Ethereum

How to Buy Ethereum in 2024

Ethereum is an open-sourced blockchain that supports thousands of decentralized applications (dApps). It’s considered the de facto network for the Web 3 era.

This guide explains how to buy Ethereum in 2024. I also discuss the best places to invest, which wallets offer secure storage, and a brief overview of Ethereum’s investment thesis.

How to Buy Ethereum – 3 Easy Steps

Let’s start with a simplified overview of how to buy Ethereum:

- Step 1: Create an Ethereum Wallet – The first step is to get a secure Ethereum wallet. Best Wallet is our top pick; it’s a self-custody wallet with strong security features. Download the Best Wallet app for iOS or Android. Set up a PIN or biometrics and write down the backup passphrase.

- Step 2: Open a Crypto Exchange Account – Next, Ethereum investors need an account with a crypto exchange. Best Wallet is the best option as it allows users to manage their crypto assets within the app as well as buy, store and swap cryptos with the tap of a button.

- Step 3: Trade ETH via Best DEX – Connect your wallet to the Best DEX and start trading ETH and BNB smart chain tokens in seconds. The Best DEX is also working on introducing real-time market updates, advanced charting via Trading View, as well as token analytics.

As I explain in more detail later, I’d suggest transferring the ETH coins to the Best Wallet app. This ensures you have 100% control of the coins, rather than relying on a third-party exchange.

Different Ways of Buying Ethereum – Wallets vs Exchanges

There are two common ways to buy Ethereum in 2024. Each comes with pros and cons.

- Some investors prefer buying Ethereum via a wallet. The ETH coins are instantly added to the wallet, meaning increased convenience. However, Ethereum wallets use third-party gateways when accepting fiat money, which means higher fees.

- Alternatively, some investors prefer using a crypto exchange to buy Ethereum. This reduces the fees, as regulated exchanges can directly accept fiat money – rather than using third-party gateways. However, investors must transfer the ETH coins to a wallet, should they require self-custody storage.

Let’s explore these two investment options in more detail. This will help you choose the best place to buy Ethereum in 2024.

Buy Ethereum Through a Crypto Wallet

Although crypto wallets are primarily used to store Ethereum, many have formed partnerships with fiat gateways. These are third-party payment processors that enable wallets to indirectly accept traditional payment methods, such as Visa, MasterCard, and PayPal.

Popular examples include Transak, Simplex, and MoonPay – but many others exist. The main benefit of buying Ethereum via a crypto wallet is convenience. The ETH coins will automatically be added to the wallet once the payment is complete. This removes the need to transfer coins from a crypto exchange. However, there are also some drawbacks.

For instance, fiat gateways typically charge excessive fees. For instance, Simplex charges average debit/credit card fees of 3.5% – 5%. Some wallets will add an additional markup, meaning the fees are even higher.

Best Wallet – Our Recommended Wallet

I rate Best Wallet as one of the best decentralized crypto wallets. Best Wallet is a self-custody wallet app for iOS and Android smartphones. A browser extension for desktop devices is also being developed – expect this in the coming months. Best Wallet offers safe ETH storage away from centralized servers; only the user has access to their private keys.

Moreover, the Best Wallet app comes packed with security features. This includes two-factor authentication and biometrics. Best Wallet is also protected by a backup passphrase for account recovery. Not only does Best Wallet support ETH but all ERC-20 tokens. It also supports custom tokens from BNB Chain and Polygon. Bitcoin will be added in the next development phase.

In terms of buying Ethereum, Best Wallet offers a user-friendly fiat on-ramp. It takes minutes to complete the KYC process. Investors can then choose from a debit/credit card or e-wallet. The ETH coins will instantly be added to Best Wallet upon completion. Best Wallet will soon be launching a fiat off-ramp too, meaning ETH can be cashed for your preferred currency.

Other Wallets to Consider

There are many other wallet options when exploring where to buy Ethereum.

Here are some of my other top picks:

- Ellipal Titan 2.0 – Considered one of the best Ethereum wallets for safety, Ellipal Titan 2.0 is a hardware solution with air-gapped security. Unlike other hardware wallets, transactions don’t require a USB or Bluetooth connection.

