News

Argo Blockchain PLC Announces Private Placement With Institutional Investor

Argo Blockchain plc (LSE:ARB)(NASDAQ:ARBK) has announced a private placement of ordinary shares and warrants with an institutional investor, raising gross proceeds of approximately £6.5 million. The company will issue 57,800,000 ordinary shares at £0.1125 per share, along with warrants to purchase an additional 57,800,000 shares at the same price, exercisable over five years. The issuance price represents a premium to recent volume-weighted average prices and a 10% discount to the closing price on July 29, 2024.

The net proceeds will be used for working capital, general corporate purposes, and debt repayment. H.C. Wainwright & Co. is acting as the exclusive placement agent. The placement shares are expected to be admitted to trading on the London Stock Exchange on or about July 31, 2024, bringing the total number of ordinary shares in issue to 636,352,148.

Argo Blockchain plc (LSE:ARB)(NASDAQ:ARBK) ha annunciato un collocamento privato di azioni ordinarie e warrant con un investitore istituzionale, raccogliendo proventi lordi di circa 6,5 milioni di sterline. L’azienda emetterà 57.800.000 azioni ordinarie a £0,1125 per azione, insieme a warrant per l’acquisto di ulteriori 57.800.000 azioni allo stesso prezzo, esercitabili nel corso di cinque anni. Il prezzo di emissione rappresenta un premio rispetto ai recenti prezzi medi ponderati per volume e uno sconto del 10% rispetto al prezzo di chiusura del 29 luglio 2024.

Le entrate nette saranno utilizzate per il capitale circolante, scopi aziendali generali e rimborso del debito. H.C. Wainwright & Co. agirà come agente di collocamento esclusivo. Le azioni del collocamento dovrebbero essere ammesse alla negoziazione sulla Borsa di Londra attorno al 31 luglio 2024, portando il numero totale di azioni ordinarie in circolazione a 636.352.148.

Argo Blockchain plc (LSE:ARB)(NASDAQ:ARBK) ha anunciado un colocación privada de acciones ordinarias y warrants con un inversor institucional, recaudando ingresos brutos de aproximadamente 6,5 millones de libras. La empresa emitirá 57.800.000 acciones ordinarias a £0,1125 por acción, junto con warrants para comprar 57.800.000 acciones adicionales al mismo precio, ejercitables durante cinco años. El precio de emisión representa una prima respecto a los precios promedio ponderados por volumen recientes y un descuento del 10% respecto al precio de cierre del 29 de julio de 2024.

Los ingresos netos se utilizarán para capital de trabajo, fines corporativos generales y pago de deudas. H.C. Wainwright & Co. actuará como agente exclusivo de colocación. Se espera que las acciones del colocación sean admitidas a negociación en la Bolsa de Valores de Londres alrededor del 31 de julio de 2024, llevando el número total de acciones ordinarias en circulación a 636.352.148.

Argo Blockchain plc (LSE:ARB)(NASDAQ:ARBK)는 기관 투자자와 함께 사모 배치를 발표하여 약 650만 파운드의 총 수익을 올렸습니다. 회사는 주당 £0.1125에 57,800,000주의 보통주를 발행하고, 같은 가격으로 추가 57,800,000주를 구매할 수 있는 권리인 워런트를 함께 발행하며, 이는 5년 이내에 행사할 수 있습니다. 발행 가격은 최근 거래량 가중 평균 가격보다 프리미엄을 나타내며 2024년 7월 29일의 종가에 비해 10%의 할인입니다.

순수익은 운전 자본, 일반 기업 목적 및 부채 상환에 사용됩니다. H.C. Wainwright & Co.는 독점 배치 대행을 맡고 있습니다. 배치 주식은 2024년 7월 31일 경 런던 증권거래소에서 거래가 시작될 것으로 예상되며, 보통주의 총 발행 수는 636,352,148주에 이를 것입니다.

Argo Blockchain plc (LSE:ARB)(NASDAQ:ARBK) a annoncé un placement privé d’actions ordinaires et de bons de souscription avec un investisseur institutionnel, levant des produits bruts d’environ 6,5 millions de livres. La société émettra 57.800.000 actions ordinaires à £0,1125 par action, accompagnées de bons de souscription permettant d’acheter 57.800.000 actions supplémentaires au même prix, exerçables sur cinq ans. Le prix d’émission représente une prime par rapport aux prix moyens pondérés par volume récents et une remise de 10 % par rapport au prix de clôture du 29 juillet 2024.

Les produits nets seront utilisés pour le fonds de roulement, des fins d’entreprise générales et le remboursement de dettes. H.C. Wainwright & Co. agit en tant qu’agent de placement exclusif. Les actions du placement devraient être admises à la négociation à la Bourse de Londres autour du 31 juillet 2024, portant le nombre total d’actions ordinaires en circulation à 636.352.148.

