News

A Timeline and History of Blockchain Technology

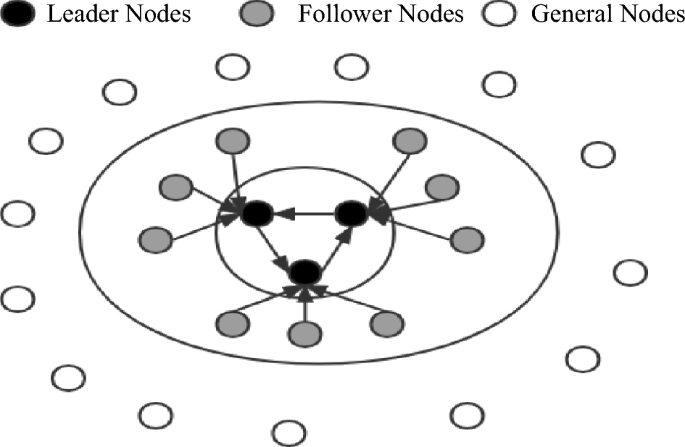

Blockchain was officially introduced in 2009 with the release of its first application — the Bitcoin cryptocurrency — but its roots reach back several decades. Many of the technologies that form the basis for blockchain today were in the works long before the emergence of Bitcoin.

Still, blockchain most identifies with Bitcoin — for better or worse. In the wild and raucous years that followed Bitcoin’s debut, blockchain earned a reputation akin to the Wild West. Its decentralized, peer-to-peer (P2P) architecture allowed just about anyone to participate in the process, making it seem too risky for business use. That started to change in 2016 when a burgeoning open source community began developing complete enterprise platforms.

Since then, the technology has taken on a life of its own, with interest coming from many quarters, despite the sometimes scary cryptocurrency headlines of late. Governments, businesses and other organizations are researching and deploying blockchain technology to meet needs that have nothing to do with digital currency. In the face of proliferating cyberthreats and government data privacy regulations, blockchain offers security, immutability, traceability and transparency across a distributed network, making it well suited for use cases that have become difficult to support and protect with traditional infrastructures.

What is blockchain?

Blockchain is a type of database that’s a public ledger for recording transactions without the need for a third party to validate each activity. It’s distributed across a P2P network and consists of data blocks linked together to form a continuous chain of immutable records. Each computer in the network maintains a copy of the ledger to avoid a single point of failure. Blocks are added in sequential order, and they’re permanent and tamperproof.

A blockchain starts with an initial block — often referred to as the Genesis block — that records the first transactions. The block is also assigned an alphanumeric string called a hash, which is based on the block’s timestamp. Blocks are added to the chain sequentially. Each block uses the hash from the previous block to create its own hash, thus linking the blocks together.

Blockchain also uses a computational process called consensus to validate a block’s authenticity before it can be added to the chain. As part of this process, most of the nodes on the blockchain network must agree that the new block’s hash has been calculated correctly. Consensus ensures that all copies of the distributed ledger are in the same state.

Initially, blockchain provided a distributed public ledger to support Bitcoin, so transactions could be recorded without the need for a central authority to establish trust in a trustless environment. Not only were transactions more efficient, but the costs typically associated with third-party verification were eliminated. Blockchain also provided greater transparency, traceability and security than conventional approaches to handling distributed transactions.

Blockchain’s historical building blocks

Although blockchain as an entity has a relatively short history, its influence today is widespread and its applications wide-ranging and growing. Through the decades, blockchain’s development and evolution include some of the following notable developments:

- Pioneers like Merkle and his tree, Chaum and digital cash, Haber and timestamping, Dwork and proof of work (PoW), Black and hashcash, Finney and reusable PoW dotted the early years of the pre-blockchain landscape.

- The presumed pseudonym Satoshi Nakamoto was created to introduce the concept of cryptocurrency and blockchain. Shortly thereafter, cryptocurrency was launched and Nakamoto conducted the first bitcoin transaction, a bitcoin exchange was established and a programmer paid 10,000 bitcoin for two pizzas.

- Bitcoin’s price soared from pennies to tens of thousands of dollars, all the while draped in controversies, shutdowns, crackdowns, bankruptcies, scams, scandals and arrests.

- Blockchain started to somewhat divorce itself from Bitcoin when the decentralized blockchain platform Ethereum eventually became one of the biggest applications of blockchain technology and opened the door to numerous business applications beyond cryptocurrencies.

- And buoyed by AI, IoT, non-fungible tokens (NFTs), decentralized finance (DeFi) and smart contracts, as well as initiatives by the likes of Walmart and Amazon, blockchain has gained legitimacy as a safe, viable alternative to traditional methods of conducting business and individual transactions.

Block-by-block description of blockchain’s inner workings.

1979

One of the early pre-blockchain technologies is the Merkle tree, named after computer scientist and mathematician Ralph Merkle. He described an approach to public key distribution and digital signatures called tree authentication in his Ph.D. thesis for Stanford University. Merkle eventually patented this idea as a method for providing digital signatures. The Merkle tree provides a data structure for verifying individual records.

1982

In his Ph.D. dissertation for the University of California, Berkeley, David Chaum described a vault system for establishing, maintaining and trusting computer systems among mutually suspicious groups. The system embodied many of the elements that comprise a blockchain. Chaum is also credited with inventing digital cash, and in 1989, he founded the company DigiCash.

1991

Stuart Haber and W. Scott Stornetta published an article describing how to timestamp digital documents to prevent users from backdating or forward-dating electronic documents. The goal was to maintain the document’s complete privacy without requiring record-keeping by a timestamping service. Haber and Stornetta updated the design to incorporate Merkle trees, which enabled multiple document certificates to live on a single block.

1993

The beginnings of the PoW concept were published in a paper by Cynthia Dwork and Moni Naor to provide “a computational technique for combatting junk mail, in particular, and controlling access to a shared resource, in general.”

1997

Adam Black introduced hashcash, a PoW algorithm that provided denial-of-service countermeasures.