- Ledger Nano X – Retailing for $149, Ledger Nano X is a multi-chain hardware wallet. It connects with Ledger Live, a desktop and mobile app that supports Ethereum investments.

- Trezor Model One – One of the best hardware wallets for budget investors, the Trezor Model One costs just $59. While it’s packed with advanced security features, the Model One doesn’t support Ethereum staking.

Buying Ethereum Through a Crypto Exchange

Crypto exchanges remain the most popular way to buy Ethereum in 2024. Many platforms are designed with beginners in mind, ensuring even first-time buyers can complete their purchase seamlessly. What’s more, the best exchanges are adequately licensed, allowing them to directly accept fiat payment methods, such as debit/credit cards and local bank transfers.

This makes crypto exchanges more competitively priced than Ethereum wallets, which rely on third-party gateways. For instance, I mentioned earlier that Simplex charges up to 5% on debit/credit card purchases. In contrast, eToro fees start from 1.5%. And, if you’re using US dollars, the deposit fee is scrapped entirely.

Once you’ve deposited funds and bought Ethereum, it’s wise to transfer the coins to a self-custody wallet. This ensures you’re in control of the coins, rather than worrying about counterparty risks. This extra step could be a drawback for some. That said, reputable exchanges approve wallet transfer requests near-instantly – so the extra step is minimal.

eToro – Our Recommended Exchange

I rate eToro as the best crypto exchange for buying Ethereum. Launched in 2007, eToro offers a regulated environment, ensuring investors can purchase ETH safely.

Beginners will like eToro’s user-friendly platform – which can be accessed online or via the app. It takes minutes to open an account, including the mandatory KYC process. Deposit methods include debit/credit cards and e-wallets. Local banking methods like ACH are also supported.

The minimum Ethereum purchase is $10. The ETH coins are instantly added to the eToro wallet, although this is a custodial solution. Fortunately, eToro allows users to withdraw their ETH to a private wallet. Although eToro is safe and user-friendly, it charges a 1% trading commission. This is more than other exchanges in the market.

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong. Take 2 mins to learn more.

Cryptocurrency is offered by eToro USA LLC (“the MSB”) (NMLS: 1769299) and is not FDIC or SIPC insured. Investing involves risk, and content is provided for educational purposes only, does not imply a recommendation, and is not a guarantee of future performance.

Other Exchanges to Consider

Hundreds of other crypto exchanges support Ethereum.

Here are some of my other top picks to consider:

- Binance – Launched in 2017, Binance is the largest crypto exchange for daily trading volumes. Investors can buy Ethereum at a commission of just 0.1% per slide.

- Kraken – Founded in 2011, Kraken is an established exchange that supports US and European clients. Payment methods include debit/credit cards and local banking networks.

- Gate.io – Those looking to buy Ethereum alongside other coins might consider Gate.io. It lists more than 1,700 altcoins, including some of the best new cryptocurrencies for 2024.

What is Ethereum?

Ethereum is the second-largest cryptocurrency project after Bitcoin. Unlike Bitcoin, Ethereum offers use cases other than just wallet-to-wallet payments. It developed the ‘smart contract’ initiative, which enables projects to build decentralized applications. Anyone can build on the Ethereum blockchain – side projects are known as ‘ERC-20’ tokens.

The more projects the better, as ERC-20 projects pay network fees in ETH – Ethereum’s native crypto coin. If you’re new to smart contracts and decentralized applications, let’s consider a simple example. One of the most popular projects to build on Ethereum is Uniswap; a decentralized exchange that supports anonymous token swaps.

Uniswap operates an autonomous business; trades are executed by smart contracts. For instance, suppose someone wants to swap USDT for DAI. Once the trade is confirmed, Uniswap executes a smart contract via the Ethereum blockchain. The user pays fees in ETH, and the token swap is automatically completed.

This is just one example of how Ethereum is building the future of Web 3. It also supports decentralized finance (DeFi) ecosystems, covering loans, savings accounts, staking, and yield farming. Ethereum is also used by NFT marketplaces and metaverse projects like Decentraland and the Sandbox.

