News

What Is It, How It Works, and How It Can Be Used

What Is a Blockchain?

A blockchain is a distributed database or ledger shared among a computer network’s nodes. They are best known for their crucial role in cryptocurrency systems for maintaining a secure and decentralized record of transactions, but they are not limited to cryptocurrency uses. Blockchains can be used to make data in any industry immutable—the term used to describe the inability to be altered.

Because there is no way to change a block, the only trust needed is at the point where a user or program enters data. This aspect reduces the need for trusted third parties, which are usually auditors or other humans that add costs and make mistakes.

Since Bitcoin’s introduction in 2009, blockchain uses have exploded via the creation of various cryptocurrencies, decentralized finance (DeFi) applications, non-fungible tokens (NFTs), and smart contracts.

Key Takeaways

- Blockchain is a type of shared database that differs from a typical database in the way it stores information; blockchains store data in blocks linked together via cryptography.

- Different types of information can be stored on a blockchain, but the most common use for transactions has been as a ledger.

- In Bitcoin’s case, the blockchain is decentralized, so no single person or group has control—instead, all users collectively retain control.

- Decentralized blockchains are immutable, which means that the data entered is irreversible. For Bitcoin, transactions are permanently recorded and viewable to anyone.

Investopedia / Xiaojie Liu

How Does a Blockchain Work?

You might be familiar with spreadsheets or databases. A blockchain is somewhat similar because it is a database where information is entered and stored. But the key difference between a traditional database or spreadsheet and a blockchain is how the data is structured and accessed.

A blockchain consists of programs called scripts that conduct the tasks you usually would in a database: Entering and accessing information and saving and storing it somewhere. A blockchain is distributed, which means multiple copies are saved on many machines, and they must all match for it to be valid.

The blockchain collects transaction information and enters it into a 4MB file called a block. Once it is full, certain information is run through an encryption algorithm, which creates a hexadecimal number called the block header hash.

The hash is then entered into the following block header and encrypted with the other information in that block’s header, creating a chain of blocks.

Transaction Process

Transactions follow a specific process, depending on the blockchain they are taking place on. For example, on Bitcoin’s blockchain, if you initiate a transaction using your cryptocurrency wallet—the application that provides an interface for the blockchain—it starts a sequence of events.

In Bitcoin, your transaction is sent to a memory pool, where it is stored and queued until a miner picks it up. Once it is entered into a block and the block fills up with transactions, it is closed, and the mining begins.

Every node in the network proposes its own blocks in this way because they all choose different transactions. Each works on their own blocks, trying to find a solution to the difficulty target, using the “nonce,” short for number used once.

The nonce value is a field in the block header that is changeable, and its value incrementally increases every attempt. Every miner starts with a nonce of zero. If the resulting hash isn’t equal to or less than the target hash, a value of one is added to the nonce, a new hash is generated, and so on. The nonce rolls over about every 4.5 billion attempts (which takes less than one second) and uses another value called the extra nonce as an additional counter. This continues until a miner generates a valid hash, winning the race and receiving the reward.

Generating these hashes until a specific value is found is the “proof-of-work” you hear so much about—it “proves” the miner did the work. The amount of work it takes to validate the hash is why the Bitcoin network consumes so much computational power and energy.

Once a block is closed, a transaction is complete. However, the block is not considered to be confirmed until five other blocks have been validated. Confirmation takes the network about one hour to complete because it averages just under 10 minutes per block (the first block with your transaction and five following blocks multiplied by 10 equals 60 minutes).

Not all blockchains follow this process. For instance, the Ethereum network randomly chooses one validator from all users with ether staked to validate blocks, which are then confirmed by the network. This is much faster and less energy intensive than Bitcoin’s process.

Blockchain Decentralization

A blockchain allows the data in a database to be spread out among several network nodes—computers or devices running software for the blockchain—at various locations. This not only creates redundancy but maintains the fidelity of the data. For example, if someone tries to alter a record at one instance of the database, the other nodes would prevent it from happening because they compare block hashes. This way, no single node within the network can alter information within the chain.

Because of this distribution—and the encrypted proof that work was done—the information and history (like the transactions in cryptocurrency) are irreversible. Such a record could be a list of transactions (such as with a cryptocurrency), but it is also possible for a non-public blockchain to hold a variety of other information like legal contracts, state identifications, or a company’s inventory. Most blockchains wouldn’t “store” these items; they would likely be sent through a hashing algorithm and represented on the blockchain by a token.

Blockchain Transparency

Because of the decentralized nature of the Bitcoin blockchain, all transactions can be transparently viewed by downloading and inspecting them or by using blockchain explorers that allow anyone to see transactions occurring live. Each node has its own copy of the chain that gets updated as fresh blocks are confirmed and added. This means that if you wanted to, you could track a bitcoin wherever it goes.

For example, exchanges have been hacked in the past, resulting in the loss of large amounts of cryptocurrency. While the hackers may have been anonymous—except for their wallet address—the crypto they extracted is easily traceable because the wallet addresses are published on the blockchain.

Of course, the records stored in the Bitcoin blockchain (as well as most others) are encrypted. This means that only the person assigned an address can reveal their identity. As a result, blockchain users can remain anonymous while preserving transparency.

Is Blockchain Secure?

Blockchain technology achieves decentralized security and trust in several ways. To begin with, new blocks are always stored linearly and chronologically. That is, they are always added to the “end” of the blockchain. After a block has been added to the end of the blockchain, previous blocks cannot be changed.

A change in any data changes the hash of the block it was in. Because each block contains the previous block’s hash, a change in one would change the following blocks. The network would generally reject an altered block because the hashes would not match. However, this can be accomplished on smaller blockchain networks.

Not all blockchains are 100% impenetrable. They are distributed ledgers that use code to create the security level they have become known for. If there are vulnerabilities in the coding, they can be exploited.

