Ethereum

Vitalik Buterin’s 22-minute proposal expected to go live in the next Ethereum upgrade – DL News

A version of this article appeared in our Decentralized newsletter of May 28. Register here.

general manager, Tim here.

Here’s what caught my attention about DeFi recently:

- Ethereum developers are targeting early 2025 for the next major upgrade.

- DL News speaks to the brain behind the second Solana phone.

- Consensys CEO hints at how the company could go public and make acquisitions.

Ethereum’s Pectra Upgrade

Leading Ethereum developers are targeting the first quarter of 2025 for the network’s next major upgrade.

The plan was solidified in the last Meeting the execution layera bi-weekly gathering of Ethereum developers.

Dubbed Pectra, the hard fork will introduce several new EIPs – or Ethereum Improvement Proposals – with a focus on user-centric improvements.

Perhaps the biggest change planned for Pectra is EIP-7702 from Ethereum co-founder Vitalik Buterin.

The EIP, which Buterin wrote 22 minutesaims to accelerate the adoption of account abstraction.

Join the community to receive our latest stories and updates

Account Abstraction promises to make Ethereum more intuitive and secure to use.

It gives Ethereum wallets the ability to schedule transactions, allowing blockchains to replicate services offered by banks and other money transfer services, such as scheduling payments.

Pectra will also introduce the EVM object format through a group of 11 EIPs to make it easier for developers to introduce new features and deprecate old ones.

The “madness” of the Solana phone

Solana Labs is in full development of its second smartphone, called Chapter 2.

DL News‘ Liam Kelly spoke with Steven Laver, the lead software engineer on the project.

“It has such great energy that the sky is the limit,” Laver said. DL News in a rare interview. “It sounds like crazy, but at the same time it feels like the end result.”

Solana’s plan for Chapter 2 is ambitious.

He wants to free crypto from desktops and the domination of application platforms.

Apple’s App Store removed crypto apps including MetaMask in October. It was later reinstated.

Apple’s App Store and Google’s Play Store charge developer fees between 15% and 30%.

Solana, Laver said, will offer an alternative.

“We are adopting a much lighter policy,” he said. “We’re doing our best to get out of the way.”

Consensys teases its projects

Consensys CEO Joe Lubin says his company could use crypto-native methods to leverage public investments.

“If we make it public in some way, we’ve always tended to use our own technology to do something,” Lubin said. DL News.

Consensys is one of the largest crypto companies. He is behind several widely used tools such as the MetaMask wallet and the Infura infrastructure suite.

In the crypto world, many consider tokenization or project airdrop events – during which a token is created and distributed to its most loyal users – to be akin to initial public offerings.

For years, there have been hints of a MetaMask airdrop. With more than 30 million users, the distribution of a MetaMask token would cause a sensation.

Lubin said Consensys is also considering acquisitions.

“The board just approved something,” he said. “We are very active.”

Besides implying that it was a company in the cybersecurity field, Lubin was coy on the details.

Data of the week

Deposits on Ethereum layer 2 blockchains just reached an all-time high of $47.4 billion, according to data from L2Beat.

But in terms of Ether, tokens have been moving out of layer 2 since an all-time high on May 13.

Ether rebounds 25% since Bloomberg Intelligence analysts revised their ratings of a spot Ethereum ETF on May 20 helped support the metric.

This week in DeFi governance

VOTE: Redacted name changes in Dinero Protocol

VOTE: Radiant DAO supports protocol extension to Base

VOTE: CoW DAO reduces binding requirements for CoW protocol solvers

Article of the week

DefiLlama dev 0xngmi offers a new lending protocol optimized for staking redeemable assets, like Ether and its liquid staking and re-staking tokens.

LSD/LRT<>ETH loop lending has seen crazy growth, but lending protocols are designed for the general case

I offer a lending protocol optimized for callable assets, which achieves higher APYs with lower risks (bad debt is IMPOSSIBLE)https://t.co/HNqP3V0is6 pic.twitter.com/6WE5FWnC6V

– 0xngmi (@0xngmi) May 26, 2024

What we’re looking at…

🗣️ Next Friday, May 31, UF will launch on-chain voting to upgrade the protocol so that its fee mechanism can reward UNI token holders for staking and delegating their tokens.

If you are a UNI holder and wish to vote on this proposal, you **must** have your UNI…

– Uniswap Foundation (@UniswapFND) May 24, 2024

The Uniswap DAO will finally vote on whether to modify the protocol so that its fee mechanism can reward UNI token holders.

Do you have a tip on DeFi? Contact us at tim@dlnews.com.

