Bitcoin

Analyst Says Bitcoin’s $71,000 Move Is Only Halfway Through, Here’s Why

An analyst explained how Bitcoin’s current surge appears to have reached the halfway point if this indicator passes.

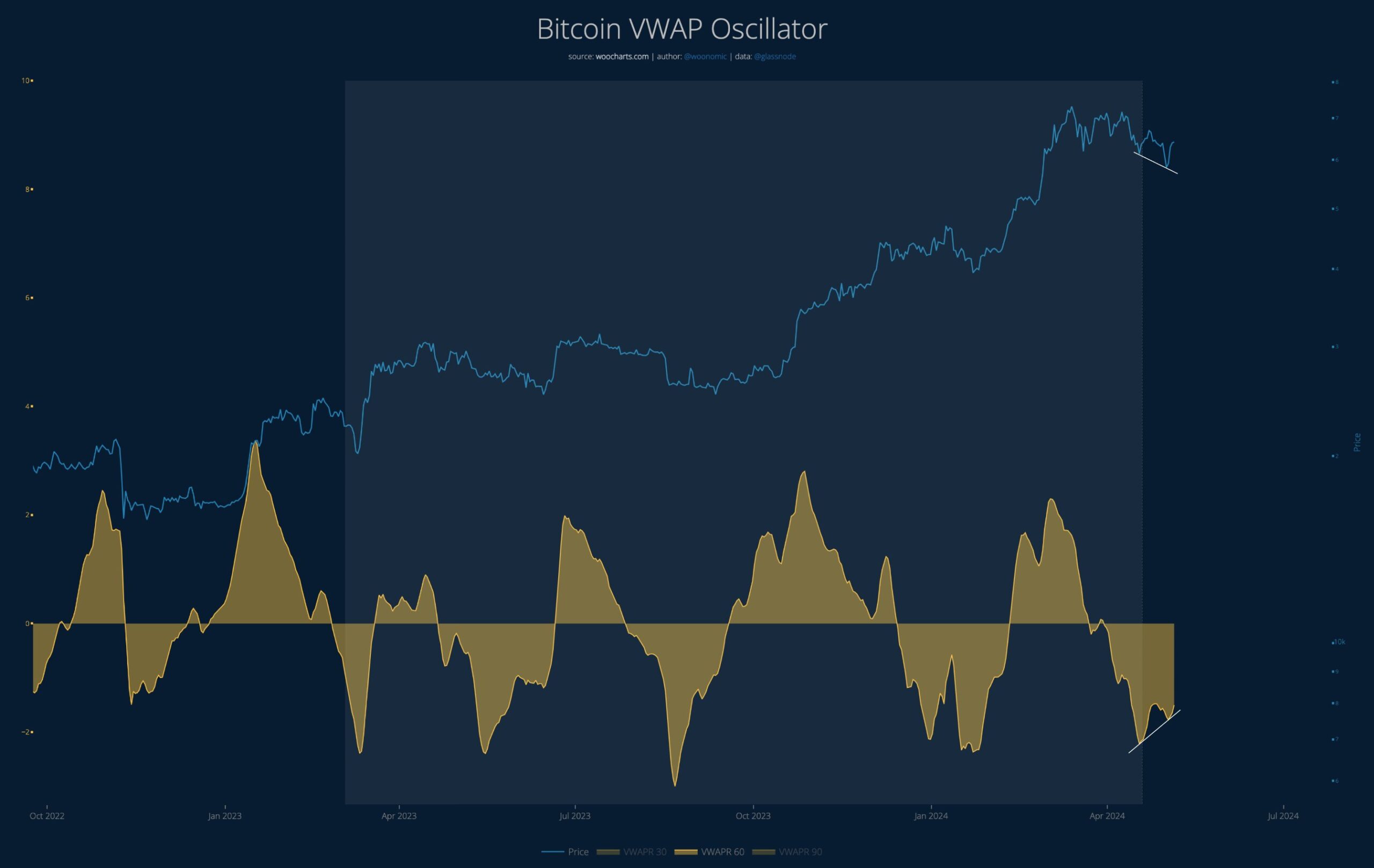

Bitcoin VWAP Oscillator Suggests BTC Only Halving Recovery

In a new publish on X, analyst Willy Woo posted an update on how Bitcoin Volume Weighted Average Price Oscillator (VWAP) it’s looking like after the last rally.