A new and smaller chain might be susceptible to this kind of attack, but the attacker would need at least half of the computational power of the network (called a 51% attack). On the Bitcoin and other larger blockchains, this is nearly impossible. By the time the hacker takes any action, the network is likely to have moved past the blocks they were trying to alter. This is because the rate at which these networks hash is exceptionally fast—the Bitcoin network hashed at a rate of 566–657 exahashes per second (18 zeros) between May and June 2024.

The Ethereum blockchain is not likely to be hacked either—the attackers would need to control more than half of the blockchain’s staked ether. Between April and June 2024, more than 32 million ETH was staked by more than one million validators. An attacker or group would need to own more than half of the validators, about 16.4 billion ETH, and be randomly selected to validate blocks enough times to get their blocks implemented.

Bitcoin vs. Blockchain

Blockchain technology was first outlined in 1991 by Stuart Haber and W. Scott Stornetta, two researchers who wanted to implement a system where document timestamps could not be tampered with. But it wasn’t until almost two decades later, with the launch of Bitcoin in January 2009, that blockchain had its first real-world application.

Bitcoin

The Bitcoin protocol is built on a blockchain. In a research paper introducing the digital currency, Bitcoin’s pseudonymous creator, Satoshi Nakamoto, referred to it as “a new electronic cash system that’s fully peer-to-peer, with no trusted third party.”

The key thing to understand is that Bitcoin uses blockchain as a means to transparently record a ledger of payments or other transactions between parties.

Blockchain

Blockchain can be used to immutably record any number of data points. This could be in the form of transactions, votes in an election, product inventories, state identifications, deeds to homes, and much more.

Currently, tens of thousands of projects are looking to implement blockchains in various ways to help society other than just recording transactions—for example, as a way to vote securely in democratic elections.

The nature of blockchain’s immutability means that fraudulent voting would become far more difficult. For example, a voting system could work such that each country’s citizens would be issued a single cryptocurrency or token.

Each candidate could then be given a specific wallet address, and the voters would send their token or crypto to the address of whichever candidate they wish to vote for. The transparent and traceable nature of blockchain would eliminate the need for human vote counting and the ability of bad actors to tamper with physical ballots.

Blockchain vs. Banks

Blockchains have been heralded as a disruptive force in the finance sector, especially with the functions of payments and banking. However, banks and decentralized blockchains are vastly different.

To see how a bank differs from blockchain, let’s compare the banking system to Bitcoin’s blockchain implementation.

How Are Blockchains Used?

As we now know, blocks on Bitcoin’s blockchain store transactional data. Today, tens of thousands of other cryptocurrency systems are running on a blockchain. But it turns out that blockchain is a reliable way of storing data about other types of transactions.

Some companies experimenting with blockchain include Walmart, Pfizer, AIG, Siemens, and Unilever, among others. For example, IBM has created its Food Trust blockchain to trace the journey that food products take to get to their locations.

Why do this? The food industry has seen countless outbreaks of E. coli, salmonella, and listeria; in some cases, hazardous materials were accidentally introduced to foods. In the past, it has taken weeks to find the source of these outbreaks or the cause of sickness from what people are eating.

Using blockchain allows brands to track a food product’s route from its origin, through each stop it makes, to delivery. Not only that, but these companies can also now see everything else it may have come in contact with, allowing the identification of the problem to occur far sooner—potentially saving lives. This is one example of blockchain in practice, but many other forms of blockchain implementation exist.

Banking and Finance

Perhaps no industry stands to benefit from integrating blockchain into its business operations more than personal banking. Financial institutions only operate during business hours, usually five days a week. That means if you try to deposit a check on Friday at 6 p.m., you will likely have to wait until Monday morning to see that money hit your account.

Even if you make your deposit during business hours, the transaction can still take one to three days to verify due to the sheer volume of transactions that banks need to settle. Blockchain, on the other hand, never sleeps.

By integrating blockchain into banks, consumers might see their transactions processed in minutes or seconds—the time it takes to add a block to the blockchain, regardless of holidays or the time of day or week. With blockchain, banks also have the opportunity to exchange funds between institutions more quickly and securely. Given the size of the sums involved, even the few days the money is in transit can carry significant costs and risks for banks.

The settlement and clearing process for stock traders can take up to three days (or longer if trading internationally), meaning that the money and shares are frozen for that period. Blockchain could drastically reduce that time.

Currency

Blockchain forms the bedrock for cryptocurrencies like Bitcoin. This design also allows for easier cross-border transactions because it bypasses currency restrictions, instabilities, or lack of infrastructure by using a distributed network that can reach anyone with an internet connection.

Healthcare

Healthcare providers can leverage blockchain to store their patients’ medical records securely. When a medical record is generated and signed, it can be written into the blockchain, which provides patients with proof and confidence that the record cannot be changed. These personal health records could be encoded and stored on the blockchain with a private key so that they are only accessible to specific individuals, thereby ensuring privacy.

Property Records

If you have ever spent time in your local Recorder’s Office, you will know that recording property rights is both burdensome and inefficient. Today, a physical deed must be delivered to a government employee at the local recording office, where it is manually entered into the county’s central database and public index. In the case of a property dispute, claims to the property must be reconciled with the public index.

This process is not just costly and time-consuming, it is also prone to human error, where each inaccuracy makes tracking property ownership less efficient. Blockchain has the potential to eliminate the need for scanning documents and tracking down physical files in a local recording office. If property ownership is stored and verified on the blockchain, owners can trust that their deed is accurate and permanently recorded.

Proving property ownership can be nearly impossible in war-torn countries or areas with little to no government or financial infrastructure and no Recorder’s Office. If a group of people living in such an area can leverage blockchain, then transparent and clear timelines of property ownership could be established.

Smart Contracts

A smart contract is computer code that can be built into the blockchain to facilitate transactions. It operates under a set of conditions to which users agree. When those conditions are met, the smart contract conducts the transaction for the users.

Supply Chains

As in the IBM Food Trust example, suppliers can use blockchain to record the origins of materials that they have purchased. This would allow companies to verify the authenticity of not only their products but also common labels such as “Organic,” “Local,” and “Fair Trade.”