Argo Blockchain plc (LSE:ARB)(NASDAQ:ARBK) hat eine Privatplatzierung von Stammaktien und Optionsscheinen mit einem institutionellen Investor angekündigt, dabei wurden brutto etwa 6,5 Millionen Pfund beschafft. Das Unternehmen wird 57.800.000 Stammaktien zu einem Preis von £0,1125 pro Aktie ausgeben, zusammen mit Optionsscheinen zum Kauf von weiteren 57.800.000 Aktien zum gleichen Preis, die über einen Zeitraum von fünf Jahren ausgeübt werden können. Der Ausgabepreis stellt eine Prämie zu den jüngsten volumengewichteten Durchschnittspreisen dar und einen Rabatt von 10 % auf den Schlusskurs vom 29. Juli 2024.

Die netto Einnahmen werden für Betriebskapital, allgemeine Unternehmenszwecke und Schuldenrückzahlung verwendet. H.C. Wainwright & Co. fungiert als exklusiver Platzierungsagent. Die Platzierungsaktien sollen voraussichtlich am oder um den 31. Juli 2024 an der Londoner Börse gehandelt werden, wodurch die Gesamtzahl der ausgegebenen Stammaktien auf 636.352.148 erhöht wird.

Positive

- Raised £6.5 million in gross proceeds through private placement

- Issuance price at a premium to 30, 60, and 90-day VWAPs

- Warrants provide potential for additional future funding

- Proceeds to be used for working capital and debt repayment

Negative

- 10% discount to the closing share price on July 29, 2024

- Potential dilution for existing shareholders if warrants are exercised

Argo Blockchain’s private placement of £6.5 million is a significant development for the company’s financial position. The issuance of 57,800,000 ordinary shares at £0.1125 per share, along with warrants, indicates a strategic move to strengthen their balance sheet. Here are key insights:

- The £0.1125 issuance price, while at a 10% discount to the closing price, is actually at a premium to recent volume-weighted average prices (VWAPs). This suggests investor confidence in Argo’s future prospects.

- The inclusion of warrants with a five-year exercise period at the same price as the issued shares provides potential for additional capital infusion in the future, totaling up to another £6.5 million if fully exercised.

- The stated use of proceeds for working capital, general corporate purposes and debt repayment indicates a focus on improving the company’s financial flexibility and reducing leverage.

However, investors should note the dilutive effect of this placement. The additional 57,800,000 shares will increase the total outstanding shares to 636,352,148, representing a dilution of approximately 9.1%. While this may pressure the stock in the short term, the improved financial position could support long-term value creation if managed effectively.

The involvement of H.C. Wainwright & Co. as the exclusive placement agent lends credibility to the transaction, potentially signaling institutional interest in the blockchain and cryptocurrency mining sector despite recent market volatility.

This private placement for Argo Blockchain, a prominent player in the cryptocurrency mining space, carries several implications for the company and the broader blockchain industry:

- Capital Intensive Nature: The need for additional funding underscores the capital-intensive nature of cryptocurrency mining operations. As mining difficulty increases and energy costs fluctuate, companies like Argo must continually invest in infrastructure and technology to remain competitive.

- Market Sentiment: The successful placement, especially at a premium to recent VWAPs, suggests that institutional investors maintain interest in the blockchain sector despite the crypto market’s volatility. This could be seen as a positive indicator for the industry’s long-term prospects.

- Strategic Positioning: By strengthening its balance sheet, Argo is potentially positioning itself to capitalize on market opportunities, such as acquiring discounted mining equipment or expanding operations during a period when smaller competitors might be struggling.

However, it’s important to consider the broader context. The cryptocurrency mining industry faces ongoing challenges, including regulatory scrutiny, environmental concerns and the upcoming Bitcoin halving event. Argo’s ability to navigate these challenges while effectively utilizing the new capital will be critical for its future success.

Investors should monitor how Argo deploys this capital, particularly in terms of energy efficiency improvements or diversification of operations, as these factors could significantly impact the company’s competitiveness and sustainability in the evolving blockchain landscape.

Argo Blockchain’s private placement offers intriguing insights into the current state of the cryptocurrency mining market and investor sentiment:

- Investor Appetite: The successful placement, particularly with an institutional investor, suggests there’s still appetite for exposure to the crypto mining sector, despite the recent market downturn. This could indicate a belief in the long-term viability of blockchain technology and cryptocurrencies.

- Valuation Metrics: The issuance price being at a premium to recent VWAPs but a discount to the current market price presents an interesting valuation dynamic. It might suggest that investors see current market prices as somewhat inflated, but still believe in the company’s longer-term prospects.

- Industry Consolidation: With Argo securing additional funding, we might be witnessing a phase of industry consolidation. Stronger players like Argo could be positioning themselves to acquire assets or market share from struggling competitors, potentially reshaping the competitive landscape.

From a broader market perspective, this transaction could be seen as a litmus test for investor sentiment towards the crypto mining sector. The successful placement might encourage other companies in the space to seek similar funding arrangements, potentially leading to increased M&A activity or capital raises in the sector.

However, it’s important to note that while this placement provides Argo with additional financial flexibility, it doesn’t necessarily signal an immediate turnaround for the crypto mining industry as a whole. Investors should continue to monitor broader trends such as Bitcoin price movements, regulatory developments and technological advancements in mining efficiency, as these factors will ultimately drive the sector’s long-term viability and profitability.

