Bitcoin

Bitcoin Creates New Environmental Injustices for Black Texas

Bitcoin is more than just a shiny new way to lose money. It’s also fueling Texas’ energy woes as the state braces for another year of record-breaking heat. And communities of color are caught in the crosshairs of climate change, those sprawling data centers, and the power plants needed to meet both demands.

Last year, during the deadliest summer in Texas history, Black people bore the brunt of the heat. Stories like the deaths of a 5-day-old Black infant and a 66-year-old Black postal worker from heat illness led to national indignation. The brutal summer only fueled the fire that the state’s power grid operator, the Electric Reliability Council of Texas, has spent years trying to put out.

After a 2021 winter storm revealed just how unprepared the state was for severe weather, Texas was searching for ways to ensure it would be producing enough electricity in times of disaster.

Their solution: new fossil fuel-powered power plants.

But while the state says these new power plants meet demand caused by severe weather and population growth, a new ERCOT Forecast says that as the state’s energy demand doubles over the next six years, most of the demand will come from water and energy consumer data centers for artificial intelligence supercomputers and cryptography processing.

Essentially, this means the state is building polluting power plants that have historically decimated black communities, in part for industries that experts say are increasing economic inequality and discrimination against black Americans.

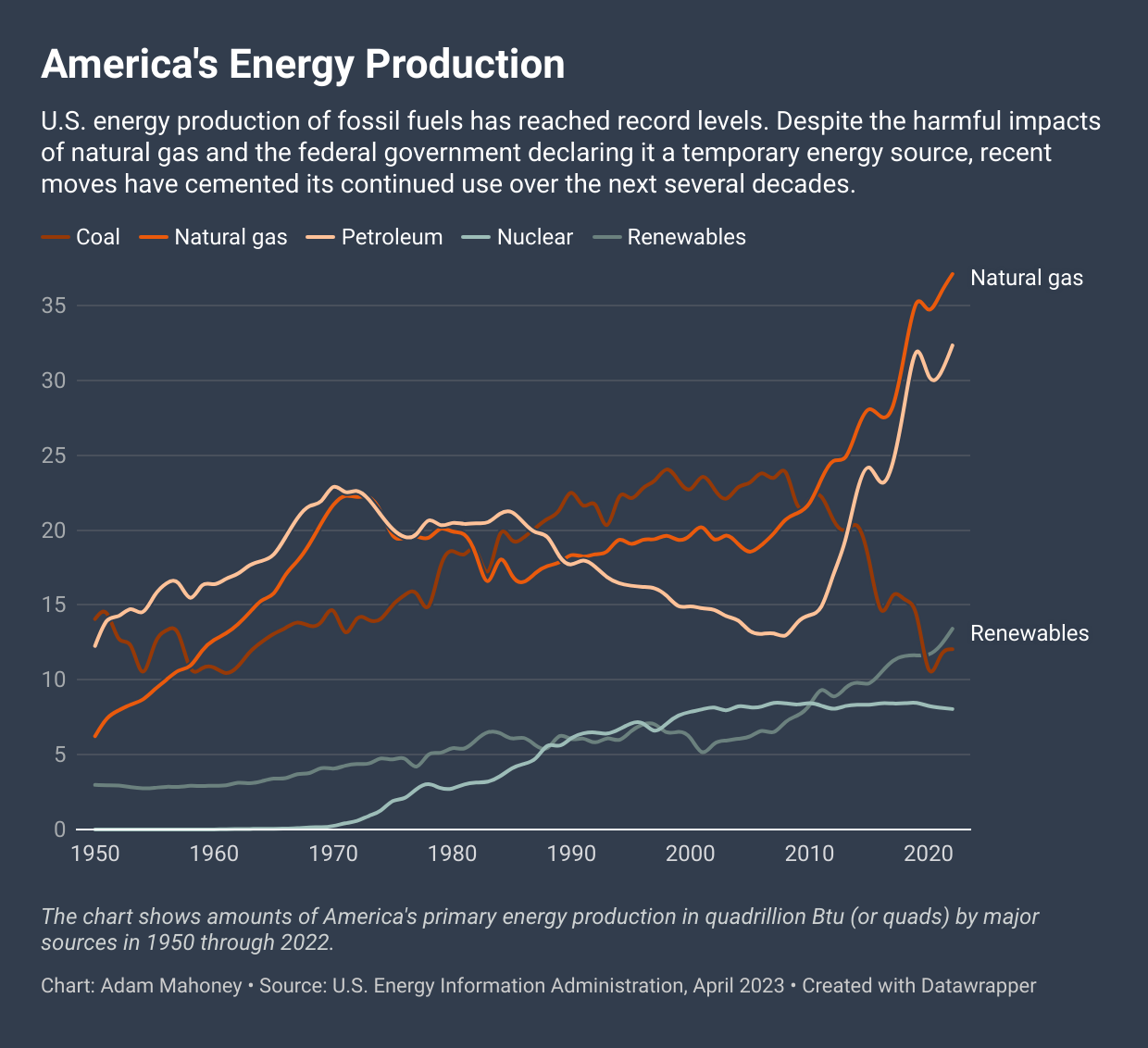

Despite analysis showing that clean energy sources such as wind and solar are far more reliable and cheaper to produce than energy from fossil fuels, in the aftermath of last summer the state decided to subsidize New gas-fired power plants worth $10 billion.

Across the country, low-income black people are most exposed to pollution from power plants and have the higher risk of death of such pollution. In Texas, more than 75 percent of the state’s gas-fired power plants are in areas where the population has a higher-than-average share of people of color, according to a Capital B analysis of EPA data.

Early documents reviewed by Capital B show that the trend of placing these facilities in communities of color may continue. Of the companies that requested financing and stated that where they would build new factories, about half, or 45 percent, would be in communities with above-average black populations.

“They’re trying to use these ‘volatile’ weather events, the freezing and the heat, as justification for all these new gas plants,” Brittney Stredic told Capital B last year. She’s part of a coalition of community members who have been fighting for a new gas plant and pipeline in her Houston neighborhood for several years. “But we don’t need it.”

