News

Argo Blockchain sees growth amid strategic optimizations By Investing.com

Argo Blockchain (ARBK), a leading cryptocurrency mining company, reported a modest revenue increase in its Q1 2024 earnings call, alongside strategic moves aimed at reducing debt and improving operational efficiency. The company generated approximately $17 million in revenue, marking a 4% rise from the previous quarter.

Argo’s cash position improved to $12.4 million, up from $7.4 million at the end of 2023, and it successfully mined 319 bitcoins with a mining margin of 38%. The company’s management outlined its commitment to optimizing mining operations and exploring growth opportunities while managing its debt obligations effectively.

Key Takeaways

- Q1 2024 revenue rose to $17 million, a 4% increase from Q4 2023.

- Argo Blockchain’s cash reserves increased to $12.4 million, from $7.4 million at the end of 2023.

- The company mined 319 bitcoins and achieved a 38% mining margin.

- Debt reduction efforts included a $10 million equity raise and the sale of the Mirabel facility.

- Argo Blockchain plans to continue economic curtailment during high power price periods and optimize rig performance.

- The company is exploring growth opportunities, including smaller sites with unique power characteristics and sustainable growth projects.

- Argo Blockchain remains focused on bitcoin mining but is open to potential AI data center projects in the future.

Company Outlook

- Argo Blockchain aims to return to growth while balancing debt obligations.

- The company is seeking to enhance operational efficiency and reduce downtime.

- Argo plans to leverage strategic partnerships and explore sustainable growth projects.

Bearish Highlights

- Power prices are expected to be volatile during Q2, which could impact profitability.

- The company is adapting to weaker mining economics by adjusting power consumption and considering newer generation machines for fleet upgrades.

Bullish Highlights

- Argo Blockchain has reduced its debt by over $12 million in the first quarter.

- The company has paid down $23 million of its Galaxy debt over the past year, reducing it to $12.8 million.

- Argo’s hash rate capacity stands at about 300 petahash at Baie-Comeau and 2.4 exahash at Helios.

Misses

- There are no specific financial misses highlighted in the summary provided.

Q&A Highlights

- CEO Thomas Chippas noted a 5% increase in daily bitcoin production in March 2024 compared to February 2024.

- CFO Jim MacCallum discussed the strategic reasons behind the sale of the Mirabel facility, emphasizing the improved financial position and operational consolidation.

In conclusion, Argo Blockchain’s Q1 2024 earnings call revealed a company navigating the challenges of the cryptocurrency mining industry with a focus on efficiency and debt management. With improved cash reserves, a commitment to economic curtailment strategies, and exploration of new growth opportunities, Argo Blockchain appears poised to maintain its position in the market while keeping an eye on future expansion possibilities. The company invites investors to attend their Annual General Meeting on June 6 to further discuss its strategy and outlook.

InvestingPro Insights

Argo Blockchain’s recent Q1 2024 performance, highlighting a modest revenue increase and strategic debt reduction, reflects its ongoing efforts to strengthen its financial position in a volatile market. To provide a deeper understanding of the company’s financial health and market performance, here are some insights based on real-time data from InvestingPro:

- Argo Blockchain’s market capitalization stands at $81.28 million, indicating its current market valuation.

- The company’s Price / Book ratio, as of the last twelve months leading up to Q4 2023, is exceptionally high at 513.32, suggesting that the stock is trading at a premium relative to its book value.

- Despite the positive revenue growth reported for the first quarter of 2024, Argo Blockchain experienced a revenue decline of -13.7% over the last twelve months as of Q4 2023.

An InvestingPro Tip to consider is the high volatility in Argo Blockchain’s stock price movements. This could impact investor sentiment and the stock’s performance in the short term. Additionally, the company’s short-term obligations exceeding its liquid assets may raise concerns about liquidity and financial stability.

For investors seeking to delve deeper into Argo Blockchain’s financial metrics and strategic insights, InvestingPro offers additional tips that could be pivotal in making informed decisions. There are currently 9 additional InvestingPro Tips available, which can be accessed at https://www.investing.com/pro/ARBK.

To enhance your InvestingPro experience, use the coupon code PRONEWS24 to get an additional 10% off a yearly or biyearly Pro and Pro+ subscription. This exclusive offer is designed to provide you with comprehensive analysis and advanced tools to navigate the complexities of the stock market.

Full transcript – Argo Blockchain ADR (ARBK) Q1 2024:

Operator: Good afternoon, and welcome to the Argo Blockchain plc Q1 update. Throughout this recorded meeting, investors will be in listen-only mode. [Operator Instructions] The company may not be in a position to answer every question received during the meeting itself, though the company can view all questions submitted today and publish responses where it’s appropriate to do so. Before we go, we’d like to submit the following poll. I’d now like to hand over to Markella Zarifi, Argo’s Financial Communications Representative. Good afternoon.

Markella Zarifi: Thank you, Paul. Before we begin, I’d like to remind everyone that today’s presentation and remarks may contain forward-looking statements. Please see our Form 20-F filed with the Securities and Exchange Commission for our full risk disclosures. With us today for our discussion of Q1 2024 results are Thomas Chippas, Argo’s Chief Executive Officer; and Jim MacCallum, Argo’s Chief Financial Officer. And now I’ll turn now over to Thomas for some introductory remarks.