1999

Markus Jakobsson and Ari Juels published the term proof of work. Also, the P2P network was popularized by the now defunct peer-to-peer file sharing application Napster. Some argued that Napster was not a true P2P network because it used a centralized server. But the service still helped breathe life into the P2P network, making it possible to build a distributed system that could benefit from the compute power and storage capacity of thousands of computers.

2000

Stefan Konst introduced the concept of cryptographically secured chains in his paper “Secure Log Files Based on Cryptographically Concatenated Entries.” His model, which showed that entries in the chain can be traced back from the Genesis block to prove authenticity, was the basis for today’s blockchain models.

2004

Hal Finney introduced reusable PoW, a mechanism for receiving a non-exchangeable — or non-fungible — hashcash token in return for an RSA-signed token. The PoW approach today plays a vital role in Bitcoin mining. Cryptocurrencies like Bitcoin and Litecoin use PoW, and Ethereum shifted to the proof-of-stake protocol to secure a network using a fraction of the energy that PoW uses.

2008

Satoshi Nakamoto, thought to be a pseudonym used by an individual — or group of individuals — published a white paper introducing the concept of cryptocurrency and blockchain and helped develop the first Bitcoin software. Blockchain infrastructure, according to the white paper, would support secure, P2P transactions without the need for trusted third parties such as banks or governments. Nakamoto’s real identity remains a mystery, but there has been no shortage of theories.

The Bitcoin/blockchain architecture was introduced and built on technologies and concepts from the previous three decades. Nakamoto’s design also presented the concept of a “chain of blocks,” making it possible to add blocks without requiring them to be signed by a trusted third party. Nakamoto defined an electronic coin as a “chain of digital signatures,” in which each owner transfers the coin to the next owner by “digitally signing a hash of the previous transaction and the public key of the next owner and adding these to the end of the coin.”

2009

Cryptocurrency was launched during the Great Recession, when the government pumped large amounts of money into the economy. Bitcoin was worth less than a penny then. Nakamoto mined the first Bitcoin block, validating the blockchain concept. The block contained 50 bitcoin and was known as the Genesis block — aka block 0. Nakamoto released Bitcoin v0.1 to the web service SourceForge as open source software. Bitcoin is now on GitHub.

The first Bitcoin transaction took place when Nakamoto sent Hal Finney 10 bitcoin in block 170. The Bitcoin-dev channel was created on the text-based instant messaging system Internet Relay Chat for Bitcoin developers. The first Bitcoin exchange — Bitcoin Market — was established, enabling people to exchange paper money for bitcoin. Nakamoto launched the Bitcoin Talk forum to share Bitcoin-related news and information.

In the spirit of cryptocurrency as money with fixed supply, Nakamoto set up a system to ensure the number of bitcoin mined won’t ever exceed 21 million.

Blockchain’s evolution through the years has been intimately tied to cryptocurrencies, namely Bitcoin.

2010

On May 22, Bitcoin made history when a programmer Laszlo Hanyecz paid 10,000 bitcoin for two delivered Papa John’s pizzas. The two pizzas back then were valued at about $40, a transaction that would balloon to a value of more than $260 million at today’s bitcoin price level.

A short time later that year, programmer Jed McCaleb launched Mt. Gox, a Tokyo-based Bitcoin exchange. Mt. Gox was short for Magic: The Gathering Online eXchange — a carryover from a fantasy card game. At its peak, Mt. Gox handled more than 70% of all Bitcoin transactions. But in August, a hacker exploited a bug in the blockchain code and created more than 184 billion bitcoin in block 74,638, tarnishing Bitcoin’s reputation. Nakamoto published a new version of the Bitcoin software, but by the end of the year, he disappeared from the Bitcoin scene completely.

2011

One-fourth of the 21 million bitcoin had been mined. By early February, the value of a bitcoin was equal to the U.S. dollar. Shortly thereafter, McCaleb sold Mt. Gox to Mark Karpelès. And soon after that, the bitcoin reached parity with the euro and British pound sterling. WikiLeaks started accepting bitcoin donations. However, Mt. Gox was hacked and bitcoin were stolen, causing an artificial drop in value and resulting in suspension of trading. Litecoin was released in October, representing one of the earlier Bitcoin spinoffs and considered the first alternative cryptocurrency.

2012

The interest in cryptocurrencies solidified. Bitcoin’s price hovered around $5 for most of the year with several fluctuations. Early that year, Mihai Alisie and Ethereum creator Vitalik Buterin launched Bitcoin Magazine and published their first issue in May. A few months later, the Bitcoin Foundation was established to promote Bitcoin and restore public perceptions of cryptocurrency after several scandals. McCaleb and Chris Larsen founded OpenCoin, which led to the development of the Ripple transaction protocol for currency transactions and real-time payments. Coinbase raised more than $600,000 in its crowd-funded seed round on its way to becoming one of the top Bitcoin exchanges.

2013

Bitcoin’s upward trajectory continued. In February, Coinbase reported selling $1 million worth of bitcoin in a single month at more than $22 each. By the end of March, with 11 million bitcoin in circulation, the currency’s total value exceeded $1 billion. And in October, the first reported bitcoin ATM launched in a Vancouver, B.C., coffee shop.

But it wasn’t all good news for digital currency. Both Thailand and China banned cryptocurrencies. The U.S. Federal Court seized Mt. Gox’s funds in the U.S. for transmitting money without a license. And the FBI shut down the dark web marketplace Silk Road, confiscating about 144,000 bitcoin worth more than $1 billion and resulting in a life prison sentence for owner Ross Ulbricht for a litany of crimes, including drug trafficking, computer hacking and money laundering.

2014

Despite setbacks, one of the more important milestones in blockchain’s history occurred when Bitcoin Magazine co-founder Buterin published a white paper proposing a decentralized application platform, leading to the creation of Ethereum and the Ethereum Foundation. Ethereum paved the way for blockchain technology to be used for applications other than cryptocurrency. It introduced smart contracts and provided developers with a platform for building decentralized applications.