O VWAP is an indicator that, as its full form suggests, calculates an average price for the cryptocurrency based not only on changes in price throughout the day, but also on the volume that has been traded at those prices.

Related Reading

Typically, this volume is measured using spot volume data provided by centralized exchanges. Still, in the case of Bitcoin, the blockchain is available for anyone to explore, so the on-chain volume is used to calculate VWAP.

The VWAP Oscillator, which is the real metric of interest here, takes the relationship between the cryptocurrency’s spot price and VWAP and represents it as an oscillator around zero.

Earlier this month, Woo pointed out how Bitcoin’s VWAP oscillator was forming a bullish divergence for the asset.

What the VWAP oscillator looked like at the beginning of the month | Source: @woonomic on X

As visible from the chart, the Bitcoin VWAP oscillator rose within the negative territory after forming an apparent bottom at that time. At the same time, the price of cryptocurrency was falling.

In the past, such a setup has proven to be bullish for the coin, and the resulting bullish momentum usually lasts until the VWAP oscillator reaches positive territory. Thus, the analyst noted that the currency had a lot of space to circulate at that time.

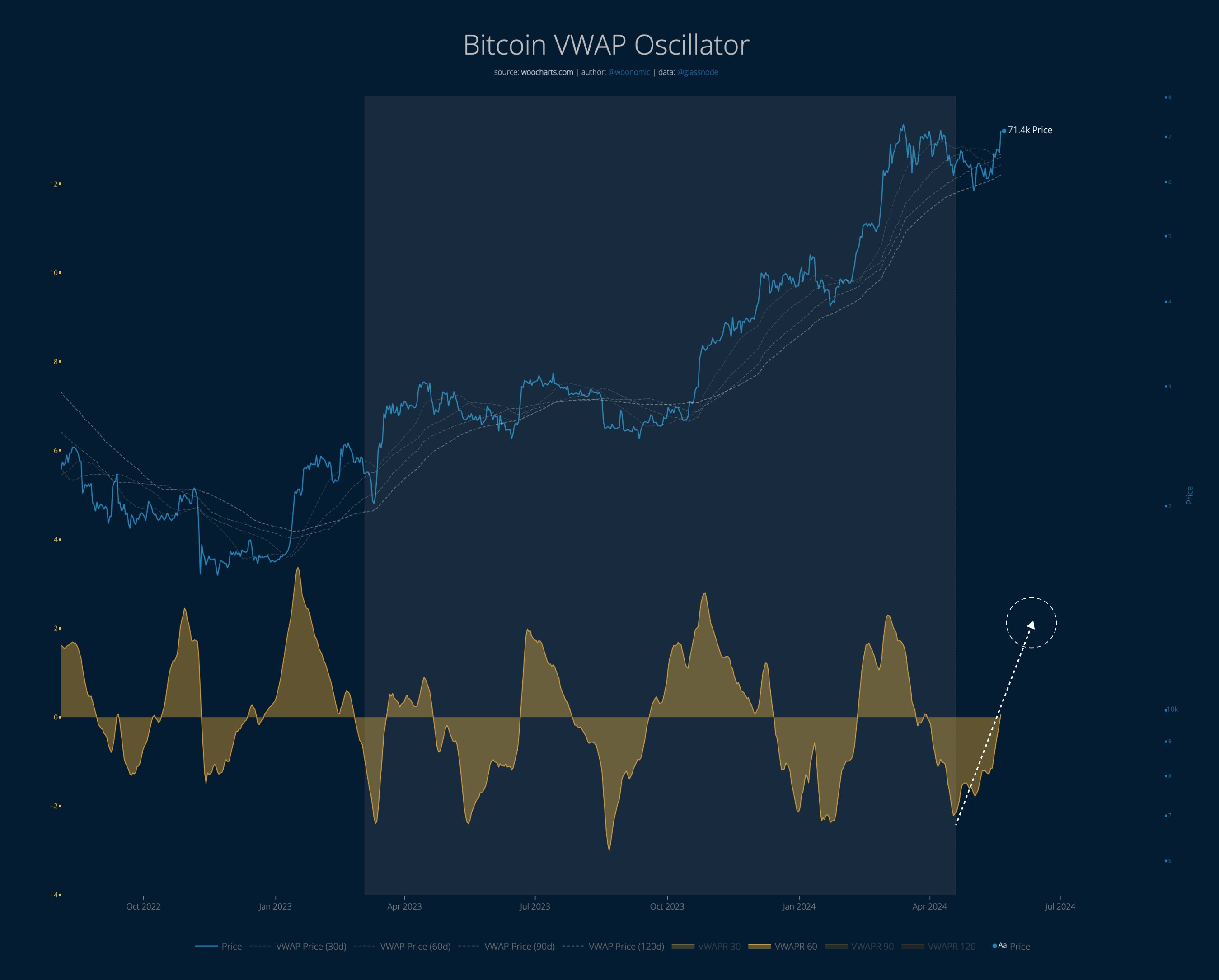

Since then, the price has staged a recovery, potentially suggesting that the bullish divergence may be bearing fruit. As Woo pointed out, the indicator returned to the neutral mark after this run.

It appears the metric value is entering positive territory | Source: @woonomic on X

It appears the metric value is entering positive territory | Source: @woonomic on X

Based on the fact that tops in the past have occurred after metric peaks in positive territory and based on the scale of these peaks typically, the analyst concludes: “this Bitcoin move is now halfway there.”

Related Reading

As for how things could play out next, the analyst says,

Consolidation under the all-time high needs to happen for a while, then we will see if the second leg gives us escape velocity to new highs that will open the floodgates.