Thomas Chippas: Thank you, Markella, and thank you, everyone, for joining us today. We recently shared our 2023 full year results, and I’m excited to update you on our progress since then for this quarter. As everyone is aware, the fourth bitcoin halving occurred just over a month ago, and Argo exited halving with a stronger balance sheet and leaner operations. As seen here, financial discipline, including deleveraging; operational excellence; and certainly, growth and strategic partnerships, are our three priorities. And they guide us on a daily basis for the sustainable future of Argo. By concentrating on these goals, we’re optimistic about the ongoing growth and development opportunities for Argo. And we have a clear objective of delivering shareholder value. So I’m certainly excited to continue with the great work the team is doing and tell you more about what we’ve been up to. A few comments first on the macro front. With the 2024 halving complete, the block subsidy that miners collect now stands at 3.125 bitcoin, down from 6.25. The launch of spot ETFs for bitcoin were certainly big drivers of price from $40,000 to $75,000. But after the halving, ETF holders began selling and it actually resulted in about 7 days of net outflows, a reversal of day after day of net inflows for those ETFs. Although initially, there was a spike in transaction fees post-halving, it was short-lived and fees declined in the subsequent weeks. Runes, one of the drivers of fees in the initial period post-halving, are now generating far lower fees than regular transactions compared to the weeks succeeding the halving. As a result, fees per day have dropped below the first quarter’s average of [64 spot 39] bitcoin. And hash price is coming down for us post-halving, Runes driven high. Concurrently, the network hash rate at an all-time high of 654 exahash before the halving, but dropped to 580 over the following 3 weeks. This reduction can be attributed to miners adjusting efficiency settings in their machines and some shutting down temporarily. This might appear significant, but such a decline, it’s not out of the ordinary, and this happened on two occasions previously this year. Going forward, the hash rate is likely to oscillate as hash price changes. However, for the near term, due to highly compressed mining margins and the upcoming summer months here in the U.S., hash rate growth will likely be restrained. And then just looking beyond bitcoin for a moment. For the long term, the head of the U.S. Federal Reserve has suggested that the Central Bank might have hit its peak rate cycle height, which is promising for bitcoin mining because it suggests a more favorable environment with potential for increasing bitcoin prices. So with that, we can talk a little bit about our 2024 results. So we generated approximately $17 million of revenue in Q1, which was an increase of 4% from the last quarter of 2023, really due to elevated hash price. At the end of the first quarter, our cash in hand stood at $12.4 million, which is an increase from the $7.4 million at the end of 2023. As mentioned previously, we had some significant balance sheet events occur in Q1 2024, including an equity raise of nearly $10 million in January and the sale of our Mirabel facility in Quebec in March. The proceeds were used to repay the facility’s existing mortgage and pay down some of the debt owed to Galaxy. So let’s move on to the next slide, we can talk a little bit more about debt reduction in further detail. So as discussed on the previous call, debt reduction has been a focus for us since we sold Helios and restructured our debt at the end of 2022. As noted, we executed 2 significant transactions in the first quarter of ’24, bolstering our cash position in addition to reducing our debt, that being the equity raise and the Mirabel sale. The Mirabel sale was a great transaction for a number of reasons. First, we realized an attractive exit on the asset with a $6.1 million sale price. And secondly, consolidating our Quebec fleet to Baie-Comeau allowed us to streamline operations with minimal impact to revenue. We were able to execute the move quickly, and we realized an annualized reduction in OpEx of about $700,000 per annum. Now let me turn it over to Jim for a deeper dive into Q1 financial results. Over to you, Jim.

Jim MacCallum: Thank you, Tom. During the first quarter, we mined 319 bitcoin, and our mining margin percentage for the quarter was 38%, which is an increase from the 34% achieved in Q4 of 2023. We generated revenue of $16.8 million and $0.6 million in power credits from economic curtailment in Texas. As mentioned, this curtailment helped us to achieve a mining margin of 38% this quarter with an average direct cost per bitcoin mined of approximately $32,000. We raised $9.9 million of gross proceeds through an equity raise in January, of which we used a portion to pay down our Galaxy debt. As Tom mentioned previously, we also sold our Mirabel facility in March for $6.1 million. The accounting gain net of tax for this transaction was $3 million. Our adjusted EBITDA has increased almost twofold over the last year and was $3.8 million during Q1 2024. This slide shows our cash flow from December 31, 2023, to March 31, 2024. We continue to have a strong focus on cash flow generation and strengthening the balance sheet. In Q1, our cash flow from operations, including working capital changes, was $3.7 million. We used that for debt reduction, and we paid $1.7 million of interest during the period. During the first quarter of 2024, we improved our cash position by $5 million to over $12 million while simultaneously paying down our debt by over $12 million. With that, I’ll turn it back over to Tom.

Thomas Chippas: Thanks, Jim. So in the period since our last — since our full year results, we have maintained our streamlined operations in Quebec through the consolidation of the fleet to Baie-Comeau, post Mirabel, as I mentioned. As part of that fleet consolidation, we did not take the opportunity to decommission — I’m sorry. We did take the opportunity to decommission and sell some older-generation machines, which reduced our total hash rate from 2.8 to 2.7 exahash. We still have the majority of our fleet, roughly 2.4 exahash of total hash rate capacity, located at Helios in Texas. Now as we think about growth. The sector is focused on, of course, transitioning to clean energy, which has always been a focus for Argo. And it requires investment in the power grid and certainly in demand response technology. As we’ve stated, as have others in the industry, we believe bitcoin miners can play a very important role in that transition. miners are exceptionally agile and well suited for load-balancing programs. And by acting as a flexible load, bitcoin mining can help balance the grid by spinning up and spinning down quickly when required. Argo is having discussions focused on ways to integrate our operational capabilities with those of energy companies, and we certainly look forward to updating everyone on those discussions in due course. So as we continue in our mission of powering an innovative and sustainable blockchain infrastructure, these three pillars will continue to be our focus. With that, back to [Markella] for any questions. Thank you.

A – Markella Zarifi: Thank you, Thomas. Thank you, everyone. The first question is from Kevin Dede from H.C. Wainwright, and it’s directed to Thomas. Can you elaborate on the Galaxy relationship, their plans for the Helios site, and how you expect mining to progress through the hot summer months, including the potential for curtailing? Additionally, are we given the opportunity to overclock? And if so, have you taken advantage of it?