07/30/2024 – 02:00 AM

LONDON, UNITED KINGDOM / ACCESSWIRE / July 30, 2024 / Argo Blockchain plc, (LSE:ARB)(NASDAQ:ARBK), is pleased to announce that it has entered into a securities purchase agreement for a private placement of its ordinary shares (“Ordinary Shares”) and accompanying warrants to purchase Ordinary Shares to an institutional investor for gross proceeds of approximately GBP £6.5 million (the “Private Placement”). Pursuant to the Private Placement, the Company will issue 57,800,000 Ordinary Shares (the “Placement Shares”) at a purchase price of GBP £0.1125 per Ordinary Share along with warrants to purchase up to 57,800,000 Ordinary Shares (the “Warrants”). The Warrants have an exercise price of GBP £0.1125 per share and an exercise period of five years.

The issuance price is at a premium to the 30 day VWAP, 60 day VWAP and 90 day VWAP and at a 10% discount to the closing middle market price of an Ordinary Share on the London Stock Exchange on 29 July 2024.

H.C. Wainwright & Co. is acting as the exclusive placement agent for the Private Placement.

The net proceeds of the Private Placement will be used by the Company for working capital and general corporate purposes, including the repayment of indebtedness.

Application will be made for the Placement Shares and the shares issuable upon exercise of the Warrants (the “Warrant Shares”), if exercised, to be admitted to the Official List and to trading on the Main Market of the London Stock Exchange. Admission of the Placement Shares and the closing of the Private Placement are expected to occur on or about 31 July 2024 (“Admission”). The Placement Shares and Warrant Shares, if any, will rank pari passu with the existing Ordinary Shares of the Company.

Following Admission, the total number of Ordinary Shares in issue will be 636,352,148, and the total number of voting rights will therefore be 636,352,148. This figure may be used by shareholders as the denominator for the calculations by which they will determine if they are required to notify their interest in, or a change to their interest in, the share capital of the Company under the FCA’s Disclosure Guidance and Transparency Rules.

The securities being offered have not been, nor will they be, registered under the United States Securities Act of 1933, as amended, and such securities may not be offered or sold within the United States absent registration under U.S. federal and state securities laws or an applicable exemption from such U.S. registration requirements.

This announcement shall not constitute an offer to sell or the solicitation of an offer to buy nor shall there be any sale of the securities in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction.

Forward looking statements

This announcement contains “forward-looking statements,” which can be identified by words like “may,” “will,” “likely,” “should,” “expect,” “anticipate,” “future,” “plan,” “believe,” “intend,” “goal,” “seek,” “estimate,” “project,” “continue” and similar expressions. Forward-looking statements are neither historical facts nor assurances of future performance. Instead, they are based only on the Company’s current beliefs, expectations and assumptions regarding the future of its business, future plans and strategies, projections, anticipated events and trends, the economy and other future conditions. Because forward-looking statements relate to the future, they are subject to inherent uncertainties, risks and changes in circumstances that are difficult to predict and many of which are outside of the Company’s control. The information in this announcement about future plans and objectives of the Company, including the expectation to complete the Private Placement and the expected expenditure of the net proceeds of the Private Placement, are forward-looking statements. The Company’s actual results and financial condition may differ materially from those indicated in the forward-looking statements. Therefore, you should not rely on any of these forward-looking statements. Important factors that could cause the Company’s actual results and financial condition to differ materially from those indicated in the forward-looking statements include, market and other conditions, the principal risks and uncertainties listed in the risk factors set forth in our Annual Report and Financial Statements and Form 20-F for the year ended December 31, 2023, and our Interim Report as of March 31, 2024.

For further information please contact:

About Argo:

Argo Blockchain plc is a dual-listed (LSE: ARB; NASDAQ: ARBK) blockchain technology company focused on large-scale cryptocurrency mining. With mining operations in Quebec and Texas, and offices in the US, Canada, and the UK, Argo’s global, sustainable operations are predominantly powered by renewable energy. In 2021, Argo became the first climate positive cryptocurrency mining company, and a signatory to the Crypto Climate Accord. For more information, visit www.argoblockchain.com.

This information is provided by RNS, the news service of the London Stock Exchange. RNS is approved by the Financial Conduct Authority to act as a Primary Information Provider in the United Kingdom. Terms and conditions relating to the use and distribution of this information may apply. For further information, please contact rns@lseg.com or visit www.rns.com.

SOURCE: Argo Blockchain PLC

View the original press release on accesswire.com

FAQ

How much did Argo Blockchain (ARBK) raise in its private placement on July 30, 2024?

Argo Blockchain raised approximately £6.5 million in gross proceeds through a private placement of ordinary shares and warrants with an institutional investor.

What is the exercise price and duration of the warrants issued by Argo Blockchain (ARBK) in the July 2024 private placement?

The warrants have an exercise price of £0.1125 per share and an exercise period of five years.

How many ordinary shares will Argo Blockchain (ARBK) have in issue after the July 2024 private placement?

Following the admission of the new shares, Argo Blockchain will have a total of 636,352,148 ordinary shares in issue.

What will Argo Blockchain (ARBK) use the proceeds from the July 2024 private placement for?

The net proceeds will be used for working capital, general corporate purposes, and the repayment of indebtedness.