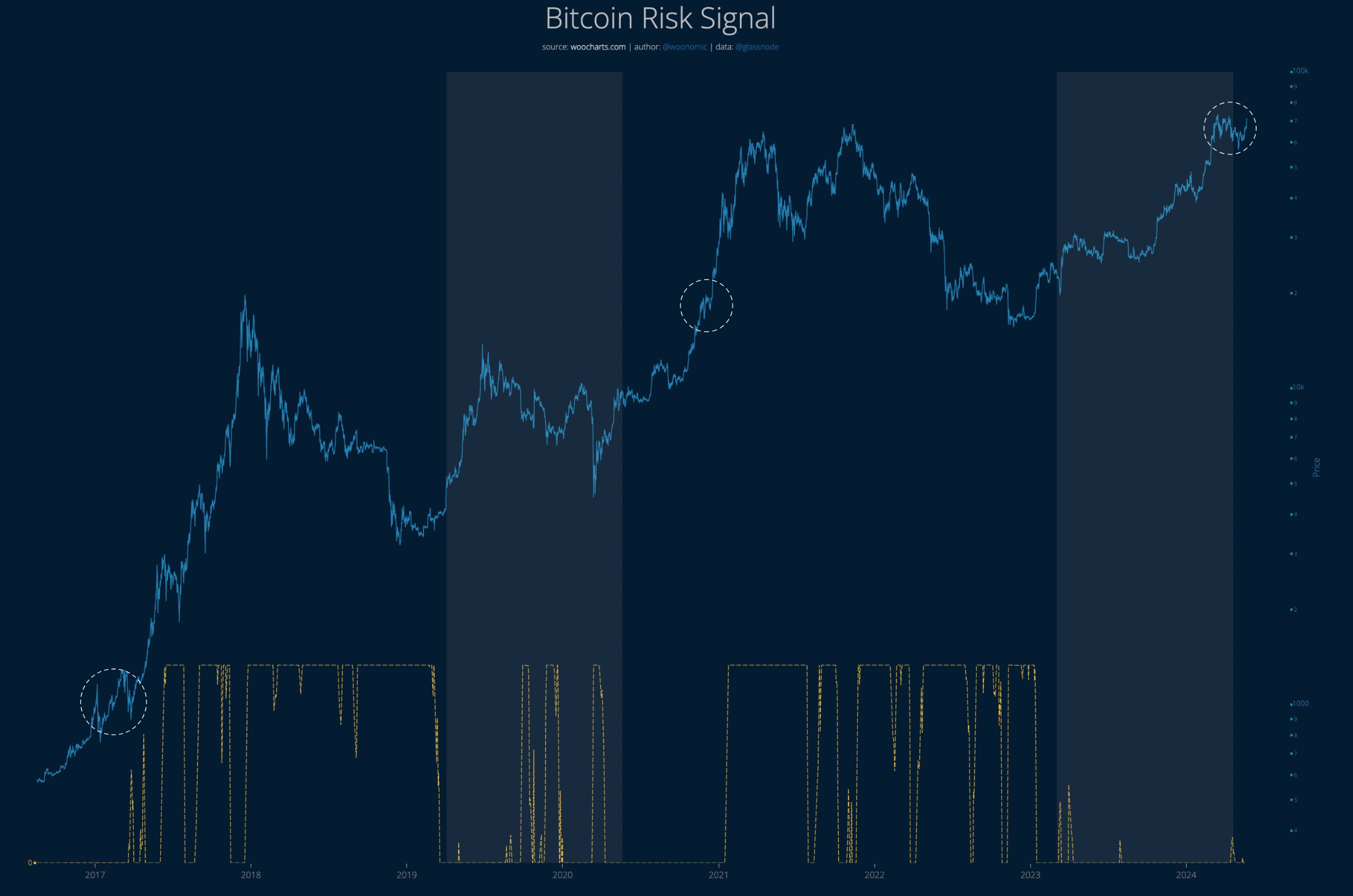

Woo also shared a “risk signal” for Bitcoin that shows where the asset stands when looking at the bigger picture.

BTC risk signal data in recent years | Source: @woonomic on X

BTC risk signal data in recent years | Source: @woonomic on X

BTC may be in that part of the cycle where risk starts to increase as the price reacts violently to capital contributions. “That’s where most of the quick wins happen,” notes the analyst.

BTC Price

Bitcoin recovered above $71,000 earlier in the day, but the asset appears to have suffered a pullback since then as it is now back below $70,000.

The asset’s price appears to have soared in the last day | Source: BTCUSD on TradingView