Read more: A gas storage plant and new pipeline disrupt life in this black community

Although Texas has recently established itself as the emerging country US renewable energy capitalThese measures signal a setback for the state — and for the climate.

Climate change and the intensified nature of winter and summer are largely caused by the burning of fossil fuels. And Texas’ response is to align itself with industries that have been shown to harm Black communities, experts say.

“There are so many downsides to cryptocurrencies, but unfortunately, the industry has a lot of money, and recently it has been using its money to get favorable policies in Washington, D.C., and places like Texas,” said Algernon Austin, director of Race and Economic Justice at the Center for Economic and Policy Research. Austin has spent years researching how the speculative get-rich-quick scheme targets the country’s most vulnerable.

“Cryptocurrencies are a shiny new way to lose money. The analysis that has been done suggests that, if anything, it has worked to increase inequality,” he added. “It is worrying that it is creating an environmental problem on top of all this.”

Artificial intelligence and cryptomining are immensely energy- and water-intensive due to the power required to process complex algorithms and transactions. As these supercomputers, which are typically three times the size of an average U.S. home, operate, they generate enormous amounts of heat that require continuous cooling — and demand for electricity.

Texas already consumes more energy than any other state, and the pollution from that consumption is palpable. Despite being home to 9 percent of the nation’s population, the state is responsible for 13 percent of all pollution from power plants and 15 percent of all pollution from natural gas plants.

The get-rich-quick mentality

It’s not Texas’ fault that the country’s new state passion for these energy intensive uses of the Internet is driving the need for energy. The energy required to run a single AI search, for example, is between 10 and 30 times the energy required to run a traditional Google search. However, its continued drive to attract business above almost all other considerations can be credited to the state.

Texas residents and experts say that in many ways, the state’s energy woes are driven by a get-rich-quick mentality that prioritizes attractive deals over the resulting strain on the power grid, water sources and rapid population growth.

But the state’s plight exemplifies the crossroads the country finds itself at as it tries to strengthen its power grids: one that can support the most vulnerable populations, like communities of color living near fossil fuel-fired power plants, or align itself with industries that further exacerbate the problems.