Thomas Chippas: Thanks for your question, Kevin. So a compelling aspect of our operations at Helios is of course the facility’s ability to curtail during periods of high power prices. For most of 2023, we procured electricity through fixed price power purchase agreements which ensured a stable cost of power. However, when market prices are high, of course, we can curtail or shut down operations and sell electricity back on the open market, a process known as economic curtailment. And as we discussed in the previous call, it generated about $7.2 million in power credits, directly reducing our cost of mining. The curtailment helped us achieve a mining margin of about 38% this quarter with an average direct cost per bitcoin mined of about $31,000. During the hot summer months, we expect to continue practicing economic curtailment when necessary. Additionally, we do have the opportunity to overclock our rigs to optimize for performance, and we’ll do so when conditions are favorable. So thank you for that, Kevin.

Markella Zarifi: Thank you, Thomas. The next question was pre-submitted in the chat and it’s directed to Jim. Will Argo invest into infrastructure again, or only focus on machines?

Jim MacCallum: Yes. Thanks for the question. Yes, currently, we have both hosted machines at Helios in Texas and owned machines at our Baie-Comeau site in Quebec, where we can also expand our capacity. As market evolves, we think there will be opportunities in both the hosted space and doing our own investing in infrastructure, and we’ll evaluate these decisions on a case-by-case basis.

Markella Zarifi: Thank you, Jim. Next question was again, pre-submitted, and it’s directed to Thomas. What can you say about the growth opportunities you are seeking out for Argo? Any details on the size, type, timing?

Thomas Chippas: Thank you for that. So we cannot get into details right now, but given Argo’s size and market position, we believe that smaller sites with unique power cost and availability characteristics could fit well into our portfolio. Look, there are certainly many groups on the hunt for power resources right now, not just bitcoin miners. But we think our size may be an advantage here as we flesh out opportunities. And certainly, we’ll have more to say when we can about those.

Markella Zarifi: Thank you, Thomas. The next question is from Kevin Dede at H.C. Wainwright once more, and it’s directed to Jim. How do you plan to return to growth while balancing debt obligations?

Jim MacCallum: Yes. Thanks, Kevin. Yes, we’ve had a strong focus on costs over the past year and feel the heavy lifting has been successfully completed here. Our run rate, as we said, for non-mining operating expenses has trended to approximately $1 million per month, and we believe that’s a reasonable outlook for the balance of the year. Our new vision centers on optimizing operational efficiency, strengthening the balance sheet and reducing debt. We aim to leverage strategic partnerships and explore sustainable growth projects while maintaining our commitment to renewable energy sources. Given that we exited the bitcoin halving with cash of just over $12 million and reduced our debt by over $12 million during the first quarter, Argo is in a strong position, and the company is in a growth mindset now. And we’ll continue to focus on fiscal responsibility.

Markella Zarifi: Thank you. Our next question is pre-submitted, and it’s directed to Jim. Can you speak to power prices for the second quarter?

Jim MacCallum: Yes. I mean, we can’t go into too much detail here, but power prices during the second quarter, which include obviously the early part of the summer, are subject to significant volatility which we certainly saw last year. This period often sees heightened uncertainty due to the potential for heat waves which can drive up demand and consequently prices. To navigate these fluctuations, we have to remain agile and capitalize on any economic curtailment programs that may arise. We can give some color. April was clearly a strong month for bitcoin economics. For May, despite the bitcoin halving, through lower power prices and optimization of our fleet’s efficiency settings, we have seen mining margins in the 30% range, albeit on the lower revenue resulting from the halving. We will closely monitor market trends and price movements, and this proactive approach will enable us to adjust our strategies in real time and optimize our mining profitability while mitigating the risks of hash price and energy cost volatility.

Markella Zarifi: Thank you, Jim. Next question was submitted in the chat, directed to Thomas. Does Argo have any plans to branch into AI data centers?

Thomas Chippas: Thank you for that. With respect to AI and HPC, this is certainly a very topical area amongst miners. We understand the demand for HPC processing in the market. But I think it’s a different business than operating a bitcoin mining facility. We have explored the possibility and we’re certainly not ruling it out for the future. However, our current strategy remains centered on bitcoin mining operations.

Markella Zarifi: Thank you, Thomas. Next question is submitted by Bill Papanastasiou of Stifel and it’s directed to Thomas. We have seen mining economics weaken following the halving event. How is management approaching the capital allocation strategy of balancing expense management with growing, upgrading the fleet? Is there any near-term path of a shift towards growth in the future?

Thomas Chippas: Thanks for that, Bill. So Argo’s fleet operates flexibly, which allows us to adjust power consumption through over- or under-clocking like a dimmer switch allows you to control the brightness of a light. And I think Jim referenced that in his comments about Q2 power. In the current market and recognizing the weaker mining economics, this adaptability is essential. So we fully appreciate the capabilities of newer generation machines and the efficiency they bring. Our growth strategy when it comes to fleet, we’ll always consider hash price, rig availability and energy costs, amongst other factors. As I’ve said, we’re shifting back to a growth mindset. We want to leverage our size to target sites that may be less appealing to larger miners and explore what opportunities we can there. And we’ll find the right fleet for those opportunities when they present themselves. Our capital allocation strategy is going to balance expense management with fleet upgrades and ensure that we can remain competitive and ready for future opportunities as they arise in the industry.

Markella Zarifi: Thank you, Thomas. Next question was also pre-submitted and directed to Jim. How does Argo plan to manage its debt, and what are the prospects for refinancing?

Jim MacCallum: Yes. Thanks for that question. Yes, we’re pleased with how we’ve managed our Galaxy debt. Over the past year, we paid it down. It started at $35 million. We paid it down $23 million or approximately 2/3 of the total balance over the last 12 months. At March 31, we reported cash of over $12 million, and our Galaxy debt has been substantially reduced to $12.8 million. We exited the halving in a strong fiscal position and continue to focus on paying down this debt and strengthening the balance sheet.