As reported by Forbes, the food industry is increasingly adopting the use of blockchain to track the path and safety of food throughout the farm-to-user journey.

Voting

As mentioned above, blockchain could facilitate a modern voting system. Voting with blockchain carries the potential to eliminate election fraud and boost voter turnout, as was tested in the November 2018 midterm elections in West Virginia.

Using blockchain in this way would make votes nearly impossible to tamper with. The blockchain protocol would also maintain transparency in the electoral process, reducing the personnel needed to conduct an election and providing officials with nearly instant results. This would eliminate the need for recounts or any real concern that fraud might threaten the election.

Pros and Cons of Blockchain

For all of its complexity, blockchain’s potential as a decentralized form of record-keeping is almost without limit. From greater user privacy and heightened security to lower processing fees and fewer errors, blockchain technology may very well see applications beyond those outlined above. But there are also some disadvantages.

Pros

-

Improved accuracy by removing human involvement in verification

-

Cost reductions by eliminating third-party verification

-

Decentralization makes it harder to tamper with

-

Transactions are secure, private, and efficient

-

Transparent technology

-

Provides a banking alternative and a way to secure personal information for citizens of countries with unstable or underdeveloped governments

Cons

-

Significant technology cost associated with some blockchains

-

Low transactions per second

-

History of use in illicit activities, such as on the dark web

-

Regulation varies by jurisdiction and remains uncertain

-

Data storage limitations

Benefits of Blockchains

Accuracy of the Chain

Transactions on the blockchain network are approved by thousands of computers and devices. This removes almost all people from the verification process, resulting in less human error and an accurate record of information. Even if a computer on the network were to make a computational mistake, the error would only be made to one copy of the blockchain and not be accepted by the rest of the network.

Cost Reductions

Typically, consumers pay a bank to verify a transaction or a notary to sign a document. Blockchain eliminates the need for third-party verification—and, with it, their associated costs. For example, business owners incur a small fee when they accept credit card payments because banks and payment-processing companies have to process those transactions. Bitcoin, on the other hand, does not have a central authority and has limited transaction fees.

Decentralization

Blockchain does not store any of its information in a central location. Instead, the blockchain is copied and spread across a network of computers. Whenever a new block is added to the blockchain, every computer on the network updates its blockchain to reflect the change.

By spreading that information across a network, rather than storing it in one central database, blockchain becomes more difficult to tamper with.

Efficient Transactions

Transactions placed through a central authority can take up to a few days to settle. If you attempt to deposit a check on Friday evening, for example, you may not actually see funds in your account until Monday morning. Financial institutions operate during business hours, usually five days a week—but a blockchain works 24 hours a day, seven days a week, and 365 days a year.

On some blockchains, transactions can be completed in minutes and considered secure after just a few. This is particularly useful for cross-border trades, which usually take much longer because of time zone issues and the fact that all parties must confirm payment processing.

Private Transactions

Many blockchain networks operate as public databases, meaning anyone with an internet connection can view a list of the network’s transaction history. Although users can access transaction details, they cannot access identifying information about the users making those transactions. It is a common misperception that blockchain networks like Bitcoin are fully anonymous; they are actually pseudonymous because there is a viewable address that can be associated with a user if the information gets out.

Secure Transactions

Once a transaction is recorded, its authenticity must be verified by the blockchain network. After the transaction is validated, it is added to the blockchain block. Each block on the blockchain contains its unique hash and the unique hash of the block before it. Therefore, the blocks cannot be altered once the network confirms them.

Transparency

Many blockchains are entirely open-source software. This means that everyone can view its code. This gives auditors the ability to review cryptocurrencies like Bitcoin for security. However, it also means there is no real authority on who controls Bitcoin’s code or how it is edited. Because of this, anyone can suggest changes or upgrades to the system. If a majority of the network users agree that the new version of the code with the upgrade is sound and worthwhile, then Bitcoin can be updated.

Private or permission blockchains may not allow for public transparency, depending on how they are designed or their purpose. These types of blockchains might be made only for an organization that wishes to track data accurately without allowing anyone outside of the permissioned users to see it.

Alternatively, there might come a point where publicly traded companies are required to provide investors with financial transparency through a regulator-approved blockchain reporting system. Using blockchains in business accounting and financial reporting would prevent companies from altering their financials to appear more profitable than they really are.

Banking the Unbanked

Perhaps the most profound facet of blockchain and cryptocurrency is the ability for anyone, regardless of ethnicity, gender, location, or cultural background, to use it. According to The World Bank, an estimated 1.3 billion adults do not have bank accounts or any means of storing their money or wealth. Moreover, nearly all of these individuals live in developing countries where the economy is in its infancy and entirely dependent on cash.

These people are often paid in physical cash. They then need to store this physical cash in hidden locations in their homes or other places, incentivizing robbers or violence. While not impossible to steal, crypto makes it more difficult for would-be thieves.

Drawbacks of Blockchains

Technology Cost

Although blockchain can save users money on transaction fees, the technology is far from free. For example, the Bitcoin network’s proof-of-work system to validate transactions consumes vast amounts of computational power. In the real world, the energy consumed by the millions of devices on the Bitcoin network is more than Pakistan consumes annually.

Some solutions to these issues are beginning to arise. For example, bitcoin-mining farms have been set up to use solar power, excess natural gas from fracking sites, or energy from wind farms.

Speed and Data Inefficiency

Bitcoin is a perfect case study for the possible inefficiencies of blockchain. Bitcoin’s PoW system takes about 10 minutes to add a new block to the blockchain. At that rate, it’s estimated that the blockchain network can only manage about three transactions per second (TPS). Although other cryptocurrencies, such as Ethereum, perform better than Bitcoin, blockchain still limits them. Legacy brand Visa, for context, can process 65,000 TPS.

Solutions to this issue have been in development for years. There are currently blockchains that boast more than 30,000 TPS. Ethereum is rolling out a series of upgrades that include data sampling, binary large objects (BLOBs), and rollups. These improvements are expected to increase network participation, reduce congestion, decrease fees, and increase transaction speeds.

