Bitcoin

$4.7 Billion in Bitcoin and Ethereum Options About to Expire! Predictions to go wrong?

- $4.7 billion worth of BTC and ETH options are about to expire, potentially influencing market volatility.

- Technical analysis on the chart shows us possible price movements for Bitcoin and Ethereum after options expiration

In today’s financial markets, all eyes are on the cryptocurrency sector as it prepares for a significant event.

Both Bitcoin [BTC] It is Ethereum [ETH] we’ve seen considerable fluctuations recently, with Bitcoin rising 1.4% and Ethereum gaining 0.7% in the last 24 hours, with a current price of $68,223 and $3,733, respectively.

This activity is notable, especially as Ethereum has outperformed, with a 23.3% increase over the past two weeks, likely driven by the U.S. Securities and Exchange Commission’s recent approval of a spot ETF for the asset.

This set the stage for today’s (May 31) main event: the expiration of a whopping $4.7 billion in notional value of BTC and ETH options contracts.

Encryption decryption options

Options in the cryptocurrency market work similarly to those in traditional finance, where traders have the right, but not the obligation, to buy (call option) or sell (put option) an underlying asset at a specified price before the contract expiration.

The Deribit platform data revealed an expected increase in market volatility triggered by today’s options expiration. This is supported by the substantial volume of Bitcoin and Ethereum options about to close.

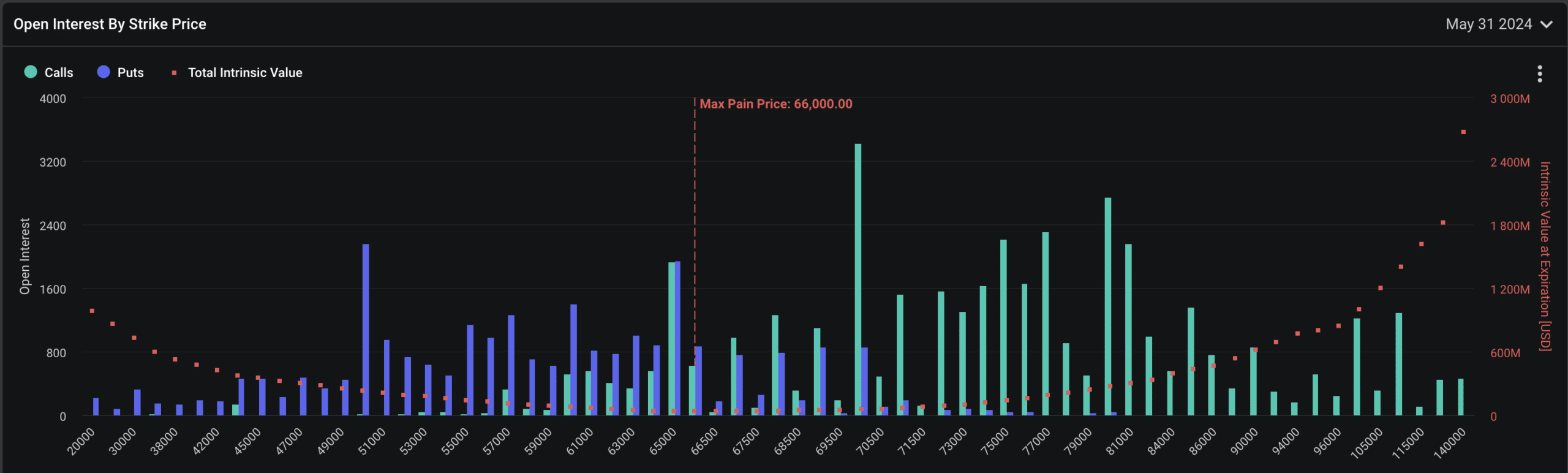

A detailed analysis of the options market shows a greater number of call options, indicating bullish sentiment among traders. Specifically, the put/call ratio for Bitcoin is 0.61, suggesting a dominance of bullish contracts.

The maximum pain point, where option holders suffer maximum financial losses, is set at around $66,000, which is considerably lower than current trading prices.

Source: Deribit

Notably, options with strike prices ranging up to $100,000 carry significant open interest, totaling a notional value of $886 million. This optimism is sharply contrasted on the downside by a substantial open interest of $519 million at the strike price of $60,000.

Notably, the current notional value for BTC call options is $2.9 billion.

Source: Deribit

For Ethereum, the scenario is slightly different. The day sees around $1.8 billion in notional value of Ethereum call contracts expiring, with a put/call ratio of 0.84.

This index suggests a more balanced view among traders regarding Ethereum’s short-term price outlook. Open interest in Ethereum futures is also peaking near all-time highs, influenced by speculative trading following the ETF approval.

Source: Deribit

Technical analysis and market forecast

To understand how Bitcoin (BTC) and Ethereum (ETH) might react to today’s significant options expiry, a technical analysis of their respective charts is essential.

Starting with Bitcoin, the daily swing structure places BTC in a premium zone, typically a signal for a potential sell-off into the discount zone before a reversal.

A closer look at the lower time frames reveals that Bitcoin recently encountered a critical supply zone on the 4-hour chart, suggesting possible downward pressure.

While no substantial downward break occurred following the test of this zone, the 2-hour chart confirms another test of a supply zone, suggesting a potential near-term decline to the $67,000 level, potentially marking the first structural break for the downside on the 4-hour Chart.

Source: TradingView

Similarly, Ethereum has tested a supply zone on its 4-hour chart, indicating a possible downtrend as it remains in the premium zone on the daily chart.

The asset’s 2-hour chart shows small structural breaks to the downside, suggesting a continued downtrend towards the $3,500 level.

Source: TradingView

In the context of these technical movements, both cryptocurrencies have already inflicted losses on some traders.

According to Coinglass, Bitcoin traders faced $19.92 million in liquidations, while Ethereum traders saw approximately $19.63 million in liquidations.

To read Bitcoin (BTC) Price Prediction 2024-25

Additionally, an AMBCrypto report grades that the Relative Strength Index (RSI) and Money Flow Index (MFI) for Bitcoin stand at 53.85 and 57.94, respectively.

These numbers indicate a balanced market where neither buyers nor sellers have dominant control, leading to continued price consolidation or limited movements.