Markella Zarifi: Thank you, Jim. Another pre-submitted question for Thomas this time. What are your plans for increasing efficiency and reducing the recent downtime at several bitcoin mining facilities?

Thomas Chippas: Thank you for that question. So with the relocation to Baie-Comeau, as I noted, we consolidated our infrastructure. And as discussed in the previous quarter’s call, the downtime was minimal and had minimal impact to revenue. In response to the downtime that we saw in February, as we also noted on the previous call, there was some maintenance upstream by power providers that was beyond our control. I think when you look at our operations team, they’re doing a very good job of maintaining uptime across the fleet, and they continually work to improve operational efficiency. And you can observe that when looking at the 5% increase in daily bitcoin production in March of ’24 compared to February of ’24. So we’ll continue to look for ways to enhance efficiency and reduce our susceptibility to downtime events on an ongoing basis.

Markella Zarifi: Thank you, Thomas. Another pre-submitted question directed to Thomas once more. Can you give an update on where hash rate currently stands across all facilities? Additionally, assuming hash prices normalize post-halving, what strategies can you implement to lower your direct and all-in cost per BTC mined to mitigate losses?

Thomas Chippas: Thank you for that. So our hash rate capacity at Baie-Comeau was about 300 petahash. And that’s the ePIC BlockMiners. And the efficiency on the nameplate for those machines is anywhere from 30 to 35 joules per terahash. At Helios, where we have about 2.4 exahash, we’re running the S19j Pros. And the nameplate efficiency is about the same in the 30 to 35 range. So to lower our direct and all-in cost per bitcoin mined, we’re going to continue to optimize the fleet for operational efficiency and leverage economic curtailment during high power prices. I think going forward, we’re open-minded about strategic opportunities for equipment acquisition and site acquisition and what have you. And we’ll continue to focus in the interim on maintaining cost-effective operations to ensure that we’re getting the best out of the fleet that we can.

Markella Zarifi: Thanks, Thomas. I think we have time for one last question. So with this one, let’s wrap that up. Last question, pre-submitted, directed to Jim. What was the thought process around selling the Mirabel facility?

Jim MacCallum: Yes. So there were clearly a number of factors that went into the sales decision. Firstly, we were very happy with the price. We think the sale price of $6.1 million, which equates to approximately $1.2 million per megawatt for that site, was significantly more than what would — what it would cost to develop a facility in North America. So we’re pleased with the price, first of all. Secondly, the sale provided an opportunity, as Tom mentioned, to consolidate our operations into the Baie-Comeau facility. So going from 2 facilities in Quebec to 1, allowing us to reduce our overhead and operational expenses, contributing to greater overall efficiency for Argo. And then lastly, the consolidation, as we’ve mentioned, has had minimal impact on our overall hash rate and revenue generation from relocating the machines. We’re able to maintain our hash rate capacity while at the same time streamlining our Quebec operations, which allows us to focus the resources and management efforts more effectively. And additionally, the net proceeds from the sale strengthened our financial position, support our growth initiatives and reduces our interest expense going forward, which is important. So these were the primary factors in deciding to sell the Mirabel facility.

Thomas Chippas: Okay. Well, thank you, everyone, for joining us today. It goes without saying that it’s certainly an exciting time in the mining space and we think an exciting time for Argo. We look forward to speaking with everyone again in a few weeks at our Annual General Meeting on June 6. Thank you very much for your time.

Operator: Fantastic. Thank you very much, indeed, for updating investors today. [Operator Instructions] On behalf of the management team of Argo Blockchain plc, we would like to thank you for attending today’s presentation. That concludes today’s session, and good afternoon to you all.

This article was generated with the support of AI and reviewed by an editor. For more information see our T&C.

News

An enhanced consensus algorithm for blockchain

The introduction of the link and reputation evaluation concepts aims to improve the stability and security of the consensus mechanism, decrease the likelihood of malicious nodes joining the consensus, and increase the reliability of the selected consensus nodes.

The link model structure based on joint action

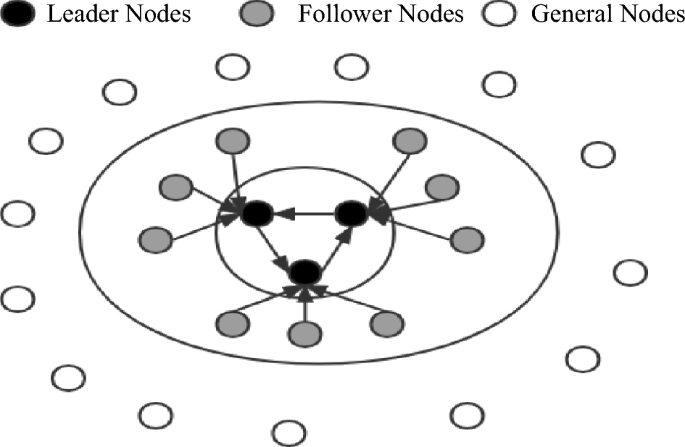

Through the LINK between nodes, all the LINK nodes engage in consistent activities during the operation of the consensus mechanism. The reputation evaluation mechanism evaluates the trustworthiness of nodes based on their historical activity status throughout the entire blockchain. The essence of LINK is to drive inactive nodes to participate in system activities through active nodes. During the stage of selecting leader nodes, nodes are selected through self-recommendation, and the reputation evaluation of candidate nodes and their LINK nodes must be qualified. The top 5 nodes of the total nodes are elected as leader nodes through voting, and the nodes in their LINK status are candidate nodes. In the event that the leader node goes down, the responsibility of the leader node is transferred to the nodes in its LINK through the view-change. The LINK connection algorithm used in this study is shown in Table 2, where LINKm is the linked group and LINKP is the percentage of linked nodes.

Table 2 LINK connection algorithm.