Entergy CEO and President Eliecer Viamontes cited that statewide desire as a reason behind his company’s decision to build new fossil fuel power plants in Texas. His company is one of two that have filed applications to open new gas-fired power plants in a predominantly Black and Latino suburb of Houston, where some neighborhoods already face cancer risks from air pollution 46 times higher than federal limits.

“We have to think about how this aligns with what the leadership of the state of Texas is pushing, which is that we have to be the number one state for business, the number one state for economic growth,” Viamontes he said. Without the new plants, he said, “There is a risk of losing economic growth in the region.”

But economic growth for whom, Austin wonders. The rise in cryptofinance in particular, a tool initially marketed as a way to reduce economic inequality, shows that mindset can work directly against improving lives in Black communities.

As state residents were hit by triple-digit heat in August, the grid operator gave millions of dollars for Bitcoin mining and data center companies to stop using so much energy. It’s a tactic Texas may have to use again for several summers to come. (To keep air conditioning running, that summer the state also obtained an emergency order from the U.S. Department of Energy allowing power plants to exceed pollution limits to produce more energy. That left communities of color facing the dual threat of suffocating heat and air pollution.)

“We’ve been incredibly misinformed because our local leaders haven’t made it a priority to talk to us about what’s going on,” said Kimberlee Walter, an activist in a Texas community that’s home to a crypto finance company that received $32 million last summer to use less energy. “These companies are wasting precious resources, driving up our energy bills and destabilizing an already very unstable grid.”

Meanwhile, in recent years, research has found that black people are more probable than white people to invest in cryptocurrencies and are more likely to incorrectly believe that the industry is regulated and safe. Black crypto investors are also more likely than white crypto investors to say they have borrowed money to make their investments.

Cryptocurrency has also increased costs for those who haven’t even invested in the coin. In Texas, it has already increased electricity costs for non-mining Texans by $1.8 billion a year, or 4.7%, according to conservative estimates from consulting firm Wood Mackenzie.

A large portion of these crypto mines have opened around the Dallas metro area, which is among the fastest-growing places for black people and is already home to 1.2 million black people. At least one of the new fossil fuel power plants proposed in a predominantly black community would be built exclusively to power a cryptomining supercomputer.

A natural gas plant lights up the sky near a 90 percent black neighborhood in Beaumont, Texas. (Adam Mahoney/Capital B)

A natural gas plant lights up the sky near a 90 percent black neighborhood in Beaumont, Texas. (Adam Mahoney/Capital B)

As natural gas production surges across the country, energy companies and government agencies are not “adequately addressing the history of the devastation that oil and gas have wrought in the Gulf South and communities of color,” said Robert Bullard, the father of environmental justice.

While clean energy is growing, Texas has a problem getting it to homes. The growth of renewable energy requires expensive transmission lines to move power to urban consumers from rural areas where wind and solar farms are located. But some residents believe the cost and infrastructure construction are worth it.

“The truth is that gas failed us when we needed it most,” the state’s Sierra Club chapter wrote after the subsidies for new plants were announced. “We need to reduce demand on the grid by making buildings more energy efficient, and we need to invest more in local and distributed energy systems like rooftop solar and battery storage. Our climate has changed, no matter how much fossil fuel-funded Texas politicians deny it.”