Featured image from Shutterstock.com, woocarts.com, chart from TradingView.com

Bitcoin

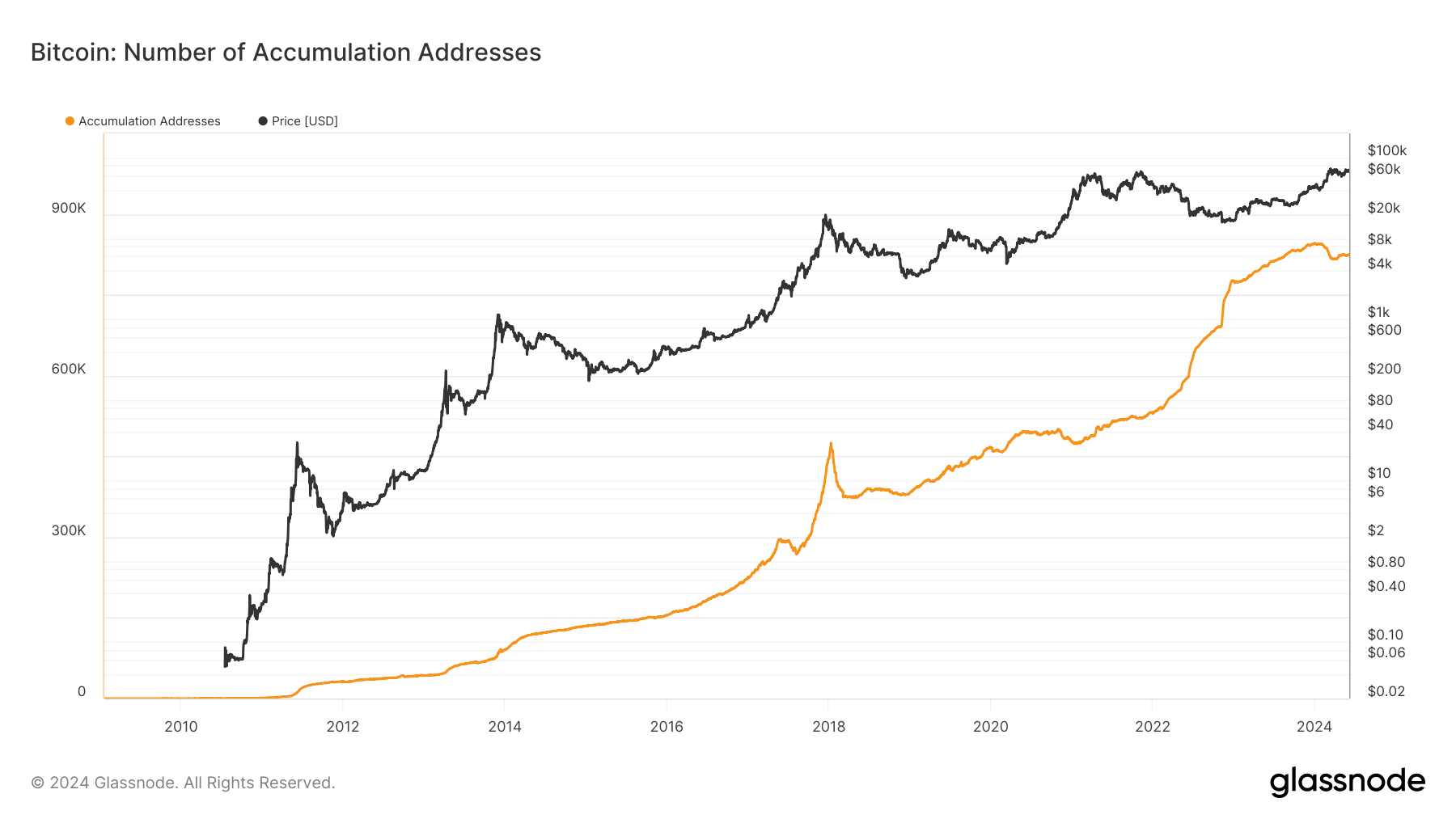

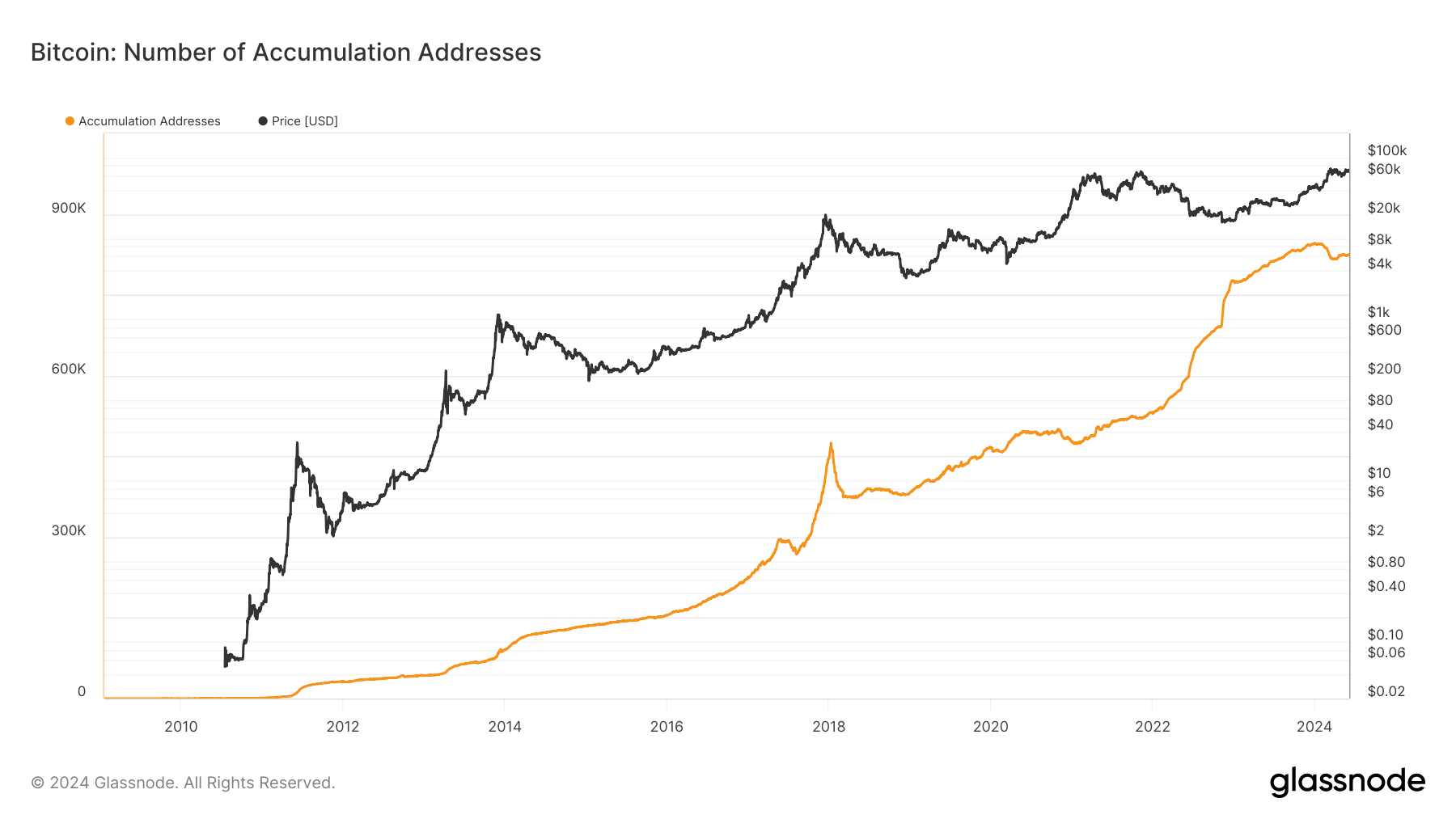

Bitcoin Accumulation Addresses Surge as Market Optimism Returns

Highlights in the chain

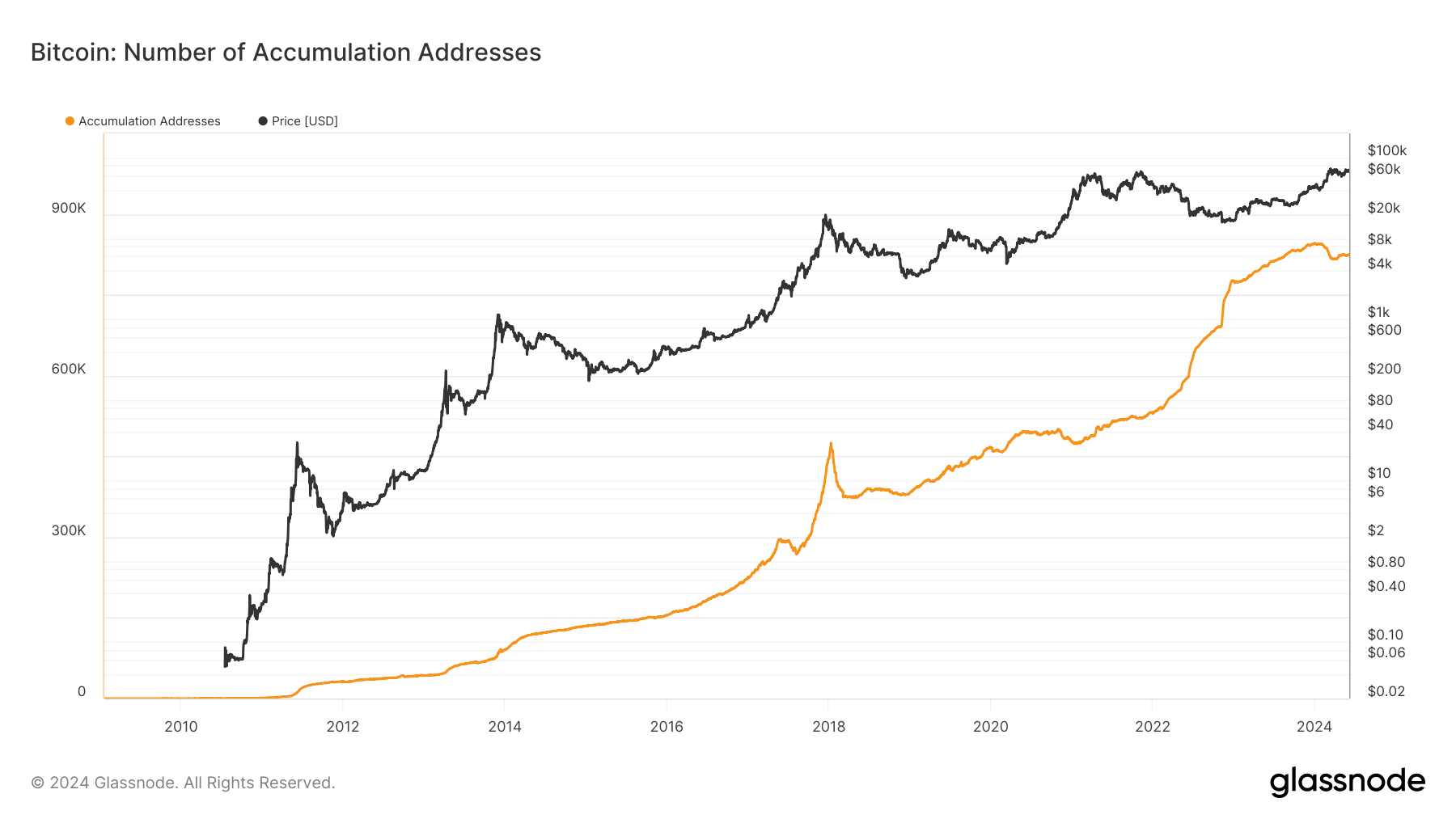

DEFINITION: The number of unique accumulation addresses. Accumulation addresses are defined as addresses that receive at least two non-dust transfers and have never spent funds. Exchange addresses and addresses received from coinbase transactions (miner addresses) are discarded. To account for lost coins, addresses that had been active for more than seven years were also omitted.

