Bitcoin

Bitcoin (BTC) Price Bottom Is Near as Miners Capitulate Near FTX Implosion Level: CryptoQuant

Bitcoin (BTC) Miners are showing signs of capitulation, an event that is typically linked to a market bottom after the world’s largest cryptocurrency suffered a 13% drop in the past 30 days.

Bitcoin is currently trading at $60,300 after falling 3% on Wednesday. This level has acted as a critical support since April, with bitcoin bouncing three times from this region before returning to the $70,000 mark.

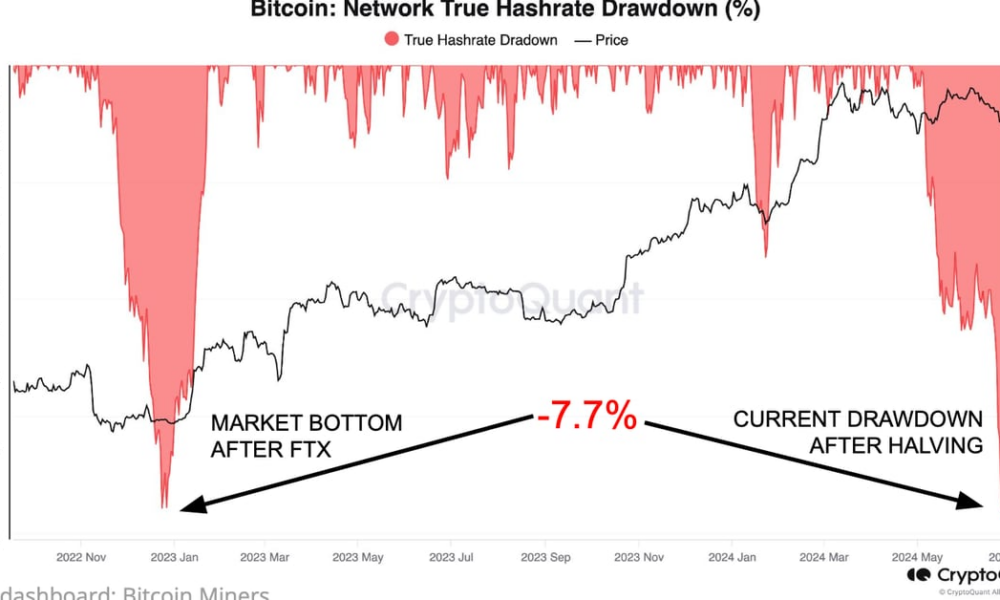

Two signs of miner capitulation are the decrease in hash rate and mining revenue per hash (hash price), both of which have fallen significantly this month, with hash rate plummeting 7.7% since the halving and hash price approaching all-time lows. Hash rate is the mining power on the Bitcoin network, and hash price refers to the revenue miners earn from a unit of hash rate.

Miners are also taking a hit to their daily revenue, which has dropped from $79 million on March 6 to $29 million today. This has led to miners shutting down their equipment and a subsequent drop in hash rate.

“Miners were hit by a 63% decline in daily revenues due to the halving and the collapse of transaction fees to 3.2% of total revenue,” CryptoQuant said in a report.

Miner capitulation levels are now comparable to December 2022, which was the market bottom following the FTX demise.