News

An enhanced consensus algorithm for blockchain

The introduction of the link and reputation evaluation concepts aims to improve the stability and security of the consensus mechanism, decrease the likelihood of malicious nodes joining the consensus, and increase the reliability of the selected consensus nodes.

The link model structure based on joint action

Through the LINK between nodes, all the LINK nodes engage in consistent activities during the operation of the consensus mechanism. The reputation evaluation mechanism evaluates the trustworthiness of nodes based on their historical activity status throughout the entire blockchain. The essence of LINK is to drive inactive nodes to participate in system activities through active nodes. During the stage of selecting leader nodes, nodes are selected through self-recommendation, and the reputation evaluation of candidate nodes and their LINK nodes must be qualified. The top 5 nodes of the total nodes are elected as leader nodes through voting, and the nodes in their LINK status are candidate nodes. In the event that the leader node goes down, the responsibility of the leader node is transferred to the nodes in its LINK through the view-change. The LINK connection algorithm used in this study is shown in Table 2, where LINKm is the linked group and LINKP is the percentage of linked nodes.

Table 2 LINK connection algorithm.

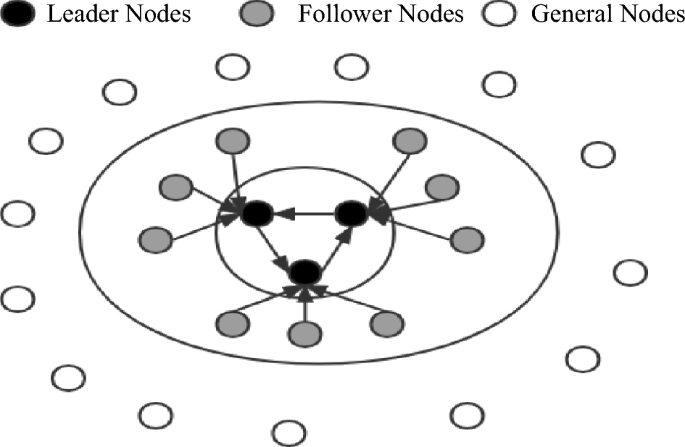

Node type

This paper presents a classification of nodes in a blockchain system based on their functionalities. The nodes are divided into three categories: leader nodes (LNs), follower nodes (FNs), and general nodes (Ns). The leader nodes (LNs) are responsible for producing blocks and are elected through voting by general nodes. The follower nodes (FNs) are nodes that are linked to leader nodes (LNs) through the LINK mechanism and are responsible for validating blocks. General nodes (N) have the ability to broadcast and disseminate information, participate in elections, and vote. The primary purpose of the LINK mechanism is to act in combination. When nodes are in the LINK, there is a distinction between the master and slave nodes, and there is a limit to the number of nodes in the LINK group (NP = {n1, nf1, nf2 ……,nfn}). As the largest proportion of nodes in the system, general nodes (N) have the right to vote and be elected. In contrast, leader nodes (LNs) and follower nodes (FNs) do not possess this right. This rule reduces the likelihood of a single node dominating the block. When the system needs to change its fundamental settings due to an increase in the number of nodes or transaction volume, a specific number of current leader nodes and candidate nodes need to vote for a reset. Subsequently, general nodes need to vote to confirm this. When both confirmations are successful, the new basic settings are used in the next cycle of the system process. This dual confirmation setting ensures the fairness of the blockchain to a considerable extent. It also ensures that the majority holds the ultimate decision-making power, thereby avoiding the phenomenon of a small number of nodes completely controlling the system.

After the completion of a governance cycle, the blockchain network will conduct a fresh election for the leader and follower nodes. As only general nodes possess the privilege to participate in the election process, the previous consortium of leader and follower nodes will lose their authorization. In the current cycle, they will solely retain broadcasting and receiving permissions for block information, while their corresponding incentives will also decrease. A diagram illustrating the node status can be found in Fig. 1.

Election method

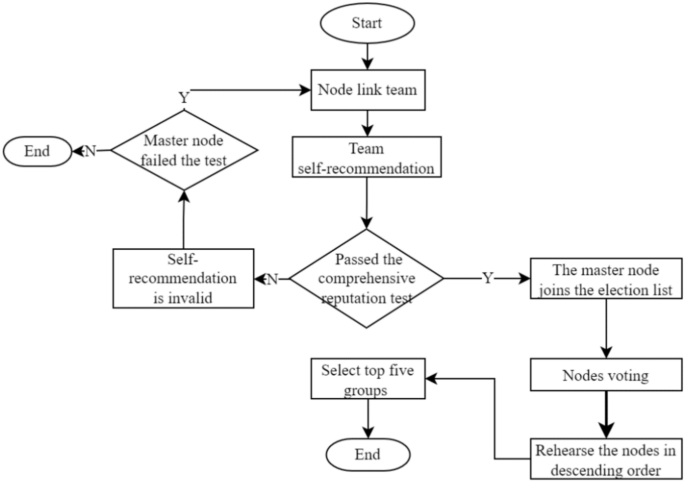

The election method adopts the node self-nomination mode. If a node wants to participate in an election, it must form a node group with one master and three slaves. One master node group and three slave node groups are inferred based on experience in this paper; these groups can balance efficiency and security and are suitable for other project collaborations. The successfully elected node joins the leader node set, and its slave nodes enter the follower node set. Considering the network situation, the maximum threshold for producing a block is set to 1 s. If the block fails to be successfully generated within the specified time, it is regarded as a disconnected state, and its reputation score is deducted. The node is skipped, and in severe cases, a view transformation is performed, switching from the master node to the slave node and inheriting its leader’s rights in the next round of block generation. Although the nodes that become leaders are high-reputation nodes, they still have the possibility of misconduct. If a node engages in misconduct, its activity will be immediately stopped, its comprehensive reputation score will be lowered, it will be disqualified from participating in the next election, and its equity will be reduced by 30%. The election process is shown in Fig. 2.