Node type

This paper presents a classification of nodes in a blockchain system based on their functionalities. The nodes are divided into three categories: leader nodes (LNs), follower nodes (FNs), and general nodes (Ns). The leader nodes (LNs) are responsible for producing blocks and are elected through voting by general nodes. The follower nodes (FNs) are nodes that are linked to leader nodes (LNs) through the LINK mechanism and are responsible for validating blocks. General nodes (N) have the ability to broadcast and disseminate information, participate in elections, and vote. The primary purpose of the LINK mechanism is to act in combination. When nodes are in the LINK, there is a distinction between the master and slave nodes, and there is a limit to the number of nodes in the LINK group (NP = {n1, nf1, nf2 ……,nfn}). As the largest proportion of nodes in the system, general nodes (N) have the right to vote and be elected. In contrast, leader nodes (LNs) and follower nodes (FNs) do not possess this right. This rule reduces the likelihood of a single node dominating the block. When the system needs to change its fundamental settings due to an increase in the number of nodes or transaction volume, a specific number of current leader nodes and candidate nodes need to vote for a reset. Subsequently, general nodes need to vote to confirm this. When both confirmations are successful, the new basic settings are used in the next cycle of the system process. This dual confirmation setting ensures the fairness of the blockchain to a considerable extent. It also ensures that the majority holds the ultimate decision-making power, thereby avoiding the phenomenon of a small number of nodes completely controlling the system.

After the completion of a governance cycle, the blockchain network will conduct a fresh election for the leader and follower nodes. As only general nodes possess the privilege to participate in the election process, the previous consortium of leader and follower nodes will lose their authorization. In the current cycle, they will solely retain broadcasting and receiving permissions for block information, while their corresponding incentives will also decrease. A diagram illustrating the node status can be found in Fig. 1.

Election method

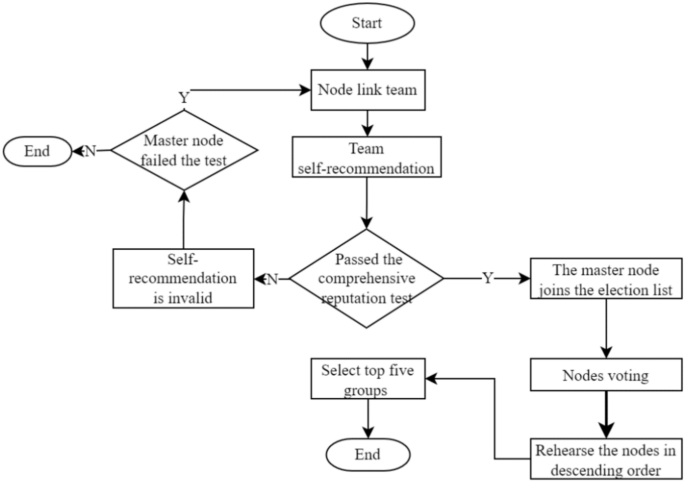

The election method adopts the node self-nomination mode. If a node wants to participate in an election, it must form a node group with one master and three slaves. One master node group and three slave node groups are inferred based on experience in this paper; these groups can balance efficiency and security and are suitable for other project collaborations. The successfully elected node joins the leader node set, and its slave nodes enter the follower node set. Considering the network situation, the maximum threshold for producing a block is set to 1 s. If the block fails to be successfully generated within the specified time, it is regarded as a disconnected state, and its reputation score is deducted. The node is skipped, and in severe cases, a view transformation is performed, switching from the master node to the slave node and inheriting its leader’s rights in the next round of block generation. Although the nodes that become leaders are high-reputation nodes, they still have the possibility of misconduct. If a node engages in misconduct, its activity will be immediately stopped, its comprehensive reputation score will be lowered, it will be disqualified from participating in the next election, and its equity will be reduced by 30%. The election process is shown in Fig. 2.

Incentives and penalties

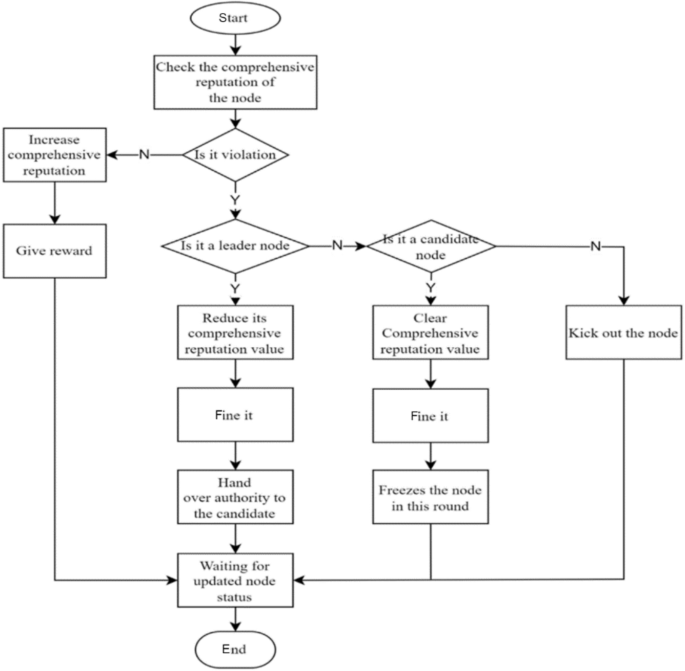

To balance the rewards between leader nodes and ordinary nodes and prevent a large income gap, two incentive/penalty methods will be employed. First, as the number of network nodes and transaction volume increase, more active nodes with significant stakes emerge. After a prolonged period of running the blockchain, there will inevitably be significant class distinctions, and ordinary nodes will not be able to win in the election without special circumstances. To address this issue, this paper proposes that rewards be reduced for nodes with stakes exceeding a certain threshold, with the reduction rate increasing linearly until it reaches zero. Second, in the event that a leader or follower node violates the consensus process, such as by producing a block out of order or being unresponsive for an extended period, penalties will be imposed. The violation handling process is illustrated in Fig. 3.

Violation handling process.