Bitcoin

Grayscale Unveils Bitcoin Mini Trust ETF

Bitcoin Currency

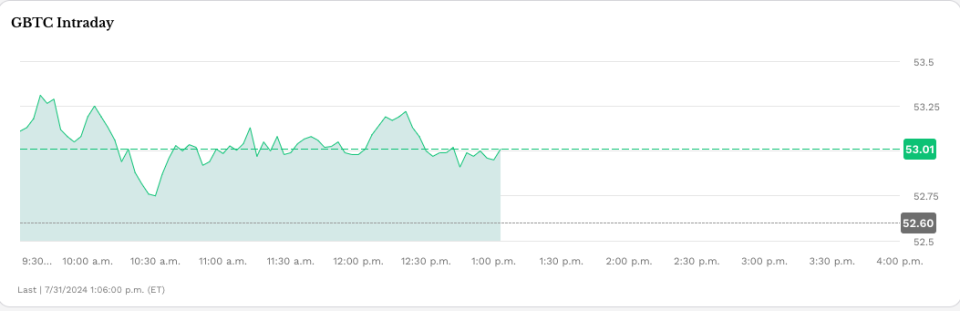

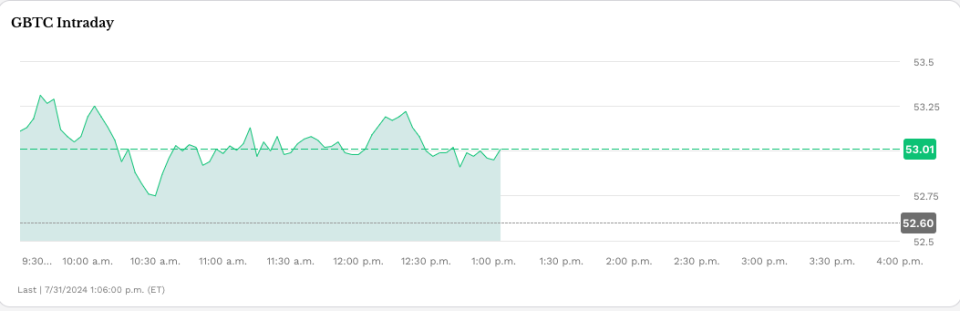

Grayscale Investments The Bitcoin Mini Trust began trading on Wednesday with a 0.15% expense ratio, offering a lower-cost option for bitcoin exposure in the market.

The Mini Trust, which has the symbol BTC and trades on NYSE Arca, is structured as a spin-off of the Grayscale Bitcoin Trust (GBTC). New shares will be distributed to existing GBTC shareholders with the fund contributing a portion of its bitcoin holdings to the new product. According to a company press releaseBTC’s S-1 registration statement became effective last week.

“The Grayscale team has believed in the transformative potential of Bitcoin since the initial launch of GBTC in 2013, and we are excited to launch the Grayscale Bitcoin Mini Trust to help further lower the barrier to entry for Bitcoin in an SEC-regulated investment vehicle,” said David LaValle, Senior Managing Director and Head of ETFs at Grayscale.

The Bitcoin Mini Trust’s debut comes amid growing interest in ETFs based on the current price of the two largest cryptocurrencies by market cap, bitcoin and ether. Spot bitcoin ETFs have generated nearly $18 billion in inflows since the first ones began trading on Jan. 11, though GBTC has lost nearly $19 billion in assets.

This fund differs from other funds because it is a conversion of an existing fund and has a 1.5% fee, the highest among spot bitcoin products that have received SEC approval this year.

Mini Bitcoin Trust Low Fee

On a Post X On Wednesday, Bloomberg senior ETF analyst Eric Balchunas noted the Bitcoin Mini Trust’s “lowest fee in the category…”

“[Important] to recognize how incredibly cheap 15bps is — about 10x cheaper than spot ETFs in other countries and other vehicles,” Balchunas wrote, adding that this pricing strategy reflects the competitive nature of the U.S. ETF market, which he referred to as the “ETF Terrordome.”

“This is what Terrordome does to fund [cost]. It reaches 1.5% [and] end in 0.15%, how to go from [a] country club to the jungle. But that’s why all the flows are here, investor paradise,” he noted.

Read more: Spot Bitcoin ETF Inflows Hit Daily High of Over $1 Billion

Bitcoin was recently trading at around $66,350, virtually flat since U.S. markets opened on Wednesday.

Grayscale also offers two spot Ethereum ETFs, the Grayscale Ethereum Trust (ETHE) and the Grayscale Ethereum (ETH) Mini Trustwhose performance is based on ETHE. ETHE outflows exceeded $1.8 billion in its first six days of trading, while ETH added more than $181 million in the same period, according to Farside. The remaining seven ETFs generated about $1.2 billion in inflows.