Financial institutions and other industries began to recognize and explore blockchain’s potential, shifting their focus from digital currency to the development of blockchain technologies. But Bitcoin stayed in the spotlight — for better and worse. The Mt. Gox Bitcoin exchange filed for bankruptcy. The Bitcoin Foundation vice chairperson was arrested for money laundering. And the U.K. tax authority classified bitcoin as private money. Yet several companies accepted bitcoin by year’s end, including the Chicago Sun-Times, Overstock.com, Microsoft, PayPal and Expedia. Bitcoin’s acceptance only added fuel to blockchain’s fire.

2015

The Ethereum Frontier network launched, enabling developers to write smart contracts and decentralized apps that could be deployed to a live network. Ethereum was on its way to becoming one of the biggest applications of blockchain technology. It drew in an active developer community that continues to this day. In addition, Nasdaq initiated a blockchain trial. The Linux Foundation launched the Hyperledger project. And nine major investment banks joined forces to form the R3 consortium, exploring how blockchain could benefit their operations. Within six months, the consortium grew to more than 40 financial institutions.

2016

The term blockchain gained acceptance as a single word, rather than being treated as two concepts, as they were in Nakamoto’s original paper. The Chamber of Digital Commerce and the Hyperledger project announced a partnership to strengthen industry advocacy and education. A bug in the Ethereum decentralized autonomous organization code was exploited, resulting in a “hard fork” in the Ethereum network. The Bitfinex cryptocurrency exchange was hacked and nearly 120,000 bitcoin were stolen — a bounty worth about $66 million.

2017

Bitcoin hit a record high of nearly $20,000. Japan recognized bitcoin as legal currency. Seven European banks formed the Digital Trade Chain Consortium to develop a trade finance platform based on blockchain. The Block.one software company introduced the EOS blockchain operating system, based on the EOS cryptocurrency and designed to support commercial decentralized applications. About 15% of global banks used blockchain technology in some capacity.

2018

Entering its 10th year, bitcoin’s value continued to drop, ending the year at about $3,800. The online payment firm Stripe stopped accepting bitcoin payments. Google, Twitter and Facebook banned cryptocurrency advertising. South Korea banned anonymous cryptocurrency trading but announced it would invest millions in blockchain initiatives. The European Commission launched the Blockchain Observatory and Forum to accelerate the development of blockchain. Baidu introduced its blockchain-as-a-service platform.

2019

Walmart launched a supply chain system based on the Hyperledger platform. Amazon announced the general availability of its Amazon Managed Blockchain service on AWS to help users build resilient Web 3.0 applications on public and private blockchains. Ethereum network transactions exceeded one million per day. Blockchain research and development took center stage as organizations embraced blockchain technology and decentralized applications for a variety of use cases.

2020

A Deloitte survey revealed that nearly 40% of respondents incorporated blockchain into production, and 55% viewed blockchain as a top strategic priority. Ethereum launched the Beacon Chain in preparation for Ethereum 2.0. Stablecoins, whose value is tied to another asset class, rose significantly because they promised more stability than traditional cybercurrencies. Interest increased in combining blockchain with AI to optimize business processes.

2021

Bitcoin reached an all-time high of $68,789.63 on Nov. 10, 2021. During its bull run, the bitcoin market cap surpassed $3 trillion. Coinbase went public and was acknowledged as the seventh biggest new listing of all time on the U.S. stock exchange. The DeFi market offering services through smart contracts on blockchain grew a whopping 600% from the previous year, reaching a value of $200 billion. And NFT artwork made headlines, selling for more than $69 million in Ethereum at the auction house Christie’s. Well-known entrepreneurs and athletes attempted to capture the meteoric rise in bitcoin’s value, including Elon Musk initially accepting cryptocurrency as payment on new Tesla vehicles and Aaron Rogers taking a portion of his multimillion-dollar NFL salary in bitcoin.

Interest in using blockchain for applications other than cryptocurrency continued as governments and enterprises considered blockchain for a variety of use cases, including voting, real estate, fitness tracking, intellectual rights, IoT and vaccine distribution in the midst of the COVID-19 pandemic. Moreover, multiple cloud providers now offered blockchain as a service, and the demand for qualified blockchain developers was greater than ever. The global blockchain technology market was valued at nearly $6 billion in 2021 and seen surpassing a trillion dollars by 2030, according to market researcher Statista.

Blockchain’s business applications spread far and wide beyond cryptos.

2022

NFTs continued their ascent, eco-friendly blockchain networks emerged and blockchain applications increased among companies. Bitcoin mining crept closer to Nakamoto’s 21 million coin limit, reaching 19 million and leaving less than 10% of bitcoin to be mined.

All-time high prices for bitcoin and other cryptocurrencies plummeted in the spring due to investor concerns about inflation and the new COVID-19 Omicron variant. Some cryptocurrency exchanges went bankrupt. The collapse of the FTX exchange and arrest of its CEO Sam Bankman-Fried amplified fears about cryptocurrency’s riskiness. The open source blockchain platform Terra also collapsed. Speculation of new U.S. government regulation of cryptocurrency added to the uncertainty but at the same time was thought to help legitimize the industry.

Globally, Danish shipping company Maersk announced the shutdown of the blockchain-based TradeLens digital ledger it co-developed with IBM because of a lack of player participation. And the Australian Stock Exchange scrapped a seven-year plan to move its trading platform to blockchain. More than 100 countries were involved in the creation of their own central bank digital currencies, according to Statista. CBDCs are digital versions of real-world fiat money to eventually help speed cross-border retail transactions on blockchain in contrast to the slower speeds and price volatility of cryptocurrency.

Blockchain’s vaunted claims of imperviousness came under attack — and not just figuratively. Blockchain analysis firm Chainalysis identified nearly 200 cryptocurrency or blockchain hacks, resulting in losses of $3.8 billion. The most noteworthy incident occurred when the video game blockchain Ronin Network reported the theft of $625 million worth of Ether and USDC stablecoins. The U.S. Treasury Department blamed a North Korean hacker collective for the attack.