Play-to-earn gaming is also expected to play a major role in the Ethereum network. Market leaders currently include Axie Infinity, Gala, and Illuvium. Although ETH has many use cases in the decentralized application space, it’s also an investment currency. In fact, most people buy Ethereum in the hope its value increases.

What’s more, Ethereum upgraded to the proof-of-stake (PoS) consensus framework in 2022. This means that ETH can be ‘staked’ for passive rewards – similar to locking cash in a CD account. While the PoS upgrade reduced energy consumption by over 99%, the long-term objective is to improve scalability and fees. More on this shortly.

Is Ethereum a Good Investment?

It’s important to consider the investment thesis when exploring how to buy Ethereum.

On the one hand, Ethereum is considered a blue-chip crypto project; it’s the second-largest by market capitalization. Ethereum is also one of the best-performing coins of all time – with the project achieving significant growth since launching in 2015.

However, Ethereum also has strong competition in the smart contract market – most competitors are faster, cheaper, and more scalable. Broader crypto metrics should also be considered, such as regulatory concerns and increased volatility.

Let’s explore these points in more detail. This will help you evaluate whether ETH is right for your investment portfolio.

The Future of Web 3 – Unparalleled Use Cases

Ethereum is a layer 1 project – meaning its blockchain is proprietary. It offers a home for the Web 3 era, which includes everything from metaverses and decentralized games to uncollateralized loans and trading facilities. Third-party projects building on the Ethereum network must use ETH to pay transaction fees.

This is crucial from an investment perspective, as it ensures ETH has constant demand. This is the case regardless of whether individual projects are successful; Ethereum continues to collect fees around the clock.

The highway toll analogy will help beginners understand this point.

- Consider Ethereum as a major highway system with tolls.

- The highway is open to all vehicles – anyone can pass through the toll by paying a fee.

- In this analogy, vehicles are ERC-20 projects.

- As more vehicles enter the highway, the toll system increases its revenues.

- And, the only payment method accepted by the toll is ETH.

- This means demand for ETH rises as more ERC-20 tokens are created.

Ultimately, Ethereum enables crypto investors to de-risk. Rather than attempting to pick the next 1000x crypto token, investors can back the Ethereum infrastructure itself. After all, when the broader ERC-20 market is doing well, this positively impacts ETH’s value.