The other issue with many blockchains is that each block can only hold so much data. The block size debate has been and continues to be one of the most pressing issues for the scalability of blockchains in the future.

Illegal Activity

While confidentiality on the blockchain network protects users from hacks and preserves privacy, it also allows for illegal trading and activity on the blockchain network. The most cited example of blockchain being used for illicit transactions is probably the Silk Road, an online dark web illegal-drug and money laundering marketplace operating from February 2011 until October 2013, when the FBI shut it down.

The dark web allows users to buy and sell illegal goods without being tracked by using the Tor Browser and make illicit purchases in Bitcoin or other cryptocurrencies. This is in stark contrast to U.S. regulations, which require financial service providers to obtain information about their customers when they open an account. They are supposed to verify the identity of each customer and confirm that they do not appear on any list of known or suspected terrorist organizations.

Illicit activity accounted for only 0.34% of all cryptocurrency transactions in 2023.

This system can be seen as both a pro and a con. It gives anyone access to financial accounts, but allows criminals to transact more easily. Many have argued that the good uses of crypto, like banking the unbanked world, outweigh the bad uses of cryptocurrency, especially when most illegal activity is still accomplished through untraceable cash.

Regulation

Many in the crypto space have expressed concerns about government regulation of cryptocurrencies. Many jurisdictions are tightening control over certain types of crypto and other virtual currencies. However, no regulations have yet been introduced that focus on restricting blockchain uses and development, only certain products created using it.

Data Storage

Another significant implication of blockchains is that they require storage. This may not appear to be substantial because we already store lots of information and data. However, as time passes, the number of growing blockchain uses will require more storage, especially on blockchains where nodes store the entire chain.

Currently, data storage is centralized in large centers. But if the world transitions to blockchain for every industry and use, its exponentially growing size would mean more advanced techniques to reduce its size or that any participants would need to continually upgrade their storage.

This could become significantly expensive in terms of both money and physical space needed, as the Bitcoin blockchain itself was more than 575 gigabytes on June 14, 2024—and this blockchain records only bitcoin transactions. This is small compared to the amount of data stored in large data centers, but a growing number of blockchains will only add to the amount of storage already required for the connected and digital world.

What Exactly Is a Blockchain?

Simply put, a blockchain is a shared database or ledger. Pieces of data are stored in data structures known as blocks, and each network node has a replica of the entire database. Security is ensured since the majority will not accept this change if somebody tries to edit or delete an entry in one copy of the ledger.

What Is a Blockchain in Easy Terms?

Imagine you typed some information into a document on your computer and sent it through a program that gave you a string of numbers and letters (called hashing, with the string called a hash). You add this hash to the beginning of another document and type information into it. Again, you use the program to create a hash, which you add to the following document. Each hash is a representation of the previous document, which creates a chain of encoded documents that cannot be altered without changing the hash. Each document is stored on computers in a network. This network of programs compares each document with the ones they have stored and accepts them as valid based on the hashes they generate. If a document doesn’t generate a hash that is a match, that document is rejected by the network.

What Is a Blockchain for Beginners?

A blockchain is a distributed network of files chained together using programs that create hashes, or strings of numbers and letters that represent the information contained in the files. Every network participant is a computer or device that compares these hashes to the one they generate. If there is a match, the file is kept. If there isn’t, the file is rejected.

The Bottom Line

With many practical applications for the technology already being implemented and explored, blockchain is finally making a name for itself in no small part because of Bitcoin and cryptocurrency. As a buzzword on the tongue of every investor in the nation, blockchain stands to make business and government operations more accurate, efficient, secure, and cheap, with fewer intermediaries.

As we head into the third decade of blockchain, it’s no longer a question of if legacy companies will catch on to the technology—it’s a question of when. Today, we see a proliferation of NFTs and the tokenization of assets. Tomorrow, we may see a combination of blockchains, tokens, and artificial intelligence all incorporated into business and consumer solutions.

News

An enhanced consensus algorithm for blockchain

The introduction of the link and reputation evaluation concepts aims to improve the stability and security of the consensus mechanism, decrease the likelihood of malicious nodes joining the consensus, and increase the reliability of the selected consensus nodes.

The link model structure based on joint action

Through the LINK between nodes, all the LINK nodes engage in consistent activities during the operation of the consensus mechanism. The reputation evaluation mechanism evaluates the trustworthiness of nodes based on their historical activity status throughout the entire blockchain. The essence of LINK is to drive inactive nodes to participate in system activities through active nodes. During the stage of selecting leader nodes, nodes are selected through self-recommendation, and the reputation evaluation of candidate nodes and their LINK nodes must be qualified. The top 5 nodes of the total nodes are elected as leader nodes through voting, and the nodes in their LINK status are candidate nodes. In the event that the leader node goes down, the responsibility of the leader node is transferred to the nodes in its LINK through the view-change. The LINK connection algorithm used in this study is shown in Table 2, where LINKm is the linked group and LINKP is the percentage of linked nodes.

Table 2 LINK connection algorithm.