Recent data from Glassnode indicates notable movements in Bitcoin accumulation addresses. The number of these addresses declined earlier this year and a resurgence began in late April. This increase is in line with broader market optimism and the stabilization of Bitcoin’s price around $60,000. According to CryptoSlate, long-term holders have added nearly 70,000 BTC since the end of the cycle, reversing a previous trend of divestment.

Furthermore, the Bitcoin halving spurred substantial accumulation. More than 115,000 BTC were accumulated in April alone, reflecting strong market confidence. This behavior is further evidenced by an increase in investor activity, with significant inflows into Bitcoin accumulation addresses reaching record levels in April.

These patterns suggest a bullish outlook among long-term holders and other key market participants, highlighting a collective confidence in Bitcoin’s future prospects. The interaction between these accumulation trends and market events like the halving will be crucial in shaping Bitcoin’s trajectory in the coming months.

Accumulation addresses: (Source: Glassnode)

Accumulation addresses: (Source: Glassnode)

´Source

Bitcoin

Bitcoin Rally and ‘Short Memories’ Rekindle Everything in Crypto

Bitcoin’s rally to near a record high is stirring up animal spirits – not just in the cryptocurrency market itself, but in the broader financial world that left the digital asset sector for dead last year.

The shift in sentiment can be seen in the improving outlook for deal flow, highlighted by Robinhood Markets Inc.’s purchase of crypto exchange Bitstamp Ltd. on Thursday, to a resurgence of venture capital investment to what some analysts expect a record amount of initial public offerings of companies linked to the sector.

