Ethereum

Ethereum ETFs See $341.8M in First-Week Net Outflows, Led by Grayscale’s ETHE

U.S. spot Ethereum exchange-traded funds had a mixed start to the week, with net inflows into most ETFs overshadowed by large net outflows from Grayscale’s converted fund, ETHE.

Farside Investors Data watch this place Ethereum (ETH) ETFs saw just over $162 million in total outflows on Friday, July 26, marking the third consecutive day of net negative flows. In contrast, spot Bitcoin (Bitcoin) AND F checked in $51.8 million in net inflows on the same day, continuing a trend of positive flows for three consecutive days.

The first spot Ethereum ETFs in the United States — nine products from eight issuers — started trading on Tuesday, July 23, following their approval by the Securities and Exchange Commission in May.

First week of ETH ETFs

During the first week of trading, most of the newly launched Ethereum ETFs saw positive inflows, with the exception of Grayscale’s ETHE, which saw net outflows of $1.51 billion. The ETHE outflows led to an aggregate weekly outflow of $341.8 million for the ETFs.

BlackRock’s ETHA led the way in terms of inflows, generating $442 million in net inflows, followed by Bitwise’s ETHW with $265.9 million and Fidelity’s FETH with $219.4 million.

VanEck’s ETHV and Franklin Templeton’s EZET saw smaller inflows of $35.4 million and $23.3 million, respectively. 21Shares’ CETH saw an inflow of just $7.5 million on launch day and saw no inflows over the next three trading days.

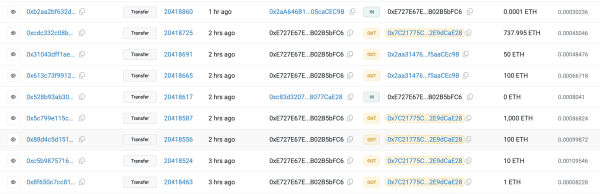

Ethereum ETF Transaction Flow in First Week of Trading | Source: Other side

Grayscale’s Two Ethereum ETFs, Explained

Grayscale, a leading crypto asset manager, launched two Ethereum spot funds last week, trading under the ticker symbols ETHE and ETH. The Grayscale Ethereum Trust, ETHE, was originally launched in 2017 as a private placement, meaning it was only available to select investors and institutions in the United States. Since 2019, shares of the Ethereum Trust have been traded over-the-counter (OTC) under the ticker symbol ETHE. ETHE’s OTC trading came with a 6-month holding period. However, since ETHE was converted to a spot Ethereum ETF last week, investors have gained the ability to sell their holdings more freely.

ETHE’s 2.5% management fee — which is relatively high compared to other ETF issuers’ fees of 0.25% or less — has caused investors to switch to competing products with lower fees, leading to outflows from Grayscale’s fund. This is very similar to what happened with Grayscale’s Bitcoin Trust (GBTC), which also converted to a BTC ETF in January and subsequently saw over $5 billion in outflows in its first month after the conversion.

Likely in anticipation of this momentum, Grayscale launched another ETF product this week, the Ethereum Mini Trust (ticker: ETH). The new product boasts a competitive fee of 0.15%, making it one of the most affordable spot Ethereum funds in the U.S. Unlike ETHE, Grayscale’s Mini Trust saw inflows every trading day last week, totaling $164 million.

Grayscale’s ETHE, which held about $10 billion in assets (2.9 million ETH) before its ETF conversion, has allocated $9.2 billion to its ETHE ETF product and just over $1 billion to its ETH fund.

The ETHE outflows, coupled with a more than 6% drop in Ethereum’s price since the ETF’s launch, have reduced Grayscale Ethereum Trust’s assets under management to approximately $7.46 billion (2.28 million ETH), as reported on its website. fund page.

Ethereum ETF vs Bitcoin ETF: Week One

It’s still early days, and if Grayscale’s spot Bitcoin ETF model is any indicator, ETHE net outflows could be slowing down. However, with an average net outflow of around $378 million per trading day last week, ETHE assets could be depleted within a month.

In terms of the Grayscale effect, one significant difference between GBTC and ETHE is that GBTC shares were trading at a discount to the spot price of BTC when the GBTC ETF product was launched. In contrast, ETHE’s “discount”—or the difference between the price of an ETHE share and the spot price of ETH—had closed by the time the spot Ethereum ETFs launched, which partly explains the greater incentive to exit the fund.

Additionally, the price of Bitcoin had increased significantly before the Bitcoin spot ETFs. launch In January, the price nearly doubled after approval expectations rose in October. In contrast, Ethereum’s price has been on the decline, dropping more than 15% since spot Ethereum ETFs were first approved on May 23.

“The main difference for me is the relatively massive outflow of ETHE. I think GBTC didn’t have that on day one because it was still at a significantly discounted price when it launched,” note James Seyffart, ETF analyst at Bloomberg, compares the outflows of the two products.

