely, if the price pulls back, strong support is likely to be found at $0.40 and $0.35, ensuring that any pullbacks will be quickly contained.

Disclaimer: This content is informational and should not be considered financial advice. The opinions expressed in this article may include the personal opinions of the author and do not reflect the opinion of The Crypto Basic. Readers are encouraged to conduct thorough research before making any investment decisions. The Crypto Basic is not responsible for any financial losses.

-Advertisement-