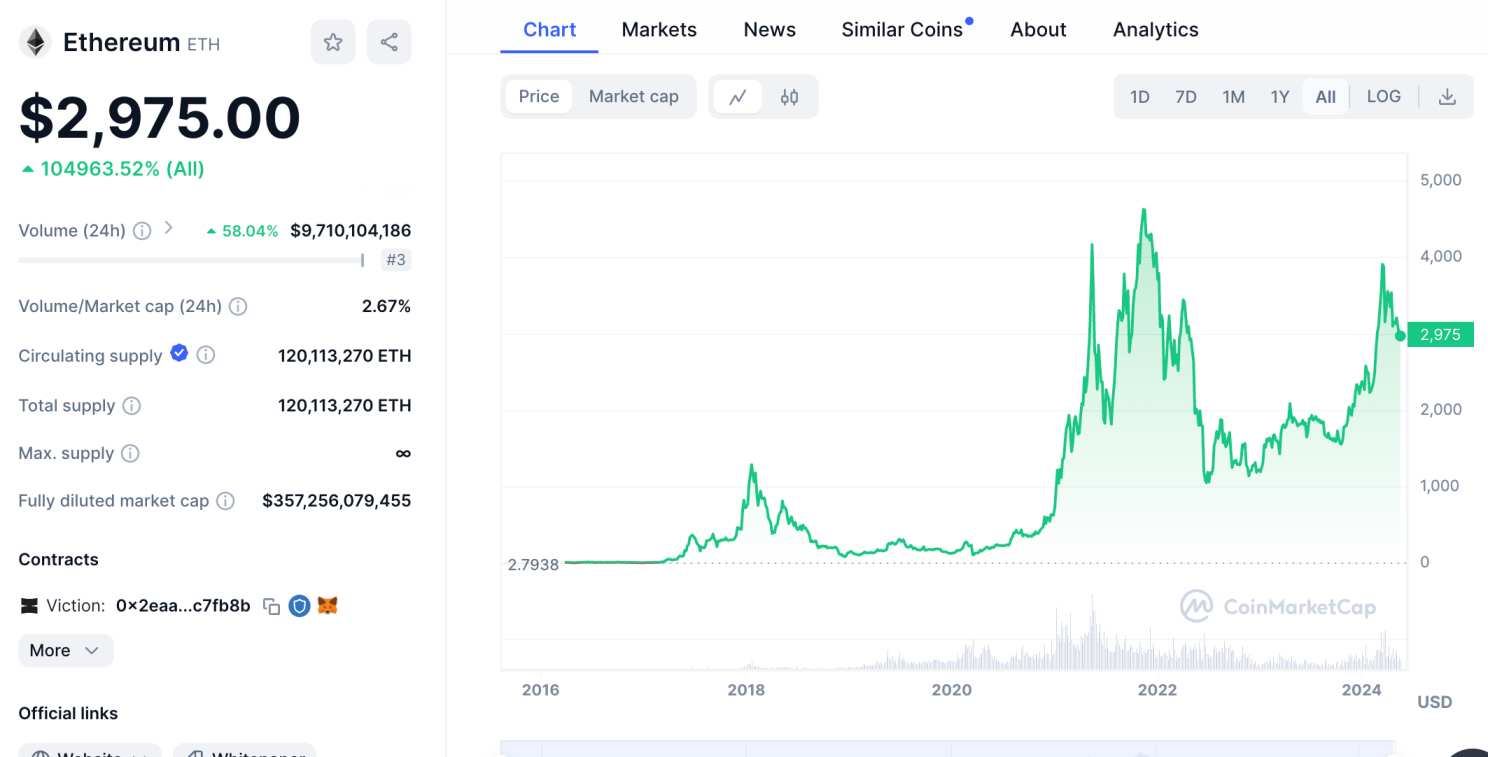

Price History and Future Potential

I mentioned earlier that Ethereum is one of the best-performing cryptocurrencies of all time. While the network launched in 2015, Ethereum held an initial coin offering (ICO) in 2014. The ICO sold ETH coins at $0.31 each. According to CoinMarketCap, Ethereum’s all-time high price of $4,891 was hit in late 2021.

This means in seven years of trading. Ethereum returned over 1.6 million percent. Now, Ethereum is already a mega-cap cryptocurrency. It was valued at over $500 billion during the 2021 bull market. This means investors shouldn’t expect a similar growth trajectory. However, there’s still a lot of upside to target.

For a start, Ethereum currently trades almost 40% below all-time highs. This means first-time buyers can secure a hugely discounted price. In addition, some analysts believe Ethereum is worth a small fraction of its future potential. This includes Cathie Wood – CEO of ARK Invest. Wood believes that Ethereum could become a $20 trillion market by 2032.

Based on current prices, Etheruem’s market capitalization is about $355 billion. Should Wood’s prediction come true, that’s an upside of over 56x. However, this is just a prediction – there’s no guarantee that Ethereum will reach these heights. Always conduct your own research when assessing Ethereum’s potential value.

Ethereum ETFs Could be Launched in 2024

Ethereum is expected to become the second cryptocurrency to have a fully-fledged ETF. According to Reuters, Ethereum ETF approvals could happen later in 2024. This would be a watershed moment for Ethereum – especially its long-term value. After all, Bitcoin’s ETFs – which were approved in January 2024, have been a huge success.

- Bitcoin was priced at $49,000 when the ETF announcement was made.

- It surpassed $73,000 by March 2024 – an increase of almost 50% in just two months.

- Considering Ethereum has a much smaller market capitalization, an ETF approval could result in even bigger gains.

Crucially, ETFs will enable financial institutions to invest in Ethereum without using an exchange. This will likely result in significant capital inflows, just like we saw with Bitcoin.

Things to Consider Before Investing in Ethereum

I’ve covered the benefits of investing in ETH, now let’s move on to the risks.

Expect High Volatility

Ethereum is a volatile asset. It witnesses rapid price increases and decreases at a considerably more volatile rate than blue-chip stocks. For example, I mentioned that Ethereum hit an all-time high of $4,891 in late 2021. The following year saw Ethereum hit lows of just over $1,000. This represents a decline of almost 80%.