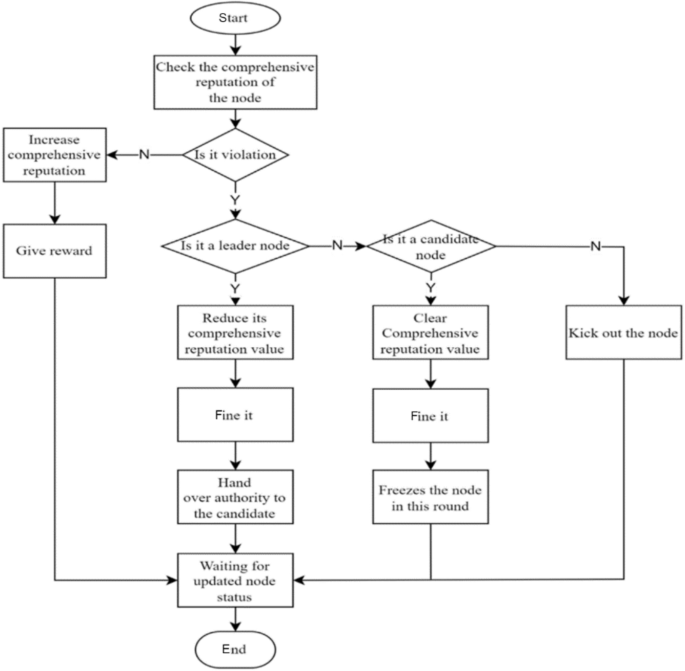

Incentives and penalties

To balance the rewards between leader nodes and ordinary nodes and prevent a large income gap, two incentive/penalty methods will be employed. First, as the number of network nodes and transaction volume increase, more active nodes with significant stakes emerge. After a prolonged period of running the blockchain, there will inevitably be significant class distinctions, and ordinary nodes will not be able to win in the election without special circumstances. To address this issue, this paper proposes that rewards be reduced for nodes with stakes exceeding a certain threshold, with the reduction rate increasing linearly until it reaches zero. Second, in the event that a leader or follower node violates the consensus process, such as by producing a block out of order or being unresponsive for an extended period, penalties will be imposed. The violation handling process is illustrated in Fig. 3.

Violation handling process.

Comprehensive reputation evaluation and election mechanism based on historical transactions

This paper reveals that the core of the DPoS consensus mechanism is the election process. If a blockchain is to run stably for a long time, it is essential to consider a reasonable election method. This paper proposes a comprehensive reputation evaluation election mechanism based on historical records. The mechanism considers the performance indicators of nodes in three dimensions: production rate, tokens, and validity. Additionally, their historical records are considered, particularly whether or not the nodes have engaged in malicious behavior. For example, nodes that have ever been malicious will receive low scores during the election process unless their overall quality is exceptionally high and they have considerable support from other nodes. Only in this case can such a node be eligible for election or become a leader node. The comprehensive reputation score is the node’s self-evaluation score, and the committee size does not affect the computational complexity.

Moreover, the comprehensive reputation evaluation proposed in this paper not only is a threshold required for node election but also converts the evaluation into corresponding votes based on the number of voters. Therefore, the election is related not only to the benefits obtained by the node but also to its comprehensive evaluation and the number of voters. If two nodes receive the same vote, the node with a higher comprehensive reputation is given priority in the ranking. For example, in an election where node A and node B each receive 1000 votes, node A’s number of stake votes is 800, its comprehensive reputation score is 50, and only four nodes vote for it. Node B’s number of stake votes is 600, its comprehensive reputation score is 80, and it receives votes from five nodes. In this situation, if only one leader node position remains, B will be selected as the leader node. Displayed in descending order of priority as comprehensive credit rating, number of voters, and stake votes, this approach aims to solve the problem of node misconduct at its root by democratizing the process and subjecting leader nodes to constraints, thereby safeguarding the fundamental interests of the vast majority of nodes.

Comprehensive reputation evaluation

This paper argues that the election process of the DPoS consensus mechanism is too simplistic, as it considers only the number of election votes that a node receives. This approach fails to comprehensively reflect the node’s actual capabilities and does not consider the voters’ election preferences. As a result, nodes with a significant stake often win and become leader nodes. To address this issue, the comprehensive reputation evaluation score is normalized considering various attributes of the nodes. The scoring results are shown in Table 3.

Table 3 Comprehensive reputation evaluation.