Ethereum

QCP sees Ethereum as a safe bet amid Bitcoin stagnation

QCP, a leading trading firm, has shared key observations on the cryptocurrency market. Bitcoin’s struggle to surpass the $70,000 mark has led QCP to predict Selling pressure is still strong, with BTC likely to remain in a tight trading range. In the meantime, Ethereum (ETH) is seen as a more promising investment, with potential gains as ETH could catch up to BTC, thanks to decreasing ETHE outflows.

Read on to find out how you can benefit from it.

Bitcoin’s Struggle: The $70,000 Barrier

For the sixth time in a row, BTC has failed to break above the $70,000 mark. Bitcoin is at $66,048 after a sharp decline. Many investors sold Bitcoin to capitalize on the rising values, which caused a dramatic drop. The market is becoming increasingly skeptical about Bitcoin’s rise, with some investors lowering their expectations.

Despite the continued sell-off from Mt. Gox and the US government, the ETF market remains bullish. There is a notable trend in favor of Ethereum (ETH) ETFs as major bulls have started investing in ETFs, indicating a bullish sentiment for ETH.

QCP Telegram Update UnderlinesIncreased market volatility. The NASDAQ has fallen 10% from its peak, led by a pullback in major technology stocks. Currency carry trades are being unwound and the VIX, a measure of market volatility, has jumped to 19.50.

The main factors driving this uncertainty are Value at Risk (VaR) shocks, high stock market valuations and global risk aversion sentiment. Commodities such as oil and copper have also declined on fears of an economic slowdown.

Additionally, QCP anticipates increased market volatility ahead of the upcoming FOMC meeting, highlighting the importance of the Federal Reserve’s statement and Jerome Powell’s subsequent press conference.

A glimmer of hope

QCP notes a positive development in the crypto space with an inflow of $33.7 million into ETH spot ETFs, which is giving a much-needed boost to ETH prices. However, they anticipate continued outflows of ETHE in the coming weeks. The recent Silk Road BTC moves by the US government have added to the market uncertainty.

QCP suggests a strategic trade involving BTC, which will likely remain in its current range, while ETH offers a more promising opportunity. They propose a trade targeting a $4,000-$4,500 range for ETH, which could generate a 5.5x return by August 30, 2024.

Ethereum

Ethereum Whale Resurfaces After 9 Years, Moves 1,111 ETH Worth $3.7 Million

An Ethereum ICO participant has emerged from nearly a decade of inactivity.

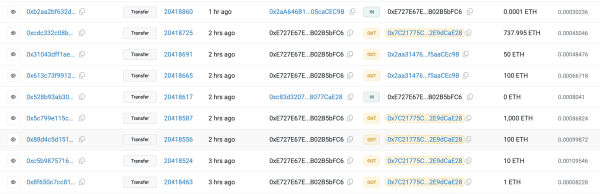

Lookonchain, a smart on-chain money tracking tool, revealed On X, this long-inactive participant recently transferred 1,111 ETH, worth approximately $3.7 million, to a new wallet. This significant move marks a notable on-chain movement, given the participant’s prolonged dormancy.

The Ethereum account in question, identified as 0xE727E67E…B02B5bFC6, received 2,000 ETH on the Genesis block over 9 years ago.

This initial allocation took place during the Ethereum ICOwhere the participant invested in ETH at around $0.31 per coin. The initial investment, worth around $620 at the time, has now grown to millions of dollars.

Recent Transactions and Movements

The inactive account became active again with several notable output transactions. Specifically, the account transferred 1,000 ETH, 100 ETH, 10 ETH, 1 ETH, and 1 more ETH to address 0x7C21775C…2E9dCaE28 within a few minutes. Additionally, it moved 1 ETH to 0x2aa31476…f5aaCE9B.

Additionally, in the latest round of transactions, the address transferred 737,995 ETH, 50 ETH, and 100 ETH, for a total of 887,995 ETH. These recent activities highlight a significant movement of funds, sparking interest and speculation in the crypto community.

Why are whales reactivating?

It is also evident that apart from 0xE727E67E…B02B5bFC6, other previously dormant Ethereum whales are waking up with significant transfers.

In May, another dormant Ethereum whale made headlines when it staked 4,032 ETHvalued at $7.4 million, after more than two years of inactivity. This whale initially acquired 60,000 ETH during the Genesis block of Ethereum’s mainnet in 2015.

At the time, this activity could have been related to Ethereum’s upgrade known as “Shanghai,” which improved the network’s scalability and performance. This whale likely intended to capitalize on the price surge that occurred after the upgrade.

Disclaimer: This content is informational and should not be considered financial advice. The opinions expressed in this article may include the personal opinions of the author and do not reflect the opinion of The Crypto Basic. Readers are encouraged to conduct thorough research before making any investment decisions. The Crypto Basic is not responsible for any financial losses.