Since then, Ethereum has hit 52-week highs of $4,092. That’s an increase of nearly 310%. These volatility levels are considered ‘typical’ in the broader crypto markets. This is why Ethereum should only be viewed as a long-term investment. Consider dollar-cost averaging your ETH investments to reduce the impact of market volatility.

Consensys vs the SEC

Consensys – a Web 3 developer active in the Ethereum ecosystem, recently sued the SEC. Consensys alleges that the SEC is unlawfully attempting to classify Ethereum as a ‘security’.

The SEC previously attempted a similar feat with Ripple. Although the court eventually ruled in Ripple’s favor.

Nonetheless, the Consensys court case means that Ethereum’s ETF hopes could be delayed for some time. As an Ethereum investor, it’s important to stay abreast of key developments.

Strong Competition From Other Smart Contract Blockchains

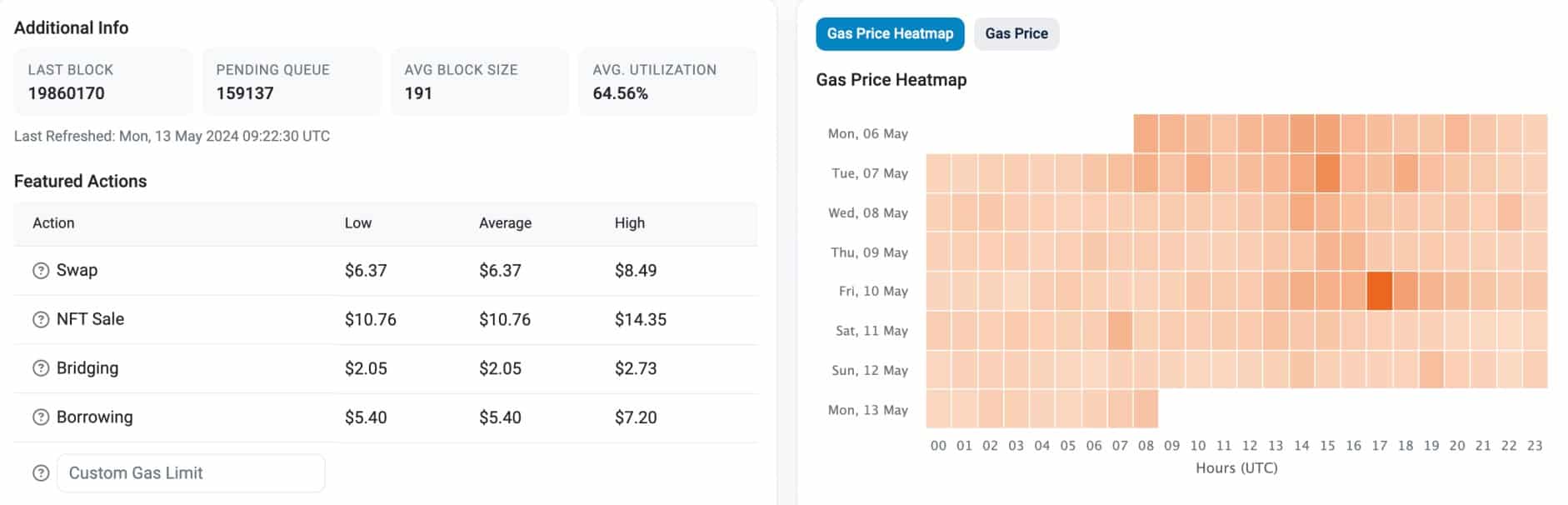

Perhaps the biggest risk facing Ethereum is existing market competition. Although Ethereum remains the most active ecosystem for decentralized applications, competitors like Solana are slowly increasing their market share. This is due to two key issues – scalability and fees.

For instance, while the network completed its PoS upgrade in late 2022, Ethereum can still only handle 12 transactions per second. This isn’t anywhere near enough to handle transactional throughput. As a result, Ethereum regularly experiences network overload, meaning fees are often too high.