Node type

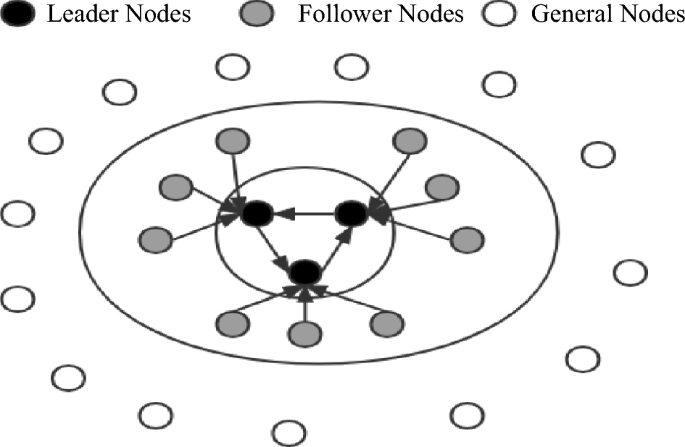

This paper presents a classification of nodes in a blockchain system based on their functionalities. The nodes are divided into three categories: leader nodes (LNs), follower nodes (FNs), and general nodes (Ns). The leader nodes (LNs) are responsible for producing blocks and are elected through voting by general nodes. The follower nodes (FNs) are nodes that are linked to leader nodes (LNs) through the LINK mechanism and are responsible for validating blocks. General nodes (N) have the ability to broadcast and disseminate information, participate in elections, and vote. The primary purpose of the LINK mechanism is to act in combination. When nodes are in the LINK, there is a distinction between the master and slave nodes, and there is a limit to the number of nodes in the LINK group (NP = {n1, nf1, nf2 ……,nfn}). As the largest proportion of nodes in the system, general nodes (N) have the right to vote and be elected. In contrast, leader nodes (LNs) and follower nodes (FNs) do not possess this right. This rule reduces the likelihood of a single node dominating the block. When the system needs to change its fundamental settings due to an increase in the number of nodes or transaction volume, a specific number of current leader nodes and candidate nodes need to vote for a reset. Subsequently, general nodes need to vote to confirm this. When both confirmations are successful, the new basic settings are used in the next cycle of the system process. This dual confirmation setting ensures the fairness of the blockchain to a considerable extent. It also ensures that the majority holds the ultimate decision-making power, thereby avoiding the phenomenon of a small number of nodes completely controlling the system.

After the completion of a governance cycle, the blockchain network will conduct a fresh election for the leader and follower nodes. As only general nodes possess the privilege to participate in the election process, the previous consortium of leader and follower nodes will lose their authorization. In the current cycle, they will solely retain broadcasting and receiving permissions for block information, while their corresponding incentives will also decrease. A diagram illustrating the node status can be found in Fig. 1.

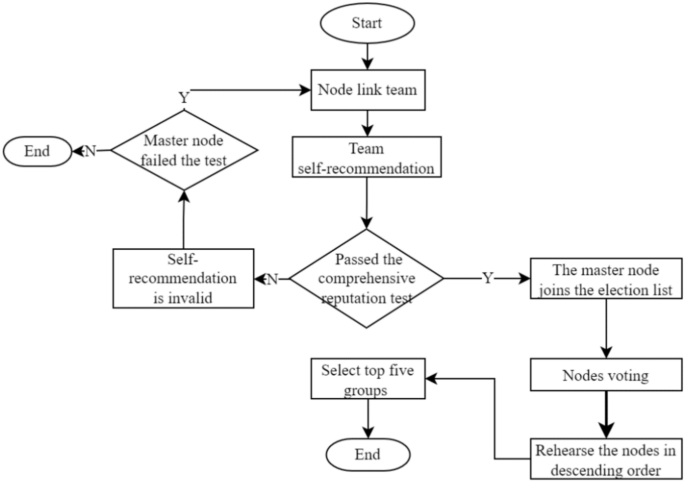

Election method

The election method adopts the node self-nomination mode. If a node wants to participate in an election, it must form a node group with one master and three slaves. One master node group and three slave node groups are inferred based on experience in this paper; these groups can balance efficiency and security and are suitable for other project collaborations. The successfully elected node joins the leader node set, and its slave nodes enter the follower node set. Considering the network situation, the maximum threshold for producing a block is set to 1 s. If the block fails to be successfully generated within the specified time, it is regarded as a disconnected state, and its reputation score is deducted. The node is skipped, and in severe cases, a view transformation is performed, switching from the master node to the slave node and inheriting its leader’s rights in the next round of block generation. Although the nodes that become leaders are high-reputation nodes, they still have the possibility of misconduct. If a node engages in misconduct, its activity will be immediately stopped, its comprehensive reputation score will be lowered, it will be disqualified from participating in the next election, and its equity will be reduced by 30%. The election process is shown in Fig. 2.

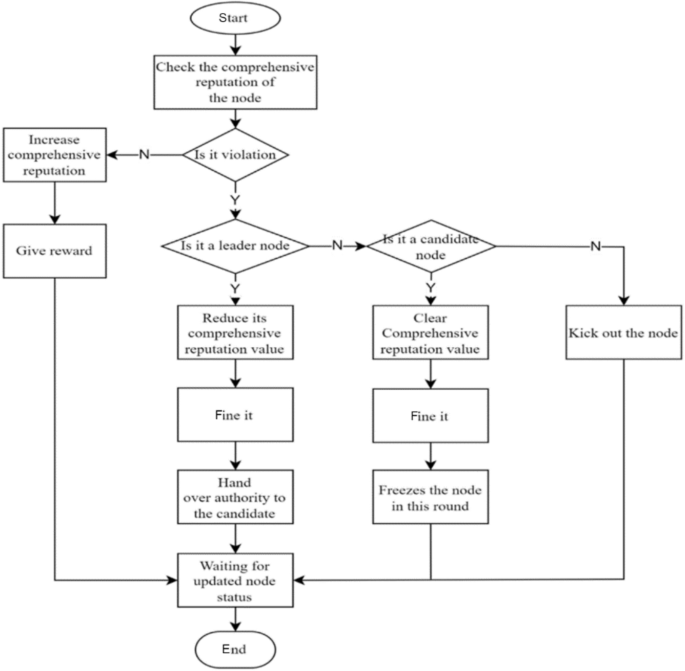

Incentives and penalties

To balance the rewards between leader nodes and ordinary nodes and prevent a large income gap, two incentive/penalty methods will be employed. First, as the number of network nodes and transaction volume increase, more active nodes with significant stakes emerge. After a prolonged period of running the blockchain, there will inevitably be significant class distinctions, and ordinary nodes will not be able to win in the election without special circumstances. To address this issue, this paper proposes that rewards be reduced for nodes with stakes exceeding a certain threshold, with the reduction rate increasing linearly until it reaches zero. Second, in the event that a leader or follower node violates the consensus process, such as by producing a block out of order or being unresponsive for an extended period, penalties will be imposed. The violation handling process is illustrated in Fig. 3.

