Ethereum

Bitcoin Investments Surge With $519 Million Inflows, While Ethereum Sees $284.9 Million Outflows

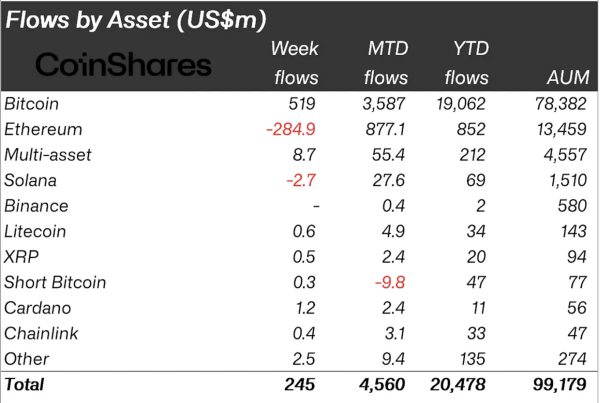

Digital asset investment products saw relatively modest inflows of $245 million last week, reflecting mixed performance across digital assets.

This would have happened despite trading volumes reaching $14.8 billion, the highest level since May, thanks to recent Ethereum ETF launches.

Price appreciation pushed total assets under management (AuM) to $99.1 billion, with year-to-date (YTD) inflows reaching a record $20.5 billion.

Bitcoin Leads Inflows, Ethereum Faces Outflows

According to the CoinShares report, Bitcoin notably led the way with robust inflows of $519 million, bringing its monthly inflows to $3.6 billion and its YTD inflows to a record $19 billion. This increase is attributed to US election commentary positioning Bitcoin as a potential strategic asset reserve asset and increased expectations for a Federal Reserve rate cut in September 2024.

Conversely, Ethereum saw significant outflows of $284.9 million last week. Despite this, Ethereum’s MTD inflows stand at $877.1 million, indicating broader positive sentiment.

Multi-asset funds saw moderate inflows of $8.7 million, while Solana saw a minor outflow of $2.7 million. Other assets such as Litecoin, XRP, Cardano, Chainlink, and Short Bitcoin saw small inflows ranging from $0.3 million to $2.5 million. Notably, “Short Bitcoin” saw a significant inflow of $47 million year-to-date despite recent outflows.

Diversified suppliers attract inbound flows

In addition, the launch U.S. cash-based Ethereum ETFs have attracted substantial market activity, marking the largest inflows since December 2020.

Grayscale Investments LLC/U in particular experienced significant weekly and year-to-date outflows, with the latter reaching $19 billion, reflecting a shift in investor sentiment. iShares ETFs/USA emerged as a dominant player, recording the highest weekly inflow of $1.2 billion and year-to-date inflows of $20 billion. Fidelity ETFs/USA also saw strong inflows across all periods, with weekly inflows of $30 million.

Meanwhile, 21Shares AG and ARK 21 Shares/USA saw moderate inflows, with YTD inflows of $21 million and $2.6 billion, respectively. Bitwise ETFs/USA reported positive YTD inflows of $2.1 billion, suggesting moderate investor interest. CoinShares XBT and Purpose Investments Inc ETF saw outflows, with YTD outflows of $378 million and $450 million, respectively.

US dominates all regional measures

At the regional level, the UNITED STATES The US led all measures, with the highest weekly inflow of $272 million, MTD inflows of $4.3 billion, and YTD inflows of $20.7 billion. The US also had the largest AUM of $76 billion. Germany faced significant outflows across all periods, with a weekly outflow of $59.6 million, an MTD outflow of $75.5 million, and a YTD outflow of $325 million.

Canada, despite a notable outflow of $489 million since the beginning of the year, posted positive weekly and monthly inflows of $2.5 million and $46.5 million, respectively. Switzerland reported strong inflows, particularly monthly inflows of $189.7 million, reflecting positive investor sentiment.

Australia, Brazil and Hong Kong saw overall positive inflows, with year-to-date inflows of $64 million, $168 million and $363 million respectively. Sweden saw outflows in most periods, with a weekly outflow of $2.6 million, a year-to-date outflow of $4.9 million and a year-to-date outflow of $331 million. Other regions contributed moderate inflows, with year-to-date inflows of $17 million, improving overall market diversity.

Disclaimer: This content is informational and should not be considered financial advice. The opinions expressed in this article may include the personal opinions of the author and do not reflect the opinion of The Crypto Basic. Readers are encouraged to conduct thorough research before making any investment decisions. The Crypto Basic is not responsible for any financial losses.

-Advertisement-