The nine newly launched Ethereum ETFs saw total net inflows of $106.7 million on their first day of trading on July 23, compared to $628 million in inflows for the Bitcoin ETFs when they debuted, according to data from SoSoValue

In terms of trading volume, ETH ETFs saw around $1.1 billion in transactions on their first day, while BTC ETFs saw $4.66 billion in trading volume on their inaugural day.

During the first week, Ethereum ETFs generated a total trading volume of approximately $4.05 billion, compared to $7.85 billion for Bitcoin ETFs during their initial week.

Analysts anticipate According to this estimate, Ethereum ETFs will attract flows ranging from 6% to 48% of those seen by Bitcoin ETFs in the first six months. This estimate suggests that total flows into Ethereum ETFs could reach between $1 trillion and $7.5 trillion by the end of January 2025.

At the time of writing this article, ETHthe second largest cryptocurrency, was trading at $3,280. Its market capitalization is around $393 billion, with a 24-hour trading volume of around $14.4 billion.

Ethereum

QCP sees Ethereum as a safe bet amid Bitcoin stagnation

QCP, a leading trading firm, has shared key observations on the cryptocurrency market. Bitcoin’s struggle to surpass the $70,000 mark has led QCP to predict Selling pressure is still strong, with BTC likely to remain in a tight trading range. In the meantime, Ethereum (ETH) is seen as a more promising investment, with potential gains as ETH could catch up to BTC, thanks to decreasing ETHE outflows.

Read on to find out how you can benefit from it.

Bitcoin’s Struggle: The $70,000 Barrier

For the sixth time in a row, BTC has failed to break above the $70,000 mark. Bitcoin is at $66,048 after a sharp decline. Many investors sold Bitcoin to capitalize on the rising values, which caused a dramatic drop. The market is becoming increasingly skeptical about Bitcoin’s rise, with some investors lowering their expectations.

Despite the continued sell-off from Mt. Gox and the US government, the ETF market remains bullish. There is a notable trend in favor of Ethereum (ETH) ETFs as major bulls have started investing in ETFs, indicating a bullish sentiment for ETH.

QCP Telegram Update UnderlinesIncreased market volatility. The NASDAQ has fallen 10% from its peak, led by a pullback in major technology stocks. Currency carry trades are being unwound and the VIX, a measure of market volatility, has jumped to 19.50.

The main factors driving this uncertainty are Value at Risk (VaR) shocks, high stock market valuations and global risk aversion sentiment. Commodities such as oil and copper have also declined on fears of an economic slowdown.

Additionally, QCP anticipates increased market volatility ahead of the upcoming FOMC meeting, highlighting the importance of the Federal Reserve’s statement and Jerome Powell’s subsequent press conference.

A glimmer of hope

QCP notes a positive development in the crypto space with an inflow of $33.7 million into ETH spot ETFs, which is giving a much-needed boost to ETH prices. However, they anticipate continued outflows of ETHE in the coming weeks. The recent Silk Road BTC moves by the US government have added to the market uncertainty.

QCP suggests a strategic trade involving BTC, which will likely remain in its current range, while ETH offers a more promising opportunity. They propose a trade targeting a $4,000-$4,500 range for ETH, which could generate a 5.5x return by August 30, 2024.

Ethereum

Ethereum Whale Resurfaces After 9 Years, Moves 1,111 ETH Worth $3.7 Million

An Ethereum ICO participant has emerged from nearly a decade of inactivity.

Lookonchain, a smart on-chain money tracking tool, revealed On X, this long-inactive participant recently transferred 1,111 ETH, worth approximately $3.7 million, to a new wallet. This significant move marks a notable on-chain movement, given the participant’s prolonged dormancy.

The Ethereum account in question, identified as 0xE727E67E…B02B5bFC6, received 2,000 ETH on the Genesis block over 9 years ago.

This initial allocation took place during the Ethereum ICOwhere the participant invested in ETH at around $0.31 per coin. The initial investment, worth around $620 at the time, has now grown to millions of dollars.

Recent Transactions and Movements

The inactive account became active again with several notable output transactions. Specifically, the account transferred 1,000 ETH, 100 ETH, 10 ETH, 1 ETH, and 1 more ETH to address 0x7C21775C…2E9dCaE28 within a few minutes. Additionally, it moved 1 ETH to 0x2aa31476…f5aaCE9B.

Additionally, in the latest round of transactions, the address transferred 737,995 ETH, 50 ETH, and 100 ETH, for a total of 887,995 ETH. These recent activities highlight a significant movement of funds, sparking interest and speculation in the crypto community.

Why are whales reactivating?

It is also evident that apart from 0xE727E67E…B02B5bFC6, other previously dormant Ethereum whales are waking up with significant transfers.

In May, another dormant Ethereum whale made headlines when it staked 4,032 ETHvalued at $7.4 million, after more than two years of inactivity. This whale initially acquired 60,000 ETH during the Genesis block of Ethereum’s mainnet in 2015.