2023

The bad news for cryptocurrency continued as the SEC indicted executives at the Coinbase and Binance exchanges and filed charges against crypto-asset entrepreneur Justin Sun and three of his wholly owned companies for the unregistered offer and sale of crypto-asset securities.

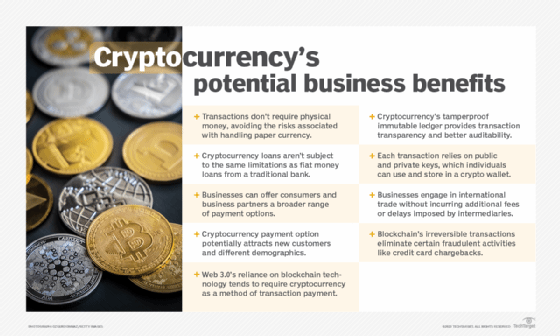

Businesses are still moving ahead with blockchain, but they’re proceeding with greater caution. While blockchain technology has been mostly applicable to finance services and banking, other viable applications include gaming, media and entertainment, real estate, healthcare, cybersecurity, smart contracts, NFTs, IoT, transportation, supply chain management and the government. But the latest iteration of the internet, Web 3.0, with its offer of decentralization and data security, may well be the greatest driver of blockchain technology.

Bitcoin for now has found some relatively solid footing in the $25,000 to $30,000 range. Bitcoin mining should reach Nakamoto’s 21 million limit sometime around 2140.

Beyond 2023

Blockchain’s promise of secure and transparent transactions without the need for intermediaries will potentially change the way enterprises conduct practically every aspect of their daily business operations for decades to come. Technologies like AI, IoT, NFTs and the metaverse will be significantly impacted by blockchain.

Gartner pegs the business value of blockchain at more than $360 billion by 2026 — modest when compared to the research firm’s estimate of $3.1 trillion by 2030. Other estimates place the blockchain market at about $1 trillion by the end of the decade.

Expect several trends to contribute greatly to blockchain’s eventual trillion-dollar-plus valuation, including the following:

- Blockchain as a cloud-based technology is essential to digital transformation initiatives and the migration of data and workloads to distributed cloud environments.

- AI and blockchain will merge as they work synergistically to increase blockchain’s efficiency and produce torrents of new data used in building more reliable machine learning models.

- NFT use cases will substantially increase, opening new avenues of revenue to content producers who tokenize and sell their work without intermediaries.

- Blockchain IoT will make digital transactions faster, more affordable and more secure by preventing tampering and increasing accountability.

- Smart contracts encoded on blockchain will enable simpler, more automated and more wide-ranging transactions.

- Blockchain will be foundational to Web 3.0 and essential to the development of the metaverse on the latest iteration of the internet.

- DeFi will provide lending, borrowing and investment services on blockchain that are more open, transparent and inclusive.

- Blockchain as a service will enable companies and developers to create, implement and administer blockchain applications without setting up and maintaining their own blockchain networks.

- Proof-of-stake protocol, which selects validators in proportion to their quantity of holdings to avoid the computational cost of PoW schemes, will gain further momentum as a viable alternative.

- Governments will replace traditional paper-based systems with distributed ledger technology.

- In answer to cyber attacks, scams and indictments, expect blockchain to be in the crosshairs of federal, state and local legislative and regulatory efforts.

- Blockchain technology will encourage new cryptocurrencies and cryptocurrency exchanges.

As universities, governments and private corporations continue to research and invest in blockchain, the technology will continue to improve and expand in the areas of security, privacy, scalability and interoperability. And since blockchain isn’t suited to every application, businesses will need to weigh the risks, evaluate the financial costs and be selective with their blockchain deployments.

Editor’s note: This article was updated in July 2024 to improve the reader experience.

Ron Karjian is an industry editor and writer at TechTarget covering business analytics, artificial intelligence, data management, security and enterprise applications.

Robert Sheldon is a technical consultant and freelance technology writer. He has written numerous books, articles and training materials related to Windows, databases, business intelligence and other areas of technology.

News

An enhanced consensus algorithm for blockchain

The introduction of the link and reputation evaluation concepts aims to improve the stability and security of the consensus mechanism, decrease the likelihood of malicious nodes joining the consensus, and increase the reliability of the selected consensus nodes.

The link model structure based on joint action

Through the LINK between nodes, all the LINK nodes engage in consistent activities during the operation of the consensus mechanism. The reputation evaluation mechanism evaluates the trustworthiness of nodes based on their historical activity status throughout the entire blockchain. The essence of LINK is to drive inactive nodes to participate in system activities through active nodes. During the stage of selecting leader nodes, nodes are selected through self-recommendation, and the reputation evaluation of candidate nodes and their LINK nodes must be qualified. The top 5 nodes of the total nodes are elected as leader nodes through voting, and the nodes in their LINK status are candidate nodes. In the event that the leader node goes down, the responsibility of the leader node is transferred to the nodes in its LINK through the view-change. The LINK connection algorithm used in this study is shown in Table 2, where LINKm is the linked group and LINKP is the percentage of linked nodes.

Table 2 LINK connection algorithm.