For example, the average fee to swap ERC-20 tokens on the Ethereum network is currently $6.37. This makes small token swaps unviable. In addition, the average NFT transaction fee is currently $10.76. Lending fees are also high at $5.40 per transaction. In contrast, other smart contract ecosystems are considerably cheaper.

For example, Solana claims to have a median transaction fee of just $0.00064. Moreover, Solana can handle thousands of transactions per second. Solana is also faster – block confirmation times take just 400 milliseconds. All that said, many experts believe that Ethereum is the safer long-term play. For a start, Solana isn’t a truly decentralized ecosystem like Ethereum.

This is one of the reasons why the Solana network frequently experiences outages. Furthermore, the likelihood is that Ethereum will eventually achieve its scalability goals of over 100,000 transactions per second. Ultimately, this could make other smart contract networks irrelevant, and help ETH become a multi-trillion-dollar asset.

How Much Does it Cost to Buy Ethereum?

Ethereum’s market price is determined by demand and supply. Its price changes every second based on buying and selling pressure. This works the same as other cryptocurrencies – and financial markets in general. Today, Ethereum trades at just under $3,000 per coin.

This makes Ethereum more affordable than Bitcoin, which trades at over $60,000. However, casual investors will be pleased to know that Ethereum can be fractionized into smaller units – known as ‘wei’. There are 1 quintillion wei for every 1 ETH. In theory, this means investors can purchase any amount they like – starting from micro-cents.

Conclusion

We’ve explained how to invest in Ethereum, covering various methods for beginners in 2024. Some investors prefer crypto exchanges, especially when using fiat money. This is because top Ethereum exchanges offer low fees and commissions.

Another option is to buy Ethereum via a crypto wallet. Most wallets come with a fiat on-ramp, meaning users can purchase ETH with a debit/credit card or e-wallet. The ETH coins are then added to the wallet directly, preventing the need to use a crypto exchange.

FAQs

How can I buy Ethereum?

Most investors buy Ethereum from a crypto exchange, such as eToro, Coinbase, or Gemini. Another option is to use a crypto wallet such as Best Wallet, which is more convenient.

How much does it cost to buy one Ethereum?

Although Ethereum currently trades at just under $3,000 – there’s no requirement to buy one full ETH. This is because ETH can be fractionized into tiny units.

What is the best place to buy Ethereum?

eToro is the best place to buy Ethereum from a regulated crypto exchange. Best Wallet is a great option for buying Ethereum directly from a self-custody wallet.

Should I buy Ethereum?

Ethereum has huge price potential, with ARK Invest CEO Cathie Wood predicting a $20 trillion market capitalization by 2032. However, Ethereum isn’t without its risks – especially when factoring in competitors like Solana and Avalanche.

References

- The Ethereum Merge Ups the Stakes—and Reshapes the Crypto Universe (Bloomberg)

- Ethereum Price Data (CoinMarketCap)

- US SEC expected to deny spot ether ETFs next month, industry sources say (Reuters)

- Consensys Sues to Block SEC From Deeming Ether a Security (The Wall Street Journal)

Ethereum

QCP sees Ethereum as a safe bet amid Bitcoin stagnation

QCP, a leading trading firm, has shared key observations on the cryptocurrency market. Bitcoin’s struggle to surpass the $70,000 mark has led QCP to predict Selling pressure is still strong, with BTC likely to remain in a tight trading range. In the meantime, Ethereum (ETH) is seen as a more promising investment, with potential gains as ETH could catch up to BTC, thanks to decreasing ETHE outflows.

Read on to find out how you can benefit from it.

Bitcoin’s Struggle: The $70,000 Barrier

For the sixth time in a row, BTC has failed to break above the $70,000 mark. Bitcoin is at $66,048 after a sharp decline. Many investors sold Bitcoin to capitalize on the rising values, which caused a dramatic drop. The market is becoming increasingly skeptical about Bitcoin’s rise, with some investors lowering their expectations.

Despite the continued sell-off from Mt. Gox and the US government, the ETF market remains bullish. There is a notable trend in favor of Ethereum (ETH) ETFs as major bulls have started investing in ETFs, indicating a bullish sentiment for ETH.

