The first half of 2024 has seen a surge in major hacks in the cryptocurrency sector. Ethereum (ETH)Bitcoin (BTC) and XRP have resulted in losses of...

Bitcoin Cash (BCH) selling pressure and lack of liquidity are the stories to watch as Mt. Gox begins redemptions, Presto Research writes. Bitcoin Cash (BCH) selling...

Hong Kong to amend cryptocurrency laws Hong Kong’s financial regulators are taking a measured approach to cryptocurrency regulation, responding with constant change to market developments. Christopher...

In Nigeria, the National Information Technology Development Agency (NITDA) is looking to establish research centers geared toward emerging technologies such as blockchain. The initiative was announced...

Updated 04/07 below. This article was originally published on July 03 Bitcoin Bitcoin suddenly dropped to around $60,000 per bitcoin after a Billionaire Bitcoin Buyer Reveals...

Bitcoin Drops to $57K: What’s Going On? And Bitcoin keeps falling. The world’s largest cryptocurrency fell below $59,000 on Thursday, July 4, 2024, hitting lows not...

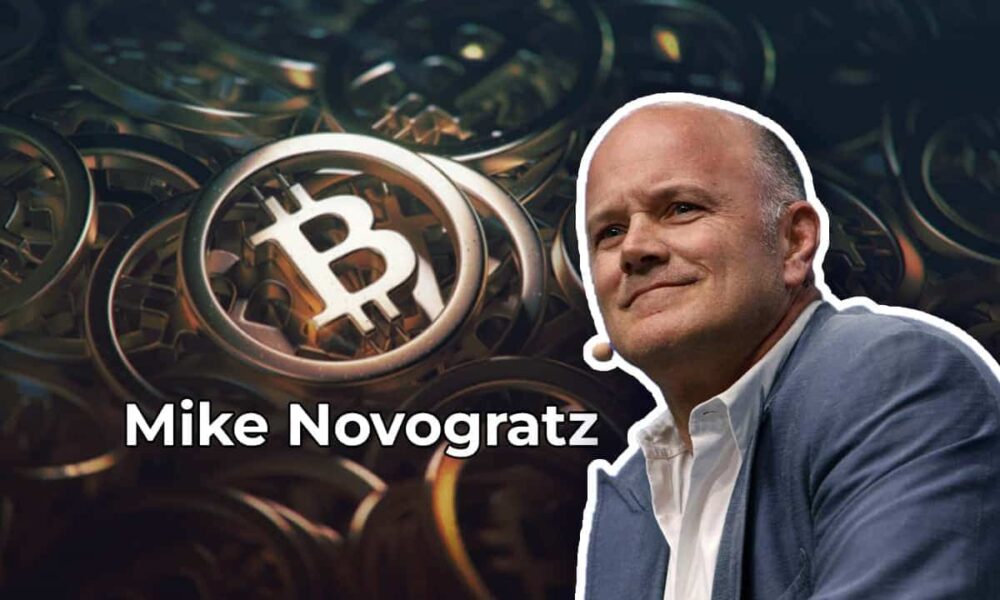

Novogratz Predicts Positive Cryptocurrency Regulation Regardless of Who Wins the Election Memecoins TREMP and BODEN have seen a decline, dropping by 16.5% and 27.9%, respectively. Mike...

Founder and CEO of Galaxy Digital Mike Novogratz believes the U.S. cryptocurrency industry is poised for positive regulatory developments regardless of the outcome of the upcoming...

Ethereum price failed to break above the $3,520 area and started a fresh decline. ETH dipped below the $3,250 support and even tested the $3,150 area....

(Bloomberg) — A third consecutive daily drop in Bitcoin (BTC-USD) has taken the digital asset close to levels last seen in February amid challenges including U.S....