Node type

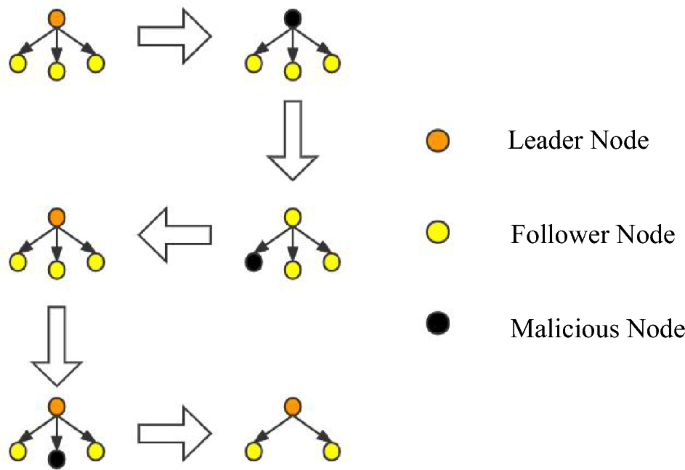

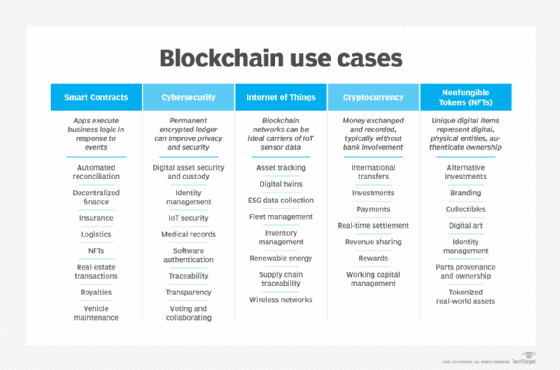

This paper presents a classification of nodes in a blockchain system based on their functionalities. The nodes are divided into three categories: leader nodes (LNs), follower nodes (FNs), and general nodes (Ns). The leader nodes (LNs) are responsible for producing blocks and are elected through voting by general nodes. The follower nodes (FNs) are nodes that are linked to leader nodes (LNs) through the LINK mechanism and are responsible for validating blocks. General nodes (N) have the ability to broadcast and disseminate information, participate in elections, and vote. The primary purpose of the LINK mechanism is to act in combination. When nodes are in the LINK, there is a distinction between the master and slave nodes, and there is a limit to the number of nodes in the LINK group (NP = {n1, nf1, nf2 ……,nfn}). As the largest proportion of nodes in the system, general nodes (N) have the right to vote and be elected. In contrast, leader nodes (LNs) and follower nodes (FNs) do not possess this right. This rule reduces the likelihood of a single node dominating the block. When the system needs to change its fundamental settings due to an increase in the number of nodes or transaction volume, a specific number of current leader nodes and candidate nodes need to vote for a reset. Subsequently, general nodes need to vote to confirm this. When both confirmations are successful, the new basic settings are used in the next cycle of the system process. This dual confirmation setting ensures the fairness of the blockchain to a considerable extent. It also ensures that the majority holds the ultimate decision-making power, thereby avoiding the phenomenon of a small number of nodes completely controlling the system.

After the completion of a governance cycle, the blockchain network will conduct a fresh election for the leader and follower nodes. As only general nodes possess the privilege to participate in the election process, the previous consortium of leader and follower nodes will lose their authorization. In the current cycle, they will solely retain broadcasting and receiving permissions for block information, while their corresponding incentives will also decrease. A diagram illustrating the node status can be found in Fig. 1.

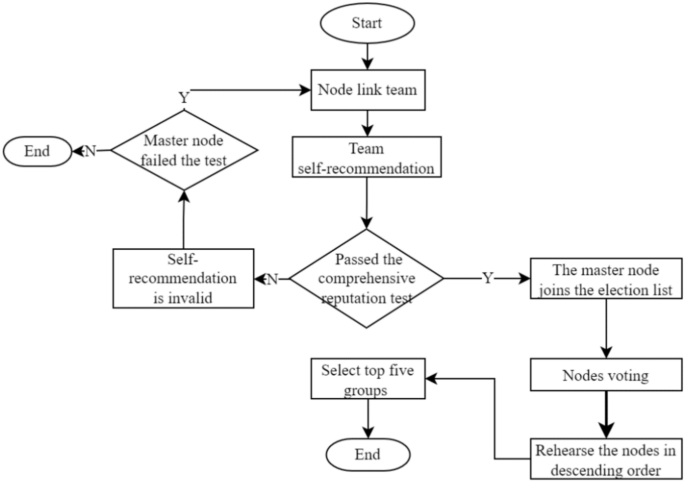

Election method

The election method adopts the node self-nomination mode. If a node wants to participate in an election, it must form a node group with one master and three slaves. One master node group and three slave node groups are inferred based on experience in this paper; these groups can balance efficiency and security and are suitable for other project collaborations. The successfully elected node joins the leader node set, and its slave nodes enter the follower node set. Considering the network situation, the maximum threshold for producing a block is set to 1 s. If the block fails to be successfully generated within the specified time, it is regarded as a disconnected state, and its reputation score is deducted. The node is skipped, and in severe cases, a view transformation is performed, switching from the master node to the slave node and inheriting its leader’s rights in the next round of block generation. Although the nodes that become leaders are high-reputation nodes, they still have the possibility of misconduct. If a node engages in misconduct, its activity will be immediately stopped, its comprehensive reputation score will be lowered, it will be disqualified from participating in the next election, and its equity will be reduced by 30%. The election process is shown in Fig. 2.