QCP Telegram Update UnderlinesIncreased market volatility. The NASDAQ has fallen 10% from its peak, led by a pullback in major technology stocks. Currency carry trades are being unwound and the VIX, a measure of market volatility, has jumped to 19.50.

The main factors driving this uncertainty are Value at Risk (VaR) shocks, high stock market valuations and global risk aversion sentiment. Commodities such as oil and copper have also declined on fears of an economic slowdown.

Additionally, QCP anticipates increased market volatility ahead of the upcoming FOMC meeting, highlighting the importance of the Federal Reserve’s statement and Jerome Powell’s subsequent press conference.

A glimmer of hope

QCP notes a positive development in the crypto space with an inflow of $33.7 million into ETH spot ETFs, which is giving a much-needed boost to ETH prices. However, they anticipate continued outflows of ETHE in the coming weeks. The recent Silk Road BTC moves by the US government have added to the market uncertainty.

QCP suggests a strategic trade involving BTC, which will likely remain in its current range, while ETH offers a more promising opportunity. They propose a trade targeting a $4,000-$4,500 range for ETH, which could generate a 5.5x return by August 30, 2024.

Ethereum

Ethereum Whale Resurfaces After 9 Years, Moves 1,111 ETH Worth $3.7 Million

An Ethereum ICO participant has emerged from nearly a decade of inactivity.

Lookonchain, a smart on-chain money tracking tool, revealed On X, this long-inactive participant recently transferred 1,111 ETH, worth approximately $3.7 million, to a new wallet. This significant move marks a notable on-chain movement, given the participant’s prolonged dormancy.

The Ethereum account in question, identified as 0xE727E67E…B02B5bFC6, received 2,000 ETH on the Genesis block over 9 years ago.

This initial allocation took place during the Ethereum ICOwhere the participant invested in ETH at around $0.31 per coin. The initial investment, worth around $620 at the time, has now grown to millions of dollars.

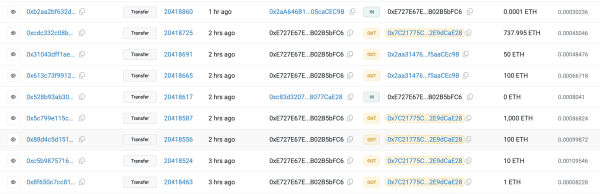

Recent Transactions and Movements

The inactive account became active again with several notable output transactions. Specifically, the account transferred 1,000 ETH, 100 ETH, 10 ETH, 1 ETH, and 1 more ETH to address 0x7C21775C…2E9dCaE28 within a few minutes. Additionally, it moved 1 ETH to 0x2aa31476…f5aaCE9B.

Additionally, in the latest round of transactions, the address transferred 737,995 ETH, 50 ETH, and 100 ETH, for a total of 887,995 ETH. These recent activities highlight a significant movement of funds, sparking interest and speculation in the crypto community.

Why are whales reactivating?

It is also evident that apart from 0xE727E67E…B02B5bFC6, other previously dormant Ethereum whales are waking up with significant transfers.

In May, another dormant Ethereum whale made headlines when it staked 4,032 ETHvalued at $7.4 million, after more than two years of inactivity. This whale initially acquired 60,000 ETH during the Genesis block of Ethereum’s mainnet in 2015.

At the time, this activity could have been related to Ethereum’s upgrade known as “Shanghai,” which improved the network’s scalability and performance. This whale likely intended to capitalize on the price surge that occurred after the upgrade.

Disclaimer: This content is informational and should not be considered financial advice. The opinions expressed in this article may include the personal opinions of the author and do not reflect the opinion of The Crypto Basic. Readers are encouraged to conduct thorough research before making any investment decisions. The Crypto Basic is not responsible for any financial losses.

-Advertisement-

Ethereum

Only Bitcoin and Ethereum are viable for ETFs in the near future

BlackRock: Only Bitcoin and Ethereum Are Viable for ETFs in the Near Future

Bitcoin and Ethereum will be the only cryptocurrencies traded via ETFs in the near future, according to Samara Cohen, chief investment officer of ETFs and indices at BlackRock, the world’s largest asset manager.