Since some of the evaluation indicators in Table 3 are continuous while others are discrete, different normalization methods need to be employed to obtain corresponding scores for different indicators. The continuous indicators include the number of transactions/people, wealth balance, network latency, network jitter, and network bandwidth, while the discrete indicators include the number of violations, the number of successful elections, and the number of votes. The value range of the indicator “number of transactions/people” is (0,1), and the value range of the other indicators is (0, + ∞). The equation for calculating the “number of transactions/people” is set as shown in Eq. (1).

$$A_{1} = \left\{ {\begin{array}{*{20}l} {0,} \hfill & {{\text{G}} = 0} \hfill \\ {\frac{{\text{N}}}{{\text{G}}}*10,} \hfill & {{\text{G}} > 0} \hfill \\ \end{array} } \right.$$

(1)

where N represents the number of transactional nodes and G represents the number of transactions. It reflects the degree of connection between the node and other nodes. Generally, nodes that transact with many others are safer than those with a large number of transactions with only a few nodes. The limit value of each item, denoted by x, is determined based on the situation and falls within the specified range, as shown in Eq. (2). The wealth balance and network bandwidth indicators use the same function to set their respective values.

$${A}_{i}=20*\left(\frac{1}{1+{e}^{-{a}_{i}x}}-0.5\right)$$

(2)

where x indicates the value of this item and expresses the limit value.

In Eq. (3), x represents the limited value of this indicator. The lower the network latency and network jitter are, the higher the score will be.

The last indicators, which are the number of violations, the number of elections, and the number of votes, are discrete values and are assigned different scores according to their respective ranges. The scores corresponding to each count are shown in Table 4.

$$A_{3} = \left\{ {\begin{array}{*{20}l} {10*\cos \frac{\pi }{200}x,} \hfill & {0 \le x \le 100} \hfill \\ {0,} \hfill & {x > 100} \hfill \\ \end{array} } \right.$$

(3)

Table 4 Score conversion.

The reputation evaluation mechanism proposed in this paper comprehensively considers three aspects of nodes, wealth level, node performance, and stability, to calculate their scores. Moreover, the scores obtain the present data based on historical records. Each node is set as an M × N dimensional matrix, where M represents M times the reputation evaluation score and N represents N dimensions of reputation evaluation (M < = N), as shown in Eq. (4).

$${\text{N}} = \left( {\begin{array}{*{20}c} {a_{11} } & \cdots & {a_{1n} } \\ \vdots & \ddots & \vdots \\ {a_{m1} } & \cdots & {a_{mn} } \\ \end{array} } \right)$$

(4)

The comprehensive reputation rating is a combined concept related to three dimensions. The rating is set after rating each aspect of the node. The weight w and the matrix l are not fixed. They are also transformed into matrix states as the position of the node in the system changes. The result of the rating is set as the output using Eq. (5).

$$\text{T}=\text{lN}{w}^{T}=\left({l}_{1}\dots {\text{l}}_{\text{m}}\right)\left(\begin{array}{ccc}{a}_{11}& \cdots & {a}_{1n}\\ \vdots & \ddots & \vdots \\ {a}_{m1}& \cdots & {a}_{mn}\end{array}\right){\left({w}_{1}\dots {w}_{n}\right)}^{T}$$

(5)

Here, T represents the comprehensive reputation score, and l and w represent the correlation coefficient. Because l is a matrix of order 1*M, M is the number of times in historical records, and M < = N is set, the number of dimensions of l is uncertain. Set the term l above to add up to 1, which is l1 + l2 + …… + ln = 1; w is also a one-dimensional matrix whose dimension is N*1, and its purpose is to act as a weight; within a certain period of time, w is a fixed matrix, and w will not change until the system changes the basic settings.

Assume that a node conducts its first comprehensive reputation rating, with no previous transaction volume, violations, elections or vote. The initial wealth of the node is 10, the latency is 50 ms, the jitter is 100 ms, and the network bandwidth is 100 M. According to the equation, the node’s comprehensive reputation rating is 41.55. This score is relatively good at the beginning and gradually increases as the patient participates in system activities continuously.

Voting calculation method

To ensure the security and stability of the blockchain system, this paper combines the comprehensive reputation score with voting and randomly sorts the blocks, as shown in Eqs. (3–6).

$$Z=\sum_{i=1}^{n}{X}_{i}+nT$$

(6)

where Z represents the final election score, Xi represents the voting rights earned by the node, n is the number of nodes that vote for this node, and T is the comprehensive reputation score.

The voting process is divided into stake votes and reputation votes. The more reputation scores and voters there are, the more total votes that are obtained. In the early stages of blockchain operation, nodes have relatively few stakes, so the impact of reputation votes is greater than that of equity votes. This is aimed at selecting the most suitable node as the leader node in the early stage. As an operation progresses, the role of equity votes becomes increasingly important, and corresponding mechanisms need to be established to regulate it. The election vote algorithm used in this paper is shown in Table 5.

Table 5 Election vote counting algorithm.