Violation handling process.

Comprehensive reputation evaluation and election mechanism based on historical transactions

This paper reveals that the core of the DPoS consensus mechanism is the election process. If a blockchain is to run stably for a long time, it is essential to consider a reasonable election method. This paper proposes a comprehensive reputation evaluation election mechanism based on historical records. The mechanism considers the performance indicators of nodes in three dimensions: production rate, tokens, and validity. Additionally, their historical records are considered, particularly whether or not the nodes have engaged in malicious behavior. For example, nodes that have ever been malicious will receive low scores during the election process unless their overall quality is exceptionally high and they have considerable support from other nodes. Only in this case can such a node be eligible for election or become a leader node. The comprehensive reputation score is the node’s self-evaluation score, and the committee size does not affect the computational complexity.

Moreover, the comprehensive reputation evaluation proposed in this paper not only is a threshold required for node election but also converts the evaluation into corresponding votes based on the number of voters. Therefore, the election is related not only to the benefits obtained by the node but also to its comprehensive evaluation and the number of voters. If two nodes receive the same vote, the node with a higher comprehensive reputation is given priority in the ranking. For example, in an election where node A and node B each receive 1000 votes, node A’s number of stake votes is 800, its comprehensive reputation score is 50, and only four nodes vote for it. Node B’s number of stake votes is 600, its comprehensive reputation score is 80, and it receives votes from five nodes. In this situation, if only one leader node position remains, B will be selected as the leader node. Displayed in descending order of priority as comprehensive credit rating, number of voters, and stake votes, this approach aims to solve the problem of node misconduct at its root by democratizing the process and subjecting leader nodes to constraints, thereby safeguarding the fundamental interests of the vast majority of nodes.

Comprehensive reputation evaluation

This paper argues that the election process of the DPoS consensus mechanism is too simplistic, as it considers only the number of election votes that a node receives. This approach fails to comprehensively reflect the node’s actual capabilities and does not consider the voters’ election preferences. As a result, nodes with a significant stake often win and become leader nodes. To address this issue, the comprehensive reputation evaluation score is normalized considering various attributes of the nodes. The scoring results are shown in Table 3.

Table 3 Comprehensive reputation evaluation.

Since some of the evaluation indicators in Table 3 are continuous while others are discrete, different normalization methods need to be employed to obtain corresponding scores for different indicators. The continuous indicators include the number of transactions/people, wealth balance, network latency, network jitter, and network bandwidth, while the discrete indicators include the number of violations, the number of successful elections, and the number of votes. The value range of the indicator “number of transactions/people” is (0,1), and the value range of the other indicators is (0, + ∞). The equation for calculating the “number of transactions/people” is set as shown in Eq. (1).

$$A_{1} = \left\{ {\begin{array}{*{20}l} {0,} \hfill & {{\text{G}} = 0} \hfill \\ {\frac{{\text{N}}}{{\text{G}}}*10,} \hfill & {{\text{G}} > 0} \hfill \\ \end{array} } \right.$$

(1)

where N represents the number of transactional nodes and G represents the number of transactions. It reflects the degree of connection between the node and other nodes. Generally, nodes that transact with many others are safer than those with a large number of transactions with only a few nodes. The limit value of each item, denoted by x, is determined based on the situation and falls within the specified range, as shown in Eq. (2). The wealth balance and network bandwidth indicators use the same function to set their respective values.

$${A}_{i}=20*\left(\frac{1}{1+{e}^{-{a}_{i}x}}-0.5\right)$$

(2)

where x indicates the value of this item and expresses the limit value.

In Eq. (3), x represents the limited value of this indicator. The lower the network latency and network jitter are, the higher the score will be.

The last indicators, which are the number of violations, the number of elections, and the number of votes, are discrete values and are assigned different scores according to their respective ranges. The scores corresponding to each count are shown in Table 4.

$$A_{3} = \left\{ {\begin{array}{*{20}l} {10*\cos \frac{\pi }{200}x,} \hfill & {0 \le x \le 100} \hfill \\ {0,} \hfill & {x > 100} \hfill \\ \end{array} } \right.$$

(3)

Table 4 Score conversion.

The reputation evaluation mechanism proposed in this paper comprehensively considers three aspects of nodes, wealth level, node performance, and stability, to calculate their scores. Moreover, the scores obtain the present data based on historical records. Each node is set as an M × N dimensional matrix, where M represents M times the reputation evaluation score and N represents N dimensions of reputation evaluation (M < = N), as shown in Eq. (4).

$${\text{N}} = \left( {\begin{array}{*{20}c} {a_{11} } & \cdots & {a_{1n} } \\ \vdots & \ddots & \vdots \\ {a_{m1} } & \cdots & {a_{mn} } \\ \end{array} } \right)$$

(4)

The comprehensive reputation rating is a combined concept related to three dimensions. The rating is set after rating each aspect of the node. The weight w and the matrix l are not fixed. They are also transformed into matrix states as the position of the node in the system changes. The result of the rating is set as the output using Eq. (5).

$$\text{T}=\text{lN}{w}^{T}=\left({l}_{1}\dots {\text{l}}_{\text{m}}\right)\left(\begin{array}{ccc}{a}_{11}& \cdots & {a}_{1n}\\ \vdots & \ddots & \vdots \\ {a}_{m1}& \cdots & {a}_{mn}\end{array}\right){\left({w}_{1}\dots {w}_{n}\right)}^{T}$$

(5)

Here, T represents the comprehensive reputation score, and l and w represent the correlation coefficient. Because l is a matrix of order 1*M, M is the number of times in historical records, and M < = N is set, the number of dimensions of l is uncertain. Set the term l above to add up to 1, which is l1 + l2 + …… + ln = 1; w is also a one-dimensional matrix whose dimension is N*1, and its purpose is to act as a weight; within a certain period of time, w is a fixed matrix, and w will not change until the system changes the basic settings.

