Ethereum

Bitcoin and Ethereum Soar on Bitcoin Conference Hype!

The cryptocurrency market is booming, thanks to the buzz surrounding the Bitcoin 2024 conference and the excitement surrounding Ethereum ETFs. This renewed interest has led to renewed investor enthusiasm for digital assets.

As a result, Bitcoin has seen an 8% recovery after a recent dip, while Ethereum’s price is currently hovering approximately $3,275.

Why the Cryptocurrency Market is Up Today

At the Bitcoin conference, MicroStrategy michael saylor

Michael Saylor is the greatest visionary in the information systems industry. An enthusiastic blockchain influencer and a splendid leader. He believes that prudent institutional investors should only consider trusting a crypto-asset network after it has been operating reliably for at least ten years without a hard fork. He is an American entrepreneur and business executive, who co-founded Microstrategy, a company that provides business intelligence, mobile software, and cloud computing services. Under his leadership, Microstrategy has grown exponentially and made its mark in the BI industry, and he is the Chairman and CEO of the same Microstrategy. He is a strong advocate of bitcoin. He is highly skilled in enterprise software and also has a rich knowledge of many domains including analytics, data warehousing, leadership, SaaS, management, cloud computing, startups, professional services, enterprise architecture, mobile devices, and many more. In 1983, he enrolled at the Massachusetts Institute of Technology (MIT) on an Air Force ROTC scholarship. And then, he joined the Theta delta chi fraternity, through which he met future Microstrategy co-founder Sanju K Bansal. He graduated from MIT in 1987 with a double major in aeronautics, science, technology, and society. He volunteers at Saylor Academy as a trustee, which provides free college education to all students worldwide. The way he got into Bitcoin, people started calling him the Bitcoin bull, he is the most bullish person when it comes to Bitcoin. He expects the entrepreneur to keep buying Bitcoin every time it goes down. The Bitcoin community started waking up to the fact that his company might own too much Bitcoin. Owning too much of Bitcoin could be detrimental to the decentralized culture of cryptocurrency that Bitcoin has so painstakingly built over the years. He is still expected to be a leading advocate for BTC throughout the year. Potentially educating businesses about Bitcoin through his powerful podcasts and learning courses. msaylor@microstrategy.com Crypto Entrepreneur and Blockchain Expert Author

shared his ambitious long-term forecast for Bitcoin. He predicted that while Bitcoin’s annual growth rate could slow from 55% to 20% by 2045, its value could still skyrocket to a staggering $13 million per coin. This optimistic outlook coincides with Bitcoin’s recent surge above $68,000.

Saylor’s optimistic position is supported by microstrategy

Business Intelligence Microstrategy

significant Bitcoin holdings. Over the past four years, the company has accumulated 226,331 BTC, now valued at around $15 billion.

Hash ribbons signal a purchase!

The Hash Ribbons indicator, which tracks Bitcoin’s hash rate moving averages, has just issued a buy signal. This indicator has issued a buy signal only once in the past year and three times in the past two years, each time leading to a price increase. The latest signal suggests that Bitcoin could soon see more positive price movement.

Bitcoin Conference and the Impact of Cryptocurrencies

The recent surge in the cryptocurrency market is fueled by excitement surrounding the Bitcoin 2024 conference and the former Speech by President Donald Trump. Bitcoin Magazine CEO David Bailey speculates that Bitcoin could hit new highs during Trump’s speech at the event.

Some experts believe Trump could use this platform to propose Bitcoin as a “strategic reserve” asset for the US government.

BlackRock Focuses on Bitcoin and Ethereum

In a panel discussion titled “From Strategy to Innovation: BlackRock’s Bitcoin Journey,” Robert Mitchnick, BlackRock’s Head of Digital Assets, emphasized that the company customers show strong preference for Bitcoin, followed by Ethereum, with limited interest in other digital assets.

Mitchnick also noted that BlackRock has no plans to significantly expand its crypto ETF lineup beyond these two major assets.

Bitcoin Technical Outlook

Looking at the daily chart of Bitcoin, there has been a recent surge in demand near the 100-day moving average, which has led to a significant rally. However, Bitcoin is currently facing resistance between $67,000 and $68,300. If it breaks through this resistance, it could move closer to its all-time high of $72,000 and possibly even its all-time high of $72,000. reach $100,000.

Meanwhile, the launch of Ethereum spot ETFs, which saw a net inflow of $106.6 million on the first day, has boosted interest in Ethereum. Ethereum price has held above the 100-day and 200-day moving averages, indicating a bullish trend. With the new ETH ETFs, the upward momentum is likely to continue, and a break above $3,400 could push its price to $3,700.