This paper argues that the election process utilized by the original DPoS consensus mechanism is overly simplistic, as it relies solely on the vote count to select the node that will oversee the entire blockchain. This approach cannot ensure the security and stability of the voting process, and if a malicious node behaves improperly during an election, it can pose a significant threat to the stability and security of the system as well as the safety of other nodes’ assets. Therefore, this paper proposes a different approach to the election process of the DPoS consensus mechanism by increasing the complexity of the process. We set up a threshold and optimized the vote-counting process to enhance the security and stability of the election. The specific performance of the proposed method was verified through experiments.

The election cycle in this paper can be customized, but it requires the agreement of the blockchain committee and general nodes. The election cycle includes four steps: node self-recommendation, calculating the comprehensive reputation score, voting, and replacing the new leader. Election is conducted only among general nodes without affecting the production or verification processes of leader nodes or follower nodes. Nodes start voting for preferred nodes. If they have no preference, they can use the LINK mechanism to collaborate with other nodes and gain additional rewards.

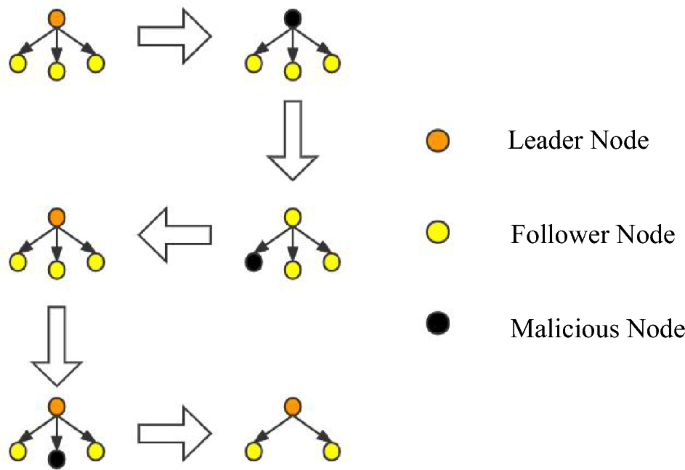

View changes

During the consensus process, conducting a large number of updates is not in line with the system’s interests, as the leader node (LN) and follower node (FN) on each node have already been established. Therefore, it is crucial to handle problematic nodes accurately when issues arise with either the LN or FN. For instance, when a node fails to perform its duties for an extended period or frequently fails to produce or verify blocks within the specified time range due to latency, the system will precisely handle them. For leader nodes, if they engage in malicious behavior such as producing blocks out of order, the behavior is recorded, and their identity as a leader node is downgraded to a follower node. The follower node inherits the leader node’s position, and the nature of their work is transformed as they swap their responsibilities of producing and verifying blocks with their original work. This type of behavior will not significantly affect the operation of the blockchain system. Instead of waiting until the end of the current committee round to punish malicious nodes, dynamic punishment is imposed on the nodes that affect the operation of the blockchain system to maintain system security. The view change operation is illustrated in Fig. 4.

In traditional PBFT, view changes are performed according to the view change protocol by changing the view number V to the next view number V + 1. During this process, nodes only receive view change messages and no other messages from other nodes. In this paper, the leader node group (LN) and follower node group (FN) are selected through an election of the LINK group. The node with LINKi[0] is added to the LN leader node group, while the other three LINK groups’ follower nodes join the FN follower node group since it is a configuration pattern of one master and three slaves. The view change in this paper requires only rearranging the node order within the LINK group to easily remove malicious nodes. Afterward, the change is broadcast to other committee nodes, and during the view transition, the LINK group does not receive block production or verification commands from the committee for stability reasons until the transition is completed.

News

The Hype Around Blockchain Mortgage Has Died Down, But This CEO Still Believes

LiquidFi Founder Ian Ferreira Sees Huge Potential in Blockchain Despite Hype around technology is dead.

“Blockchain technology has been a buzzword for a long time, and it shouldn’t be,” Ferriera said. “It should be a technology that lives in the background, but it makes everything much more efficient, much more transparent, and ultimately it saves costs for everyone. That’s the goal.”

Before founding his firm, Ferriera was a portfolio manager at a hedge fund, a job that ended up revealing “interesting intricacies” related to the mortgage industry.

Being a mortgage trader opened Ferriera’s eyes to a lot of the operational and infrastructure problems that needed to be solved in the mortgage-backed securities industry, he said. That later led to the birth of LiquidFi.

“The point of what we do is to get raw data attached to a resource [a loan] on a blockchain so that it’s provable. You reduce that trust problem because you have the data, you have the document associated with that data,” said the LiquidFi CEO.

Ferriera spoke with National Mortgage News about the value of blockchain technology, why blockchain hype has fizzled out, and why it shouldn’t.

News

New bill pushes Department of Veterans Affairs to examine how blockchain can improve its work

The Department of Veterans Affairs would have to evaluate how blockchain technology could be used to improve benefits and services offered to veterans, according to a legislative proposal introduced Tuesday.

The bill, sponsored by Rep. Nancy Mace, R-S.C., would direct the VA to “conduct a comprehensive study of the feasibility, potential benefits, and risks associated with using distributed ledger technology in various programs and services.”

Distributed ledger technology, including blockchain, is used to protect and track information by storing data across multiple computers and keeping a record of its use.