Bitcoin

Bitcoin halving reduces production and reduces revenues for main miners

Fortaleza Digital Mining reported a 47.1% decline in its monthly revenue Bitcoin mining production in May.

The company extracted 82 BTC during the first full month after the halving, compared to 155 BTC in April.

Meanwhile, revenue for the month was $5.2 million, a 46% drop from the previous month.

Stronghold explicitly attributed the drop to the halving. The company said:

“The main driver of the decline was due to the first full month of post-halving operations.”

The company also reported an average hash price of $0.052 per TH/s in May, down from 0.095 in April. He attributed the change to the halving and reduction in block rewards, the 0.8% decline in Bitcoin’s price, and the drop in transaction fees to 7.4% in May from 25.3% in April.

It observed a network hash rate of 1.2%, partially offsetting the trend.

Decline in production at all levels

Similarly, Cipher Mining reported that it mined 166 BTC in May versus 296 BTC in April, representing a 43.9% month-over-month drop.

The company acknowledged the impact of the Bitcoin halving, but emphasized that it maintained positive cash flows and expanded its inventories and operating locations.

Digital Marathon fared a little better, reporting that produced 616 BTC in May, down 27.5% from 850 BTC in April. The company said it mitigated the drawdown by increasing the number of mining blocks won in May to 170 – up from 129 blocks in April.

Marathon said it held 17,857 BTC at the end of May and sold 390 BTC in May. It reported a powered hash rate of 29.3 EH/s and an installed hash rate of 30.6 EH/s.

sCleanspark, Riot PlatformsIt is Bit Farms also reported similar declines in its BTC production fell

O Bitcoin halved occurred on April 20, 2024, reducing block rewards from 6,250 to 3,125. The event also impacted miner’s difficulty.

Mentioned in this article

Bitcoin

‘Crypto is eating junior resources’ lunch’ – Peter Grandich on how mining lost ground to Bitcoin

Kitco NEWS has a diverse team of journalists who report on the economy, stock markets, commodities, cryptocurrencies, mining and metals with accuracy and objectivity. Our goal is to help people make informed market decisions through in-depth reports, daily market summaries, interviews with prominent industry figures, comprehensive (often exclusive) coverage of key industry events, and analysis of developments affecting the market .

-

News1 year ago

News1 year ago“Captain Tsubasa – RIVALS” launches on Oasys Blockchain

-

Ethereum1 year ago

Ethereum1 year agoComment deux frères auraient dérobé 25 millions de dollars lors d’un braquage d’Ethereum de 12 secondes • The Register

-

News1 year ago

News1 year agoSolana ranks the fastest blockchain in the world, surpassing Ethereum, Polygon ⋆ ZyCrypto

-

Videos1 year ago

Videos1 year agoHistoric steps for US cryptocurrencies! With a shocking majority vote!🚨

-

Videos1 year ago

Videos1 year agoIs Emorya the next gem💎 of this Bitcoin bull run?

-

News1 year ago

News1 year agoSolana Surpasses Ethereum and Polygon as the Fastest Blockchain ⋆ ZyCrypto

-

Videos1 year ago

Videos1 year agoNexus Chain – Ethereum L2 with the GREATEST Potential?

-

Ethereum1 year ago

Ethereum1 year agoScaling Ethereum with L2s damaged its Tokenomics. Is it possible to repair it?

-

Videos1 year ago

Videos1 year agoRaoul Pal’s Crypto Predictions AFTER Bitcoin Halving in 2024 (The NEXT Solana)

-

Regulation1 year ago

Regulation1 year ago🔒 Cryptocurrencies need regulation to thrive: Tyler Cowen

-

Bitcoin1 year ago

Bitcoin1 year ago‘Beyond’ $20 trillion by 2030 – Jack Dorsey’s plan to boost Bitcoin price

-

Videos1 year ago

Videos1 year agoThe cryptocurrency market is in trouble | SEC vs. Uniswap