At the time, this activity could have been related to Ethereum’s upgrade known as “Shanghai,” which improved the network’s scalability and performance. This whale likely intended to capitalize on the price surge that occurred after the upgrade.

Disclaimer: This content is informational and should not be considered financial advice. The opinions expressed in this article may include the personal opinions of the author and do not reflect the opinion of The Crypto Basic. Readers are encouraged to conduct thorough research before making any investment decisions. The Crypto Basic is not responsible for any financial losses.

-Advertisement-

Ethereum

Only Bitcoin and Ethereum are viable for ETFs in the near future

BlackRock: Only Bitcoin and Ethereum Are Viable for ETFs in the Near Future

Bitcoin and Ethereum will be the only cryptocurrencies traded via ETFs in the near future, according to Samara Cohen, chief investment officer of ETFs and indices at BlackRock, the world’s largest asset manager.

In an interview with Bloomberg TV, Cohen explained that while Bitcoin and Ethereum have met BlackRock’s rigorous criteria for exchange-traded funds (ETFs), no other digital asset currently comes close. “We’re really looking at the investability to see what meets the criteria, what meets the criteria that we want to achieve in an ETF,” Cohen said. “Both in terms of the investability and from what we’re hearing from our clients, Bitcoin and Ethereum definitely meet those criteria, but it’s going to be a while before we see anything else.”

Cohen noted that beyond the technical challenges of launching new ETFs, the demand for other crypto ETFs, particularly Solana, is not there yet. While Solana is being touted as the next potential ETF candidate, Cohen noted that the market appetite remains lacking.

BlackRock’s interest in Bitcoin and Ethereum ETFs comes after the successful launch of Ethereum ETFs last week, which saw weekly trading volume for the crypto fund soar to $14.8 billion, the highest level since May. The success has fueled speculation about the next possible ETF, with Solana frequently mentioned as a contender.

Solana, known as a faster and cheaper alternative to Ethereum, has been the subject of two separate ETF filings in the US by VanEck and 21Shares. However, the lack of CME Solana futures, unlike Bitcoin and Ethereum, is a significant hurdle for SEC approval of a Solana ETF.

Despite these challenges, some fund managers remain optimistic about Solana’s potential. Franklin Templeton recently described Solana as an “exciting and major development that we believe will drive the crypto space forward.” Solana currently accounts for about 3% of the overall cryptocurrency market value, with a market cap of $82 billion, according to data from CoinGecko.

Meanwhile, Bitcoin investors continue to show strong support, as evidenced by substantial inflows into BlackRock’s iShares Bitcoin Trust (NASDAQ: IBIT). On July 22, IBIT reported inflows of $526.7 million, the highest single-day total since March. This impressive haul stands in stark contrast to the collective inflow of just $6.9 million seen across the remaining 10 Bitcoin ETFs, according to data from Farside Investors. The surge in IBIT inflows coincides with Bitcoin’s significant $68,000 level, just 8% off its all-time high of $73,000.

Ethereum

Ethereum Posts First Consecutive Monthly Losses Since August 2023 on New ETFs

Available exclusively via

Bitcoin ETF vs Ethereum: A Detailed Comparison of IBIT and ETHA

Andjela Radmilac · 3 days ago

CryptoSlate’s latest market report takes an in-depth look at the technical and practical differences between IBIT and BlackRock’s ETHA to explain how these products work.

-

Ethereum10 months ago

Ethereum10 months agoEthereum Posts First Consecutive Monthly Losses Since August 2023 on New ETFs

-

Regulation10 months ago

Regulation10 months agoCryptocurrency Regulation in Slovenia 2024

-

News10 months ago

News10 months agoNew bill pushes Department of Veterans Affairs to examine how blockchain can improve its work

-

Regulation10 months ago

Regulation10 months agoThink You Own Your Crypto? New UK Law Would Ensure It – DL News

-

Regulation10 months ago

Regulation10 months agoA Blank Slate for Cryptocurrencies: Kamala Harris’ Regulatory Opportunity

-

Regulation10 months ago

Regulation10 months agoUpbit, Coinone, Bithumb Face New Fees Under South Korea’s Cryptocurrency Law

-

Regulation10 months ago

Regulation10 months agoBahamas Passes Cryptocurrency Bill Designed to Prevent FTX, Terra Disasters

-

Regulation10 months ago

Regulation10 months agoIndia to Follow G20 Policy for Cryptocurrency Regulation: MoS Finance

-

Ethereum1 year ago

Ethereum1 year agoComment deux frères auraient dérobé 25 millions de dollars lors d’un braquage d’Ethereum de 12 secondes • The Register

-

Videos1 year ago

Videos1 year agoNexus Chain – Ethereum L2 with the GREATEST Potential?

-

News10 months ago

News10 months agoEU supports 15 startups to fight online disinformation with blockchain

-

Ethereum1 year ago

Ethereum1 year agoScaling Ethereum with L2s damaged its Tokenomics. Is it possible to repair it?