The story continues

Read more: Spot Ethereum ETFs Approved to Start Trading

Permanent link | © Copyright 2024 etf.com. All rights reserved

Bitcoin

Bitcoin (BTC) Price Drops Below $65K After FOMC as Middle East Tensions Rise

Cryptocurrencies fell sharply on Wednesday as rising geopolitical risks captivated investors’ attention following the conclusion of the Federal Reserve’s July meeting.

Bitcoin (BTC) fell to $64,500 from around $66,500, where it traded following Federal Reserve Chairman Jerome Powell’s press conference and is down more than 2% in the past 24 hours. Major altcoins including ether (ETH)sunbathing (SUN)Avalanche AVAX (AVAX) and Cardano (ADA) also fell, while Ripple’s XRP saved some of its early gains today. The broad cryptocurrency market benchmark CoinDesk 20 Index was 0.8% lower than 24 hours ago.

The liquidation happened when the New York Times reported that Iran’s leaders have ordered retaliation against Israel over the killing of Hamas leader Ismail Haniyeh in Tehran, raising the risk of a wider conflict in the region.

Earlier today, the Fed left benchmark interest rates unchanged and gave little indication that a widely expected rate cut in September is a given. The Fed’s Powell said that while no decision has been made on a September cut, the “broad sense is that we are getting closer” to cutting rates.

While digital assets suffered losses, most traditional asset classes rose higher during the day. U.S. 10-year bond yields fell 10 basis points, while gold rose 1.5% to $2,450, slightly below its record highs, and WTI crude oil prices rose 5%. Stocks also rallied during the day, with the tech-heavy Nasdaq 100 index rebounding 3% and the S&P 500 closing the session 2.2% higher, led by 12% gains in chipmaker giant Nvidia (NVDA).

The different performances across asset classes could be due to traders’ positioning ahead of the Fed meeting, Zach Pandl, head of research at Grayscale, said in an emailed note.

“Equities may have been slightly underutilized after the recent dip, while bitcoin is coming off a strong period with solid inflows, while gold has recovered after a period of weakness,” he said.

“Overall, the combination of Fed rate cuts, bipartisan focus on cryptocurrency policy issues, and the prospect of a second Trump administration that could advocate for a weaker U.S. dollar should be viewed as very positive for bitcoin,” he concluded.

UPDATE (July 31, 2024, 21:30 UTC): Adds grayscale comments.

Bitcoin

Donald Trump’s Cryptocurrency Enthusiasm Is Just Another Scam

Former US President Donald Trump spoke at the Libertarian National Convention in May and lent his a strong support to crypto: “I will also stop Joe Biden’s crusade to crush crypto. … I will ensure that the future of crypto and the future of bitcoin is made in the US, not taken overseas. I will support the right to self-custody. To the 50 million crypto holders in the country, I say this: With your vote, I will keep Elizabeth Warren and her henchmen out of your bitcoin.”

Former US President Donald Trump spoke at the Libertarian National Convention in May and lent his a strong support to crypto: “I will also stop Joe Biden’s crusade to crush crypto. … I will ensure that the future of crypto and the future of bitcoin is made in the US, not taken overseas. I will support the right to self-custody. To the 50 million crypto holders in the country, I say this: With your vote, I will keep Elizabeth Warren and her henchmen out of your bitcoin.”

Trump continued to court the cryptocurrency industry in the months that followed; he he appeared at the Bitcoin 2024 Conference in Nashville this week, along with independent presidential candidate Robert F. Kennedy Jr.’s parting words to Trump — “Have fun with your bitcoin, your cryptocurrency and whatever else you’re playing with” — were less than enthusiastic, but the industry itself remains packed with ardent Trump supporters.

This turnaround came as a surprise, given Trump’s previous strong opposition to cryptocurrency. When Facebook was floating its Libra cryptocurrency in 2019, Trump tweeted: “I am not a fan of Bitcoin and other cryptocurrencies, which are not money, and whose value is highly volatile and based on thin air.” Former national security adviser John Bolton’s White House memoir, The Room Where It Happened, quotes Trump as telling Treasury Secretary Steven Mnuchin: “Don’t be a trade negotiator. Go after Bitcoin.” [for fraud].” In 2021, Trump counted Fox Business that bitcoin “just looks like a scam. … I want the dollar to be the world’s currency.”