-Advertisement-

Ethereum

Only Bitcoin and Ethereum are viable for ETFs in the near future

BlackRock: Only Bitcoin and Ethereum Are Viable for ETFs in the Near Future

Bitcoin and Ethereum will be the only cryptocurrencies traded via ETFs in the near future, according to Samara Cohen, chief investment officer of ETFs and indices at BlackRock, the world’s largest asset manager.

In an interview with Bloomberg TV, Cohen explained that while Bitcoin and Ethereum have met BlackRock’s rigorous criteria for exchange-traded funds (ETFs), no other digital asset currently comes close. “We’re really looking at the investability to see what meets the criteria, what meets the criteria that we want to achieve in an ETF,” Cohen said. “Both in terms of the investability and from what we’re hearing from our clients, Bitcoin and Ethereum definitely meet those criteria, but it’s going to be a while before we see anything else.”

Cohen noted that beyond the technical challenges of launching new ETFs, the demand for other crypto ETFs, particularly Solana, is not there yet. While Solana is being touted as the next potential ETF candidate, Cohen noted that the market appetite remains lacking.

BlackRock’s interest in Bitcoin and Ethereum ETFs comes after the successful launch of Ethereum ETFs last week, which saw weekly trading volume for the crypto fund soar to $14.8 billion, the highest level since May. The success has fueled speculation about the next possible ETF, with Solana frequently mentioned as a contender.

Solana, known as a faster and cheaper alternative to Ethereum, has been the subject of two separate ETF filings in the US by VanEck and 21Shares. However, the lack of CME Solana futures, unlike Bitcoin and Ethereum, is a significant hurdle for SEC approval of a Solana ETF.

Despite these challenges, some fund managers remain optimistic about Solana’s potential. Franklin Templeton recently described Solana as an “exciting and major development that we believe will drive the crypto space forward.” Solana currently accounts for about 3% of the overall cryptocurrency market value, with a market cap of $82 billion, according to data from CoinGecko.

Meanwhile, Bitcoin investors continue to show strong support, as evidenced by substantial inflows into BlackRock’s iShares Bitcoin Trust (NASDAQ: IBIT). On July 22, IBIT reported inflows of $526.7 million, the highest single-day total since March. This impressive haul stands in stark contrast to the collective inflow of just $6.9 million seen across the remaining 10 Bitcoin ETFs, according to data from Farside Investors. The surge in IBIT inflows coincides with Bitcoin’s significant $68,000 level, just 8% off its all-time high of $73,000.

Ethereum

Ethereum Posts First Consecutive Monthly Losses Since August 2023 on New ETFs

Available exclusively via

Bitcoin ETF vs Ethereum: A Detailed Comparison of IBIT and ETHA

Andjela Radmilac · 3 days ago

CryptoSlate’s latest market report takes an in-depth look at the technical and practical differences between IBIT and BlackRock’s ETHA to explain how these products work.

-

Ethereum10 months ago

Ethereum10 months agoEthereum Posts First Consecutive Monthly Losses Since August 2023 on New ETFs

-

Regulation10 months ago

Regulation10 months agoCryptocurrency Regulation in Slovenia 2024

-

News10 months ago

News10 months agoNew bill pushes Department of Veterans Affairs to examine how blockchain can improve its work

-

Regulation10 months ago

Regulation10 months agoThink You Own Your Crypto? New UK Law Would Ensure It – DL News

-

Regulation10 months ago

Regulation10 months agoA Blank Slate for Cryptocurrencies: Kamala Harris’ Regulatory Opportunity

-

Regulation10 months ago

Regulation10 months agoUpbit, Coinone, Bithumb Face New Fees Under South Korea’s Cryptocurrency Law

-

Regulation10 months ago

Regulation10 months agoBahamas Passes Cryptocurrency Bill Designed to Prevent FTX, Terra Disasters

-

Regulation10 months ago

Regulation10 months agoIndia to Follow G20 Policy for Cryptocurrency Regulation: MoS Finance

-

Ethereum1 year ago

Ethereum1 year agoComment deux frères auraient dérobé 25 millions de dollars lors d’un braquage d’Ethereum de 12 secondes • The Register

-

Videos1 year ago

Videos1 year agoNexus Chain – Ethereum L2 with the GREATEST Potential?

-

News10 months ago

News10 months agoEU supports 15 startups to fight online disinformation with blockchain

-

Ethereum1 year ago

Ethereum1 year agoScaling Ethereum with L2s damaged its Tokenomics. Is it possible to repair it?