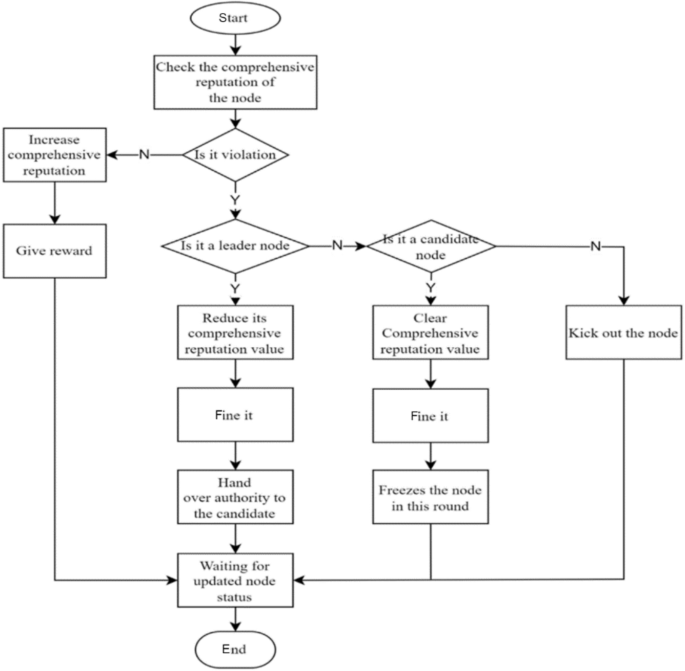

Incentives and penalties

To balance the rewards between leader nodes and ordinary nodes and prevent a large income gap, two incentive/penalty methods will be employed. First, as the number of network nodes and transaction volume increase, more active nodes with significant stakes emerge. After a prolonged period of running the blockchain, there will inevitably be significant class distinctions, and ordinary nodes will not be able to win in the election without special circumstances. To address this issue, this paper proposes that rewards be reduced for nodes with stakes exceeding a certain threshold, with the reduction rate increasing linearly until it reaches zero. Second, in the event that a leader or follower node violates the consensus process, such as by producing a block out of order or being unresponsive for an extended period, penalties will be imposed. The violation handling process is illustrated in Fig. 3.

Violation handling process.

Comprehensive reputation evaluation and election mechanism based on historical transactions

This paper reveals that the core of the DPoS consensus mechanism is the election process. If a blockchain is to run stably for a long time, it is essential to consider a reasonable election method. This paper proposes a comprehensive reputation evaluation election mechanism based on historical records. The mechanism considers the performance indicators of nodes in three dimensions: production rate, tokens, and validity. Additionally, their historical records are considered, particularly whether or not the nodes have engaged in malicious behavior. For example, nodes that have ever been malicious will receive low scores during the election process unless their overall quality is exceptionally high and they have considerable support from other nodes. Only in this case can such a node be eligible for election or become a leader node. The comprehensive reputation score is the node’s self-evaluation score, and the committee size does not affect the computational complexity.

Moreover, the comprehensive reputation evaluation proposed in this paper not only is a threshold required for node election but also converts the evaluation into corresponding votes based on the number of voters. Therefore, the election is related not only to the benefits obtained by the node but also to its comprehensive evaluation and the number of voters. If two nodes receive the same vote, the node with a higher comprehensive reputation is given priority in the ranking. For example, in an election where node A and node B each receive 1000 votes, node A’s number of stake votes is 800, its comprehensive reputation score is 50, and only four nodes vote for it. Node B’s number of stake votes is 600, its comprehensive reputation score is 80, and it receives votes from five nodes. In this situation, if only one leader node position remains, B will be selected as the leader node. Displayed in descending order of priority as comprehensive credit rating, number of voters, and stake votes, this approach aims to solve the problem of node misconduct at its root by democratizing the process and subjecting leader nodes to constraints, thereby safeguarding the fundamental interests of the vast majority of nodes.

Comprehensive reputation evaluation

This paper argues that the election process of the DPoS consensus mechanism is too simplistic, as it considers only the number of election votes that a node receives. This approach fails to comprehensively reflect the node’s actual capabilities and does not consider the voters’ election preferences. As a result, nodes with a significant stake often win and become leader nodes. To address this issue, the comprehensive reputation evaluation score is normalized considering various attributes of the nodes. The scoring results are shown in Table 3.

Table 3 Comprehensive reputation evaluation.

Since some of the evaluation indicators in Table 3 are continuous while others are discrete, different normalization methods need to be employed to obtain corresponding scores for different indicators. The continuous indicators include the number of transactions/people, wealth balance, network latency, network jitter, and network bandwidth, while the discrete indicators include the number of violations, the number of successful elections, and the number of votes. The value range of the indicator “number of transactions/people” is (0,1), and the value range of the other indicators is (0, + ∞). The equation for calculating the “number of transactions/people” is set as shown in Eq. (1).

$$A_{1} = \left\{ {\begin{array}{*{20}l} {0,} \hfill & {{\text{G}} = 0} \hfill \\ {\frac{{\text{N}}}{{\text{G}}}*10,} \hfill & {{\text{G}} > 0} \hfill \\ \end{array} } \right.$$

(1)

where N represents the number of transactional nodes and G represents the number of transactions. It reflects the degree of connection between the node and other nodes. Generally, nodes that transact with many others are safer than those with a large number of transactions with only a few nodes. The limit value of each item, denoted by x, is determined based on the situation and falls within the specified range, as shown in Eq. (2). The wealth balance and network bandwidth indicators use the same function to set their respective values.

$${A}_{i}=20*\left(\frac{1}{1+{e}^{-{a}_{i}x}}-0.5\right)$$

(2)

where x indicates the value of this item and expresses the limit value.

In Eq. (3), x represents the limited value of this indicator. The lower the network latency and network jitter are, the higher the score will be.

The last indicators, which are the number of violations, the number of elections, and the number of votes, are discrete values and are assigned different scores according to their respective ranges. The scores corresponding to each count are shown in Table 4.

$$A_{3} = \left\{ {\begin{array}{*{20}l} {10*\cos \frac{\pi }{200}x,} \hfill & {0 \le x \le 100} \hfill \\ {0,} \hfill & {x > 100} \hfill \\ \end{array} } \right.$$

(3)

Table 4 Score conversion.