Read also : Microstrategy’s Saylor Predicts Bitcoin Market Cap to Explode to $280 Trillion

Is this the start of a new bull run for cryptocurrencies? Let us know what you think.

Ethereum

QCP sees Ethereum as a safe bet amid Bitcoin stagnation

QCP, a leading trading firm, has shared key observations on the cryptocurrency market. Bitcoin’s struggle to surpass the $70,000 mark has led QCP to predict Selling pressure is still strong, with BTC likely to remain in a tight trading range. In the meantime, Ethereum (ETH) is seen as a more promising investment, with potential gains as ETH could catch up to BTC, thanks to decreasing ETHE outflows.

Read on to find out how you can benefit from it.

Bitcoin’s Struggle: The $70,000 Barrier

For the sixth time in a row, BTC has failed to break above the $70,000 mark. Bitcoin is at $66,048 after a sharp decline. Many investors sold Bitcoin to capitalize on the rising values, which caused a dramatic drop. The market is becoming increasingly skeptical about Bitcoin’s rise, with some investors lowering their expectations.

Despite the continued sell-off from Mt. Gox and the US government, the ETF market remains bullish. There is a notable trend in favor of Ethereum (ETH) ETFs as major bulls have started investing in ETFs, indicating a bullish sentiment for ETH.

QCP Telegram Update UnderlinesIncreased market volatility. The NASDAQ has fallen 10% from its peak, led by a pullback in major technology stocks. Currency carry trades are being unwound and the VIX, a measure of market volatility, has jumped to 19.50.

The main factors driving this uncertainty are Value at Risk (VaR) shocks, high stock market valuations and global risk aversion sentiment. Commodities such as oil and copper have also declined on fears of an economic slowdown.

Additionally, QCP anticipates increased market volatility ahead of the upcoming FOMC meeting, highlighting the importance of the Federal Reserve’s statement and Jerome Powell’s subsequent press conference.

A glimmer of hope

QCP notes a positive development in the crypto space with an inflow of $33.7 million into ETH spot ETFs, which is giving a much-needed boost to ETH prices. However, they anticipate continued outflows of ETHE in the coming weeks. The recent Silk Road BTC moves by the US government have added to the market uncertainty.

QCP suggests a strategic trade involving BTC, which will likely remain in its current range, while ETH offers a more promising opportunity. They propose a trade targeting a $4,000-$4,500 range for ETH, which could generate a 5.5x return by August 30, 2024.

Ethereum

Ethereum Whale Resurfaces After 9 Years, Moves 1,111 ETH Worth $3.7 Million

An Ethereum ICO participant has emerged from nearly a decade of inactivity.

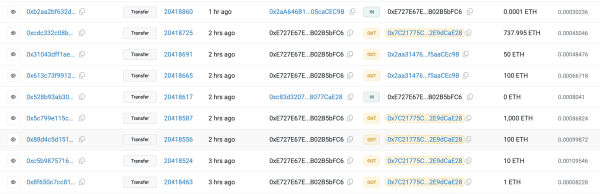

Lookonchain, a smart on-chain money tracking tool, revealed On X, this long-inactive participant recently transferred 1,111 ETH, worth approximately $3.7 million, to a new wallet. This significant move marks a notable on-chain movement, given the participant’s prolonged dormancy.

The Ethereum account in question, identified as 0xE727E67E…B02B5bFC6, received 2,000 ETH on the Genesis block over 9 years ago.

This initial allocation took place during the Ethereum ICOwhere the participant invested in ETH at around $0.31 per coin. The initial investment, worth around $620 at the time, has now grown to millions of dollars.

Recent Transactions and Movements

The inactive account became active again with several notable output transactions. Specifically, the account transferred 1,000 ETH, 100 ETH, 10 ETH, 1 ETH, and 1 more ETH to address 0x7C21775C…2E9dCaE28 within a few minutes. Additionally, it moved 1 ETH to 0x2aa31476…f5aaCE9B.

Additionally, in the latest round of transactions, the address transferred 737,995 ETH, 50 ETH, and 100 ETH, for a total of 887,995 ETH. These recent activities highlight a significant movement of funds, sparking interest and speculation in the crypto community.

Why are whales reactivating?

It is also evident that apart from 0xE727E67E…B02B5bFC6, other previously dormant Ethereum whales are waking up with significant transfers.

In May, another dormant Ethereum whale made headlines when it staked 4,032 ETHvalued at $7.4 million, after more than two years of inactivity. This whale initially acquired 60,000 ETH during the Genesis block of Ethereum’s mainnet in 2015.

At the time, this activity could have been related to Ethereum’s upgrade known as “Shanghai,” which improved the network’s scalability and performance. This whale likely intended to capitalize on the price surge that occurred after the upgrade.