Comprehensive reputation evaluation and election mechanism based on historical transactions

This paper reveals that the core of the DPoS consensus mechanism is the election process. If a blockchain is to run stably for a long time, it is essential to consider a reasonable election method. This paper proposes a comprehensive reputation evaluation election mechanism based on historical records. The mechanism considers the performance indicators of nodes in three dimensions: production rate, tokens, and validity. Additionally, their historical records are considered, particularly whether or not the nodes have engaged in malicious behavior. For example, nodes that have ever been malicious will receive low scores during the election process unless their overall quality is exceptionally high and they have considerable support from other nodes. Only in this case can such a node be eligible for election or become a leader node. The comprehensive reputation score is the node’s self-evaluation score, and the committee size does not affect the computational complexity.

Moreover, the comprehensive reputation evaluation proposed in this paper not only is a threshold required for node election but also converts the evaluation into corresponding votes based on the number of voters. Therefore, the election is related not only to the benefits obtained by the node but also to its comprehensive evaluation and the number of voters. If two nodes receive the same vote, the node with a higher comprehensive reputation is given priority in the ranking. For example, in an election where node A and node B each receive 1000 votes, node A’s number of stake votes is 800, its comprehensive reputation score is 50, and only four nodes vote for it. Node B’s number of stake votes is 600, its comprehensive reputation score is 80, and it receives votes from five nodes. In this situation, if only one leader node position remains, B will be selected as the leader node. Displayed in descending order of priority as comprehensive credit rating, number of voters, and stake votes, this approach aims to solve the problem of node misconduct at its root by democratizing the process and subjecting leader nodes to constraints, thereby safeguarding the fundamental interests of the vast majority of nodes.

Comprehensive reputation evaluation

This paper argues that the election process of the DPoS consensus mechanism is too simplistic, as it considers only the number of election votes that a node receives. This approach fails to comprehensively reflect the node’s actual capabilities and does not consider the voters’ election preferences. As a result, nodes with a significant stake often win and become leader nodes. To address this issue, the comprehensive reputation evaluation score is normalized considering various attributes of the nodes. The scoring results are shown in Table 3.

Table 3 Comprehensive reputation evaluation.

Since some of the evaluation indicators in Table 3 are continuous while others are discrete, different normalization methods need to be employed to obtain corresponding scores for different indicators. The continuous indicators include the number of transactions/people, wealth balance, network latency, network jitter, and network bandwidth, while the discrete indicators include the number of violations, the number of successful elections, and the number of votes. The value range of the indicator “number of transactions/people” is (0,1), and the value range of the other indicators is (0, + ∞). The equation for calculating the “number of transactions/people” is set as shown in Eq. (1).

$$A_{1} = \left\{ {\begin{array}{*{20}l} {0,} \hfill & {{\text{G}} = 0} \hfill \\ {\frac{{\text{N}}}{{\text{G}}}*10,} \hfill & {{\text{G}} > 0} \hfill \\ \end{array} } \right.$$

(1)

where N represents the number of transactional nodes and G represents the number of transactions. It reflects the degree of connection between the node and other nodes. Generally, nodes that transact with many others are safer than those with a large number of transactions with only a few nodes. The limit value of each item, denoted by x, is determined based on the situation and falls within the specified range, as shown in Eq. (2). The wealth balance and network bandwidth indicators use the same function to set their respective values.

$${A}_{i}=20*\left(\frac{1}{1+{e}^{-{a}_{i}x}}-0.5\right)$$

(2)

where x indicates the value of this item and expresses the limit value.

In Eq. (3), x represents the limited value of this indicator. The lower the network latency and network jitter are, the higher the score will be.

The last indicators, which are the number of violations, the number of elections, and the number of votes, are discrete values and are assigned different scores according to their respective ranges. The scores corresponding to each count are shown in Table 4.

$$A_{3} = \left\{ {\begin{array}{*{20}l} {10*\cos \frac{\pi }{200}x,} \hfill & {0 \le x \le 100} \hfill \\ {0,} \hfill & {x > 100} \hfill \\ \end{array} } \right.$$

(3)

Table 4 Score conversion.

The reputation evaluation mechanism proposed in this paper comprehensively considers three aspects of nodes, wealth level, node performance, and stability, to calculate their scores. Moreover, the scores obtain the present data based on historical records. Each node is set as an M × N dimensional matrix, where M represents M times the reputation evaluation score and N represents N dimensions of reputation evaluation (M < = N), as shown in Eq. (4).

$${\text{N}} = \left( {\begin{array}{*{20}c} {a_{11} } & \cdots & {a_{1n} } \\ \vdots & \ddots & \vdots \\ {a_{m1} } & \cdots & {a_{mn} } \\ \end{array} } \right)$$

(4)

The comprehensive reputation rating is a combined concept related to three dimensions. The rating is set after rating each aspect of the node. The weight w and the matrix l are not fixed. They are also transformed into matrix states as the position of the node in the system changes. The result of the rating is set as the output using Eq. (5).

$$\text{T}=\text{lN}{w}^{T}=\left({l}_{1}\dots {\text{l}}_{\text{m}}\right)\left(\begin{array}{ccc}{a}_{11}& \cdots & {a}_{1n}\\ \vdots & \ddots & \vdots \\ {a}_{m1}& \cdots & {a}_{mn}\end{array}\right){\left({w}_{1}\dots {w}_{n}\right)}^{T}$$

(5)

Here, T represents the comprehensive reputation score, and l and w represent the correlation coefficient. Because l is a matrix of order 1*M, M is the number of times in historical records, and M < = N is set, the number of dimensions of l is uncertain. Set the term l above to add up to 1, which is l1 + l2 + …… + ln = 1; w is also a one-dimensional matrix whose dimension is N*1, and its purpose is to act as a weight; within a certain period of time, w is a fixed matrix, and w will not change until the system changes the basic settings.