Why the change? There doesn’t seem to be any crypto votes. Trump’s “50 million” number comes from a poorly sampled push survey by cryptocurrency exchange Coinbase which claimed 52 million cryptocurrency users in the United States starting in February 2023. But one survey A survey conducted last October by the US Federal Reserve showed that only 7% of adults (about 18.3 million people) admitted to owning or using cryptocurrencies — down from 10% in 2022 and 12% in 2021. Many of these people are likely wallet owners who were left holding the bag after crypto plunged in 2022 — and are not necessarily new fans.

What Trump wants from the cryptocurrency industry is money. The cryptocurrency industry has already raised more than US$ 180 million to run in the 2024 US elections through his super PACs Fairshake, Defend American Jobs and Protect Progress.

Fairshake spent $10 million on taking Rep. Katie Porter in the primary battle for Dianne Feinstein’s California Senate seat by funding Porter’s pro-crypto rival Adam Schiff. This put $2 million to knock out Rep. Jamaal Bowman in the Democratic primary for New York’s 16th District in favor of pro-crypto George Latimer. In the Utah Senate Republican primary, Rep. John Curtis defeated Trent Staggs with the help of $4.7 million from Defend American Jobs. In Alabama’s House District 2, the majority of campaign expenses came from the cryptocurrency industry.

Fairshake is substantially financed by Coinbase, cryptocurrency issuer Ripple Labs, and Silicon Valley venture capital firm Andreessen Horowitz, or a16z. Silicon Valley was awash in cryptocurrencies during the 2021 bubble, and a16z in particular continues to promote blockchain startups to this day — and still holds a huge amount of bubble crypto tokens that he wishes he could cash in on.

Many in Silicon Valley would like an authoritarian who they think will let them run wild with money — while bailing them out in tough times. Indeed, Trump promised Bitcoin 2024 participants that he hold all bitcoins that the United States acquires. (Never mind that it is usually acquired as the proceeds of crime.) Silicon Valley explicitly sees regulation of any kind as its greatest enemy. Three a16z manifestos — “Politics and the Future” It is “The Techno-Optimist Manifesto” and 2024 “The Small Tech Agenda—describe co-founders Marc Andreessen and Ben Horowitz’s demands for a technology-powered capitalism unhindered by regulation or social considerations. They name “experts,” “bureaucracy,” and “social responsibility” as their “enemies.” Their 2024 statement alleges that banks are unfairly cutting off startups from the banking system; these would be crypto companies funded by a16z.

Trump’s vice presidential pick, Senator J.D. Vance, is a former Silicon Valley venture capitalist. He was once employed by Peter Thiel, who bankrolled Vance’s successful 2022 Senate run; Vance has been described as a “Thiel creation”. He has increased support for the Trump ticket among his venture capital associates. Vance is a bitcoin holder and a frequent advocate of encryption. He recently released a draft bill to review how the Securities and Exchange Commission (SEC) and the Commodity Futures Trading Commission (CFTC) control crypto assets. In 2023, he circulated a bill to prevent banks from cutting out cryptocurrency exchanges.

Minimal regulation has been tried before. It led to the wild exuberance of the 1920s, which ended with the Black Tuesday crash of 1929 and the Great Depression of the 1930s. Regulators like the SEC were put in place during this era to protect investors and transform the securities market from a jungle into a well-tended garden, leading to many prosperous and stable decades that followed.

Crypto provides the opposite of a stable and functional system; it is a practical example of how a lack of regulation allows opportunists and scammers to cause large-scale disasters. The 2022 Crypto Crash repeated the 2008 financial crisis in miniature. FTX’s Sam Bankman-Fried was feted as a financial prodigy who would perform economic miracles if you just gave him carte blanche; he ended up stealing billions of dollars of customers’ money, destroying the lives of ordinary people, and is now in a prison cell.

U.S. regulators have long been concerned about the prospect of cryptocurrency contagion to the broader economy. Criminal money laundering is rampant in cryptocurrency; even the Trump administration has made rules in December 2020 to reduce the risk of money laundering from crypto. Meanwhile, the crypto industry has persistently tried to infiltrate systemically risky corners of the economy, such as pension funds.