Disclaimer: This content is informational and should not be considered financial advice. The opinions expressed in this article may include the personal opinions of the author and do not reflect the opinion of The Crypto Basic. Readers are encouraged to conduct thorough research before making any investment decisions. The Crypto Basic is not responsible for any financial losses.

-Advertisement-

Ethereum

Only Bitcoin and Ethereum are viable for ETFs in the near future

BlackRock: Only Bitcoin and Ethereum Are Viable for ETFs in the Near Future

Bitcoin and Ethereum will be the only cryptocurrencies traded via ETFs in the near future, according to Samara Cohen, chief investment officer of ETFs and indices at BlackRock, the world’s largest asset manager.

In an interview with Bloomberg TV, Cohen explained that while Bitcoin and Ethereum have met BlackRock’s rigorous criteria for exchange-traded funds (ETFs), no other digital asset currently comes close. “We’re really looking at the investability to see what meets the criteria, what meets the criteria that we want to achieve in an ETF,” Cohen said. “Both in terms of the investability and from what we’re hearing from our clients, Bitcoin and Ethereum definitely meet those criteria, but it’s going to be a while before we see anything else.”

Cohen noted that beyond the technical challenges of launching new ETFs, the demand for other crypto ETFs, particularly Solana, is not there yet. While Solana is being touted as the next potential ETF candidate, Cohen noted that the market appetite remains lacking.

BlackRock’s interest in Bitcoin and Ethereum ETFs comes after the successful launch of Ethereum ETFs last week, which saw weekly trading volume for the crypto fund soar to $14.8 billion, the highest level since May. The success has fueled speculation about the next possible ETF, with Solana frequently mentioned as a contender.

Solana, known as a faster and cheaper alternative to Ethereum, has been the subject of two separate ETF filings in the US by VanEck and 21Shares. However, the lack of CME Solana futures, unlike Bitcoin and Ethereum, is a significant hurdle for SEC approval of a Solana ETF.

Despite these challenges, some fund managers remain optimistic about Solana’s potential. Franklin Templeton recently described Solana as an “exciting and major development that we believe will drive the crypto space forward.” Solana currently accounts for about 3% of the overall cryptocurrency market value, with a market cap of $82 billion, according to data from CoinGecko.

Meanwhile, Bitcoin investors continue to show strong support, as evidenced by substantial inflows into BlackRock’s iShares Bitcoin Trust (NASDAQ: IBIT). On July 22, IBIT reported inflows of $526.7 million, the highest single-day total since March. This impressive haul stands in stark contrast to the collective inflow of just $6.9 million seen across the remaining 10 Bitcoin ETFs, according to data from Farside Investors. The surge in IBIT inflows coincides with Bitcoin’s significant $68,000 level, just 8% off its all-time high of $73,000.

Ethereum

Ethereum Posts First Consecutive Monthly Losses Since August 2023 on New ETFs

Available exclusively via

Bitcoin ETF vs Ethereum: A Detailed Comparison of IBIT and ETHA

Andjela Radmilac · 3 days ago

CryptoSlate’s latest market report takes an in-depth look at the technical and practical differences between IBIT and BlackRock’s ETHA to explain how these products work.

-

Ethereum12 months ago

Ethereum12 months agoEthereum Posts First Consecutive Monthly Losses Since August 2023 on New ETFs

-

Regulation12 months ago

Regulation12 months agoCryptocurrency Regulation in Slovenia 2024

-

News12 months ago

News12 months agoNew bill pushes Department of Veterans Affairs to examine how blockchain can improve its work

-

Regulation12 months ago

Regulation12 months agoThink You Own Your Crypto? New UK Law Would Ensure It – DL News

-

Regulation12 months ago

Regulation12 months agoUpbit, Coinone, Bithumb Face New Fees Under South Korea’s Cryptocurrency Law

-

Regulation12 months ago

Regulation12 months agoA Blank Slate for Cryptocurrencies: Kamala Harris’ Regulatory Opportunity

-

Regulation12 months ago

Regulation12 months agoBahamas Passes Cryptocurrency Bill Designed to Prevent FTX, Terra Disasters

-

Regulation12 months ago

Regulation12 months agoIndia to Follow G20 Policy for Cryptocurrency Regulation: MoS Finance

-

News1 year ago

News1 year ago“Captain Tsubasa – RIVALS” launches on Oasys Blockchain

-

Ethereum1 year ago

Ethereum1 year agoComment deux frères auraient dérobé 25 millions de dollars lors d’un braquage d’Ethereum de 12 secondes • The Register

-

News12 months ago

News12 months agoEU supports 15 startups to fight online disinformation with blockchain

-

News1 year ago

News1 year agoSolana ranks the fastest blockchain in the world, surpassing Ethereum, Polygon ⋆ ZyCrypto