Assume that a node conducts its first comprehensive reputation rating, with no previous transaction volume, violations, elections or vote. The initial wealth of the node is 10, the latency is 50 ms, the jitter is 100 ms, and the network bandwidth is 100 M. According to the equation, the node’s comprehensive reputation rating is 41.55. This score is relatively good at the beginning and gradually increases as the patient participates in system activities continuously.

Voting calculation method

To ensure the security and stability of the blockchain system, this paper combines the comprehensive reputation score with voting and randomly sorts the blocks, as shown in Eqs. (3–6).

$$Z=\sum_{i=1}^{n}{X}_{i}+nT$$

(6)

where Z represents the final election score, Xi represents the voting rights earned by the node, n is the number of nodes that vote for this node, and T is the comprehensive reputation score.

The voting process is divided into stake votes and reputation votes. The more reputation scores and voters there are, the more total votes that are obtained. In the early stages of blockchain operation, nodes have relatively few stakes, so the impact of reputation votes is greater than that of equity votes. This is aimed at selecting the most suitable node as the leader node in the early stage. As an operation progresses, the role of equity votes becomes increasingly important, and corresponding mechanisms need to be established to regulate it. The election vote algorithm used in this paper is shown in Table 5.

Table 5 Election vote counting algorithm.

This paper argues that the election process utilized by the original DPoS consensus mechanism is overly simplistic, as it relies solely on the vote count to select the node that will oversee the entire blockchain. This approach cannot ensure the security and stability of the voting process, and if a malicious node behaves improperly during an election, it can pose a significant threat to the stability and security of the system as well as the safety of other nodes’ assets. Therefore, this paper proposes a different approach to the election process of the DPoS consensus mechanism by increasing the complexity of the process. We set up a threshold and optimized the vote-counting process to enhance the security and stability of the election. The specific performance of the proposed method was verified through experiments.

The election cycle in this paper can be customized, but it requires the agreement of the blockchain committee and general nodes. The election cycle includes four steps: node self-recommendation, calculating the comprehensive reputation score, voting, and replacing the new leader. Election is conducted only among general nodes without affecting the production or verification processes of leader nodes or follower nodes. Nodes start voting for preferred nodes. If they have no preference, they can use the LINK mechanism to collaborate with other nodes and gain additional rewards.

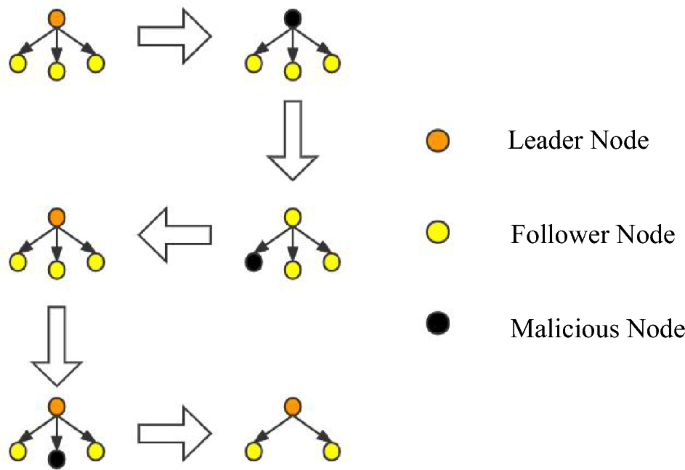

View changes

During the consensus process, conducting a large number of updates is not in line with the system’s interests, as the leader node (LN) and follower node (FN) on each node have already been established. Therefore, it is crucial to handle problematic nodes accurately when issues arise with either the LN or FN. For instance, when a node fails to perform its duties for an extended period or frequently fails to produce or verify blocks within the specified time range due to latency, the system will precisely handle them. For leader nodes, if they engage in malicious behavior such as producing blocks out of order, the behavior is recorded, and their identity as a leader node is downgraded to a follower node. The follower node inherits the leader node’s position, and the nature of their work is transformed as they swap their responsibilities of producing and verifying blocks with their original work. This type of behavior will not significantly affect the operation of the blockchain system. Instead of waiting until the end of the current committee round to punish malicious nodes, dynamic punishment is imposed on the nodes that affect the operation of the blockchain system to maintain system security. The view change operation is illustrated in Fig. 4.

In traditional PBFT, view changes are performed according to the view change protocol by changing the view number V to the next view number V + 1. During this process, nodes only receive view change messages and no other messages from other nodes. In this paper, the leader node group (LN) and follower node group (FN) are selected through an election of the LINK group. The node with LINKi[0] is added to the LN leader node group, while the other three LINK groups’ follower nodes join the FN follower node group since it is a configuration pattern of one master and three slaves. The view change in this paper requires only rearranging the node order within the LINK group to easily remove malicious nodes. Afterward, the change is broadcast to other committee nodes, and during the view transition, the LINK group does not receive block production or verification commands from the committee for stability reasons until the transition is completed.

News

The Hype Around Blockchain Mortgage Has Died Down, But This CEO Still Believes

LiquidFi Founder Ian Ferreira Sees Huge Potential in Blockchain Despite Hype around technology is dead.

“Blockchain technology has been a buzzword for a long time, and it shouldn’t be,” Ferriera said. “It should be a technology that lives in the background, but it makes everything much more efficient, much more transparent, and ultimately it saves costs for everyone. That’s the goal.”

Before founding his firm, Ferriera was a portfolio manager at a hedge fund, a job that ended up revealing “interesting intricacies” related to the mortgage industry.

Being a mortgage trader opened Ferriera’s eyes to a lot of the operational and infrastructure problems that needed to be solved in the mortgage-backed securities industry, he said. That later led to the birth of LiquidFi.

“The point of what we do is to get raw data attached to a resource [a loan] on a blockchain so that it’s provable. You reduce that trust problem because you have the data, you have the document associated with that data,” said the LiquidFi CEO.