Assume that a node conducts its first comprehensive reputation rating, with no previous transaction volume, violations, elections or vote. The initial wealth of the node is 10, the latency is 50 ms, the jitter is 100 ms, and the network bandwidth is 100 M. According to the equation, the node’s comprehensive reputation rating is 41.55. This score is relatively good at the beginning and gradually increases as the patient participates in system activities continuously.

Voting calculation method

To ensure the security and stability of the blockchain system, this paper combines the comprehensive reputation score with voting and randomly sorts the blocks, as shown in Eqs. (3–6).

$$Z=\sum_{i=1}^{n}{X}_{i}+nT$$

(6)

where Z represents the final election score, Xi represents the voting rights earned by the node, n is the number of nodes that vote for this node, and T is the comprehensive reputation score.

The voting process is divided into stake votes and reputation votes. The more reputation scores and voters there are, the more total votes that are obtained. In the early stages of blockchain operation, nodes have relatively few stakes, so the impact of reputation votes is greater than that of equity votes. This is aimed at selecting the most suitable node as the leader node in the early stage. As an operation progresses, the role of equity votes becomes increasingly important, and corresponding mechanisms need to be established to regulate it. The election vote algorithm used in this paper is shown in Table 5.

Table 5 Election vote counting algorithm.

This paper argues that the election process utilized by the original DPoS consensus mechanism is overly simplistic, as it relies solely on the vote count to select the node that will oversee the entire blockchain. This approach cannot ensure the security and stability of the voting process, and if a malicious node behaves improperly during an election, it can pose a significant threat to the stability and security of the system as well as the safety of other nodes’ assets. Therefore, this paper proposes a different approach to the election process of the DPoS consensus mechanism by increasing the complexity of the process. We set up a threshold and optimized the vote-counting process to enhance the security and stability of the election. The specific performance of the proposed method was verified through experiments.

The election cycle in this paper can be customized, but it requires the agreement of the blockchain committee and general nodes. The election cycle includes four steps: node self-recommendation, calculating the comprehensive reputation score, voting, and replacing the new leader. Election is conducted only among general nodes without affecting the production or verification processes of leader nodes or follower nodes. Nodes start voting for preferred nodes. If they have no preference, they can use the LINK mechanism to collaborate with other nodes and gain additional rewards.

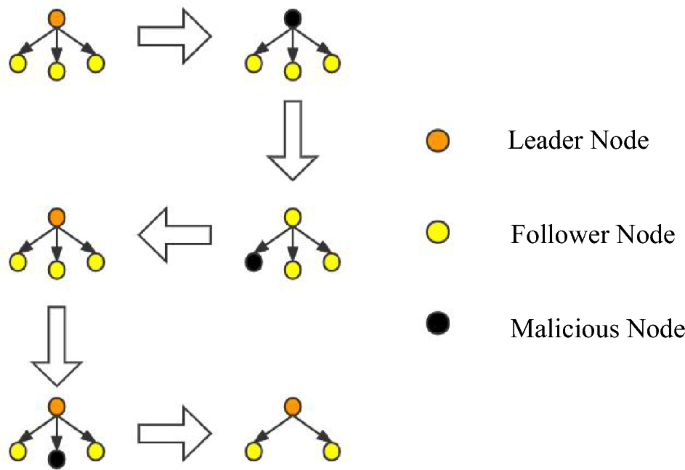

View changes

During the consensus process, conducting a large number of updates is not in line with the system’s interests, as the leader node (LN) and follower node (FN) on each node have already been established. Therefore, it is crucial to handle problematic nodes accurately when issues arise with either the LN or FN. For instance, when a node fails to perform its duties for an extended period or frequently fails to produce or verify blocks within the specified time range due to latency, the system will precisely handle them. For leader nodes, if they engage in malicious behavior such as producing blocks out of order, the behavior is recorded, and their identity as a leader node is downgraded to a follower node. The follower node inherits the leader node’s position, and the nature of their work is transformed as they swap their responsibilities of producing and verifying blocks with their original work. This type of behavior will not significantly affect the operation of the blockchain system. Instead of waiting until the end of the current committee round to punish malicious nodes, dynamic punishment is imposed on the nodes that affect the operation of the blockchain system to maintain system security. The view change operation is illustrated in Fig. 4.

In traditional PBFT, view changes are performed according to the view change protocol by changing the view number V to the next view number V + 1. During this process, nodes only receive view change messages and no other messages from other nodes. In this paper, the leader node group (LN) and follower node group (FN) are selected through an election of the LINK group. The node with LINKi[0] is added to the LN leader node group, while the other three LINK groups’ follower nodes join the FN follower node group since it is a configuration pattern of one master and three slaves. The view change in this paper requires only rearranging the node order within the LINK group to easily remove malicious nodes. Afterward, the change is broadcast to other committee nodes, and during the view transition, the LINK group does not receive block production or verification commands from the committee for stability reasons until the transition is completed.

News

The Hype Around Blockchain Mortgage Has Died Down, But This CEO Still Believes

LiquidFi Founder Ian Ferreira Sees Huge Potential in Blockchain Despite Hype around technology is dead.

“Blockchain technology has been a buzzword for a long time, and it shouldn’t be,” Ferriera said. “It should be a technology that lives in the background, but it makes everything much more efficient, much more transparent, and ultimately it saves costs for everyone. That’s the goal.”

Before founding his firm, Ferriera was a portfolio manager at a hedge fund, a job that ended up revealing “interesting intricacies” related to the mortgage industry.

Being a mortgage trader opened Ferriera’s eyes to a lot of the operational and infrastructure problems that needed to be solved in the mortgage-backed securities industry, he said. That later led to the birth of LiquidFi.

“The point of what we do is to get raw data attached to a resource [a loan] on a blockchain so that it’s provable. You reduce that trust problem because you have the data, you have the document associated with that data,” said the LiquidFi CEO.