According to the text of the legislation, which Mace’s office shared exclusively with Nextgov/FCW ahead of its publication, blockchain “could significantly improve benefits allocation, insurance program management, and recordkeeping within the Department of Veterans Affairs.”

“We need to bring the federal government into the 21st century,” Mace said in a statement. “This bill will open the door to research on improving outdated systems that fail our veterans because we owe it to them to use every tool at our disposal to improve their lives.”

Within one year of the law taking effect, the Department of Veterans Affairs will be required to submit a report to the House and Senate Veterans Affairs committees detailing its findings, as well as the benefits and risks identified in using the technology.

The mandatory review is expected to include information on how the department’s use of blockchain could improve the way benefits decisions are administered, improve the management and security of veterans’ personal data, streamline the insurance claims process, and “increase transparency and accountability in service delivery.”

The Department of Veterans Affairs has been studying the potential benefits of using distributed ledger technology, with the department emission a request for information in November 2021 seeking input from contractors on how blockchain could be leveraged, in part, to streamline its supply chains and “secure data sharing between institutions.”

The VA’s National Institute of Artificial Intelligence has also valued the use of blockchain, with three of the use cases tested during the 2021 AI tech sprint focused on examining its capabilities.

Mace previously introduced a May bill that would direct Customs and Border Protection to create a public blockchain platform to store and share data collected at U.S. borders.

Lawmakers also proposed additional measures that would push the Department of Veterans Affairs to consider adopting other modernized technologies to improve veteran services.

Rep. David Valadao, R-Calif., introduced legislation in June that would have directed the department to report to lawmakers on how it plans to expand the use of “certain automation tools” to process veterans’ claims. The House of Representatives Subcommittee on Disability Assistance and Memorial Affairs gave a favorable hearing on the congressman’s bill during a Markup of July 23.

News

California DMV Uses Blockchain to Fight Auto Title Fraud

TDR’s Three Takeaways: California DMV Uses Blockchain to Fight Fraud

- California DMV uses blockchain technology to manage 42 million auto titles.

- The initiative aims to improve safety and reduce car title fraud.

- The immutable nature of blockchain ensures accurate and tamper-proof records.

The California Department of Motor Vehicles (DMV) is implementing blockchain technology to manage and secure 42 million auto titles. This innovative move aims to address and reduce the persistent problem of auto title fraud, a problem that costs consumers and the industry millions of dollars each year. By moving to a blockchain-based system, the DMV is taking advantage of the technology’s key feature: immutability.

Blockchain, a decentralized ledger technology, ensures that once a car title is registered, it cannot be altered or tampered with. This creates a highly secure and transparent system, significantly reducing the risk of fraudulent activity. Every transaction and update made to a car title is permanently recorded on the blockchain, providing a complete and immutable history of the vehicle’s ownership and status.

As first reported by Reuters, the DMV’s adoption of blockchain isn’t just about preventing fraud. It’s also aimed at streamlining the auto title process, making it more efficient and intuitive. Traditional auto title processing involves a lot of paperwork and manual verification, which can be time-consuming and prone to human error. Blockchain technology automates and digitizes this process, reducing the need for physical documents and minimizing the chances of errors.

Additionally, blockchain enables faster verification and transfer of car titles. For example, when a car is sold, the transfer of ownership can be done almost instantly on the blockchain, compared to days or even weeks in the conventional system. This speed and efficiency can benefit both the DMV and the vehicle owners.

The California DMV’s move is part of a broader trend of government agencies exploring blockchain technology to improve their services. By adopting this technology, the DMV is setting a precedent for other states and industries to follow, showcasing blockchain’s potential to improve safety and efficiency in public services.

-

Ethereum12 months ago

Ethereum12 months agoEthereum Posts First Consecutive Monthly Losses Since August 2023 on New ETFs

-

Regulation12 months ago

Regulation12 months agoCryptocurrency Regulation in Slovenia 2024

-

News12 months ago

News12 months agoNew bill pushes Department of Veterans Affairs to examine how blockchain can improve its work

-

Regulation12 months ago

Regulation12 months agoThink You Own Your Crypto? New UK Law Would Ensure It – DL News

-

Regulation12 months ago

Regulation12 months agoUpbit, Coinone, Bithumb Face New Fees Under South Korea’s Cryptocurrency Law

-

Regulation12 months ago

Regulation12 months agoA Blank Slate for Cryptocurrencies: Kamala Harris’ Regulatory Opportunity

-

Regulation12 months ago

Regulation12 months agoBahamas Passes Cryptocurrency Bill Designed to Prevent FTX, Terra Disasters

-

Regulation12 months ago

Regulation12 months agoIndia to Follow G20 Policy for Cryptocurrency Regulation: MoS Finance

-

News1 year ago

News1 year ago“Captain Tsubasa – RIVALS” launches on Oasys Blockchain

-

Ethereum1 year ago

Ethereum1 year agoComment deux frères auraient dérobé 25 millions de dollars lors d’un braquage d’Ethereum de 12 secondes • The Register

-

News12 months ago

News12 months agoEU supports 15 startups to fight online disinformation with blockchain

-

News1 year ago

News1 year agoSolana ranks the fastest blockchain in the world, surpassing Ethereum, Polygon ⋆ ZyCrypto