In an interview with Bloomberg TV, Cohen explained that while Bitcoin and Ethereum have met BlackRock’s rigorous criteria for exchange-traded funds (ETFs), no other digital asset currently comes close. “We’re really looking at the investability to see what meets the criteria, what meets the criteria that we want to achieve in an ETF,” Cohen said. “Both in terms of the investability and from what we’re hearing from our clients, Bitcoin and Ethereum definitely meet those criteria, but it’s going to be a while before we see anything else.”

Cohen noted that beyond the technical challenges of launching new ETFs, the demand for other crypto ETFs, particularly Solana, is not there yet. While Solana is being touted as the next potential ETF candidate, Cohen noted that the market appetite remains lacking.

BlackRock’s interest in Bitcoin and Ethereum ETFs comes after the successful launch of Ethereum ETFs last week, which saw weekly trading volume for the crypto fund soar to $14.8 billion, the highest level since May. The success has fueled speculation about the next possible ETF, with Solana frequently mentioned as a contender.

Solana, known as a faster and cheaper alternative to Ethereum, has been the subject of two separate ETF filings in the US by VanEck and 21Shares. However, the lack of CME Solana futures, unlike Bitcoin and Ethereum, is a significant hurdle for SEC approval of a Solana ETF.

Despite these challenges, some fund managers remain optimistic about Solana’s potential. Franklin Templeton recently described Solana as an “exciting and major development that we believe will drive the crypto space forward.” Solana currently accounts for about 3% of the overall cryptocurrency market value, with a market cap of $82 billion, according to data from CoinGecko.

Meanwhile, Bitcoin investors continue to show strong support, as evidenced by substantial inflows into BlackRock’s iShares Bitcoin Trust (NASDAQ: IBIT). On July 22, IBIT reported inflows of $526.7 million, the highest single-day total since March. This impressive haul stands in stark contrast to the collective inflow of just $6.9 million seen across the remaining 10 Bitcoin ETFs, according to data from Farside Investors. The surge in IBIT inflows coincides with Bitcoin’s significant $68,000 level, just 8% off its all-time high of $73,000.

Ethereum

Ethereum Posts First Consecutive Monthly Losses Since August 2023 on New ETFs

Available exclusively via

Bitcoin ETF vs Ethereum: A Detailed Comparison of IBIT and ETHA

Andjela Radmilac · 3 days ago

CryptoSlate’s latest market report takes an in-depth look at the technical and practical differences between IBIT and BlackRock’s ETHA to explain how these products work.

-

Ethereum8 months ago

Ethereum8 months agoEthereum Posts First Consecutive Monthly Losses Since August 2023 on New ETFs

-

Regulation8 months ago

Regulation8 months agoCryptocurrency Regulation in Slovenia 2024

-

News8 months ago

News8 months agoNew bill pushes Department of Veterans Affairs to examine how blockchain can improve its work

-

Regulation8 months ago

Regulation8 months agoThink You Own Your Crypto? New UK Law Would Ensure It – DL News

-

Regulation8 months ago

Regulation8 months agoA Blank Slate for Cryptocurrencies: Kamala Harris’ Regulatory Opportunity

-

Regulation8 months ago

Regulation8 months agoUpbit, Coinone, Bithumb Face New Fees Under South Korea’s Cryptocurrency Law

-

Regulation8 months ago

Regulation8 months agoBahamas Passes Cryptocurrency Bill Designed to Prevent FTX, Terra Disasters

-

Regulation8 months ago

Regulation8 months agoIndia to Follow G20 Policy for Cryptocurrency Regulation: MoS Finance

-

Videos11 months ago

Videos11 months agoNexus Chain – Ethereum L2 with the GREATEST Potential?

-

Ethereum11 months ago

Ethereum11 months agoScaling Ethereum with L2s damaged its Tokenomics. Is it possible to repair it?

-

Ethereum11 months ago

Ethereum11 months agoComment deux frères auraient dérobé 25 millions de dollars lors d’un braquage d’Ethereum de 12 secondes • The Register

-

News11 months ago

News11 months agoSolana ranks the fastest blockchain in the world, surpassing Ethereum, Polygon ⋆ ZyCrypto