Ferriera spoke with National Mortgage News about the value of blockchain technology, why blockchain hype has fizzled out, and why it shouldn’t.

News

New bill pushes Department of Veterans Affairs to examine how blockchain can improve its work

The Department of Veterans Affairs would have to evaluate how blockchain technology could be used to improve benefits and services offered to veterans, according to a legislative proposal introduced Tuesday.

The bill, sponsored by Rep. Nancy Mace, R-S.C., would direct the VA to “conduct a comprehensive study of the feasibility, potential benefits, and risks associated with using distributed ledger technology in various programs and services.”

Distributed ledger technology, including blockchain, is used to protect and track information by storing data across multiple computers and keeping a record of its use.

According to the text of the legislation, which Mace’s office shared exclusively with Nextgov/FCW ahead of its publication, blockchain “could significantly improve benefits allocation, insurance program management, and recordkeeping within the Department of Veterans Affairs.”

“We need to bring the federal government into the 21st century,” Mace said in a statement. “This bill will open the door to research on improving outdated systems that fail our veterans because we owe it to them to use every tool at our disposal to improve their lives.”

Within one year of the law taking effect, the Department of Veterans Affairs will be required to submit a report to the House and Senate Veterans Affairs committees detailing its findings, as well as the benefits and risks identified in using the technology.

The mandatory review is expected to include information on how the department’s use of blockchain could improve the way benefits decisions are administered, improve the management and security of veterans’ personal data, streamline the insurance claims process, and “increase transparency and accountability in service delivery.”

The Department of Veterans Affairs has been studying the potential benefits of using distributed ledger technology, with the department emission a request for information in November 2021 seeking input from contractors on how blockchain could be leveraged, in part, to streamline its supply chains and “secure data sharing between institutions.”

The VA’s National Institute of Artificial Intelligence has also valued the use of blockchain, with three of the use cases tested during the 2021 AI tech sprint focused on examining its capabilities.

Mace previously introduced a May bill that would direct Customs and Border Protection to create a public blockchain platform to store and share data collected at U.S. borders.

Lawmakers also proposed additional measures that would push the Department of Veterans Affairs to consider adopting other modernized technologies to improve veteran services.

Rep. David Valadao, R-Calif., introduced legislation in June that would have directed the department to report to lawmakers on how it plans to expand the use of “certain automation tools” to process veterans’ claims. The House of Representatives Subcommittee on Disability Assistance and Memorial Affairs gave a favorable hearing on the congressman’s bill during a Markup of July 23.

News

California DMV Uses Blockchain to Fight Auto Title Fraud

TDR’s Three Takeaways: California DMV Uses Blockchain to Fight Fraud

- California DMV uses blockchain technology to manage 42 million auto titles.

- The initiative aims to improve safety and reduce car title fraud.

- The immutable nature of blockchain ensures accurate and tamper-proof records.

The California Department of Motor Vehicles (DMV) is implementing blockchain technology to manage and secure 42 million auto titles. This innovative move aims to address and reduce the persistent problem of auto title fraud, a problem that costs consumers and the industry millions of dollars each year. By moving to a blockchain-based system, the DMV is taking advantage of the technology’s key feature: immutability.

Blockchain, a decentralized ledger technology, ensures that once a car title is registered, it cannot be altered or tampered with. This creates a highly secure and transparent system, significantly reducing the risk of fraudulent activity. Every transaction and update made to a car title is permanently recorded on the blockchain, providing a complete and immutable history of the vehicle’s ownership and status.

As first reported by Reuters, the DMV’s adoption of blockchain isn’t just about preventing fraud. It’s also aimed at streamlining the auto title process, making it more efficient and intuitive. Traditional auto title processing involves a lot of paperwork and manual verification, which can be time-consuming and prone to human error. Blockchain technology automates and digitizes this process, reducing the need for physical documents and minimizing the chances of errors.

Additionally, blockchain enables faster verification and transfer of car titles. For example, when a car is sold, the transfer of ownership can be done almost instantly on the blockchain, compared to days or even weeks in the conventional system. This speed and efficiency can benefit both the DMV and the vehicle owners.

The California DMV’s move is part of a broader trend of government agencies exploring blockchain technology to improve their services. By adopting this technology, the DMV is setting a precedent for other states and industries to follow, showcasing blockchain’s potential to improve safety and efficiency in public services.

-

Ethereum11 months ago

Ethereum11 months agoEthereum Posts First Consecutive Monthly Losses Since August 2023 on New ETFs

-

Regulation11 months ago

Regulation11 months agoCryptocurrency Regulation in Slovenia 2024

-

News11 months ago

News11 months agoNew bill pushes Department of Veterans Affairs to examine how blockchain can improve its work

-

Regulation11 months ago

Regulation11 months agoThink You Own Your Crypto? New UK Law Would Ensure It – DL News

-

Regulation11 months ago

Regulation11 months agoA Blank Slate for Cryptocurrencies: Kamala Harris’ Regulatory Opportunity

-

Regulation11 months ago

Regulation11 months agoUpbit, Coinone, Bithumb Face New Fees Under South Korea’s Cryptocurrency Law

-

Regulation11 months ago

Regulation11 months agoBahamas Passes Cryptocurrency Bill Designed to Prevent FTX, Terra Disasters

-

Regulation11 months ago

Regulation11 months agoIndia to Follow G20 Policy for Cryptocurrency Regulation: MoS Finance

-

Ethereum1 year ago

Ethereum1 year agoComment deux frères auraient dérobé 25 millions de dollars lors d’un braquage d’Ethereum de 12 secondes • The Register

-

Videos1 year ago

Videos1 year agoNexus Chain – Ethereum L2 with the GREATEST Potential?

-

News11 months ago

News11 months agoEU supports 15 startups to fight online disinformation with blockchain

-

News1 year ago

News1 year agoSolana ranks the fastest blockchain in the world, surpassing Ethereum, Polygon ⋆ ZyCrypto