The reputation evaluation mechanism proposed in this paper comprehensively considers three aspects of nodes, wealth level, node performance, and stability, to calculate their scores. Moreover, the scores obtain the present data based on historical records. Each node is set as an M × N dimensional matrix, where M represents M times the reputation evaluation score and N represents N dimensions of reputation evaluation (M < = N), as shown in Eq. (4).

$${\text{N}} = \left( {\begin{array}{*{20}c} {a_{11} } & \cdots & {a_{1n} } \\ \vdots & \ddots & \vdots \\ {a_{m1} } & \cdots & {a_{mn} } \\ \end{array} } \right)$$

(4)

The comprehensive reputation rating is a combined concept related to three dimensions. The rating is set after rating each aspect of the node. The weight w and the matrix l are not fixed. They are also transformed into matrix states as the position of the node in the system changes. The result of the rating is set as the output using Eq. (5).

$$\text{T}=\text{lN}{w}^{T}=\left({l}_{1}\dots {\text{l}}_{\text{m}}\right)\left(\begin{array}{ccc}{a}_{11}& \cdots & {a}_{1n}\\ \vdots & \ddots & \vdots \\ {a}_{m1}& \cdots & {a}_{mn}\end{array}\right){\left({w}_{1}\dots {w}_{n}\right)}^{T}$$

(5)

Here, T represents the comprehensive reputation score, and l and w represent the correlation coefficient. Because l is a matrix of order 1*M, M is the number of times in historical records, and M < = N is set, the number of dimensions of l is uncertain. Set the term l above to add up to 1, which is l1 + l2 + …… + ln = 1; w is also a one-dimensional matrix whose dimension is N*1, and its purpose is to act as a weight; within a certain period of time, w is a fixed matrix, and w will not change until the system changes the basic settings.

Assume that a node conducts its first comprehensive reputation rating, with no previous transaction volume, violations, elections or vote. The initial wealth of the node is 10, the latency is 50 ms, the jitter is 100 ms, and the network bandwidth is 100 M. According to the equation, the node’s comprehensive reputation rating is 41.55. This score is relatively good at the beginning and gradually increases as the patient participates in system activities continuously.

Voting calculation method

To ensure the security and stability of the blockchain system, this paper combines the comprehensive reputation score with voting and randomly sorts the blocks, as shown in Eqs. (3–6).

$$Z=\sum_{i=1}^{n}{X}_{i}+nT$$

(6)

where Z represents the final election score, Xi represents the voting rights earned by the node, n is the number of nodes that vote for this node, and T is the comprehensive reputation score.

The voting process is divided into stake votes and reputation votes. The more reputation scores and voters there are, the more total votes that are obtained. In the early stages of blockchain operation, nodes have relatively few stakes, so the impact of reputation votes is greater than that of equity votes. This is aimed at selecting the most suitable node as the leader node in the early stage. As an operation progresses, the role of equity votes becomes increasingly important, and corresponding mechanisms need to be established to regulate it. The election vote algorithm used in this paper is shown in Table 5.

Table 5 Election vote counting algorithm.

This paper argues that the election process utilized by the original DPoS consensus mechanism is overly simplistic, as it relies solely on the vote count to select the node that will oversee the entire blockchain. This approach cannot ensure the security and stability of the voting process, and if a malicious node behaves improperly during an election, it can pose a significant threat to the stability and security of the system as well as the safety of other nodes’ assets. Therefore, this paper proposes a different approach to the election process of the DPoS consensus mechanism by increasing the complexity of the process. We set up a threshold and optimized the vote-counting process to enhance the security and stability of the election. The specific performance of the proposed method was verified through experiments.

The election cycle in this paper can be customized, but it requires the agreement of the blockchain committee and general nodes. The election cycle includes four steps: node self-recommendation, calculating the comprehensive reputation score, voting, and replacing the new leader. Election is conducted only among general nodes without affecting the production or verification processes of leader nodes or follower nodes. Nodes start voting for preferred nodes. If they have no preference, they can use the LINK mechanism to collaborate with other nodes and gain additional rewards.

View changes

During the consensus process, conducting a large number of updates is not in line with the system’s interests, as the leader node (LN) and follower node (FN) on each node have already been established. Therefore, it is crucial to handle problematic nodes accurately when issues arise with either the LN or FN. For instance, when a node fails to perform its duties for an extended period or frequently fails to produce or verify blocks within the specified time range due to latency, the system will precisely handle them. For leader nodes, if they engage in malicious behavior such as producing blocks out of order, the behavior is recorded, and their identity as a leader node is downgraded to a follower node. The follower node inherits the leader node’s position, and the nature of their work is transformed as they swap their responsibilities of producing and verifying blocks with their original work. This type of behavior will not significantly affect the operation of the blockchain system. Instead of waiting until the end of the current committee round to punish malicious nodes, dynamic punishment is imposed on the nodes that affect the operation of the blockchain system to maintain system security. The view change operation is illustrated in Fig. 4.

In traditional PBFT, view changes are performed according to the view change protocol by changing the view number V to the next view number V + 1. During this process, nodes only receive view change messages and no other messages from other nodes. In this paper, the leader node group (LN) and follower node group (FN) are selected through an election of the LINK group. The node with LINKi[0] is added to the LN leader node group, while the other three LINK groups’ follower nodes join the FN follower node group since it is a configuration pattern of one master and three slaves. The view change in this paper requires only rearranging the node order within the LINK group to easily remove malicious nodes. Afterward, the change is broadcast to other committee nodes, and during the view transition, the LINK group does not receive block production or verification commands from the committee for stability reasons until the transition is completed.

News

The Hype Around Blockchain Mortgage Has Died Down, But This CEO Still Believes

LiquidFi Founder Ian Ferreira Sees Huge Potential in Blockchain Despite Hype around technology is dead.

“Blockchain technology has been a buzzword for a long time, and it shouldn’t be,” Ferriera said. “It should be a technology that lives in the background, but it makes everything much more efficient, much more transparent, and ultimately it saves costs for everyone. That’s the goal.”

Before founding his firm, Ferriera was a portfolio manager at a hedge fund, a job that ended up revealing “interesting intricacies” related to the mortgage industry.

Being a mortgage trader opened Ferriera’s eyes to a lot of the operational and infrastructure problems that needed to be solved in the mortgage-backed securities industry, he said. That later led to the birth of LiquidFi.

“The point of what we do is to get raw data attached to a resource [a loan] on a blockchain so that it’s provable. You reduce that trust problem because you have the data, you have the document associated with that data,” said the LiquidFi CEO.