Four U.S. banks collapsed during the 2023 banking crisis, the first since 2020. Two of them, Silvergate Bank and Signature Bank, were deeply embedded in the crypto world — Silvergate in particular appears to have collapsed directly from its heavy reliance on FTX and failed a few months after that. Silicon Valley Bank was not involved in crypto but collapsed due to a run on the bench due to panic among venture capital deposit holders, particularly Thiel’s Founders Fund.

Project 2025the Heritage Foundation mammoth conservative wish list The plan, which Trump and Vance have both endorsed and tried to distance themselves from at various times, emphasizes the importance of party loyalists, noting especially financial regulation. The plan recommends replacing as much of the federal bureaucracy as possible with loyalists and “trusted” career officials rather than nonpartisan “experts.” Vance defended in 2021 that Trump should “fire every mid-level bureaucrat, every civil servant in the administrative state” and “replace them with our people.” Loyalty will likely trump competence.

Crypto is barely mentioned directly in Project 2025 — suggesting it has little active support among the broader conservative coalition. But near the end of the manifesto is a plan to dismantle most U.S. financial regulations and investor protections put in place since the 1930s, suggesting the exemption the crypto industry seeks from current SEC and CFTC regulations.

Bitcoin, the first cryptocurrency, started as an ideological project to promote a strange variant of Murray Rothbard’s anarcho-capitalism and the Austrian gold-backed economy—the kind we abandoned to escape the Great Depression. Crypto quickly co-opted the “end of the Fed” and “establishment elites” conspiracy theories of the John Birch Society and Eustace Mullins. It’s a way for billionaire capitalists like Thiel, Andreessen and Elon Musk to claim they’re not part of the so-called elite.

If a second Trump administration were to limp along with financial regulators and allow cryptocurrencies to have free rein, it could help foster the collapse of the U.S. economy that bitcoin claimed to prevent. But Trump is more likely to be happy to take the crypto money and run.

Bitcoin

Trump’s Bitcoin (BTC) Reserve Plan Seen as Just a ‘Small Token Stash’

Donald Trump’s recent promise to create a “strategic national stockpile of Bitcoin” may not turn out to be as big a commitment as the hype surrounding the announcement makes it seem.

“Trump’s proposal is extremely modest,” said George Selgin, director emeritus of the Center for Monetary and Financial Alternatives at the Cato Institutea Washington-based public policy group. “It doesn’t have much economic implication.”

-

Ethereum12 months ago

Ethereum12 months agoEthereum Posts First Consecutive Monthly Losses Since August 2023 on New ETFs

-

Regulation12 months ago

Regulation12 months agoCryptocurrency Regulation in Slovenia 2024

-

News12 months ago

News12 months agoNew bill pushes Department of Veterans Affairs to examine how blockchain can improve its work

-

Regulation12 months ago

Regulation12 months agoThink You Own Your Crypto? New UK Law Would Ensure It – DL News

-

Regulation12 months ago

Regulation12 months agoUpbit, Coinone, Bithumb Face New Fees Under South Korea’s Cryptocurrency Law

-

Regulation12 months ago

Regulation12 months agoA Blank Slate for Cryptocurrencies: Kamala Harris’ Regulatory Opportunity

-

Regulation12 months ago

Regulation12 months agoBahamas Passes Cryptocurrency Bill Designed to Prevent FTX, Terra Disasters

-

Regulation12 months ago

Regulation12 months agoIndia to Follow G20 Policy for Cryptocurrency Regulation: MoS Finance

-

News1 year ago

News1 year ago“Captain Tsubasa – RIVALS” launches on Oasys Blockchain

-

Ethereum1 year ago

Ethereum1 year agoComment deux frères auraient dérobé 25 millions de dollars lors d’un braquage d’Ethereum de 12 secondes • The Register

-

News12 months ago

News12 months agoEU supports 15 startups to fight online disinformation with blockchain

-

News1 year ago

News1 year agoSolana ranks the fastest blockchain in the world, surpassing Ethereum, Polygon ⋆ ZyCrypto