Ferriera spoke with National Mortgage News about the value of blockchain technology, why blockchain hype has fizzled out, and why it shouldn’t.

News

New bill pushes Department of Veterans Affairs to examine how blockchain can improve its work

The Department of Veterans Affairs would have to evaluate how blockchain technology could be used to improve benefits and services offered to veterans, according to a legislative proposal introduced Tuesday.

The bill, sponsored by Rep. Nancy Mace, R-S.C., would direct the VA to “conduct a comprehensive study of the feasibility, potential benefits, and risks associated with using distributed ledger technology in various programs and services.”

Distributed ledger technology, including blockchain, is used to protect and track information by storing data across multiple computers and keeping a record of its use.

According to the text of the legislation, which Mace’s office shared exclusively with Nextgov/FCW ahead of its publication, blockchain “could significantly improve benefits allocation, insurance program management, and recordkeeping within the Department of Veterans Affairs.”

“We need to bring the federal government into the 21st century,” Mace said in a statement. “This bill will open the door to research on improving outdated systems that fail our veterans because we owe it to them to use every tool at our disposal to improve their lives.”

Within one year of the law taking effect, the Department of Veterans Affairs will be required to submit a report to the House and Senate Veterans Affairs committees detailing its findings, as well as the benefits and risks identified in using the technology.

The mandatory review is expected to include information on how the department’s use of blockchain could improve the way benefits decisions are administered, improve the management and security of veterans’ personal data, streamline the insurance claims process, and “increase transparency and accountability in service delivery.”

The Department of Veterans Affairs has been studying the potential benefits of using distributed ledger technology, with the department emission a request for information in November 2021 seeking input from contractors on how blockchain could be leveraged, in part, to streamline its supply chains and “secure data sharing between institutions.”

The VA’s National Institute of Artificial Intelligence has also valued the use of blockchain, with three of the use cases tested during the 2021 AI tech sprint focused on examining its capabilities.

Mace previously introduced a May bill that would direct Customs and Border Protection to create a public blockchain platform to store and share data collected at U.S. borders.

Lawmakers also proposed additional measures that would push the Department of Veterans Affairs to consider adopting other modernized technologies to improve veteran services.

Rep. David Valadao, R-Calif., introduced legislation in June that would have directed the department to report to lawmakers on how it plans to expand the use of “certain automation tools” to process veterans’ claims. The House of Representatives Subcommittee on Disability Assistance and Memorial Affairs gave a favorable hearing on the congressman’s bill during a Markup of July 23.

News

California DMV Uses Blockchain to Fight Auto Title Fraud

TDR’s Three Takeaways: California DMV Uses Blockchain to Fight Fraud

- California DMV uses blockchain technology to manage 42 million auto titles.

- The initiative aims to improve safety and reduce car title fraud.

- The immutable nature of blockchain ensures accurate and tamper-proof records.

The California Department of Motor Vehicles (DMV) is implementing blockchain technology to manage and secure 42 million auto titles. This innovative move aims to address and reduce the persistent problem of auto title fraud, a problem that costs consumers and the industry millions of dollars each year. By moving to a blockchain-based system, the DMV is taking advantage of the technology’s key feature: immutability.

Blockchain, a decentralized ledger technology, ensures that once a car title is registered, it cannot be altered or tampered with. This creates a highly secure and transparent system, significantly reducing the risk of fraudulent activity. Every transaction and update made to a car title is permanently recorded on the blockchain, providing a complete and immutable history of the vehicle’s ownership and status.

As first reported by Reuters, the DMV’s adoption of blockchain isn’t just about preventing fraud. It’s also aimed at streamlining the auto title process, making it more efficient and intuitive. Traditional auto title processing involves a lot of paperwork and manual verification, which can be time-consuming and prone to human error. Blockchain technology automates and digitizes this process, reducing the need for physical documents and minimizing the chances of errors.

Additionally, blockchain enables faster verification and transfer of car titles. For example, when a car is sold, the transfer of ownership can be done almost instantly on the blockchain, compared to days or even weeks in the conventional system. This speed and efficiency can benefit both the DMV and the vehicle owners.

The California DMV’s move is part of a broader trend of government agencies exploring blockchain technology to improve their services. By adopting this technology, the DMV is setting a precedent for other states and industries to follow, showcasing blockchain’s potential to improve safety and efficiency in public services.

-

Ethereum12 months ago

Ethereum12 months agoEthereum Posts First Consecutive Monthly Losses Since August 2023 on New ETFs

-

Regulation12 months ago

Regulation12 months agoCryptocurrency Regulation in Slovenia 2024

-

News12 months ago

News12 months agoNew bill pushes Department of Veterans Affairs to examine how blockchain can improve its work

-

Regulation12 months ago

Regulation12 months agoThink You Own Your Crypto? New UK Law Would Ensure It – DL News

-

Regulation12 months ago

Regulation12 months agoUpbit, Coinone, Bithumb Face New Fees Under South Korea’s Cryptocurrency Law

-

Regulation12 months ago

Regulation12 months agoA Blank Slate for Cryptocurrencies: Kamala Harris’ Regulatory Opportunity

-

Regulation12 months ago

Regulation12 months agoBahamas Passes Cryptocurrency Bill Designed to Prevent FTX, Terra Disasters

-

Regulation12 months ago

Regulation12 months agoIndia to Follow G20 Policy for Cryptocurrency Regulation: MoS Finance

-

News1 year ago

News1 year ago“Captain Tsubasa – RIVALS” launches on Oasys Blockchain

-

Ethereum1 year ago

Ethereum1 year agoComment deux frères auraient dérobé 25 millions de dollars lors d’un braquage d’Ethereum de 12 secondes • The Register

-

News12 months ago

News12 months agoEU supports 15 startups to fight online disinformation with blockchain

-

News1 year ago

News1 year agoSolana ranks the fastest blockchain in the world, surpassing Ethereum, Polygon ⋆ ZyCrypto