Ferriera spoke with National Mortgage News about the value of blockchain technology, why blockchain hype has fizzled out, and why it shouldn’t.

News

New bill pushes Department of Veterans Affairs to examine how blockchain can improve its work

The Department of Veterans Affairs would have to evaluate how blockchain technology could be used to improve benefits and services offered to veterans, according to a legislative proposal introduced Tuesday.

The bill, sponsored by Rep. Nancy Mace, R-S.C., would direct the VA to “conduct a comprehensive study of the feasibility, potential benefits, and risks associated with using distributed ledger technology in various programs and services.”

Distributed ledger technology, including blockchain, is used to protect and track information by storing data across multiple computers and keeping a record of its use.

According to the text of the legislation, which Mace’s office shared exclusively with Nextgov/FCW ahead of its publication, blockchain “could significantly improve benefits allocation, insurance program management, and recordkeeping within the Department of Veterans Affairs.”

“We need to bring the federal government into the 21st century,” Mace said in a statement. “This bill will open the door to research on improving outdated systems that fail our veterans because we owe it to them to use every tool at our disposal to improve their lives.”

Within one year of the law taking effect, the Department of Veterans Affairs will be required to submit a report to the House and Senate Veterans Affairs committees detailing its findings, as well as the benefits and risks identified in using the technology.

The mandatory review is expected to include information on how the department’s use of blockchain could improve the way benefits decisions are administered, improve the management and security of veterans’ personal data, streamline the insurance claims process, and “increase transparency and accountability in service delivery.”

The Department of Veterans Affairs has been studying the potential benefits of using distributed ledger technology, with the department emission a request for information in November 2021 seeking input from contractors on how blockchain could be leveraged, in part, to streamline its supply chains and “secure data sharing between institutions.”

The VA’s National Institute of Artificial Intelligence has also valued the use of blockchain, with three of the use cases tested during the 2021 AI tech sprint focused on examining its capabilities.

Mace previously introduced a May bill that would direct Customs and Border Protection to create a public blockchain platform to store and share data collected at U.S. borders.

Lawmakers also proposed additional measures that would push the Department of Veterans Affairs to consider adopting other modernized technologies to improve veteran services.

Rep. David Valadao, R-Calif., introduced legislation in June that would have directed the department to report to lawmakers on how it plans to expand the use of “certain automation tools” to process veterans’ claims. The House of Representatives Subcommittee on Disability Assistance and Memorial Affairs gave a favorable hearing on the congressman’s bill during a Markup of July 23.

News

California DMV Uses Blockchain to Fight Auto Title Fraud

TDR’s Three Takeaways: California DMV Uses Blockchain to Fight Fraud

- California DMV uses blockchain technology to manage 42 million auto titles.

- The initiative aims to improve safety and reduce car title fraud.

- The immutable nature of blockchain ensures accurate and tamper-proof records.

The California Department of Motor Vehicles (DMV) is implementing blockchain technology to manage and secure 42 million auto titles. This innovative move aims to address and reduce the persistent problem of auto title fraud, a problem that costs consumers and the industry millions of dollars each year. By moving to a blockchain-based system, the DMV is taking advantage of the technology’s key feature: immutability.

Blockchain, a decentralized ledger technology, ensures that once a car title is registered, it cannot be altered or tampered with. This creates a highly secure and transparent system, significantly reducing the risk of fraudulent activity. Every transaction and update made to a car title is permanently recorded on the blockchain, providing a complete and immutable history of the vehicle’s ownership and status.

As first reported by Reuters, the DMV’s adoption of blockchain isn’t just about preventing fraud. It’s also aimed at streamlining the auto title process, making it more efficient and intuitive. Traditional auto title processing involves a lot of paperwork and manual verification, which can be time-consuming and prone to human error. Blockchain technology automates and digitizes this process, reducing the need for physical documents and minimizing the chances of errors.

Additionally, blockchain enables faster verification and transfer of car titles. For example, when a car is sold, the transfer of ownership can be done almost instantly on the blockchain, compared to days or even weeks in the conventional system. This speed and efficiency can benefit both the DMV and the vehicle owners.

The California DMV’s move is part of a broader trend of government agencies exploring blockchain technology to improve their services. By adopting this technology, the DMV is setting a precedent for other states and industries to follow, showcasing blockchain’s potential to improve safety and efficiency in public services.

-

Ethereum11 months ago

Ethereum11 months agoEthereum Posts First Consecutive Monthly Losses Since August 2023 on New ETFs

-

Regulation11 months ago

Regulation11 months agoCryptocurrency Regulation in Slovenia 2024

-

News11 months ago

News11 months agoNew bill pushes Department of Veterans Affairs to examine how blockchain can improve its work

-

Regulation11 months ago

Regulation11 months agoThink You Own Your Crypto? New UK Law Would Ensure It – DL News

-

Regulation11 months ago

Regulation11 months agoUpbit, Coinone, Bithumb Face New Fees Under South Korea’s Cryptocurrency Law

-

Regulation11 months ago

Regulation11 months agoA Blank Slate for Cryptocurrencies: Kamala Harris’ Regulatory Opportunity

-

Regulation11 months ago

Regulation11 months agoBahamas Passes Cryptocurrency Bill Designed to Prevent FTX, Terra Disasters

-

Regulation11 months ago

Regulation11 months agoIndia to Follow G20 Policy for Cryptocurrency Regulation: MoS Finance

-

Ethereum1 year ago

Ethereum1 year agoComment deux frères auraient dérobé 25 millions de dollars lors d’un braquage d’Ethereum de 12 secondes • The Register

-

News1 year ago

News1 year ago“Captain Tsubasa – RIVALS” launches on Oasys Blockchain

-

News11 months ago

News11 months agoEU supports 15 startups to fight online disinformation with blockchain

-

Videos1 year ago

Videos1 year agoNexus Chain – Ethereum L2 with the GREATEST Potential?